Are you feeling overwhelmed by your auto loan payments? You're not alone; many people find themselves in similar situations and are seeking effective solutions. It's essential to explore payment arrangements that can alleviate financial stress while keeping your vehicle secure. So, if you're looking for guidance on how to navigate this process, read on for valuable insights!

Personal Information

Establishing an auto loan payment arrangement requires clear communication regarding personal details. Full Name (such as John Doe) should be prominently displayed, alongside the Address (including Street, City, State, and Zip Code) for accurate identification. Additionally, including a Loan Account Number (specific to the loan agreement) is essential for reference. Phone Number (preferably mobile for direct communication) ensures accessibility, while Email Address provides an alternative contact method. Lastly, highlighting the Date of communication (like October 1, 2023) is important for record-keeping purposes.

Loan Account Details

The auto loan payment arrangement requires precise loan account details to facilitate efficient processing and communication. Loan account number (typically a 10 to 12 digit identifier) serves as the primary reference for tracking payments and account status. Borrower name (full legal name) must match the name on the loan documentation. Monthly payment amount (specific dollar amount due) should reflect the agreed-upon schedule. Due date (specific day of the month) signifies when the payment is expected, while the payment method (such as ACH transfer, check, or online payment portal) influences how transactions will be processed. Furthermore, contact information (phone number, email address) is vital for immediate communication regarding payment updates or account inquiries.

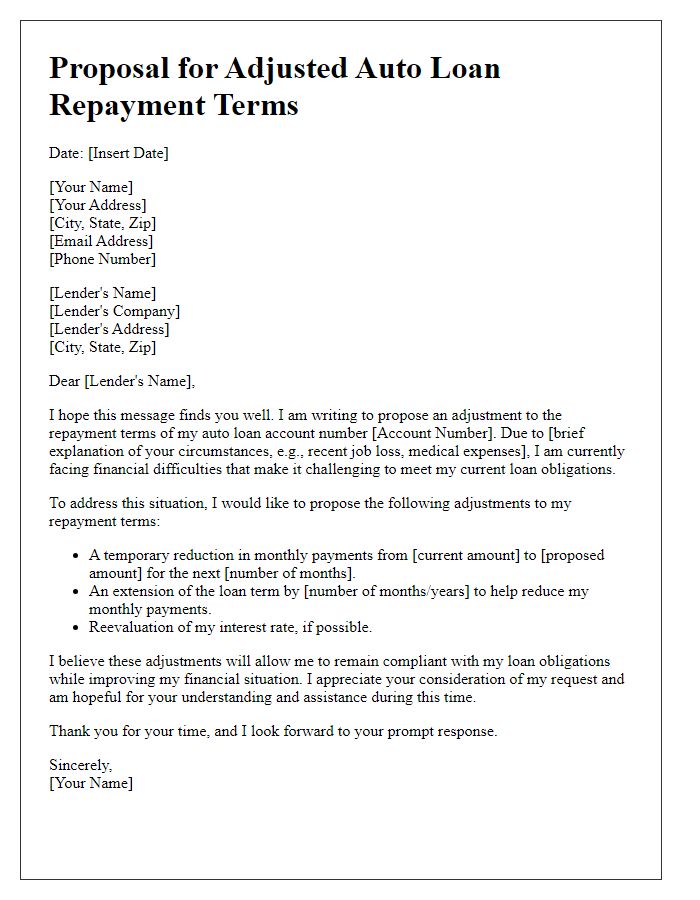

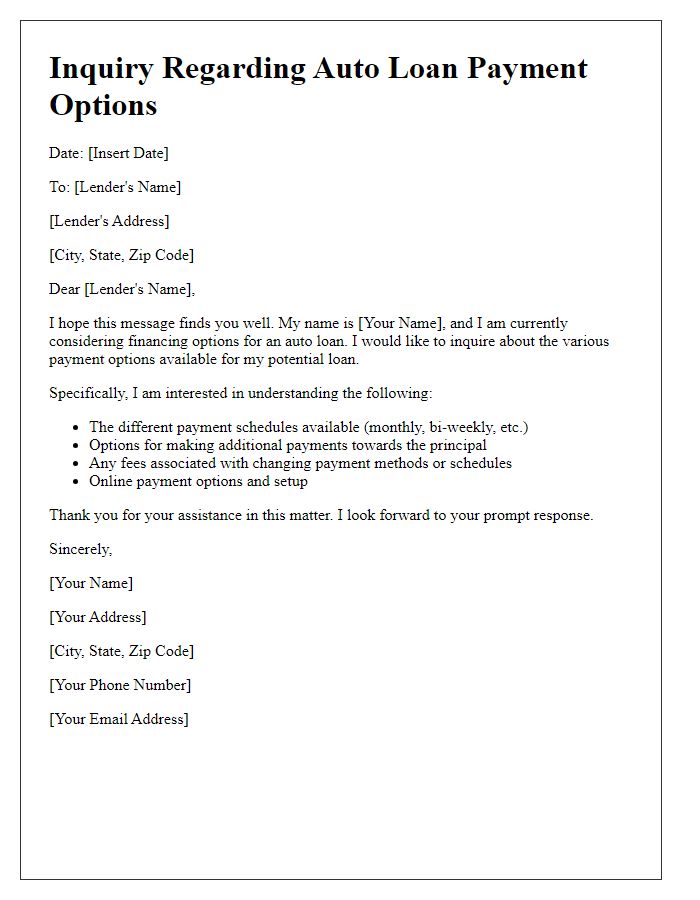

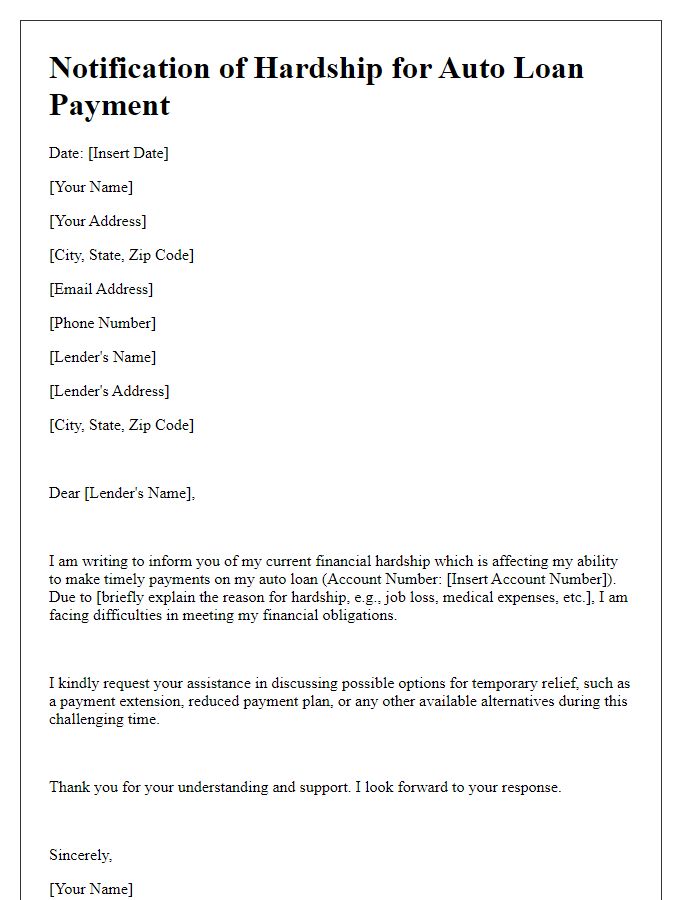

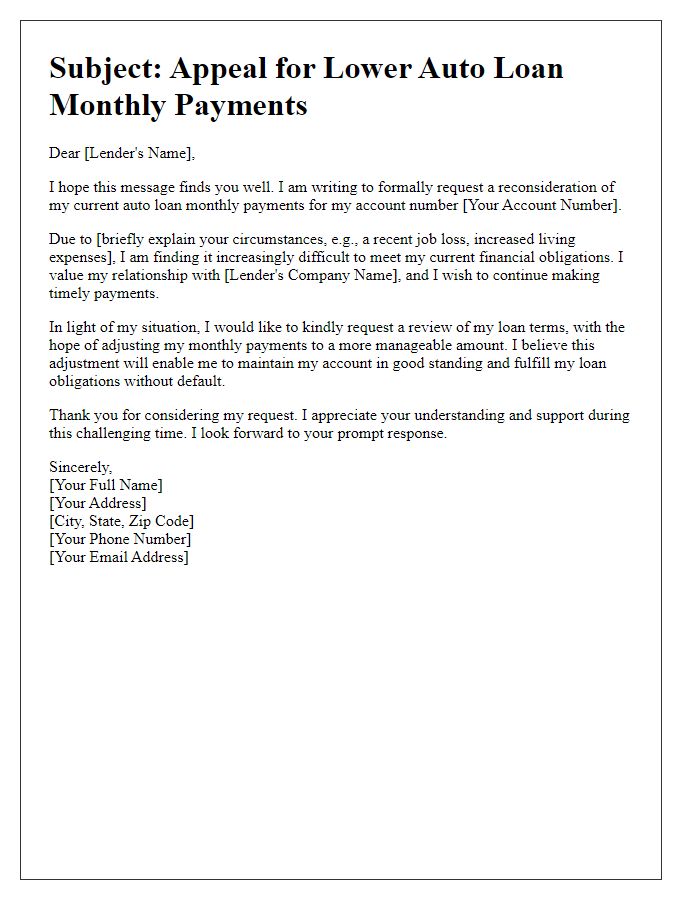

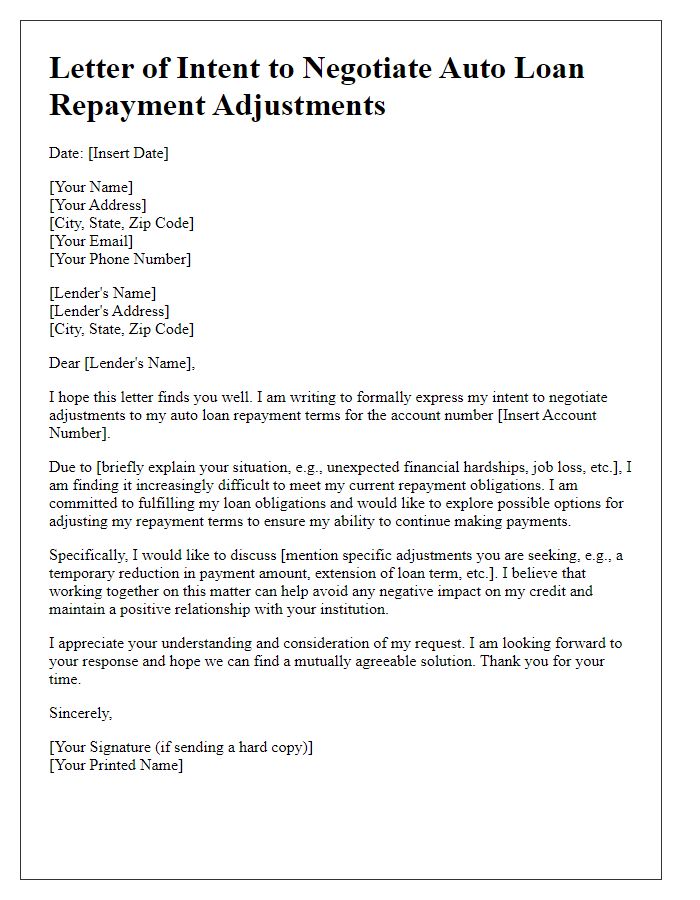

Payment Arrangement Proposal

Auto loan agreements often require careful consideration when discussing payment arrangements for borrowers facing financial difficulties. Regions such as California, known for high living costs, may also influence these arrangements. Lenders, regulated by the Truth in Lending Act, assess borrowers' current financial standings, including income and expenses. Various options may be available, such as temporary payment reductions, deferrals, or extended loan terms for loans typically secured by vehicles, like cars and SUVs. Communication with financial institutions is crucial, as missed payments can lead to repossession and impact credit scores significantly, often measured by the FICO score system, which ranges from 300 to 850. Understanding the terms before proceeding with such arrangements ensures informed decisions and potentially less drastic financial consequences.

Justification for Arrangement

Auto loan payment arrangements often stem from financial hardships such as job loss or unexpected medical expenses, impacting borrowers' ability to meet monthly obligations. In some cases, borrowers may request adjustments due to temporary situations like reduced work hours or seasonal employment fluctuations. Lenders usually assess these scenarios, considering account history and payment patterns before granting leniency. Arrangements can include extended loan terms or modified payment schedules aiming to ease financial pressure, while ensuring continued loan management and minimizing default risk.

Contact Information

Auto loan payment arrangements often require specific contact information to facilitate communication and ensure that all relevant parties can be reached effectively. Such arrangements typically include the borrower's details, such as full name, current address (important for claiming residency), phone number (for immediate communication), and email address (for written correspondence). The lending institution's contact information is equally important, including the name of the financial institution, its customer service phone number, mailing address for physical correspondence, and email address for electronic communication. Including account numbers can help specify the loan in question, allowing for efficient processing of payment inquiries or changes. In some cases, dates of payments can be critical, outlining when payments are due and ensuring adherence to any agreed terms.

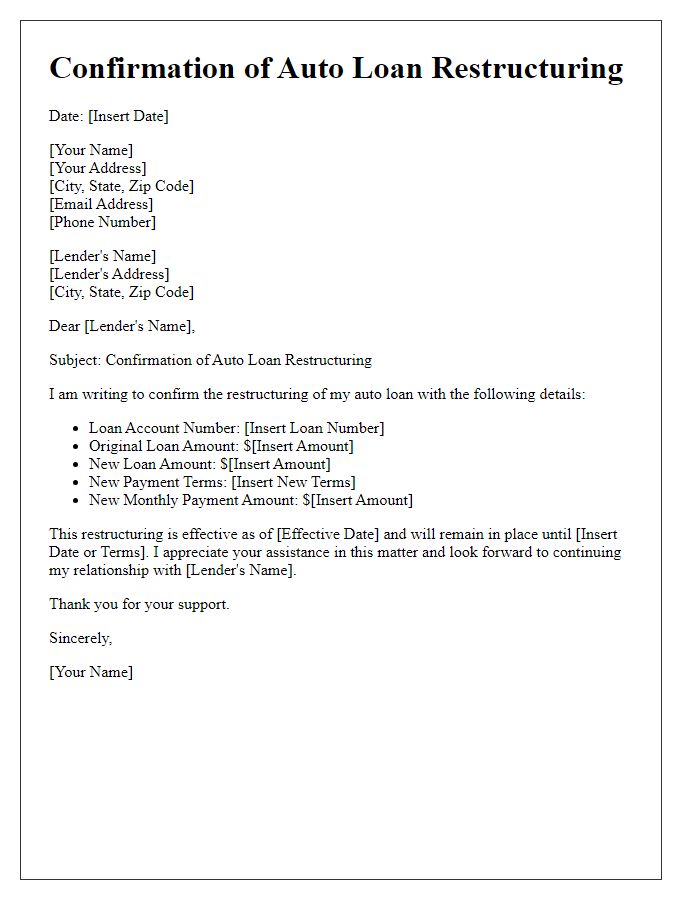

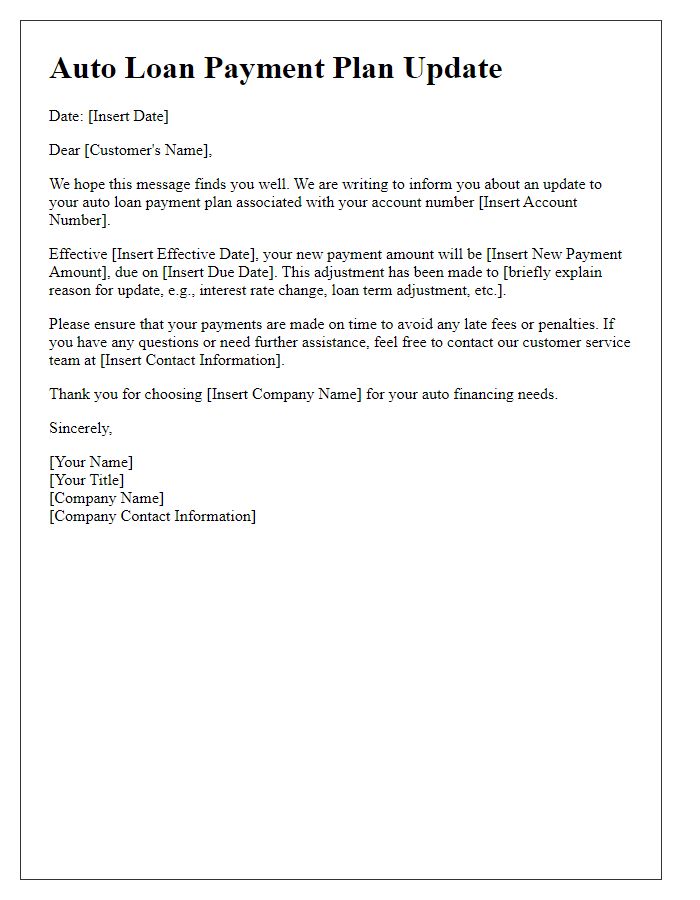

Letter Template For Auto Loan Payment Arrangement Samples

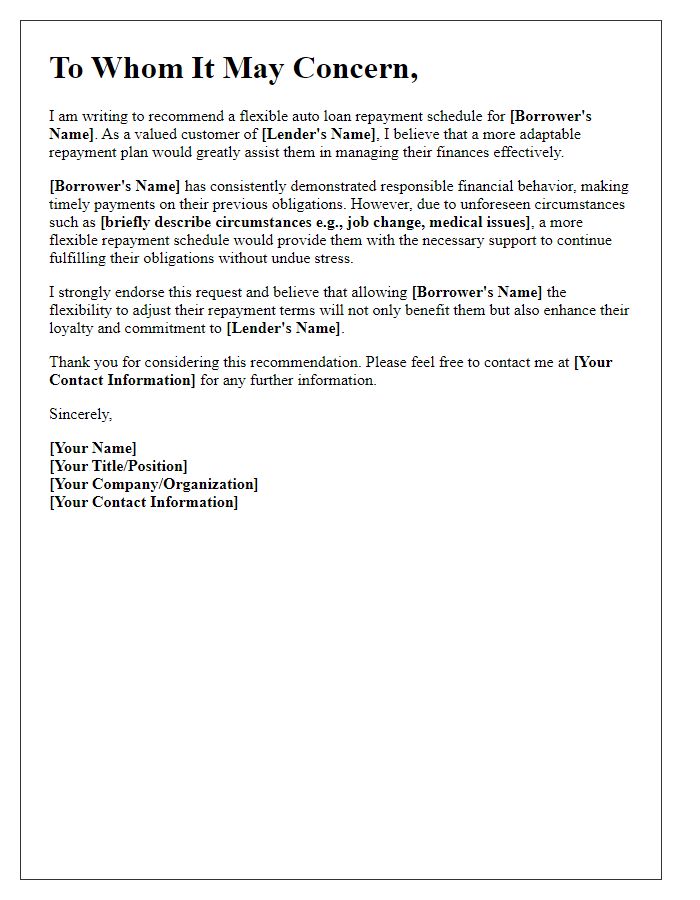

Letter template of recommendation for flexible auto loan repayment schedule

Comments