Are you considering requesting a loan increase to help fund your financial goals? Whether you're looking to renovate your home, consolidate debt, or invest in a new opportunity, drafting a well-structured letter can make all the difference. In this article, we'll explore the key elements you should include in your request to ensure it resonates with your lender. So, let's dive in and discover how to effectively communicate your need for a loan increase!

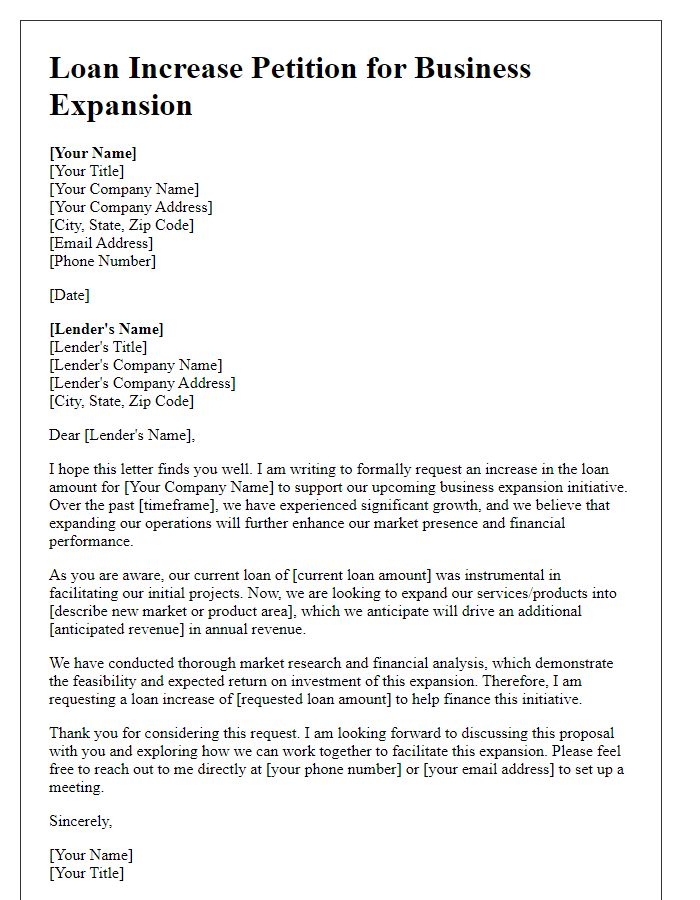

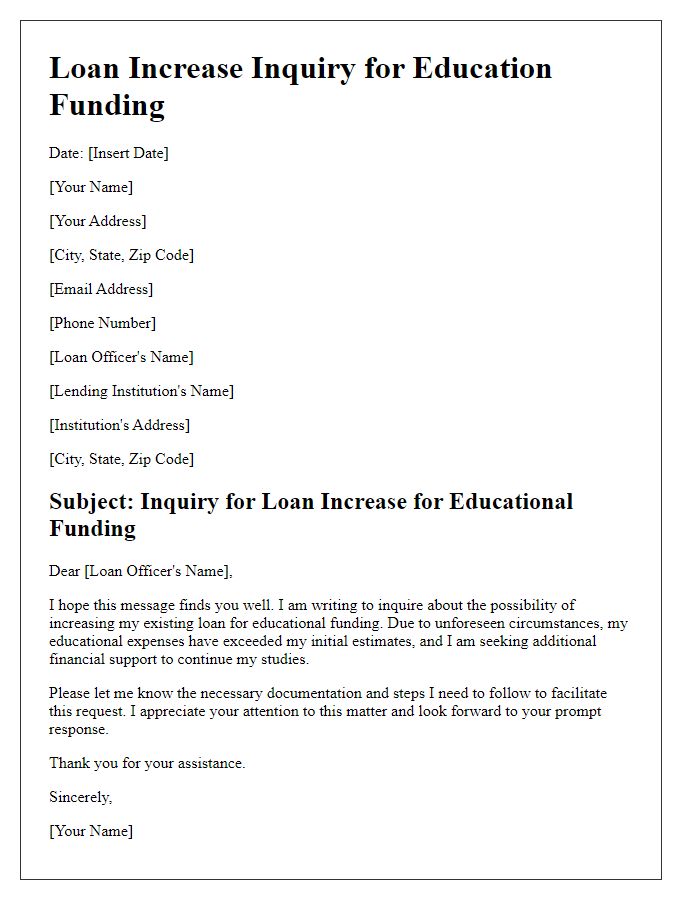

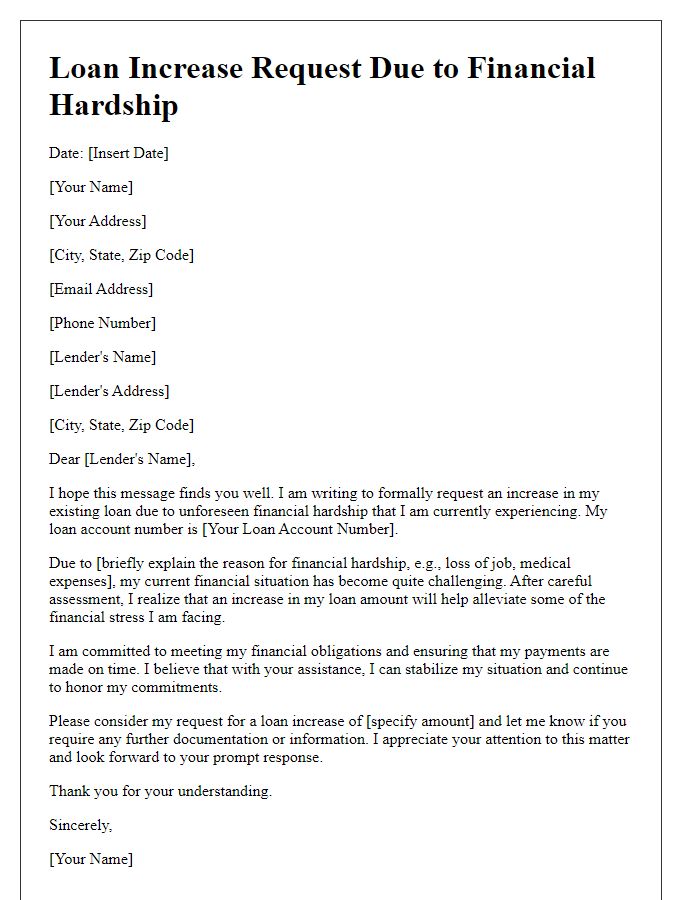

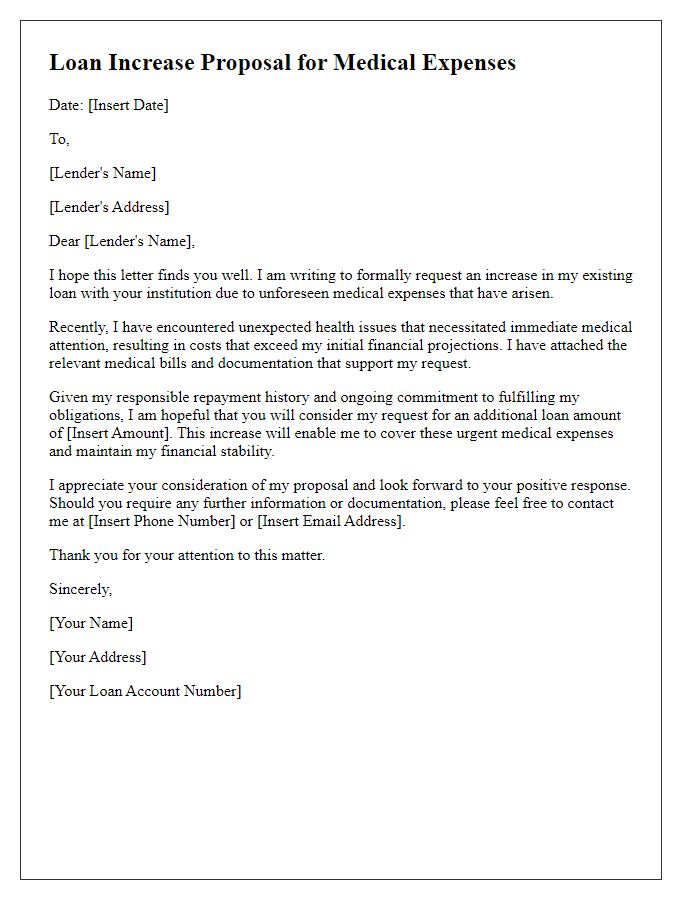

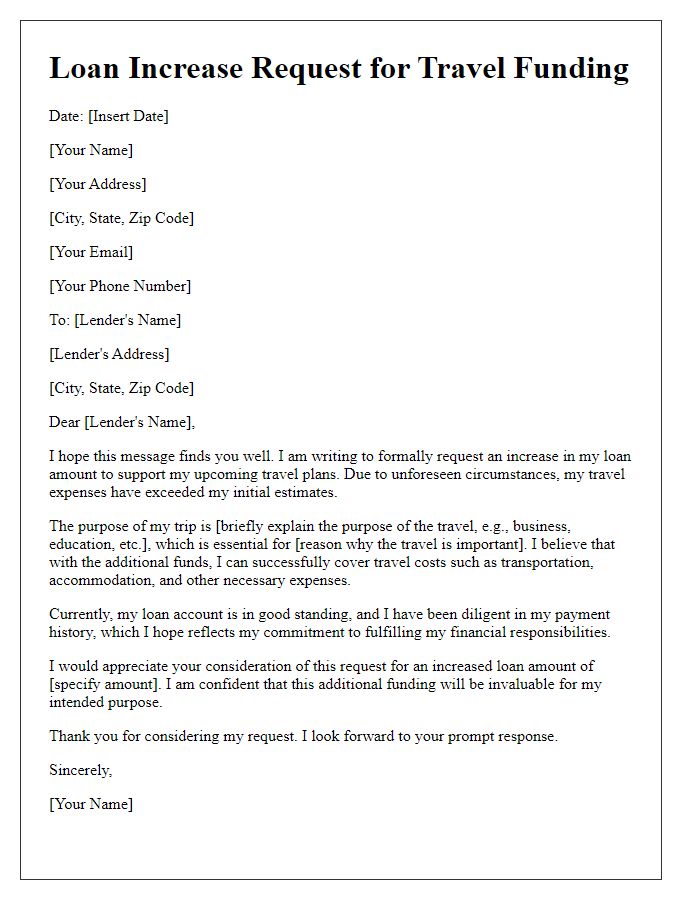

Clear subject line

An increase in loan approval can significantly impact financial flexibility for borrowers seeking to cover expenses. Many clients, such as small business owners or families managing home renovations, often request additional loan amounts to ensure adequate funding. Documentation including income statements, credit history, and existing debts plays a critical role in the evaluation process conducted by financial institutions like banks or credit unions. Approval rates can vary based on factors such as the borrower's credit score, loan-to-value ratio, and repayment capacity. Understanding the criteria for loan modification can enhance the chances of receiving a favorable response to increase requests.

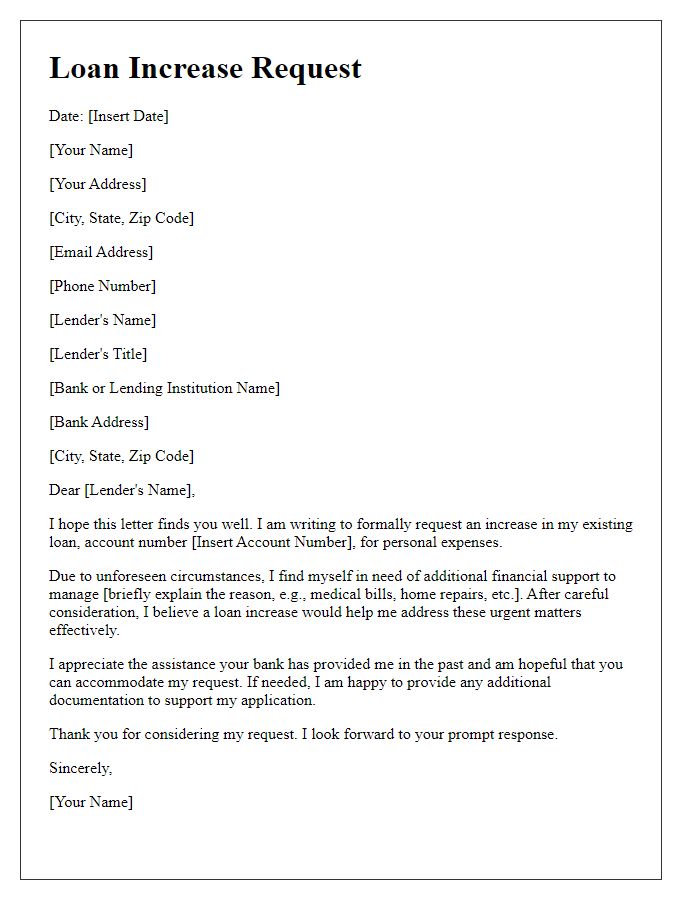

Personal details and account information

Requesting a loan increase requires clear communication of personal details and account information. Borrowers should include their name, which identifies them in the financial institution's database. The account number is essential for the bank to access account history, including payment patterns, current balance, and length of relationship with the bank, providing insight into creditworthiness. Relevant contact information, such as a phone number and email address, should also be included for follow-up communication. It is crucial to mention the current loan amount and payment terms, as this establishes the context for the request, highlighting the increase needed alongside any specific purpose for the additional funds, whether for personal expenses, home renovations, or unexpected emergencies.

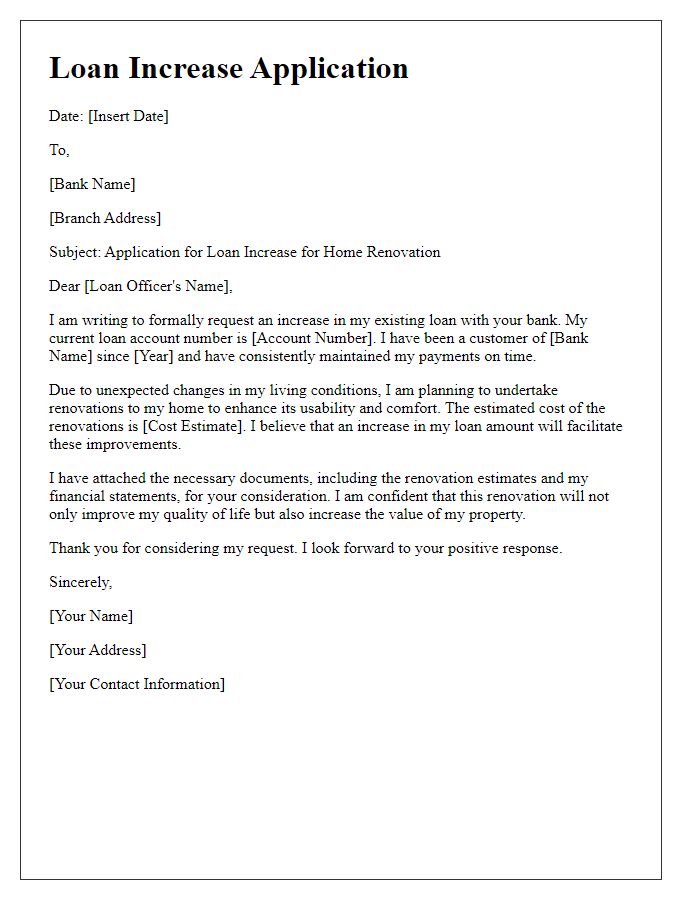

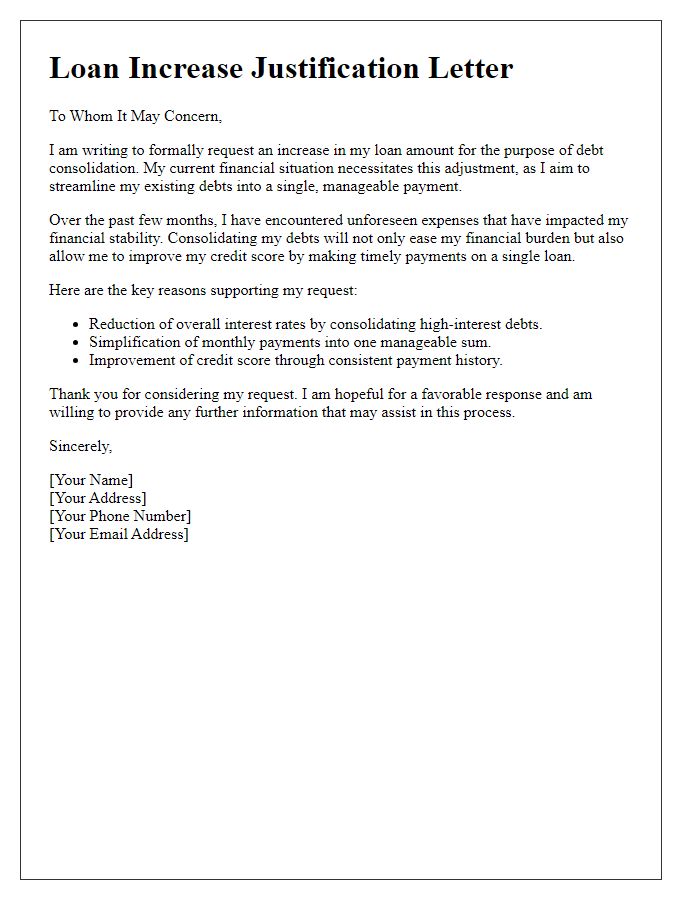

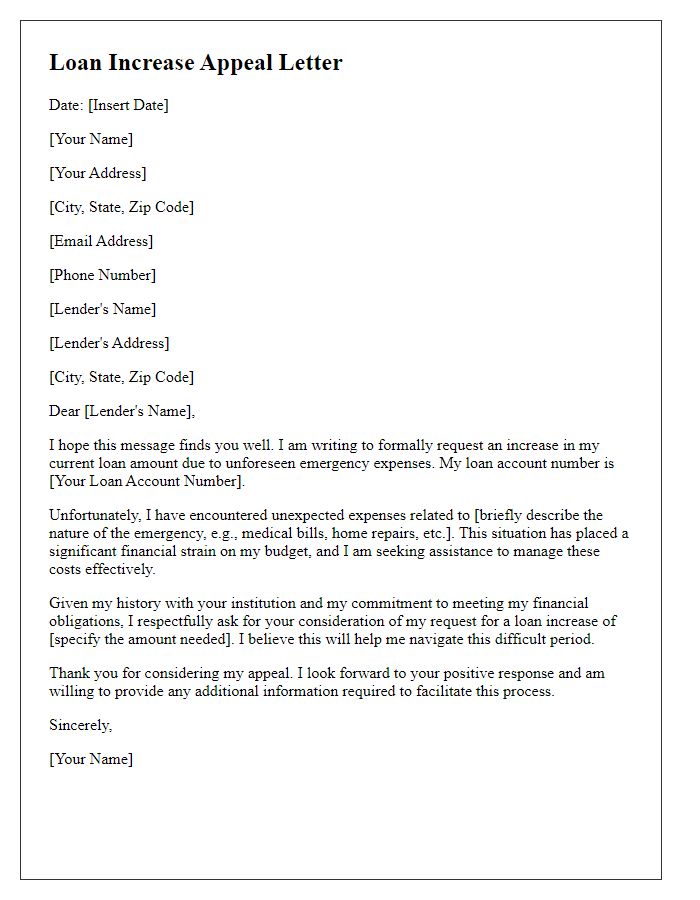

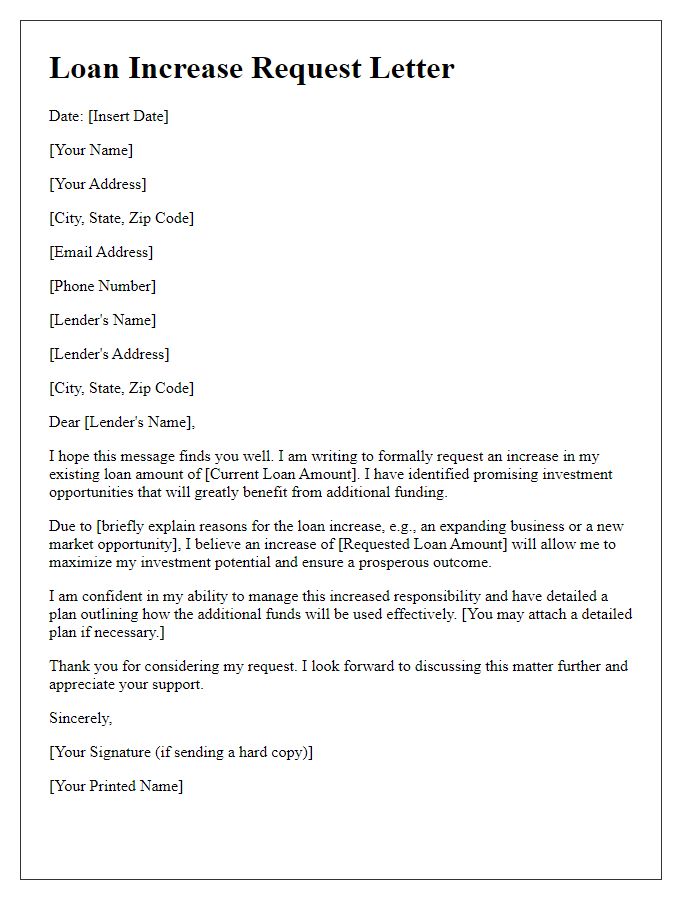

Reason for loan increase

Obtaining a loan increase is crucial for individuals or businesses requiring additional financial resources. Major expenses, such as home renovations, medical bills, or educational costs, often necessitate this increase. Economic conditions, like rising inflation (currently at approximately 8% in many regions) or sudden job loss, may further exacerbate financial needs. Specific events, including natural disasters or significant life changes, can also justify a request for heightened loan amounts. Providing clear, substantial reasons for the increase, alongside a well-structured plan for repayment, can enhance the chances of approval from lenders.

Financial background and repayment ability

Individuals seeking a loan increase should present a comprehensive overview of financial background and repayment ability, particularly emphasizing stable income sources such as monthly salaries (e.g., $5,000) from an employer, rental income (e.g., $1,200) from properties, or dividends from investments. A detailed bank statement showcasing healthy savings (such as a minimum balance of $15,000) and an excellent credit score (700+) can enhance trust in repayment capability. Highlighting existing assets, such as real estate valued at $300,000 and a reliable vehicle worth $20,000, along with a track record of timely repayments on current loans (zero late payments over the last five years) strengthens the argument for a loan increase. Finally, mentioning upcoming financial improvements, like a promotion or additional freelance work, can bolster a convincing case for increased loan approval.

Contact information for follow-up

Requesting an increase in a personal loan can involve several essential components, including details about current loan status, reasons for the increase request, and supporting financial information. It is crucial to include specific figures, such as the current loan amount of $10,000, monthly payment of $300, and desired increase of $5,000 to support urgent expenses or consolidate higher-interest debt. Clear documentation, such as recent pay stubs, credit score reports, and a budget summary, can strengthen the request by demonstrating repayment capability. Including contact information, such as a phone number (555-123-4567) and email address (example@email.com), facilitates follow-ups and ensures efficient communication with the lending institution throughout the approval process.

Comments