Are you feeling overwhelmed by business loan debt? You're not aloneâmany entrepreneurs face similar challenges as they navigate their financial paths. In this article, we'll explore the intricacies of debt restructuring and how it can provide a fresh start for your business. So, if you're ready to turn your financial situation around, keep reading to discover valuable insights and effective strategies!

Purpose of Restructuring

Business loan debt restructuring serves to optimize financial stability and improve cash flow for struggling enterprises. This process often involves negotiating new terms with creditors, such as extending repayment periods or reducing interest rates, enabling businesses to manage their debt more effectively. Restructuring can alleviate immediate financial pressures, allowing companies to redirect resources towards growth initiatives or operational enhancements. As of 2023, many businesses facing economic downturns or revenue fluctuations have utilized restructuring to avoid bankruptcy, enabling them to sustain operations and preserve jobs. This strategic financial maneuver aims to create a sustainable path forward, promoting long-term viability and resilience in an ever-changing market landscape.

Current Financial Situation

The current financial situation for businesses seeking loan debt restructuring typically demonstrates a range of challenges, including reduced cash flow and increasing liabilities. Many companies face declining revenues due to market fluctuations or ongoing economic impacts, such as those from the COVID-19 pandemic. For instance, businesses in hospitality sectors may experience a revenue drop exceeding 60% compared to pre-pandemic levels. Accumulated debt, sometimes stretching beyond six figures, strains operational budgets, leading to difficulty meeting monthly payment obligations. In such cases, creditors may be approached for renegotiation of terms, aiming to lower interest rates or extend repayment periods. A structured approach, involving detailed financial statements and forecasts, is crucial for demonstrating the necessity of restructuring, ultimately guiding businesses towards viability while preserving stakeholder relationships.

Proposed Restructuring Plan

A proposed restructuring plan for business loan debt outlines strategic adjustments aimed at enhancing financial stability and ensuring long-term growth. This plan typically involves renegotiating terms such as lowering interest rates, extending loan maturities, and reducing monthly payments to better align with current cash flow, allowing companies to manage their obligations more effectively. Financial institutions may require detailed documentation, including current income statements, balance sheets, and cash flow projections, to evaluate the business's ability to meet restructured terms. By presenting a comprehensive plan highlighting operational efficiencies, projected revenue increases, and risk mitigation strategies, businesses can foster constructive dialogue with lenders, potentially leading to favorable terms that bolster their recovery efforts.

Benefits of Restructuring

Restructuring business loan debt can offer several advantages for companies facing financial challenges. Improved cash flow management arises from extending repayment terms, reducing monthly financial burdens significantly. This flexibility allows businesses to allocate resources to critical operations while maintaining stability. Lower interest rates negotiated during restructuring can also reduce overall debt costs, enhancing profitability. Furthermore, restructuring facilitates better coordination with creditors, fostering positive relationships and potentially leading to additional funding opportunities. Businesses may also experience a restored credit rating over time, improving future borrowing conditions. Overall, restructuring serves as a strategic approach to regain financial footing and achieve long-term sustainability.

Request for Approval

A business loan debt restructuring proposal involves a strategic plan aimed at modifying existing loan terms to improve financial stability for a company facing repayment challenges. This process typically includes requesting adjustments to interest rates, extending payment periods, or altering payment schedules. In crucial situations, consultation with financial advisors highlights the necessity for this restructuring to maintain operational continuity. Companies often present detailed financial statements, including cash flow projections and debt analysis, to demonstrate the impacts of current loan obligations on overall business performance. Approval of this request can lead to enhanced liquidity, enabling the company to focus on growth and stability amid economic fluctuations.

Letter Template For Explaining Business Loan Debt Restructuring Samples

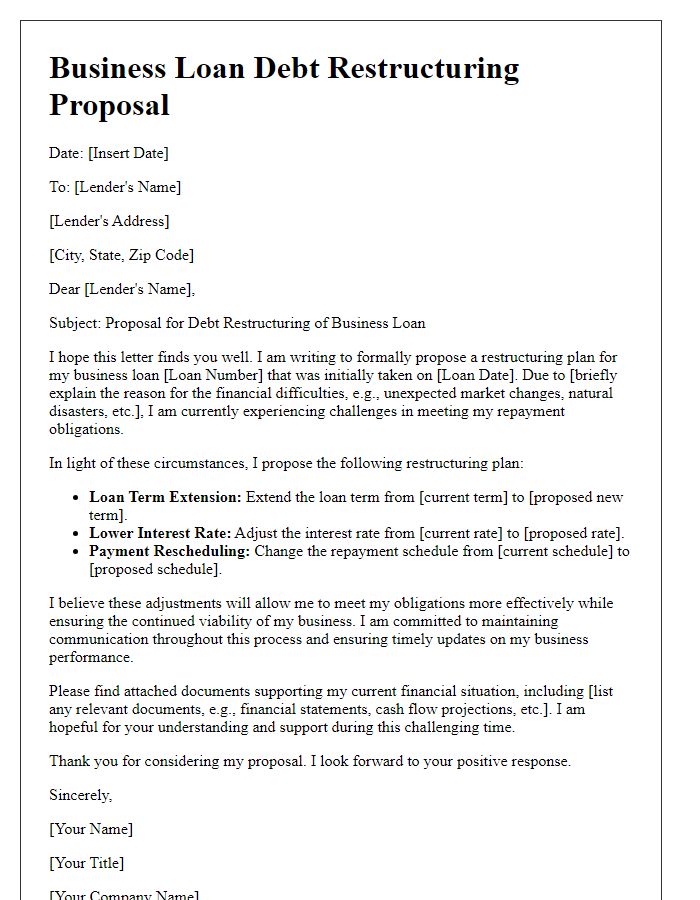

Letter template of business loan debt restructuring proposal for financial relief.

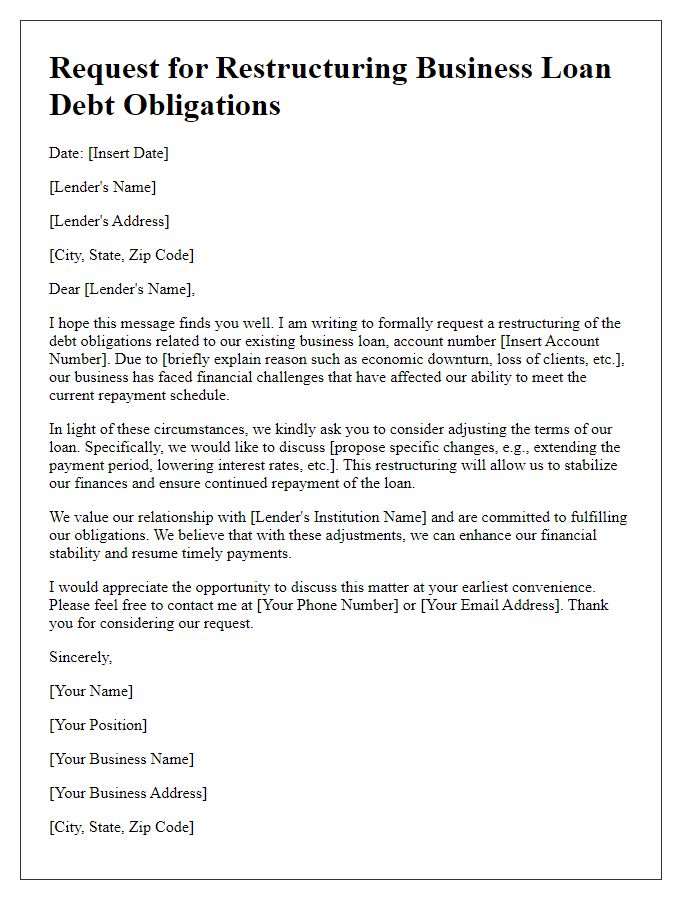

Letter template of request for restructuring business loan debt obligations.

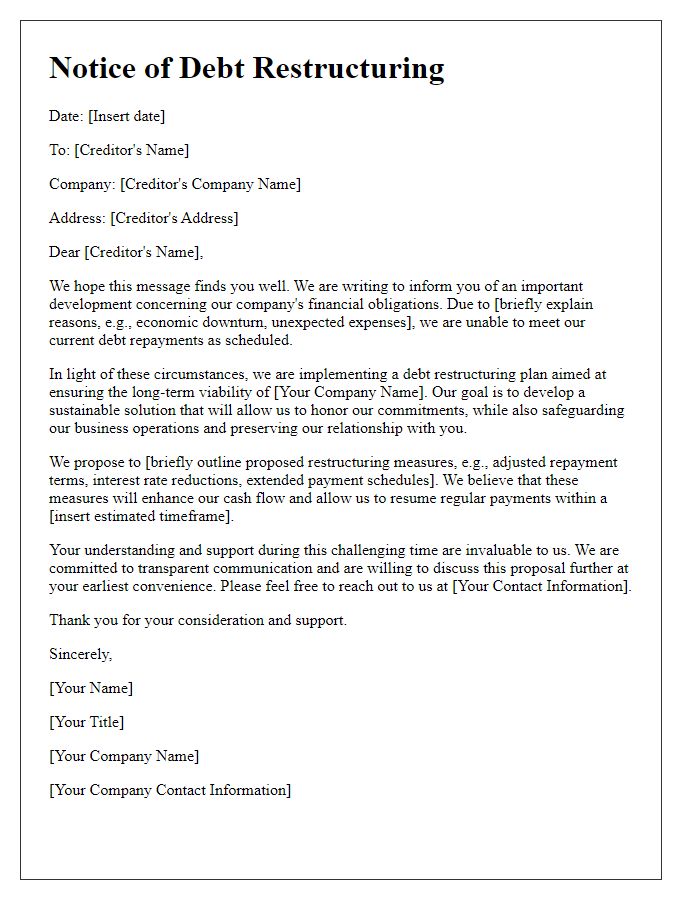

Letter template of business debt restructuring explanation for creditors.

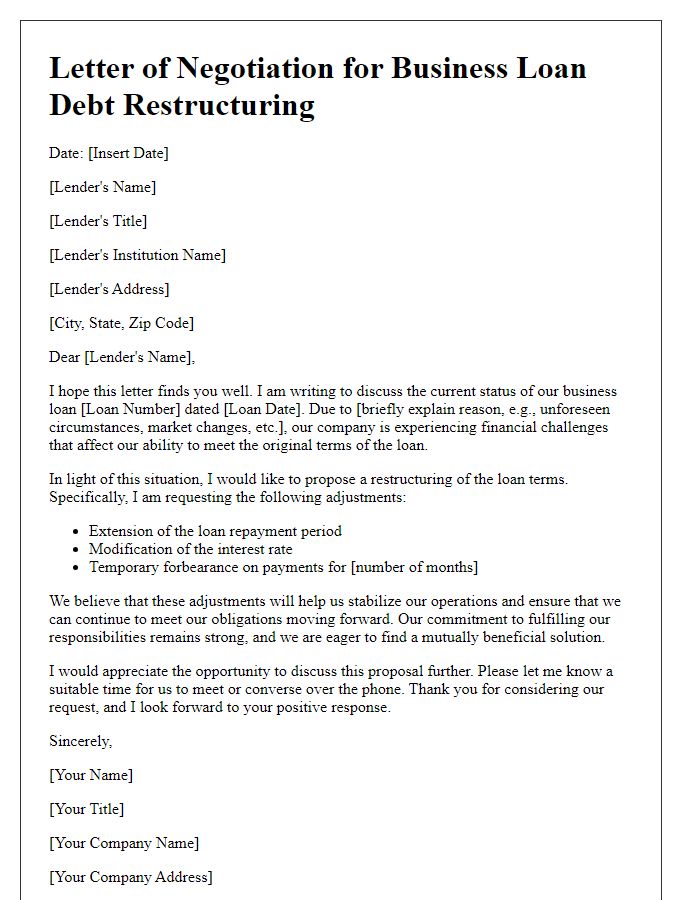

Letter template of negotiating terms for business loan debt restructuring.

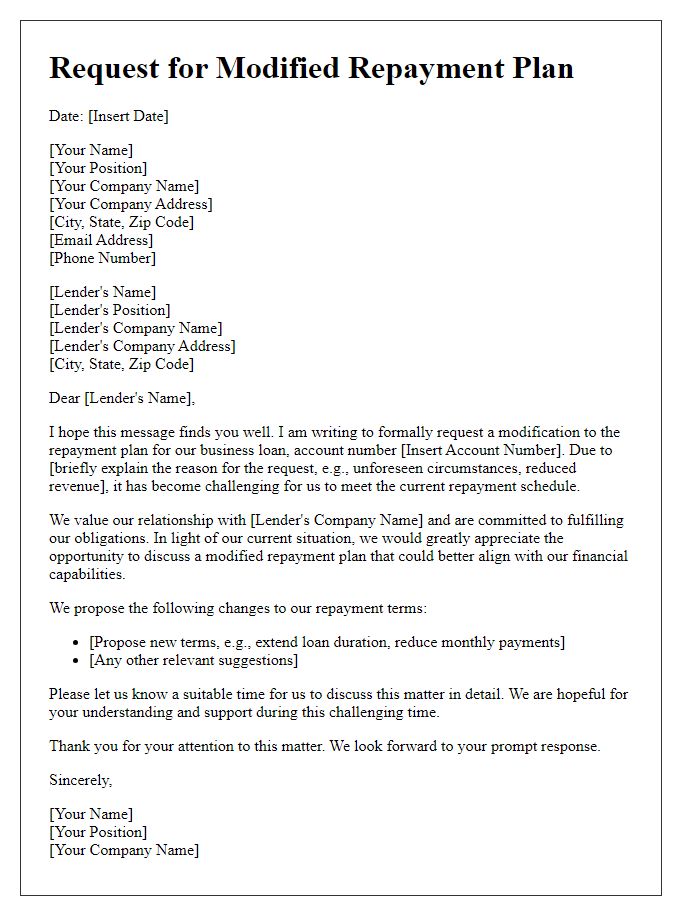

Letter template of request for modified repayment plan on business loans.

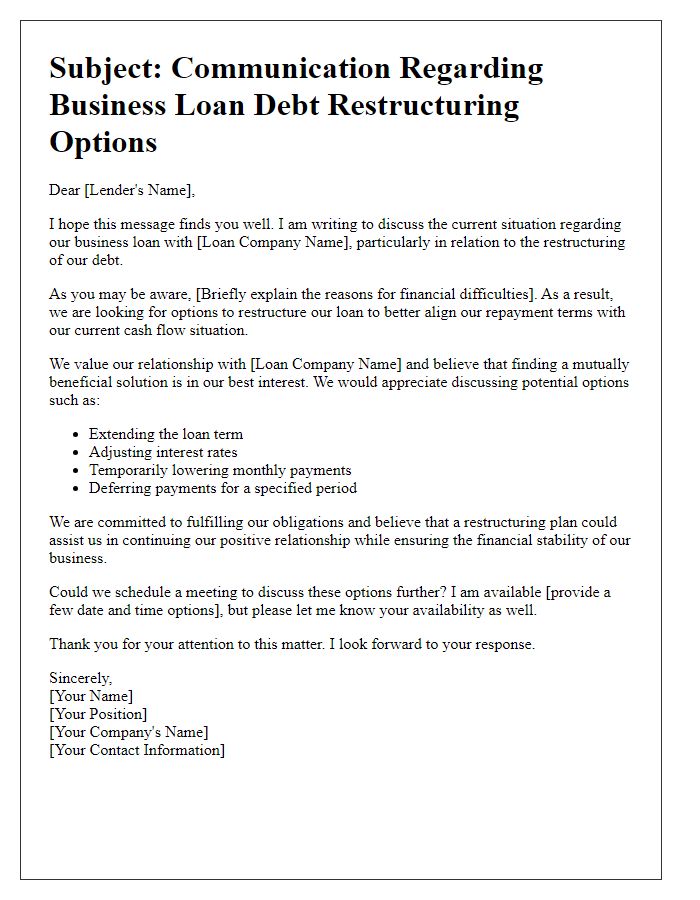

Letter template of communication regarding business loan debt restructuring options.

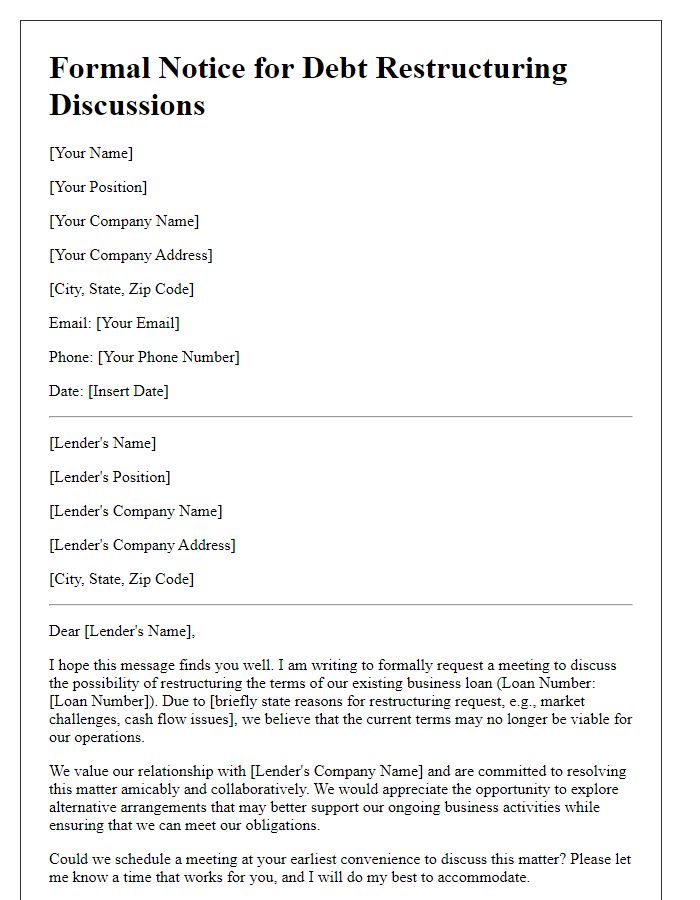

Letter template of formal notice for business loan debt restructuring discussions.

Letter template of explanation for stakeholders regarding loan debt restructuring strategy.

Letter template of summary of business loan debt restructuring benefits.

Comments