Are you considering asking for a personal loan increase but unsure how to present your case? Crafting a persuasive letter can make all the difference, and it's essential to clearly articulate your reasons while maintaining a friendly tone. By outlining your financial situation, ongoing obligations, and how an increased loan would support your goals, you're setting the stage for a favorable response. Join us as we explore tips and a sample template to help you write an effective request!

Financial Justification and Necessity

Personal loan increases may arise from various financial necessities. An unexpected medical expense, such as a $15,000 surgery, can strain monthly budgets significantly. Job loss can lead to reduced income, requiring additional funds to cover essential living expenses like rent and utilities in cities like San Francisco, where monthly rents average $3,000. Increased educational costs, particularly tuition hikes from institutions like Harvard University, can add pressure on existing finances. Additionally, natural disasters, such as hurricanes causing $100 billion in damage, often necessitate immediate financial assistance for recovery. Lastly, investing in small businesses during economic downturns might require a temporary raise in loan limits to ensure operational continuity and avoid bankruptcy.

Loan Repayment Plan and Capacity

A personal loan increase may be required due to a series of unforeseen financial obligations. Current repayment obligations include a personal loan totaling $10,000 with an annual percentage rate of 15%, requiring monthly payments of $300, due until 2026. Recently incurred expenses from medical emergencies, totaling $5,000, and essential home repairs estimated at $4,000 exacerbate financial stress. Additionally, the regional job market in Houston, Texas, shows signs of limited opportunities, threatening current employment stability. A comprehensive repayment plan, factoring in expected income from a stable job at $55,000 annually, alongside a disciplined budgeting strategy, demonstrates the increased loan amount can be managed effectively. A favorable interest rate negotiation can also enhance overall affordability, assuring timely repayments without default risk.

Reason for Current Loan Sufficiency

Current personal loan amounts often become insufficient due to life changes, such as unexpected medical expenses or significant home repairs, particularly in areas prone to natural disasters like hurricanes or floods. For instance, an average emergency room visit can exceed $1,500 in the United States, alongside substantial costs for home repairs which can range from $5,000 to $20,000 based on damage severity. Factors influencing loan sufficiency also include rising costs of living in urban centers, with inflation rates affecting basic necessities. Increased financial obligations may arise from education expenses, where tuition rates at four-year colleges can reach upwards of $30,000 annually. Consequently, an increase in loan amount can provide necessary financial coverage to manage these evolving life circumstances effectively.

Impact on Financial Stability

A personal loan increase can significantly impact financial stability by providing essential funds for unexpected expenses. In emergency situations, such as medical bills exceeding $10,000 or urgent home repairs after natural disasters, access to additional capital can prevent financial strain. Higher loan amounts can also facilitate the consolidation of existing debt, improving cash flow by potentially reducing monthly payments by 30-50%. Moreover, an increased loan can support important investments, such as professional development courses costing around $2,500, enhancing career opportunities. Maintaining a good credit score, typically above 700, is crucial for obtaining favorable interest rates, which can further reinforce long-term financial health.

Future Financial Goals and Outcomes

Individuals seeking a personal loan increase should consider their future financial goals and outcomes, which may include significant projects such as home renovations (average costs can range from $15,000 to $50,000), educational expenses (tuition fees for universities can exceed $30,000 annually), or starting a small business (initial investment could vary widely, often requiring $10,000 to $100,000). Any increase in loan availability could provide necessary funds to enhance living conditions, improve long-term employment prospects, or invest in entrepreneurial ventures, potentially yielding higher annual returns. Effective planning and budget management will ensure that the financial obligations remain manageable while allowing individuals to achieve their aspirations. Moreover, a higher loan amount can facilitate better cash flow management and help in attaining a more stable financial future.

Letter Template For Justifying Need For Personal Loan Increase Samples

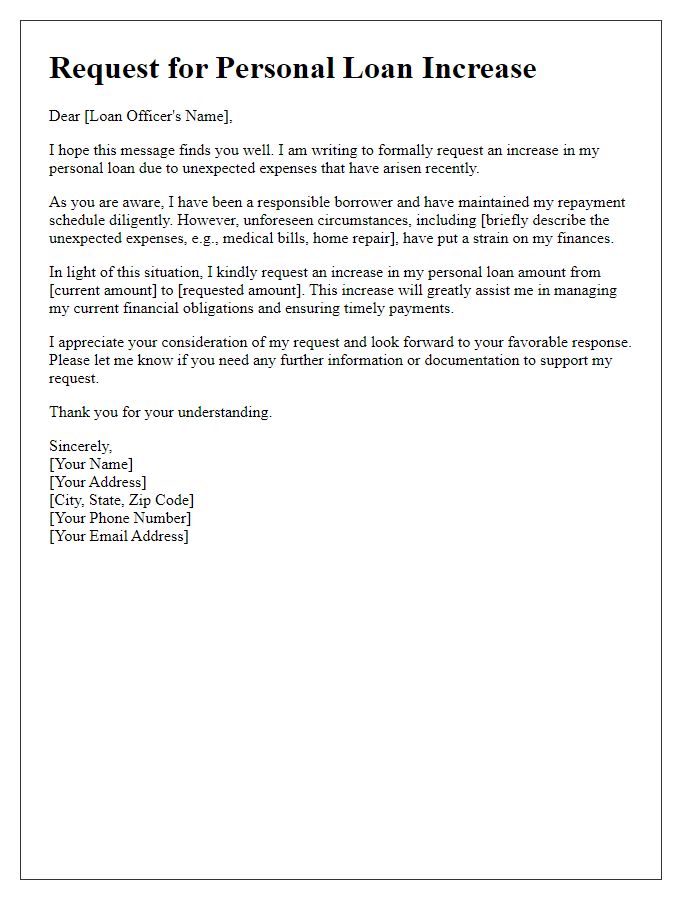

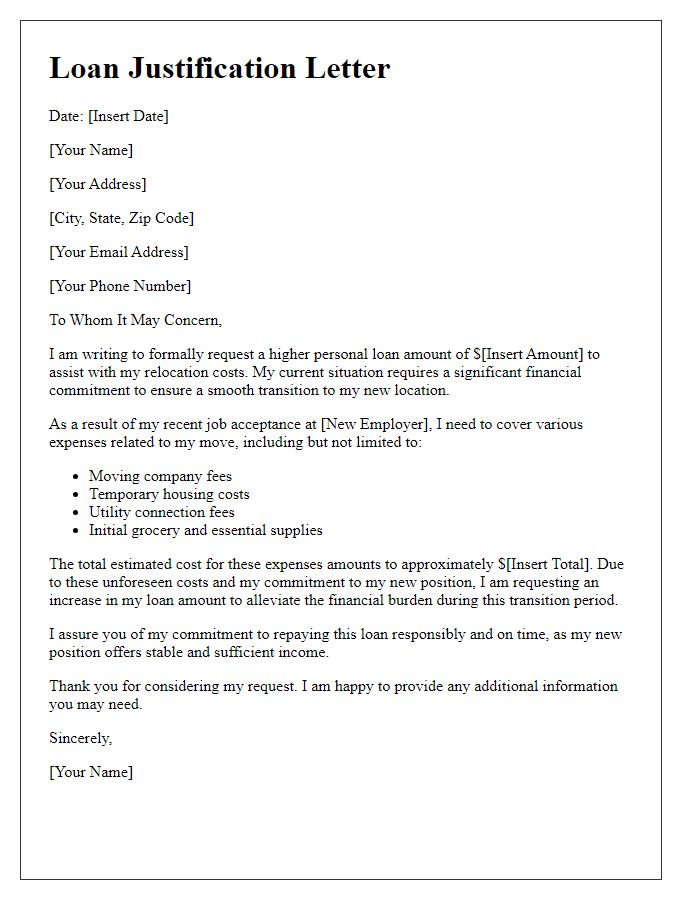

Letter template of request for personal loan increase due to unexpected expenses.

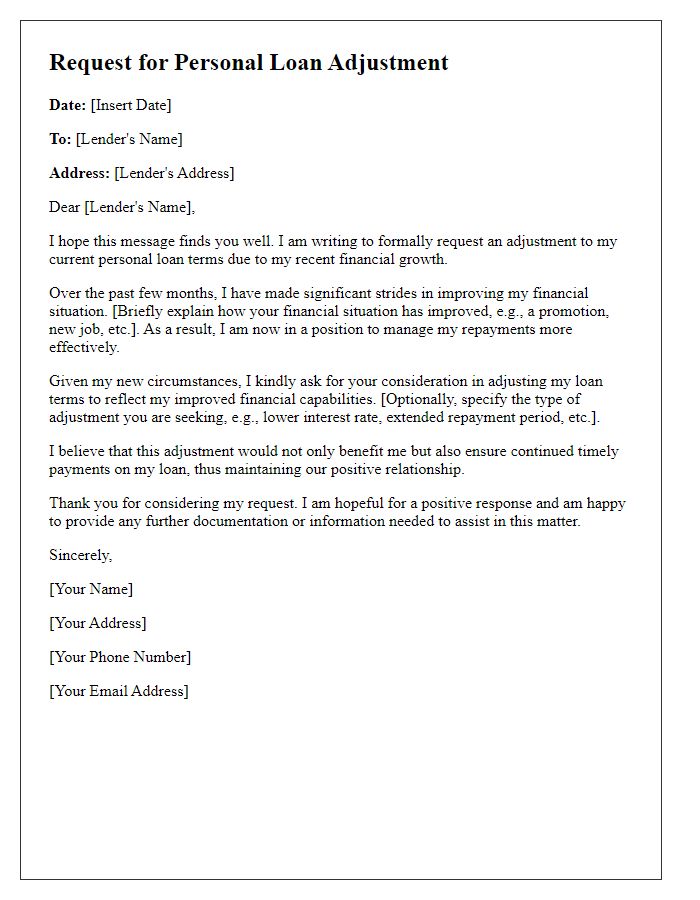

Letter template of appeal for personal loan adjustment based on financial growth.

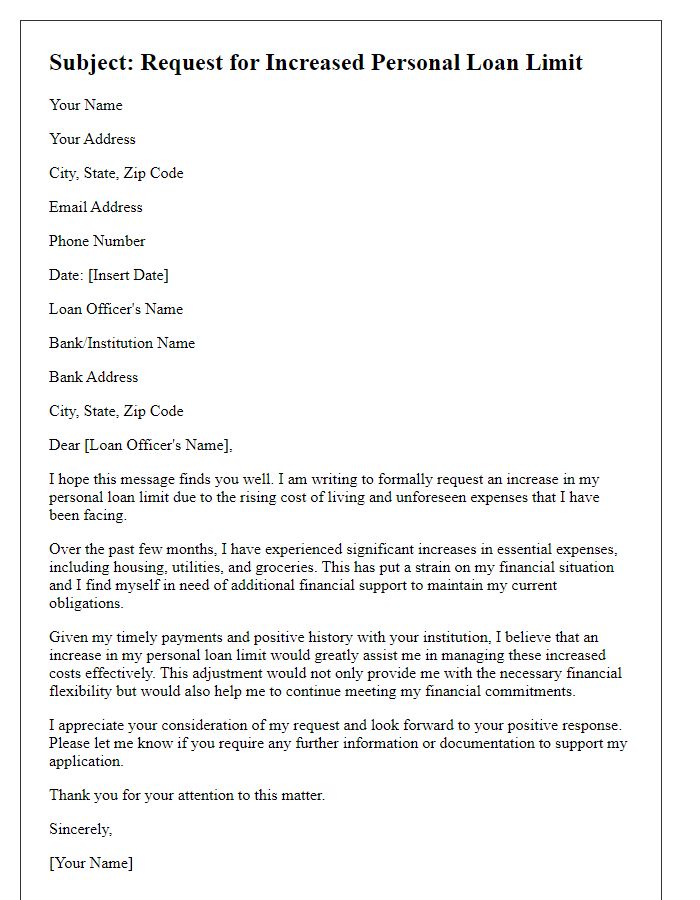

Letter template of justification for raising personal loan limit due to increased cost of living.

Letter template of explanation for requiring higher personal loan amount for home renovations.

Letter template of request for enhancement of personal loan for educational purposes.

Letter template of inquiry for personal loan increase due to medical emergencies.

Letter template of justification for personal loan augmentation for debt consolidation.

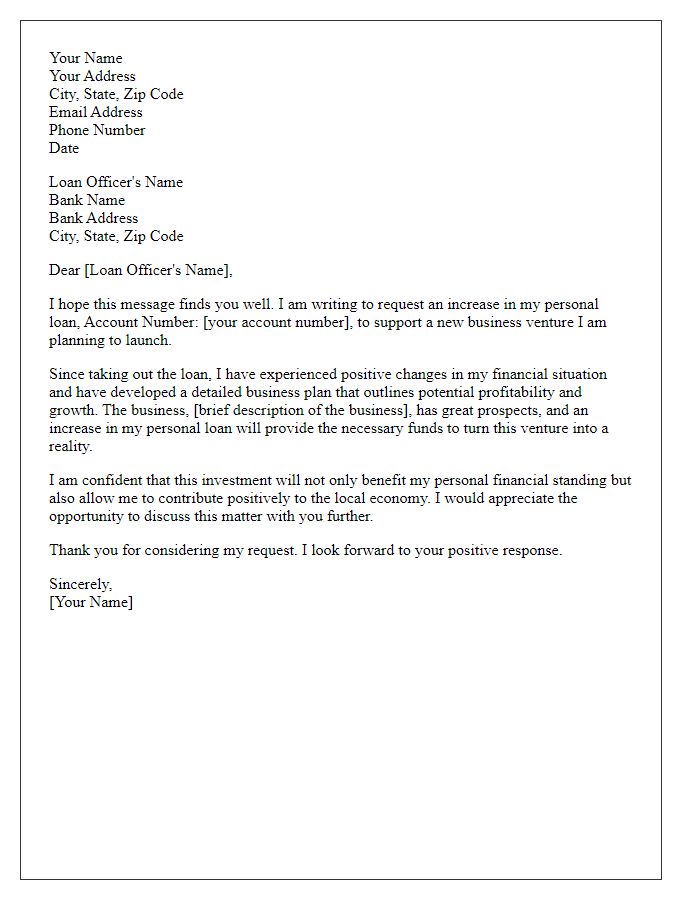

Letter template of request for increase in personal loan to support a new business venture.

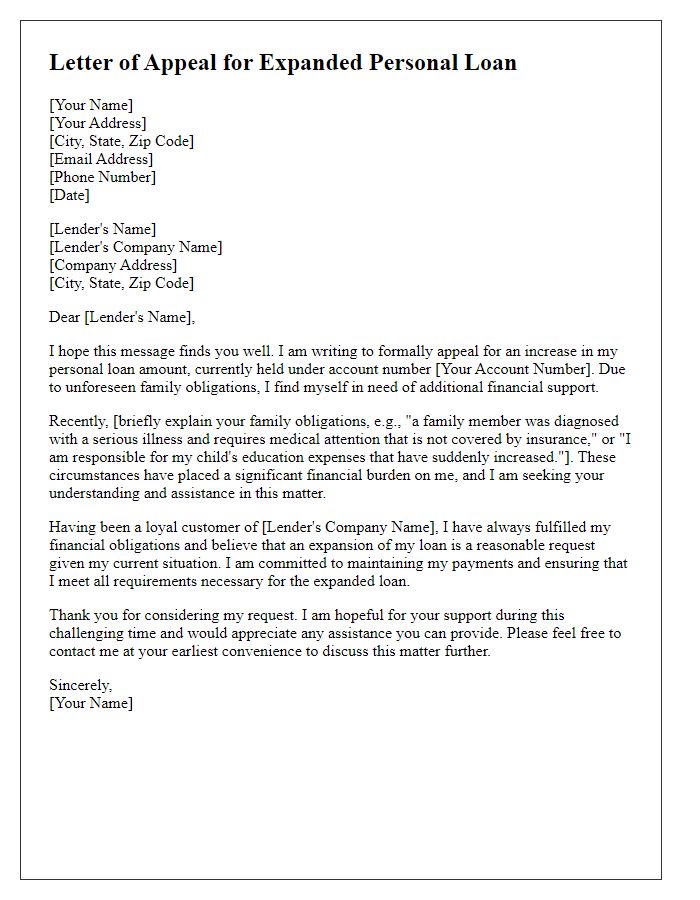

Letter template of appeal for expanded personal loan due to family obligations.

Comments