In these challenging times, many businesses have found themselves navigating the unexpected turbulence brought about by the pandemic. If you're considering restructuring your business loan to better align with your current financial situation, you're not alone. This process can help alleviate some of the strain and set your company on a path toward recovery. Let's explore how a business loan restructuring might work for you and what steps you can take to get startedâread more to uncover valuable insights!

Introduction and Business Impact Overview

Many small businesses, like cafes and retail stores, have faced unprecedented challenges due to the COVID-19 pandemic, resulting in significant financial strain. For instance, in April 2020, approximately 30% of small businesses in the United States temporarily closed, impacting revenue streams and employment levels. The mandated restrictions led to reduced foot traffic, with reports showing a decline of up to 80% in sales for some establishments. This downturn has affected cash flow, making it difficult to meet loan obligations. Consequently, many business owners find themselves seeking a restructuring of existing loans to accommodate new financial realities and ensure sustainability moving forward.

Specific Loan Details and Restructuring Request

In a challenging economic climate, many businesses are seeking relief from their financial commitments, especially those impacted by the COVID-19 pandemic. Specific examples include companies that secured Small Business Administration (SBA) loans, which varied in amount from $10,000 to over $2 million, that are now struggling to meet monthly payment obligations. For instance, firms based in urban centers like New York City or Los Angeles, where lockdowns greatly affected foot traffic, have faced decreased revenue by as much as 70%. Restructuring requests typically outline the need for longer repayment terms, possibly extending from five years to ten years, or a temporary reduction in interest rates from 5% to as low as 2% during crisis recovery. Effective communication with lenders, such as local banks or credit unions, is crucial for negotiating terms that allow businesses to regain stability while ensuring lenders maintain a manageable risk level.

Financial Statements and Projections

The COVID-19 pandemic severely impacted small businesses' financial stability, leading many to seek loan restructuring solutions. Critical Financial Statements, such as the Balance Sheet and Profit and Loss Statement, reveal plummeting revenues, with many businesses reporting declines of 30% to 50% compared to pre-pandemic levels. Projections for the upcoming fiscal year indicate slow recovery, estimating a return to only 75% of pre-COVID revenue levels by mid-2024, primarily due to ongoing supply chain disruptions and reduced consumer spending. Cash Flow Analysis highlights potential shortfalls, suggesting the need for adjusted payment terms to maintain liquidity and prevent default. Therefore, timely loan restructuring discussions with financial institutions are essential for sustaining operations and workforce stability in challenging economic conditions.

Mitigation Strategies and Future Plans

Business loan restructuring can be crucial for companies affected by the COVID-19 pandemic. Implementing effective mitigation strategies helps sustain operations and ensures long-term viability. For instance, businesses have adopted cost-cutting measures, including reducing staff hours or renegotiating supplier contracts, to manage decreased cash flow. Future plans involve diversifying revenue streams, such as expanding e-commerce platforms or adopting new technologies for remote work capabilities. Additionally, financial forecasting tools are utilized to assess cash reserves and create contingency plans for potential disruptions. By focusing on these strategies, businesses can present a compelling case for restructuring their loans while demonstrating a proactive approach towards recovery and growth in an uncertain economic climate.

Contact Information and Follow-up Proposal

Business owners facing financial challenges due to the COVID-19 pandemic often seek loan restructuring options. This involves reaching out to lenders for assistance in modifying existing loan agreements. Emphasizing contact details such as email addresses and phone numbers (e.g., business name at example.com, (555) 123-4567) facilitates direct communication. A follow-up proposal must clearly outline the requested changes, including reduced interest rates (e.g., from 5% to 3%), extended repayment terms (e.g., from 5 years to 10 years), and potential deferments on principal payments (e.g., a 6-month deferral). Showing a commitment to repay and detailing operational adjustments implemented due to the pandemic is crucial. Providing a solid business plan and projections for recovery demonstrates proactive management and enhances the likelihood of a favorable restructuring outcome.

Letter Template For Business Loan Restructuring Due To Pandemic Samples

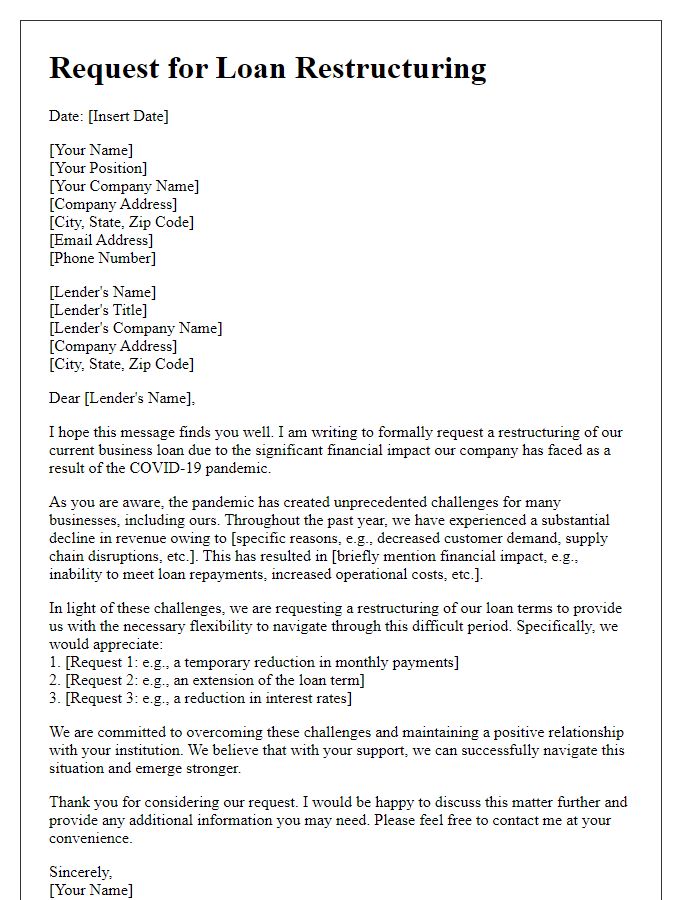

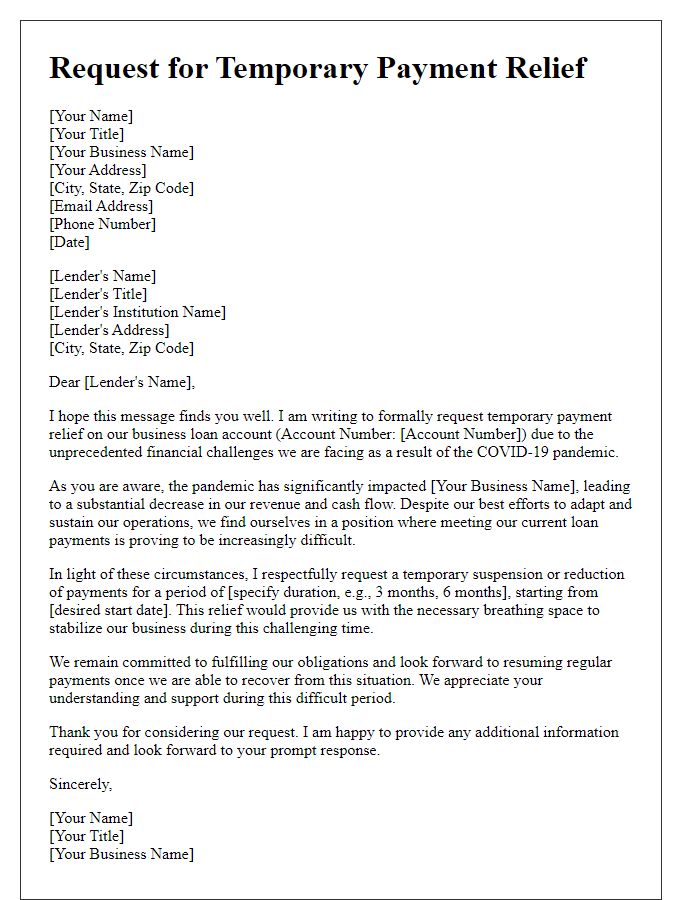

Letter template of business loan restructuring request citing financial impact of pandemic.

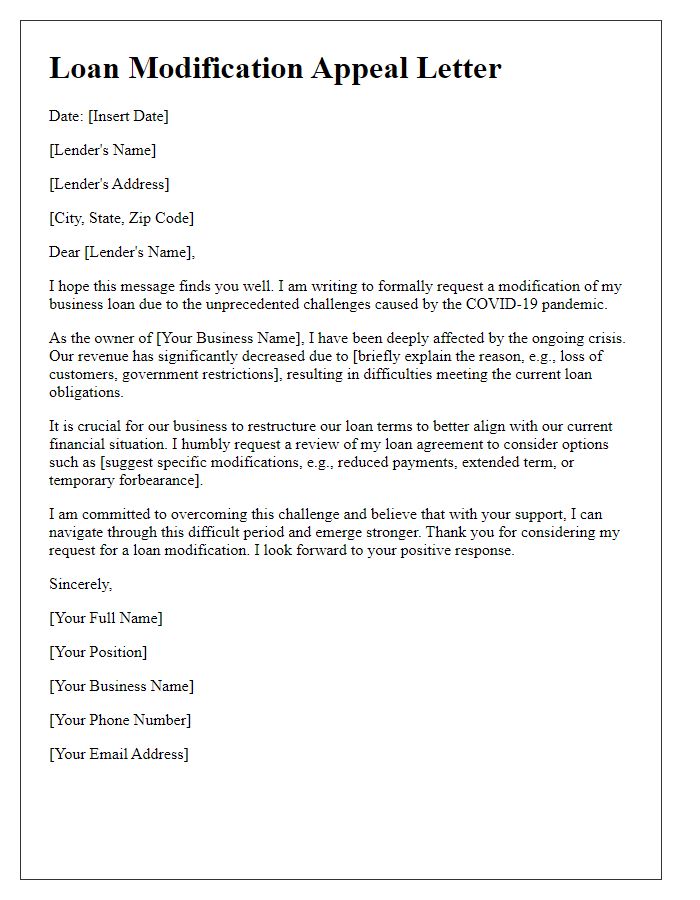

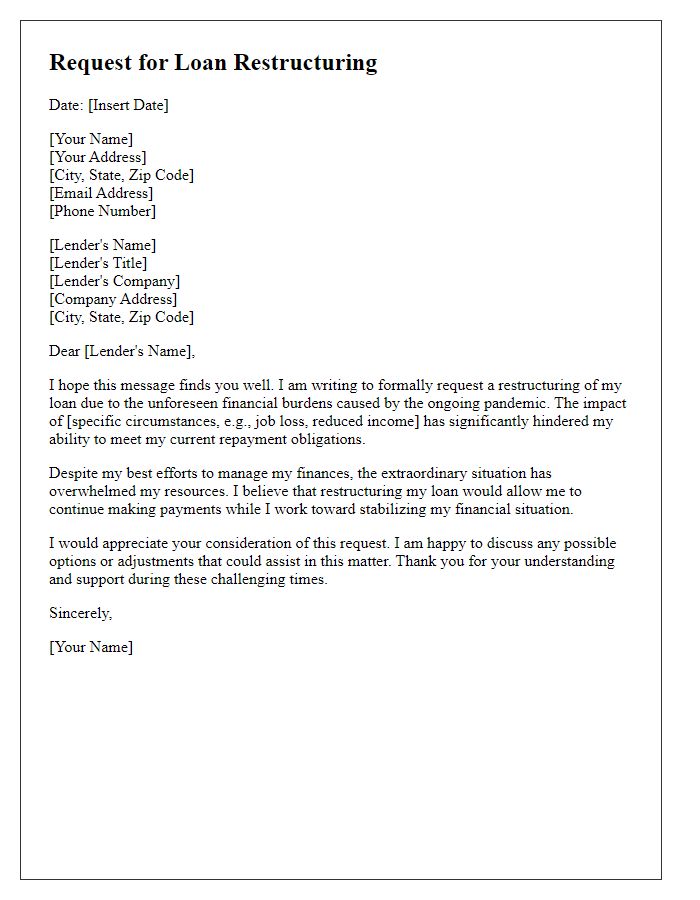

Letter template of loan modification appeal for business due to COVID-19 challenges.

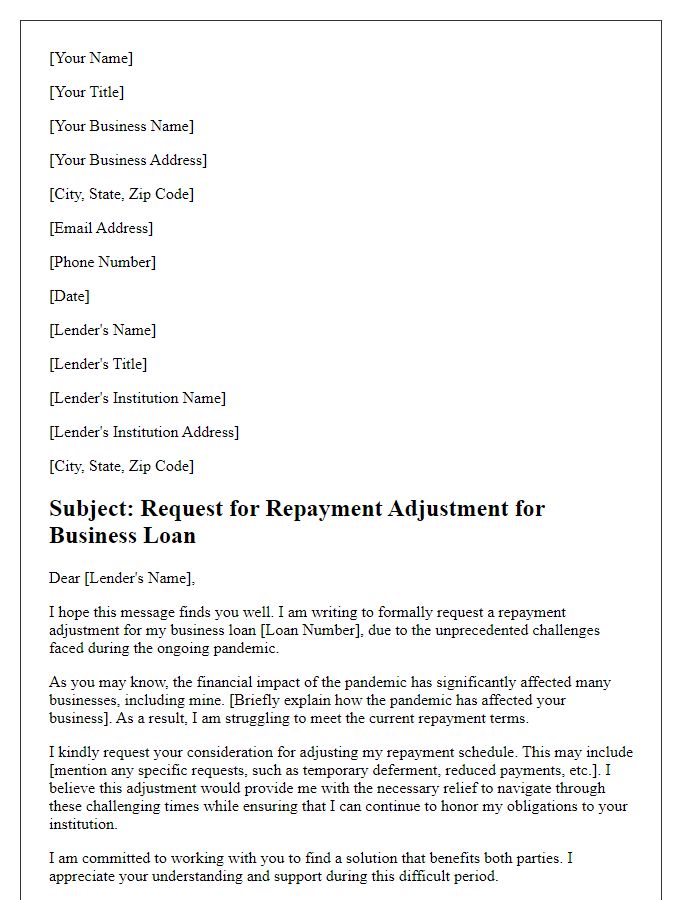

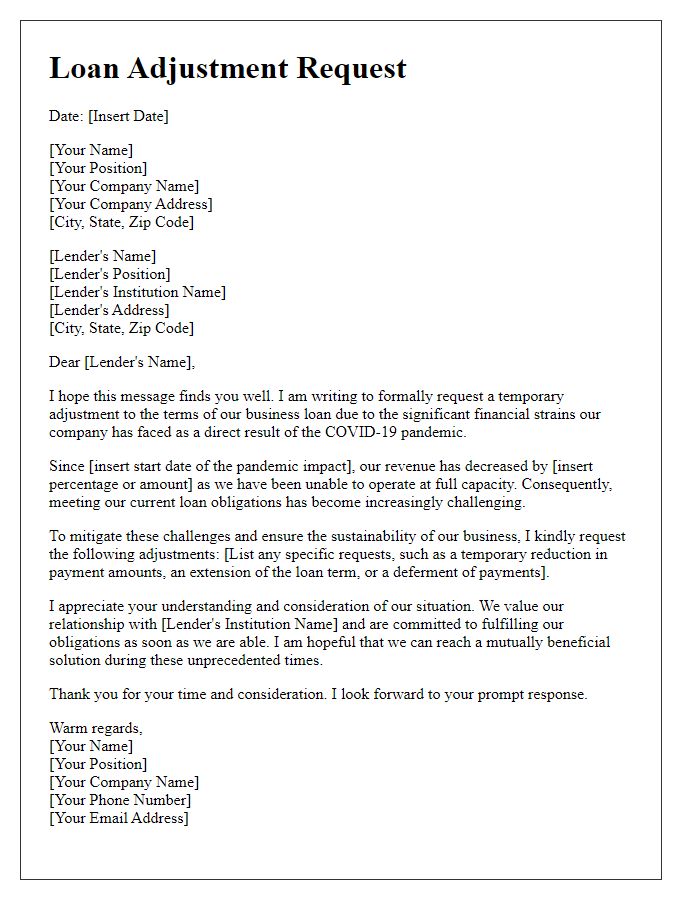

Letter template of request for repayment adjustment for business loan amidst pandemic.

Letter template of business loan restructuring inquiry post-pandemic disruption.

Letter template of official appeal for flexible loan terms for struggling business during pandemic.

Letter template of financial hardship explanation for loan restructure request amid COVID-19.

Letter template of business restructuring proposal due to pandemic-related revenue loss.

Letter template of request for temporary payment relief on business loan due to pandemic.

Letter template of plea for loan restructuring consideration due to unforeseen pandemic circumstances.

Comments