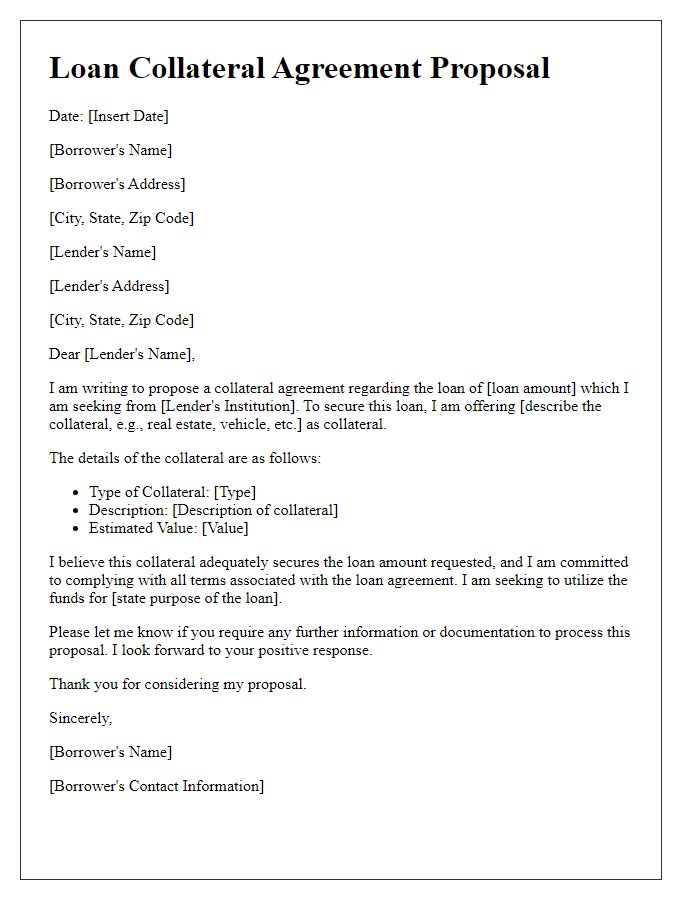

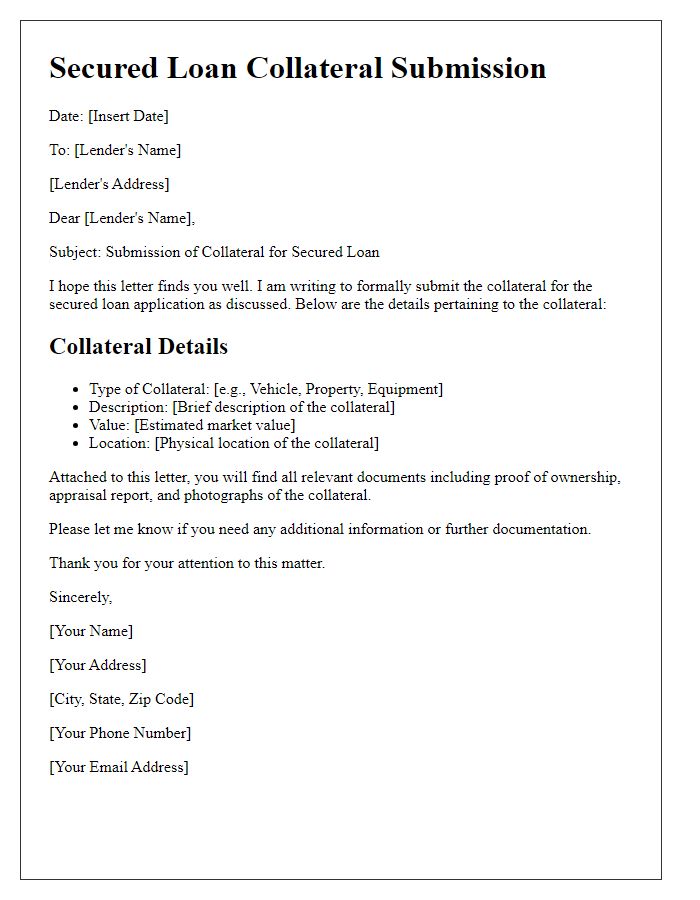

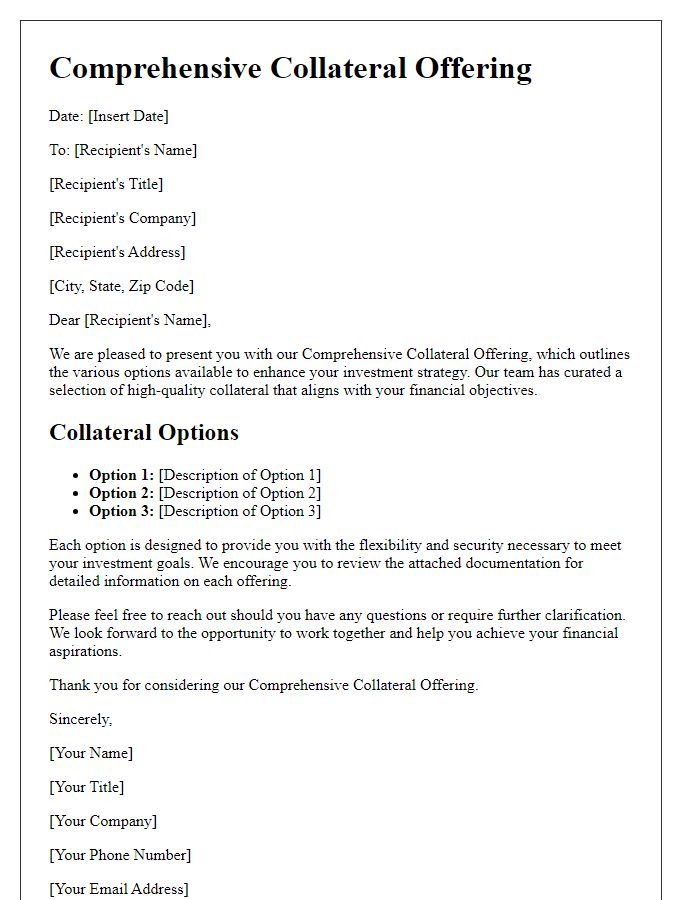

Are you considering applying for a loan and looking for the best way to present your collateral? Crafting the perfect letter can make all the difference in securing that funding you need. In this article, we'll walk you through a simple, effective template that highlights your assets clearly and professionally. So, let's dive in and explore how to create a compelling collateral offer letter!

Comprehensive asset description

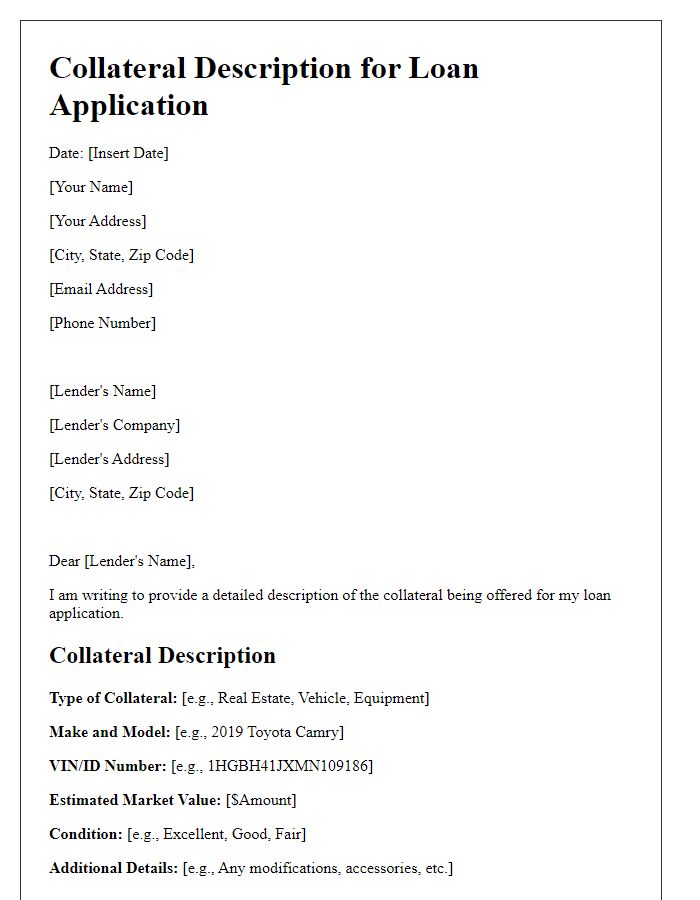

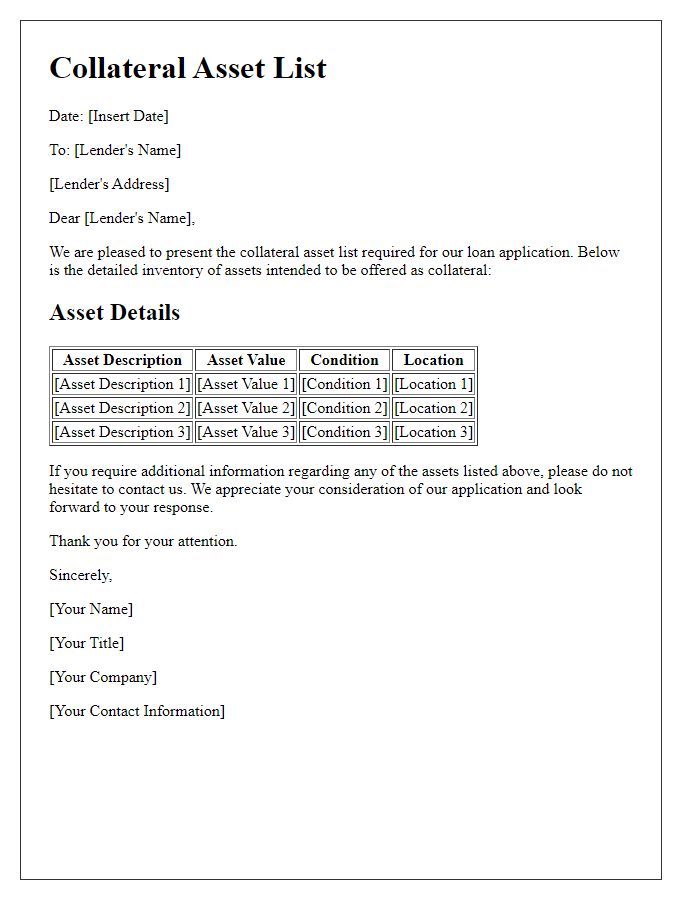

The collateral offered against the loan consists of a commercial property located at 1234 Market Street, San Francisco, California, valued at approximately $1.5 million. This three-story brick building, constructed in 1995, spans 10,000 square feet and is occupied by multiple tenants, generating a stable annual rental income of $120,000. The property lies within a thriving business district, surrounded by retail shops, restaurants, and public transportation, contributing to its high demand and potential for appreciation. Additionally, the offer includes machinery and equipment valued at $200,000 utilized in the on-site operations, featuring state-of-the-art technology purchased in early 2023. Inventory levels at the time of valuation stand at $75,000, consisting of finished goods ready for sale to customers. Documentation confirming ownership, appraisals, and rental agreements are readily available for review, establishing a solid framework for this loan collateral.

Valuation and appraisal details

Valuation and appraisal details are critical components when detailing a loan collateral offer. The appraisal report outlines the fair market value of the asset, such as real estate, machinery, or vehicles. A professional appraiser typically conducts this assessment, often using methods such as the sales comparison approach for residential properties or cost approach for unique assets. Loan collateral, such as a commercial property in Los Angeles valued at $1.5 million, must meet lender criteria for loan-to-value ratios. Detailed descriptions of property attributes, including square footage, condition, and location, enhance credibility. Additionally, clear documentation of any recent renovations or improvements that may boost value is essential. Timely appraisals, usually completed within 30 days, ensure updated valuations that align with market trends, providing lenders with a comprehensive risk assessment for the collateral offered.

Legal ownership and title status

The legal ownership status of the collateral property, located at 123 Main Street, Springfield, indicates that the borrower holds clear title, unencumbered by liens or disputes. Current title records, retrieved from the Springfield County Registrar's Office, confirm that the property is free of any mortgages or legal claims, establishing a solid foundation for securing the loan. Moreover, the comprehensive title report, issued on March 10, 2023, verifies that all property taxes are paid and up to date, ensuring compliance with local regulations and enhancing the asset's value. This collateral, assessed at $250,000, is positioned favorably within the residential real estate market, contributing to its desirability and security as a loan backing.

Lien and encumbrance information

Incorporating detailed lien and encumbrance information is crucial when offering collateral for a loan. Collateral might include assets such as real estate properties, automobiles, or business equipment, each of which can be affected by existing liens. A lien refers to a legal right or interest that a lender has in the borrower's property, typically as security for a debt. For instance, a mortgage on a residential property could place a lien that prioritizes the lender's claim against other creditors in the event of default. Encumbrances may involve restrictions or claims against the property that can affect its transferability or value. Specifics about liens, like whether they are first or second mortgages, should also include information regarding other debts tied to the collateral. Clarity about the total amount owed, payment history, and current status will enhance understanding. Additionally, documenting any encumbrances such as easements or zoning restrictions can also provide a comprehensive view of the property's capabilities and limitations.

Insurance coverage documentation

Comprehensive insurance coverage documentation ensures the protection of loan collateral, particularly in the case of valuable assets such as real estate properties or vehicles. Policies should cover total insured value, typically assessed by a certified appraiser, and include specific provisions for fire, theft, and natural disasters. Financial institutions often require evidence of adequate coverage before approving loans exceeding specific thresholds, often around $50,000. Documentation must delineate the insured party, detailing the lender's interest in the collateral, along with policy numbers and effective dates. Failure to maintain adequate coverage can lead to significant financial repercussions, including possible loan defaults, emphasizing the importance of meticulous record-keeping.

Comments