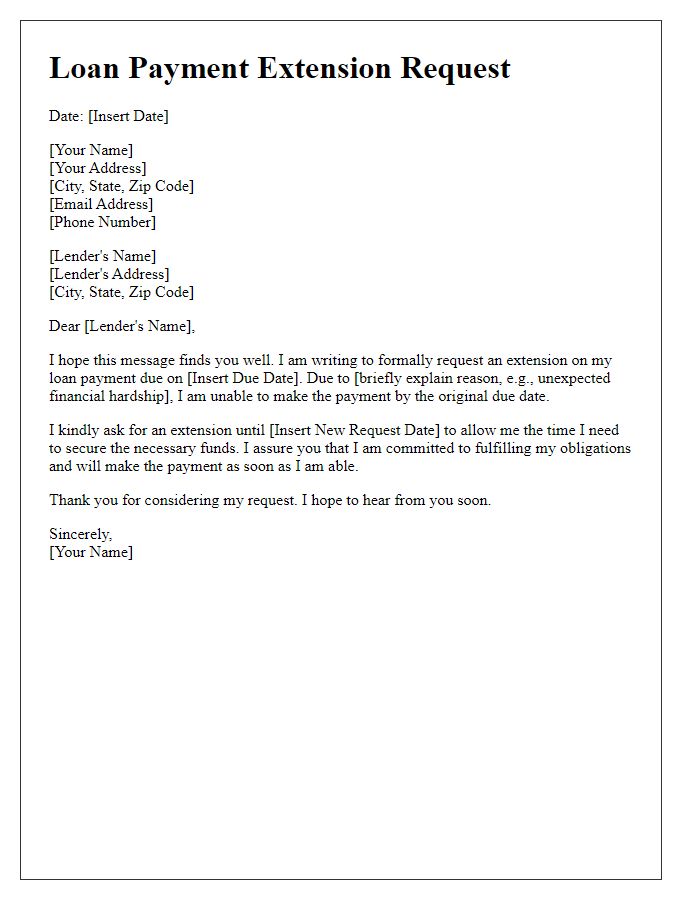

Are you feeling overwhelmed about how to explain your late loan payments? It's a common challenge that many face, and finding the right words can make all the difference. Crafting a thoughtful letter can help you maintain transparency and build trust with your lender while addressing the situation. Let's dive deeper into how to effectively communicate your circumstances so you can get back on track.

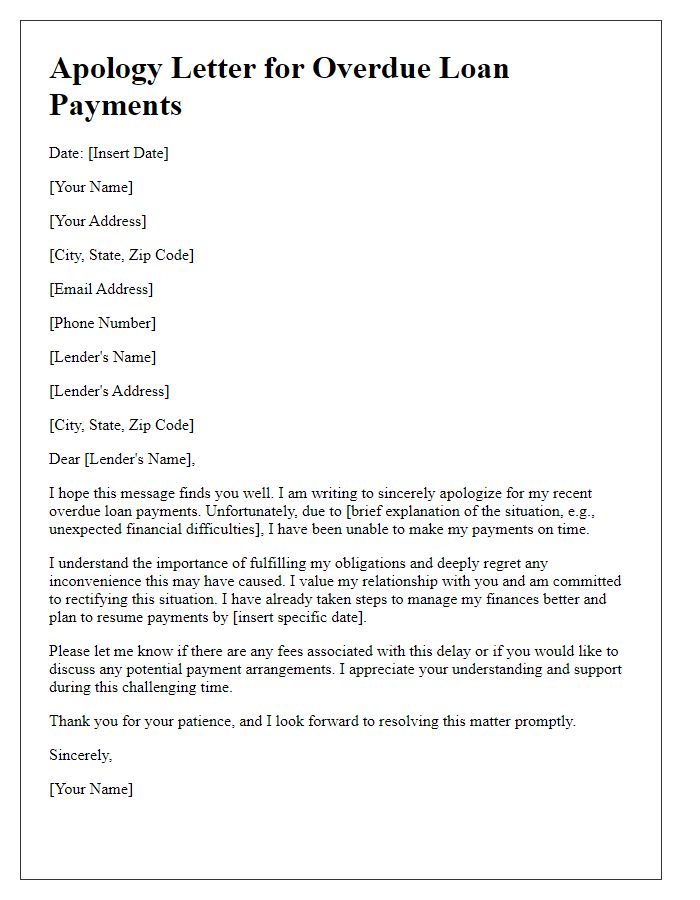

Apology and Responsibility Statement

Late loan payments can disrupt financial stability and create potential penalties. A responsible borrower recognizes the obligations tied to loans, often sourced from banks or credit unions, which necessitate timely payments to avoid interest rate increases. Factors causing delays can include unforeseen circumstances, such as medical emergencies resulting in high expenses, or job loss leading to decreased income. Acknowledgment of these challenges, along with a commitment to rectify the delay and meet future obligations promptly, enhances trust between the borrower and lender. Documenting communication with financial institutions can also pave the way for revised payment plans or assistance programs, aiding in the overall management of personal finances.

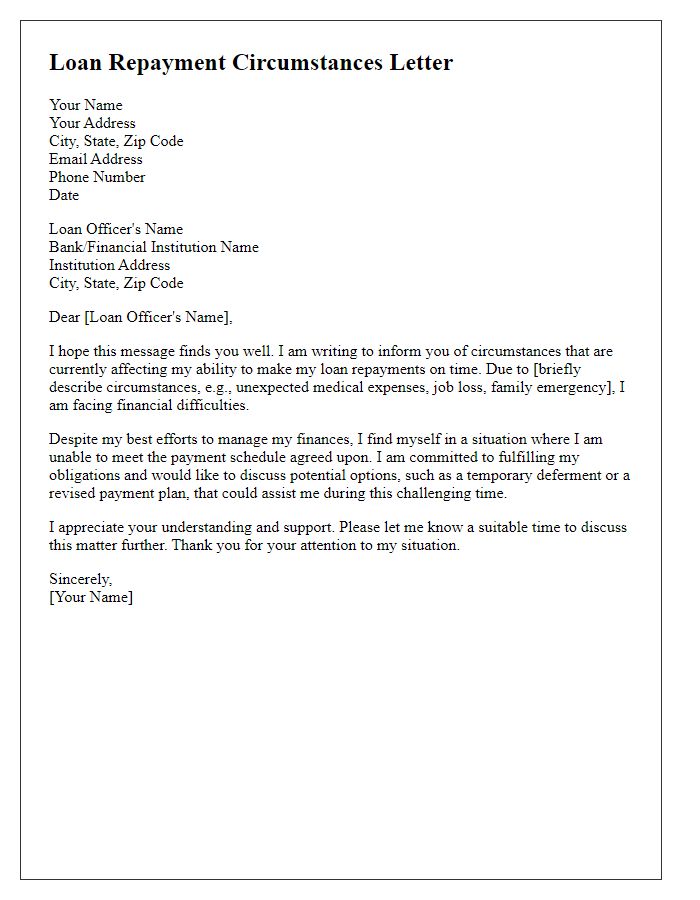

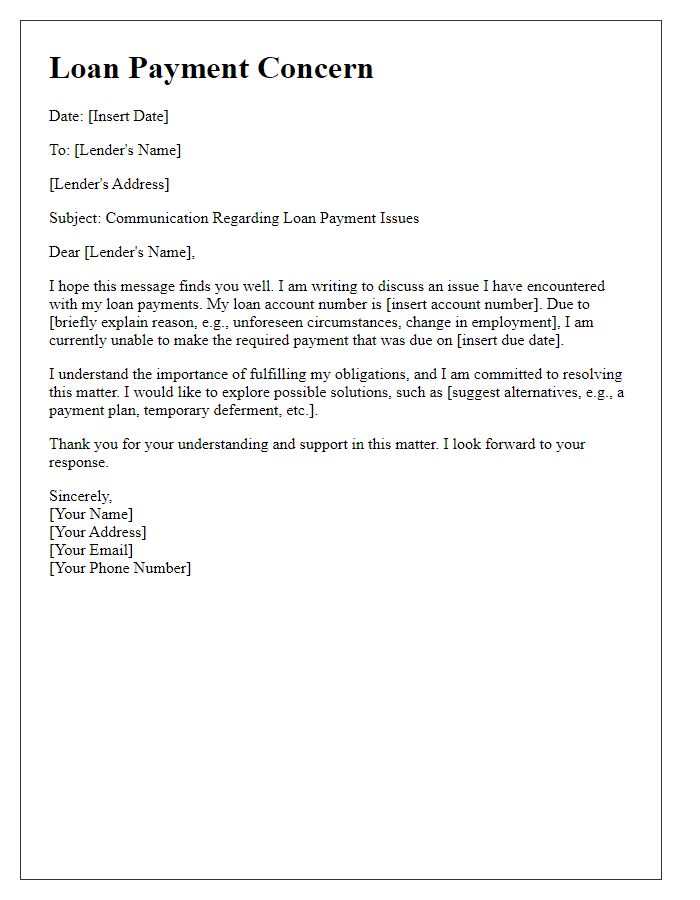

Explanation of Delay

Facing difficulties with loan repayment can lead to significant financial stress. Unexpected circumstances, such as sudden job loss or a medical emergency, can contribute to delays in fulfilling payment obligations. For instance, an individual may encounter a job loss affecting monthly income, resulting in reduced cash flow for essential expenses and loan payments. Another example could be an unexpected hospital visit incurring high medical bills that divert funds from regular payments. As a result, financial institutions often recommend contacting them immediately to discuss repayment options, which can help alleviate the burden and prevent further financial penalties. Open communication can lead to revised payment plans or temporary forbearance, ensuring better management of personal finances during challenging times.

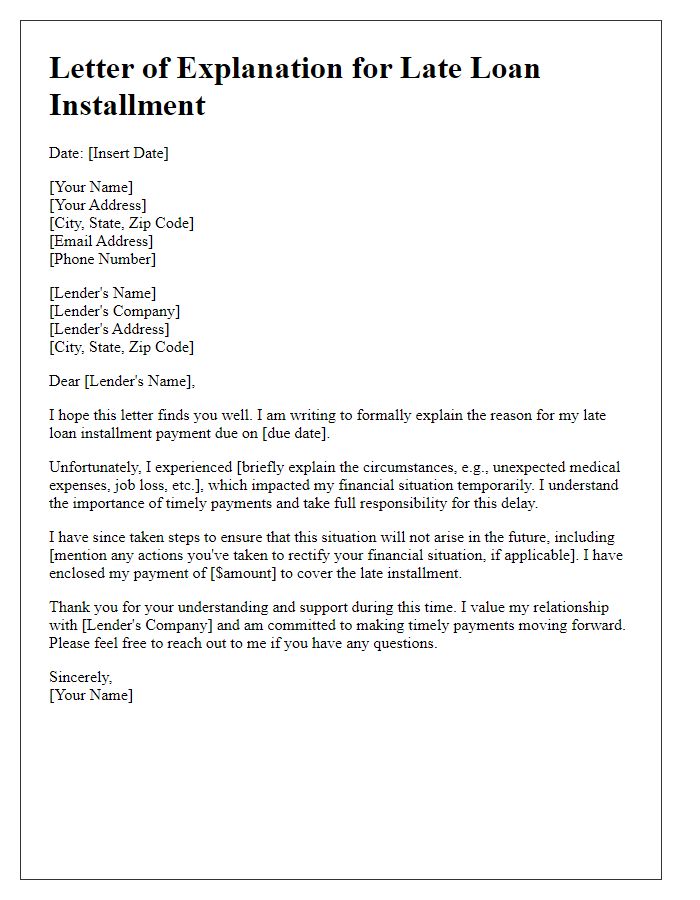

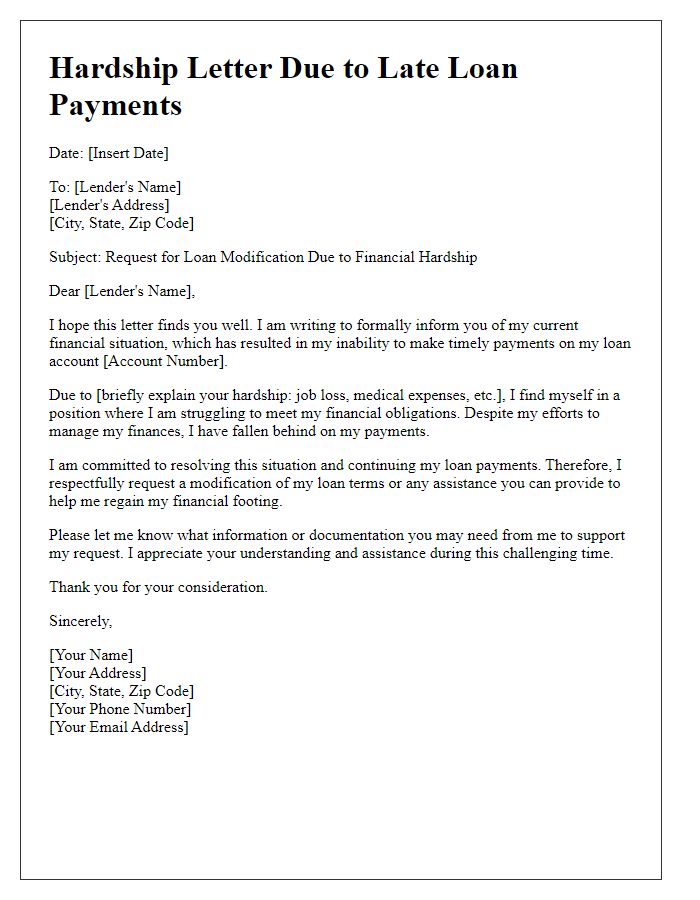

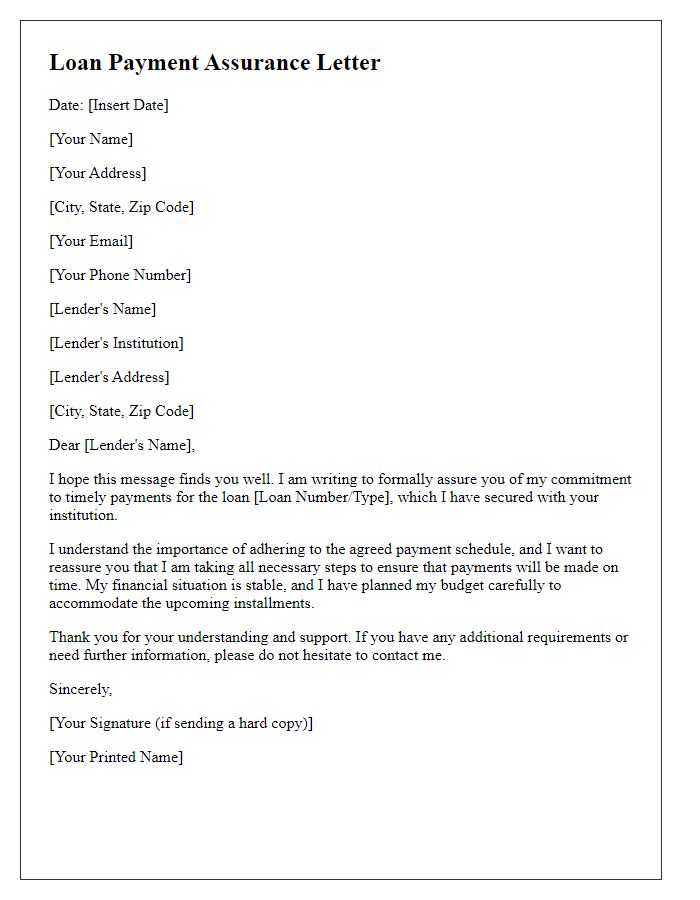

Assurance of Corrective Measures

In recent months, loan payments have been delayed due to unforeseen circumstances, including financial difficulties experienced during the COVID-19 pandemic and job loss affecting payment capabilities. These circumstances resulted in missed payments, leading to late fees and a negative impact on my credit score. To ensure timely payments in the future, I have taken steps such as securing stable employment, creating a detailed budget, and setting up automatic payments on my loan account, ensuring consistent adherence to the payment schedule. Furthermore, I remain committed to maintaining clear communication with the lender regarding any potential issues that may arise moving forward.

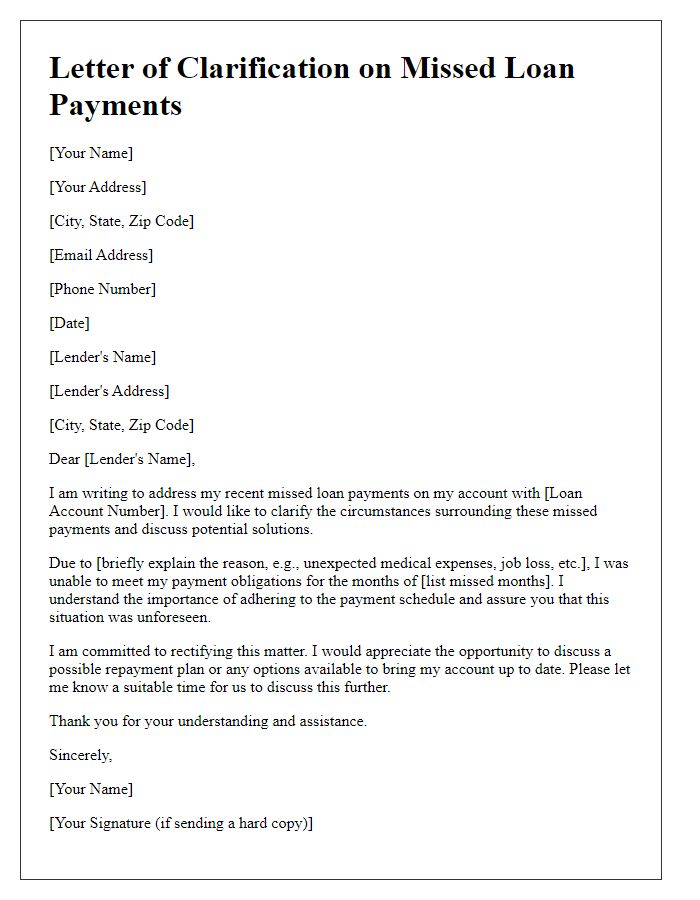

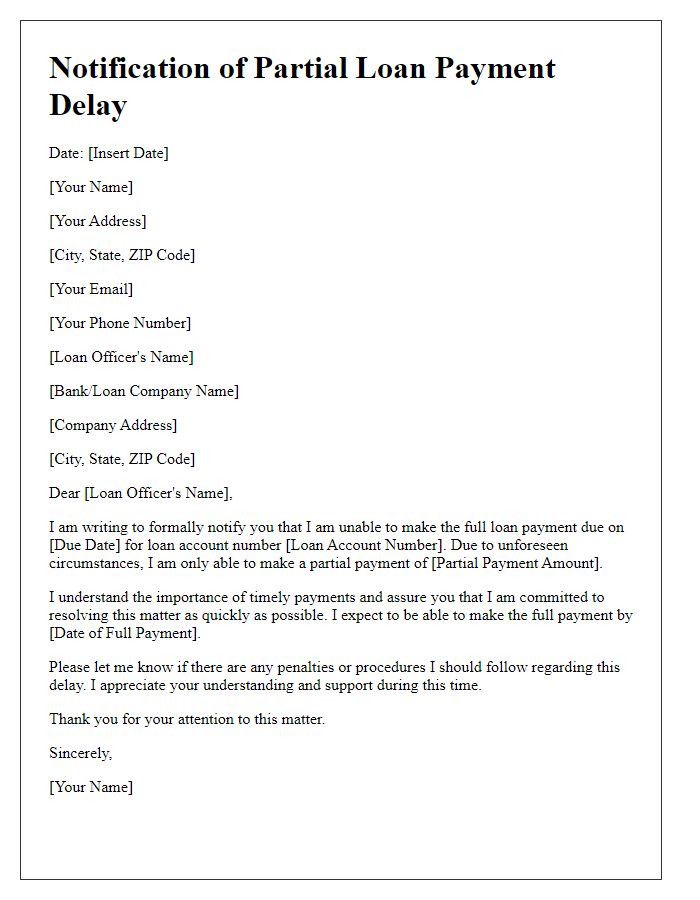

Payment Plan Proposal

Late loan payments can significantly affect credit scores and financial stability. A borrower might face challenges due to unexpected circumstances such as job loss (which affected 3.5 million Americans in 2020) or medical emergencies, leading to missed deadlines. The proposed payment plan offers a structured solution to manage arrears while maintaining communication with the lending institution, such as a bank or credit union. This plan typically includes smaller, manageable payments over an extended period, often requesting a grace period of 30 to 90 days. Establishing clear terms can demonstrate commitment to resolving the situation and preserving the relationship with the lender.

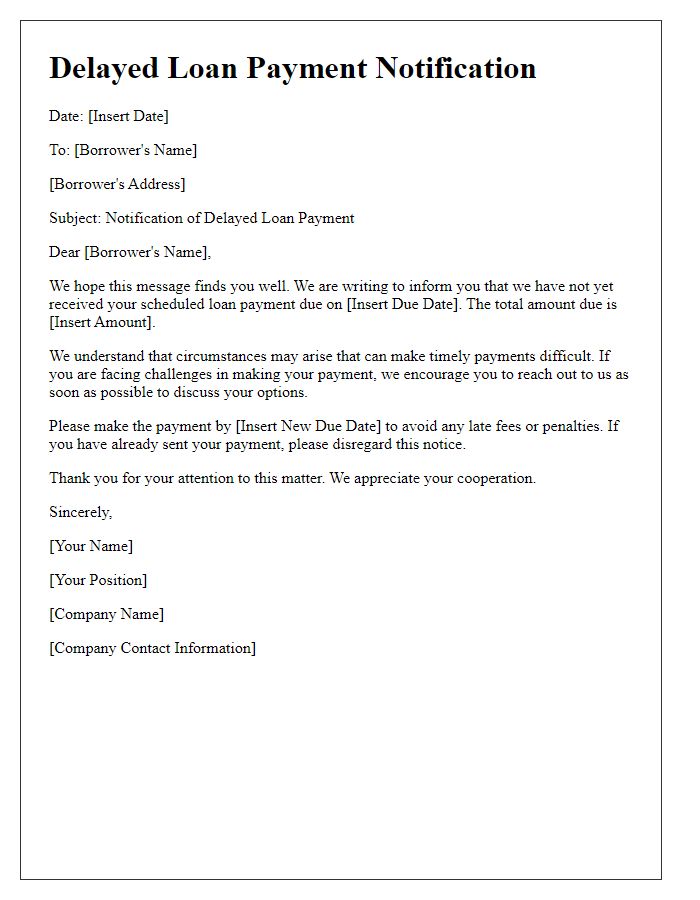

Contact Information for Further Discussion

When addressing late loan payments, it is crucial to communicate clearly and effectively. Many borrowers might face difficulties, such as temporary financial setbacks due to unexpected events, including job loss or medical emergencies. It is vital to mention the specific loan type, such as a personal loan or mortgage, to provide context. Notifying the lender, such as a regional bank or credit union, is essential to discuss repayment options. Including direct contact information, like a phone number or email address, ensures the lender can reach out for further discussion regarding possible resolutions, like deferment or restructuring the loan terms, to alleviate immediate financial pressure on the borrower.

Comments