Are you feeling overwhelmed by the insurance claim process and how it impacts your loan payments? You're not alone; many find navigating these waters challenging, especially when financial obligations are on the line. In this article, we'll walk you through a comprehensive letter template specifically designed to help you communicate your situation effectively to your lender or insurance company. So, let's dive in and explore how to draft a compelling claim that could ease your financial burden!

Clear Subject Line

Insurance claims can significantly impact loan payment schedules, presenting challenges for borrowers. For instance, when filing a claim for property damage due to natural disasters such as hurricanes or floods, policyholders may face delays in receiving compensation, which can affect their ability to make timely mortgage payments. Loan servicers, such as Wells Fargo or Bank of America, require documentation of the insurance claim process, which often includes specific forms like the Proof of Loss statement. Missing payments may trigger additional fees or affect the credit score, which typically ranges from 300 to 850. Borrowers must communicate effectively with both insurance companies and lenders to ensure a clear understanding of loan obligations during the claim process.

Policy and Loan Details

Filing an insurance claim related to loan payments can be a complex process, particularly in reference to a specific policy, such as Policy Number A123456789 for Homeowners Insurance, insured by XYZ Insurance Company. The affected loan, a Mortgage Loan Number L987654321 with a principal amount of $250,000, financed through ABC Lending Institution, necessitates detailed documentation of the events leading to the claim. An incident, such as a natural disaster occurring in Florida in September 2022, that caused significant property damage may trigger this claim. It's essential to report the nature of damages accurately, as this could correlate directly to the ability to meet monthly loan obligations of approximately $1,500. Timely completion of claim forms and submission of receipts for repairs, alongside comprehensive loss documentation, will expedite the review process by the insurance adjuster.

Description of Incident

In a recent incident involving a vehicle collision, a policyholder's car was struck by another vehicle in downtown Los Angeles during peak traffic hours. The accident occurred on 5th Street near the intersection with Main Street, around 3 PM, resulting in significant damage to the front end of the policyholder's car, a 2020 Honda Accord. The impact caused the airbags to deploy, leading to both vehicle damage and potential injuries to the occupants. Emergency services arrived on the scene, documenting the event. This unfortunate incident has directly affected the policyholder's ability to meet loan payments, as they rely on the vehicle for daily commuting to work at a nearby tech company, contributing to financial strain during the repair process. Further complications arose due to delays in the insurance claim process, further postponing timely payments.

Supporting Documentation

In the realm of financial transactions, supporting documentation serves as a critical element for insurance claims that affect loan payments. Essential records include policy documents (detailed descriptions of coverage), loan agreements (contracts specifying terms, interest rates, and repayment schedules), and evidence of loss (photographs, police reports, or repair estimates). Additionally, medical records (notes that outline injury or damage as a result of the insured event) can substantiate claims related to personal injury. Time-stamped invoices (official statements detailing costs incurred) provide clarity on expenses pertinent to the claim. Financial statements (yearly or quarterly records showcasing income) may also be requested to demonstrate ongoing financial obligations. Each document fundamentally strengthens the claim's validity, ensuring that lenders and insurers can efficiently process requests while adhering to regulatory standards.

Request for Prompt Resolution

Insurance claims can significantly impact loan repayments, affecting financial stability. Processing time for claims, often taking weeks or even months (averaging 30 to 60 days), can lead to delayed payments. In cases of disability or severe illness, for instance with critical conditions like cancer or stroke, loan holders may face increased stress. Communication with insurance companies, such as those regulated by state commissions, becomes crucial. Lack of timely resolution may also incur late fees on loans, affecting credit scores, which range from 300 to 850. Documenting all interactions and maintaining contact with financial institutions can facilitate a smoother claims process.

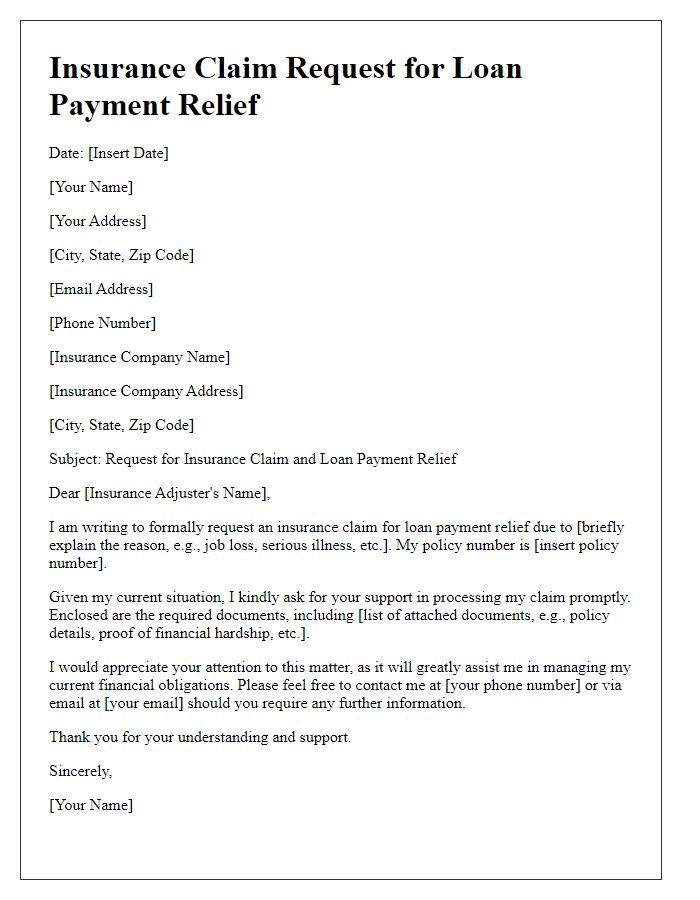

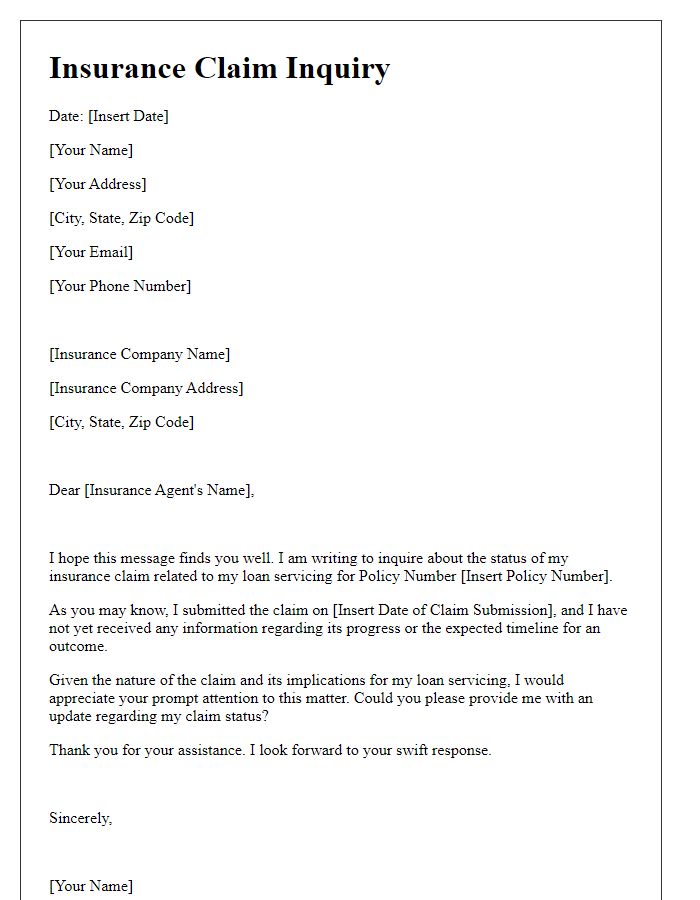

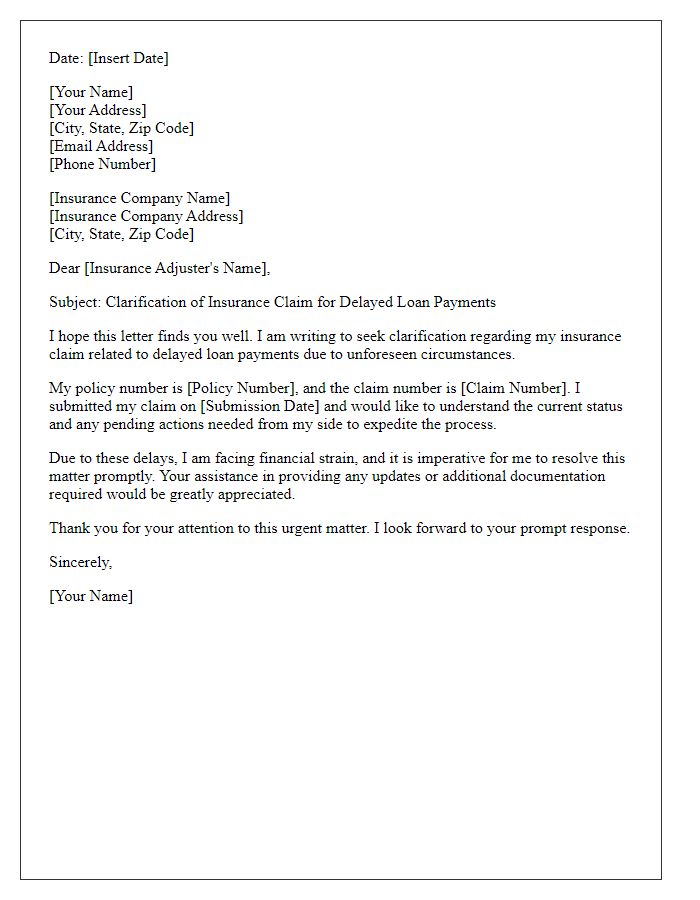

Letter Template For Insurance Claim Affecting Loan Payment Samples

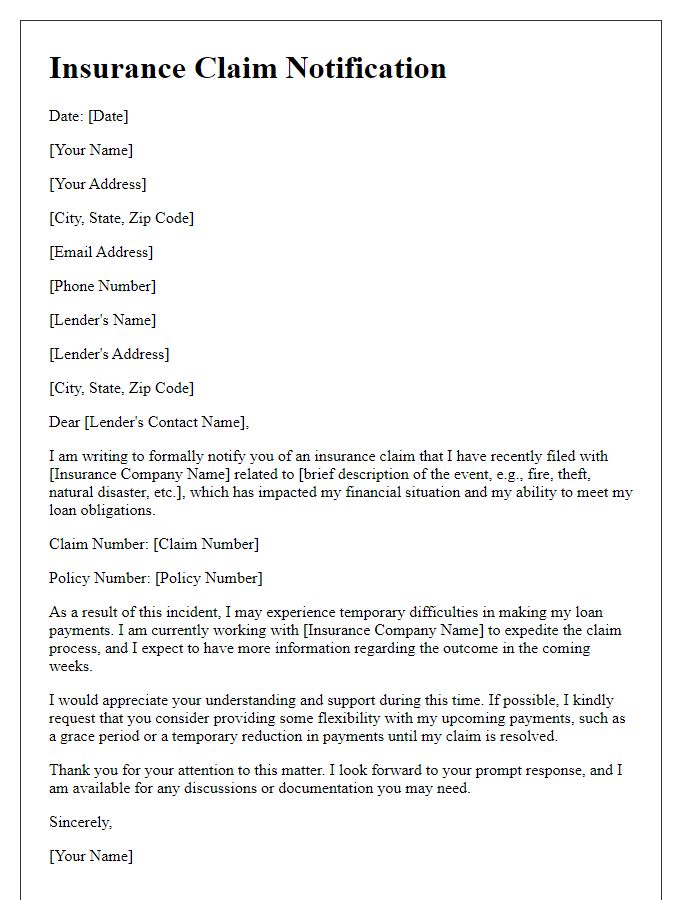

Letter template of insurance claim notification impacting loan obligations.

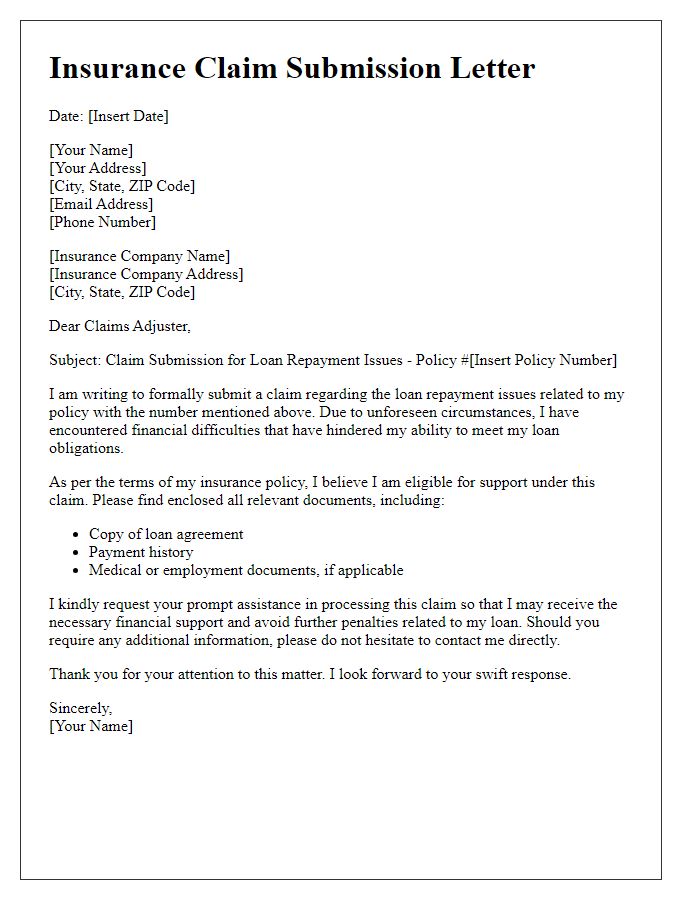

Letter template of insurance claim submission concerning loan repayment issues.

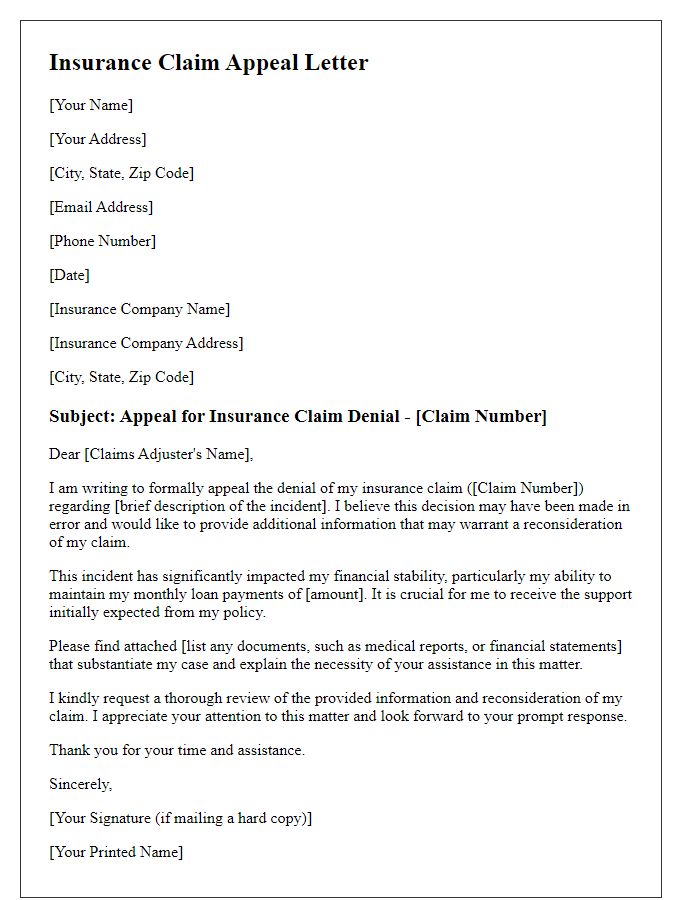

Letter template of insurance claim appeal affecting monthly loan payments.

Letter template of insurance claim update for alterations in loan payment schedule.

Letter template of insurance claim documentation for loan payment adjustments.

Letter template of insurance claim follow-up regarding loan financial impact.

Letter template of insurance claim statement affecting loan repayment process.

Comments