Are you feeling overwhelmed by your mortgage payments? You're not alone, and it's perfectly fine to seek help! In this article, we'll explore how to craft a thoughtful letter to request a mortgage payment reduction. So, let's dive in and empower you with the tools to ease your financial burden!

Borrower's financial situation and hardship explanation

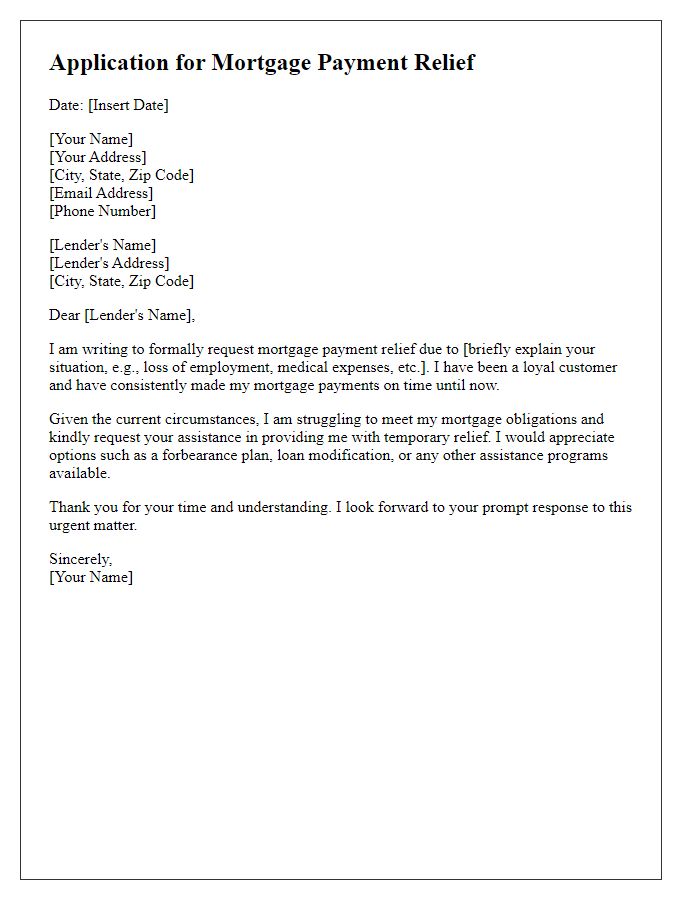

Facing financial difficulties can significantly impact a borrower's ability to meet mortgage obligations. Various factors, including unexpected job loss, medical expenses, or a reduction in income, can create hardship. In 2021, the U.S. reported millions of citizens struggling to pay housing costs due to the pandemic's economic effects. These struggles may lead a borrower to seek assistance from their mortgage lender in the form of a payment reduction. By articulating their situation clearly and concisely, borrowers can present information about their financial challenges, such as monthly income, essential expenses, and any supporting documentation like unemployment benefits or medical bills, to request a modification of their mortgage payment terms. Failure to address such hardships often contributes to the risk of foreclosure, which affects not only a borrower's credit score but also their overall financial stability in the long run.

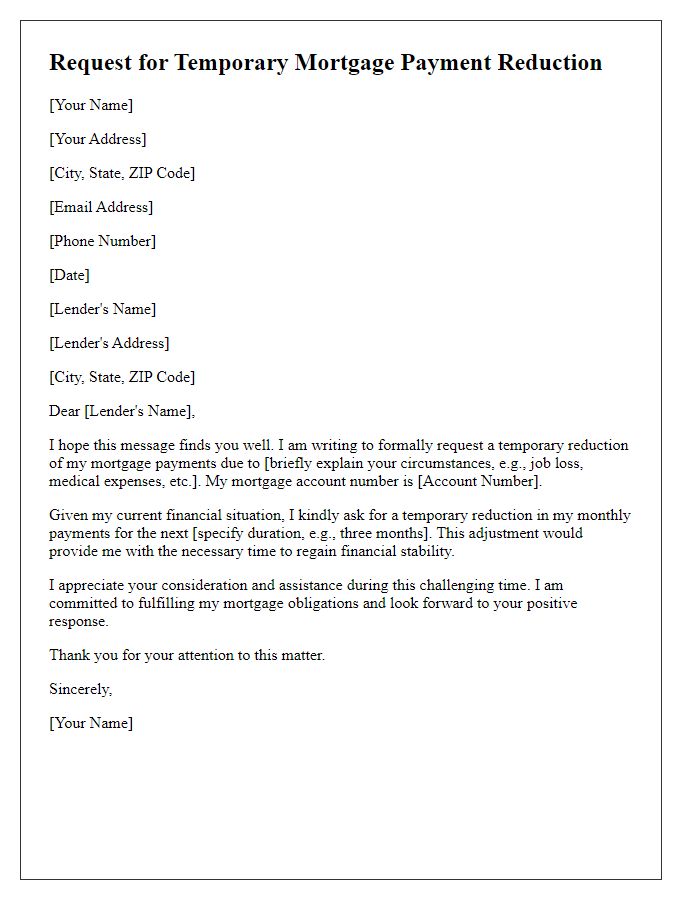

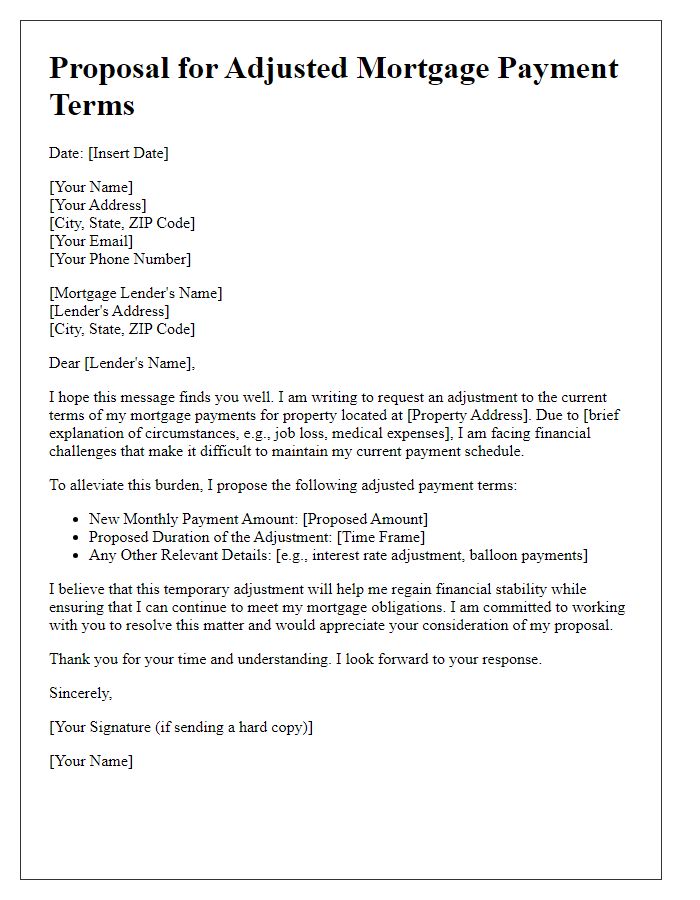

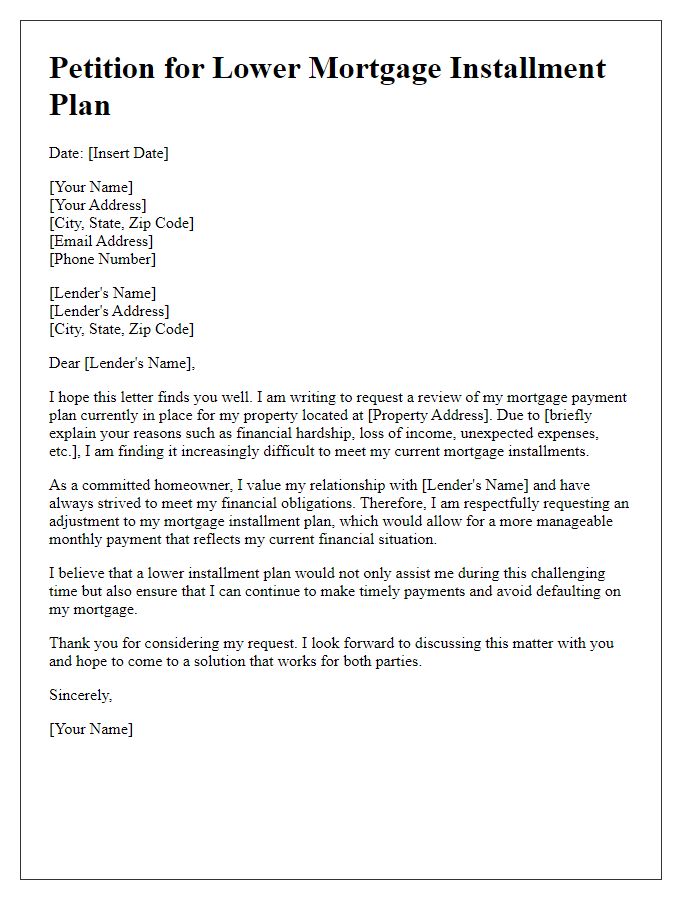

Specific reduction request and proposed new terms

Mortgage payment reductions can provide relief to homeowners facing financial challenges. For instance, a homeowner currently paying $2,000 monthly for a fixed-rate mortgage at an interest rate of 4% may request a reduction to $1,500 monthly. This proposed adjustment seeks to alleviate financial stress amid circumstances such as job loss or unexpected medical expenses. Suggested new terms could involve extending the loan's duration from 30 years to 40 years, thereby reducing the monthly burden while maintaining an overall manageable repayment plan. Supporting documentation, such as proof of income changes and detailed monthly expenses, can further strengthen the request for consideration by the lender.

Supporting documentation and evidence

Individuals seeking mortgage payment reduction may need to present supporting documentation and evidence to lenders. Essential documents include recent pay stubs, reflecting current income (usually from the last 30 days), personal bank statements, detailing all transactions for the past two to three months, and tax returns, often for the previous year, showcasing annual earnings. Additionally, a hardship letter, clearly explaining the circumstances causing financial strain, is crucial. This letter should articulate specific reasons, such as job loss or medical expenses. Furthermore, including a budget showing monthly income against expenses can provide critical insight into financial stability. Mortgage statements should also be submitted, revealing current mortgage status and payment history, often emphasizing any late payments or missed deadlines. Finally, detailed evidence of financial liabilities, including credit card statements or loan agreements, can substantiate claims of excessive debt impacting the ability to maintain regular mortgage payments.

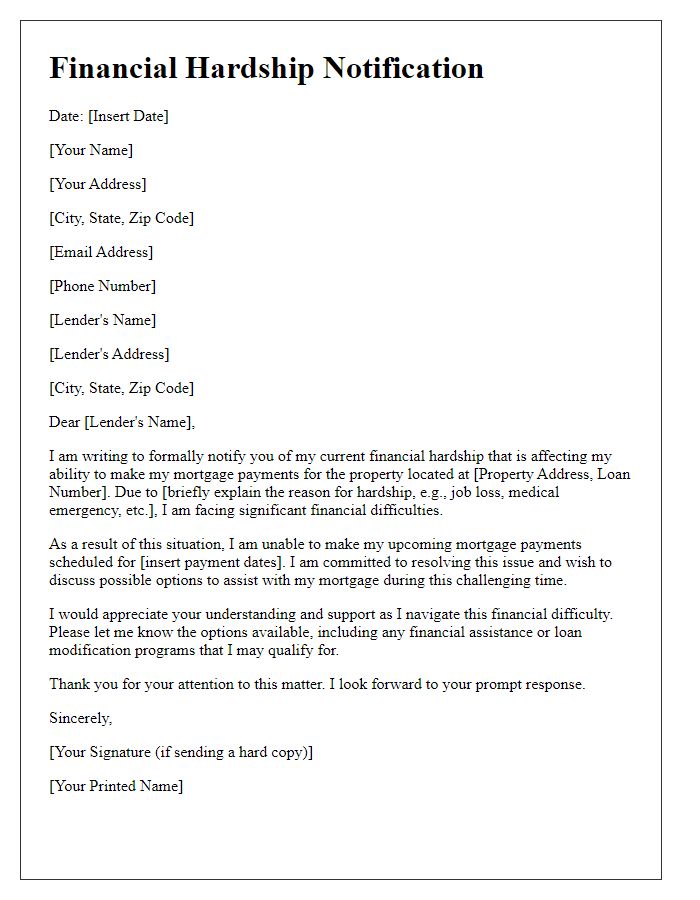

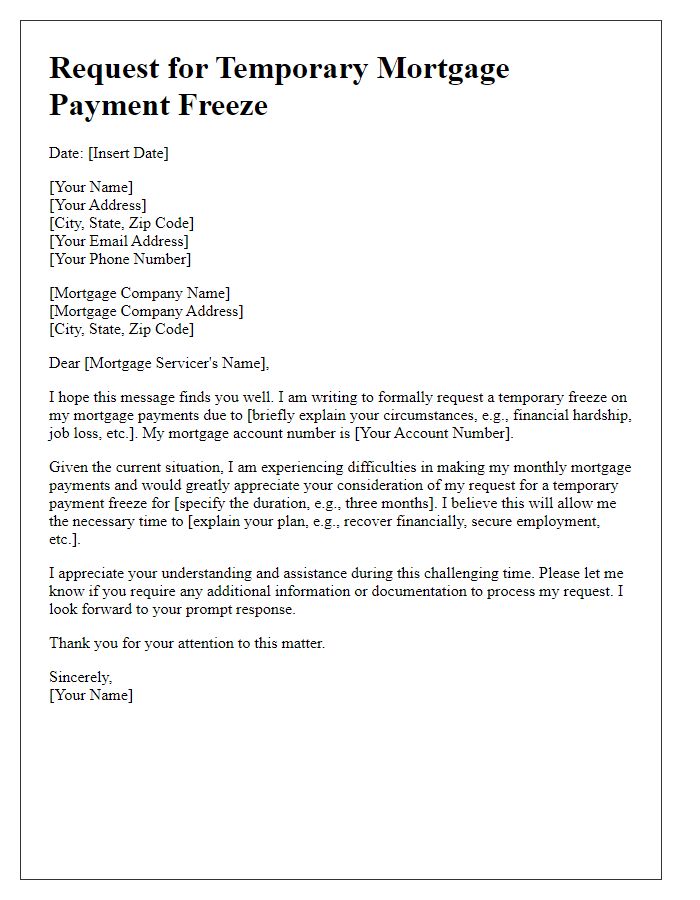

Contact information and preferred communication method

Requesting a mortgage payment reduction is a crucial process for homeowners facing financial difficulties. Homeowners should begin by gathering personal information, including full legal name, property address, and account number linked to the mortgage with their lender. Clear contact information such as phone number and email address is essential for prompt communication. Preferred communication methods should be highlighted, for instance, indicating whether they prefer phone calls during specific hours or email correspondence for quicker responses. It is also helpful to mention the reasons for requesting a reduction, such as financial hardship due to job loss or increased living expenses, providing a comprehensive understanding of the situation to the lender.

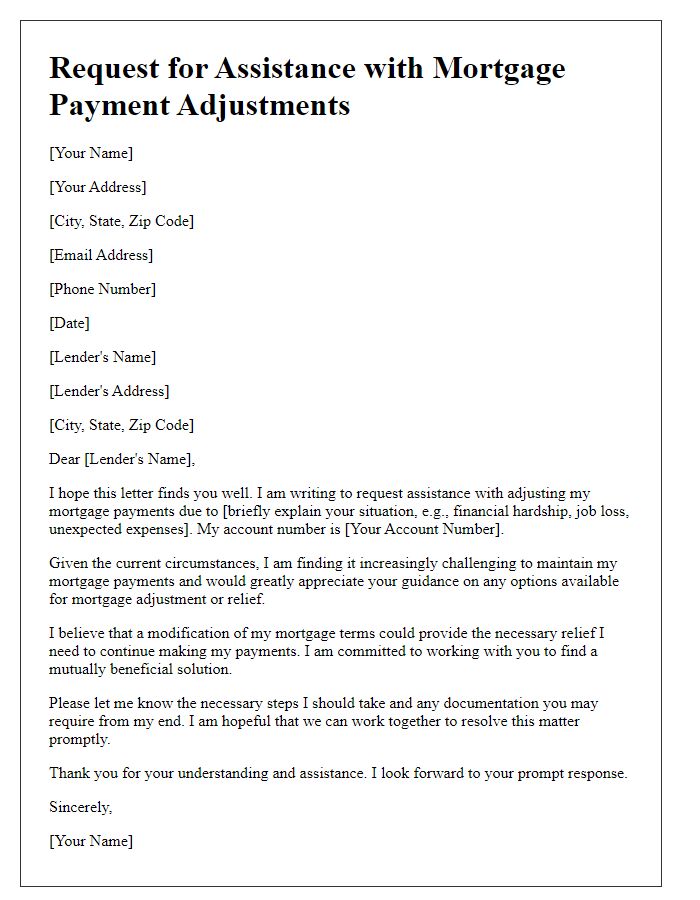

Gratitude and request for prompt consideration

Experiencing financial difficulties can prompt a need for assistance, particularly regarding mortgage obligations tied to home ownership. Individuals might seek support from lenders, emphasizing genuine appreciation for prior assistance received. Highlighting personal circumstances, such as unexpected medical bills or job loss, can clarify the urgency for a reduction in monthly mortgage payments. Additionally, referencing the economic climate, particularly post-COVID-19 changes affecting employment stability, could strengthen the request. Clear communication regarding the specific reduction sought, while expressing gratitude for any previous help, is essential for fostering a cooperative dialogue with financial institutions. Prompt consideration and understanding from lenders can facilitate a more manageable repayment plan, enabling continued homeownership stability.

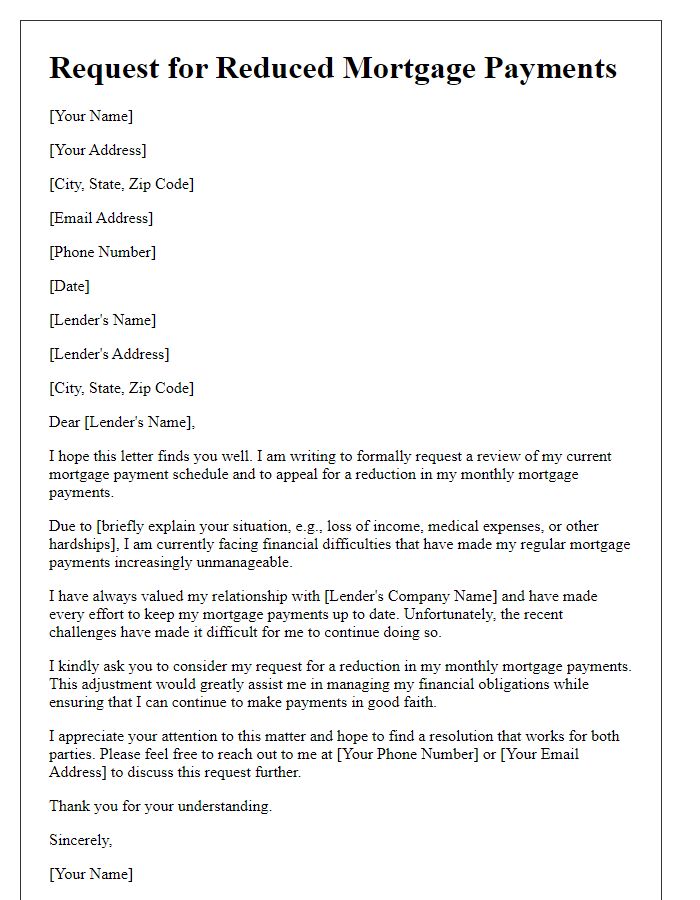

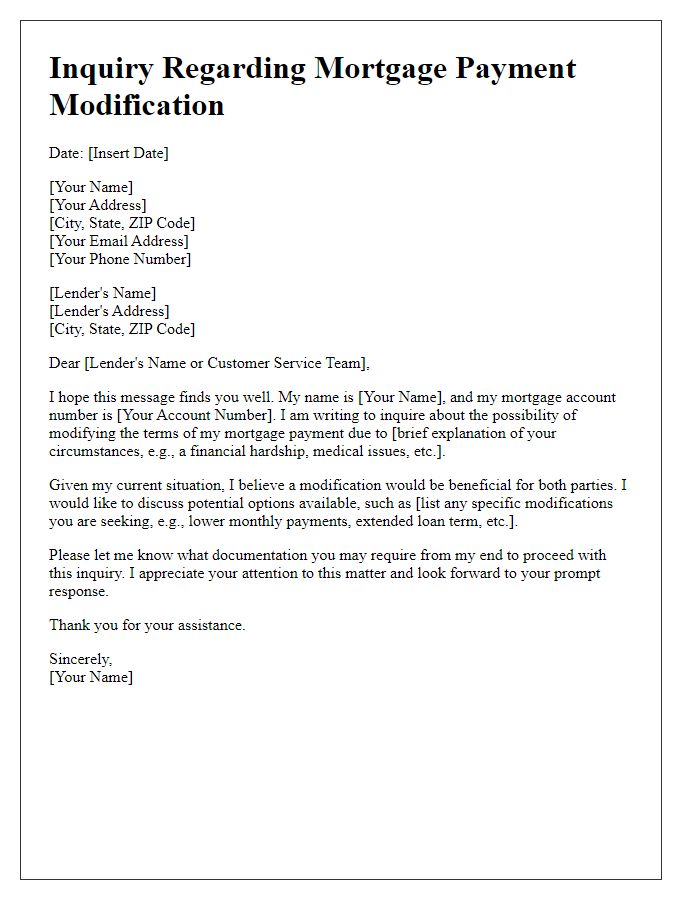

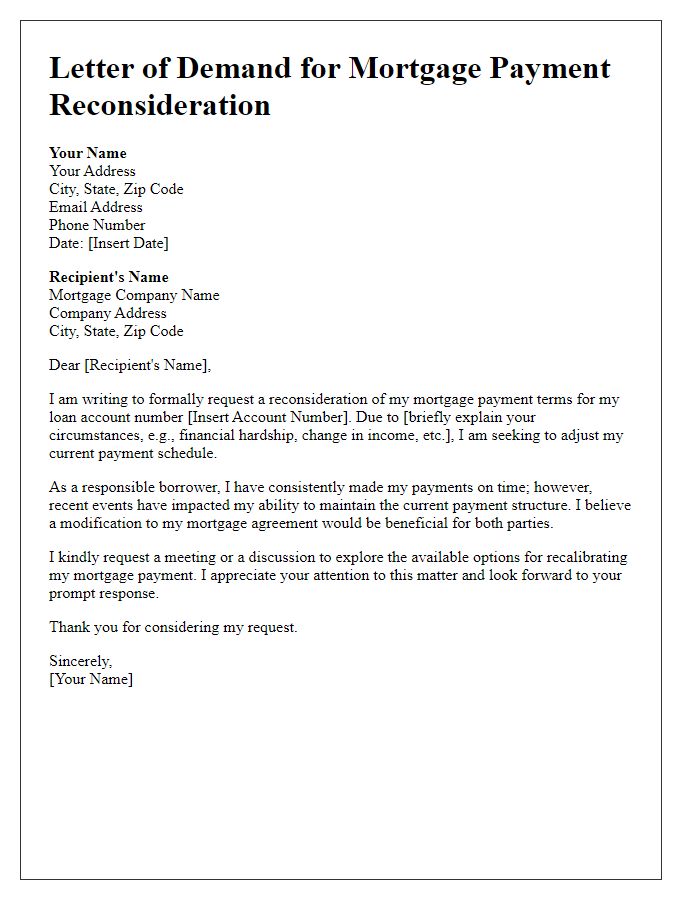

Letter Template For Requesting Mortgage Payment Reduction Samples

Letter template of notification for financial hardship affecting mortgage payments

Comments