Are you considering applying for a business loan but unsure how to articulate your purpose effectively? Crafting a clear and compelling letter is key to communicating your goals and ambitions to potential lenders. In this guide, we'll walk you through how to structure your letter, highlighting what to include to make a strong case for your financing needs. So, let's dive in and discover how you can set your business up for success!

Clear Objective Statement

A small business seeking a loan often requires clarity in its objective to ensure successful funding outcomes. For instance, a local bakery aiming for a $50,000 loan intends to expand its operations by upgrading equipment. This includes acquiring a modern oven, which costs approximately $20,000, and renovating the storefront to enhance customer experience, estimated at around $25,000. Furthermore, the remaining funds will be allocated for marketing campaigns targeting nearby neighborhoods, focusing on social media ads and local partnerships. Demonstrating these specific objectives highlights the bakery's strategic plan to increase revenue by 30% within the next year.

Detailed Use of Funds

A well-structured business loan request outlines the specific allocation of funds aimed at enhancing operational efficiency and growth. Expansion initiatives (such as opening a new location in a bustling urban area like downtown Chicago) can benefit from a portion of the loan, ensuring a significant market presence. Updating equipment (like advanced manufacturing machinery from companies such as Siemens or GE) enhances productivity and product quality. Marketing campaigns (targeting a demographic of 25-40-year-olds) utilizing social media platforms such as Instagram and Facebook increase brand awareness and customer engagement. Additionally, working capital (adequate for covering three months of operational expenses) ensures the business can maintain daily operations without cash flow interruptions. Investing in employee training (including workshops from industry experts) cultivates a skilled workforce dedicated to driving business success.

Expected Business Impact

Seeking a business loan significantly impacts growth trajectories and operational efficiency in enterprises, particularly small to medium-sized businesses. Capital infusion enables strategic investments in critical areas such as technology upgrades, enhancing inventory (with potential increases of 25% in turnover), marketing expansion to capture new customer segments, and hiring skilled personnel (projected to enhance productivity by 30%). For instance, in the retail industry, funds can facilitate the installation of advanced point-of-sale systems, reducing transaction times by up to 40%, which improves customer satisfaction. Moreover, access to additional working capital allows for better cash flow management, reducing reliance on high-interest credit options. Ultimately, securing a business loan is pivotal for fostering innovation, scaling operations, and ensuring long-term sustainability in competitive markets.

Repayment Plan Explanation

A comprehensive repayment plan is essential for the successful management of a business loan. When seeking a loan, such as those offered by banks or financial institutions, clarity on the intended use of funds enhances credibility. For example, the loan amount of $100,000 may be allocated for purchasing new machinery, enhancing operational efficiency in a manufacturing facility located in Chicago, Illinois. Repayment plans typically span three to five years, based on monthly payments calculated through amortization schedules. Interest rates, ranging from 5% to 10%, depending on creditworthiness, will significantly impact overall costs. Furthermore, demonstrating a detailed cash flow projection helps lenders assess the business's ability to meet payment obligations through increased revenue generated by the equipment. Establishing a solid plan with milestones ensures transparency and commitment, ultimately increasing the likelihood of loan approval.

Supporting Documentation

A detailed business loan application often requires supporting documentation that illustrates the purpose of the funds. Documentation may include a comprehensive business plan that outlines the specific goals for utilizing the loan, such as expanding operations, purchasing inventory, or investing in new technology. Financial statements, including profit and loss statements from the past three years, can demonstrate the company's financial health and projected growth. Additionally, cash flow projections for the next 12 months can provide insight into how the loan will impact the business's ability to meet its obligations. Tax returns for the previous three years can further substantiate financial claims and enhance the credibility of the application. Market analysis reports that highlight industry trends and competitive advantages can be included to justify the need for funding, illustrating how the loan will facilitate a strategic initiative aimed at increasing market share or enhancing product offerings. Supporting documentation should be organized, clear, and relevant to effectively communicate the intended use of the loan funds.

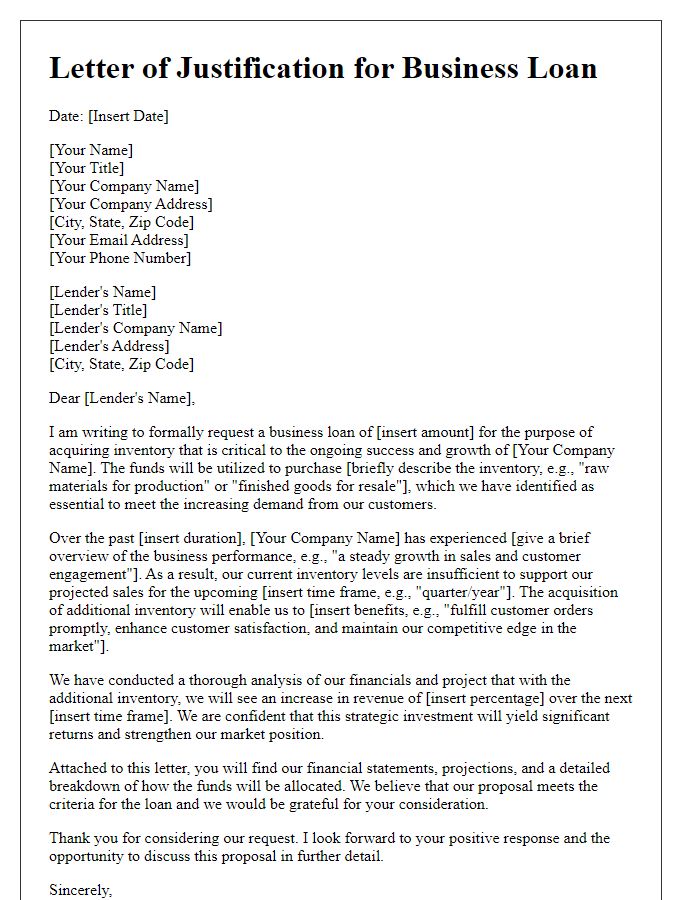

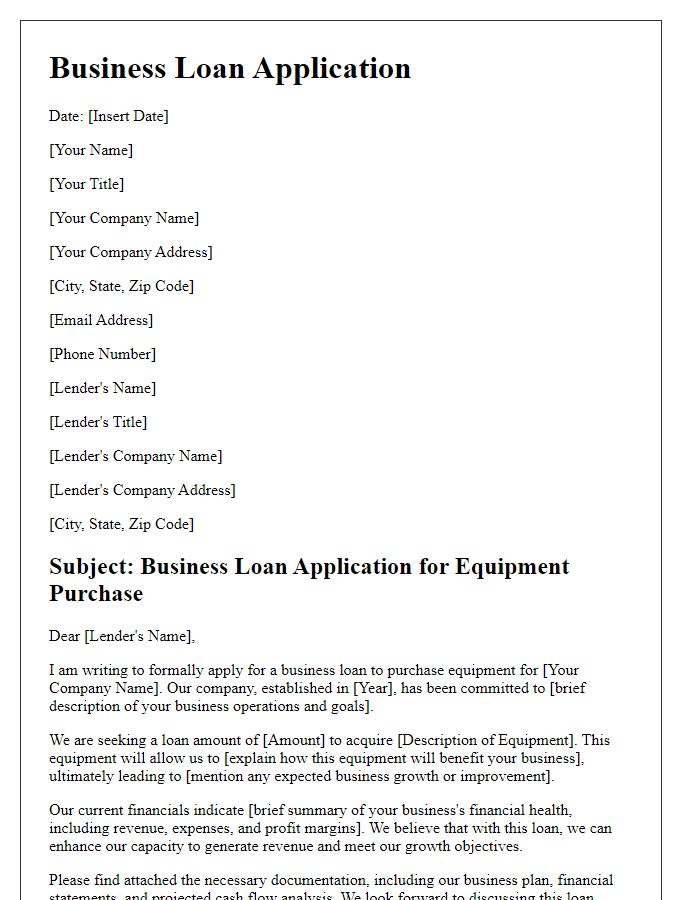

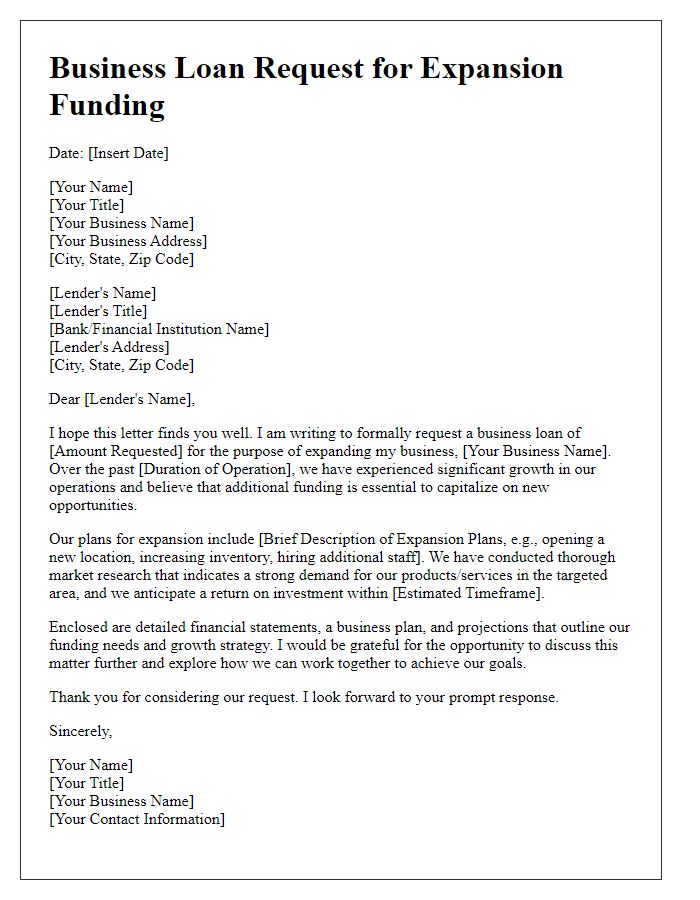

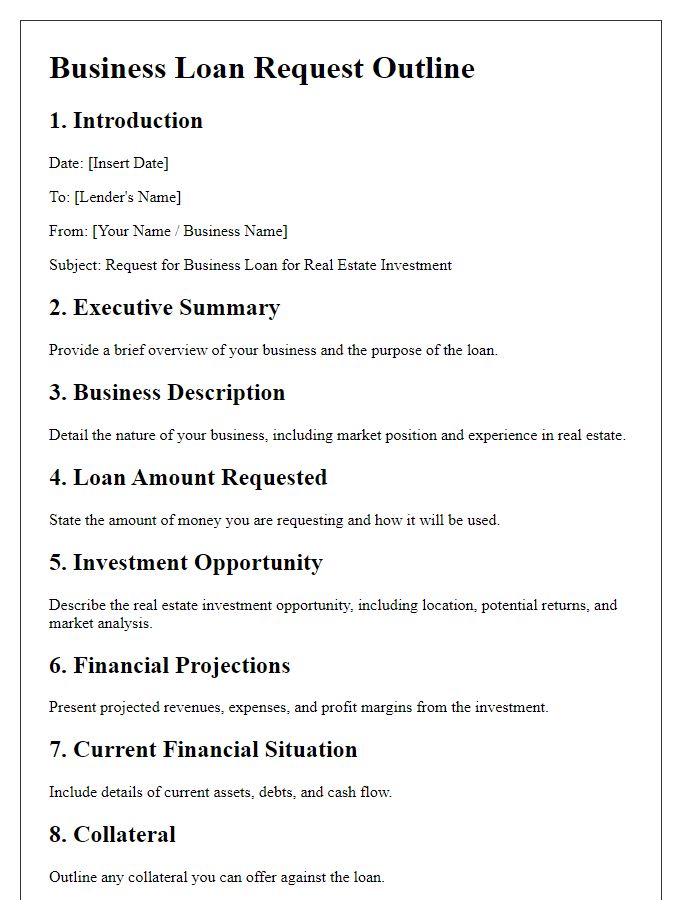

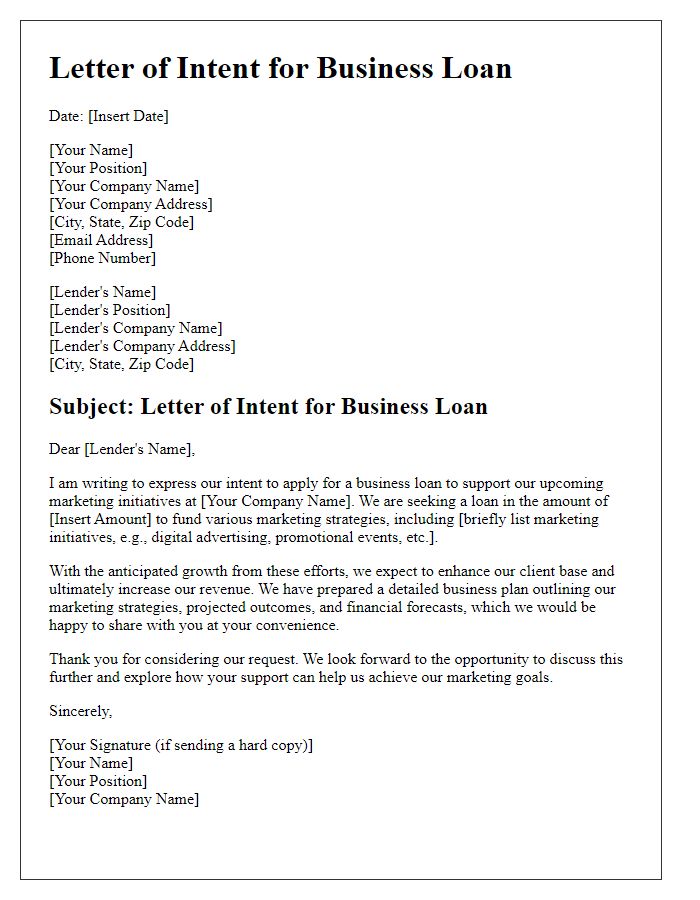

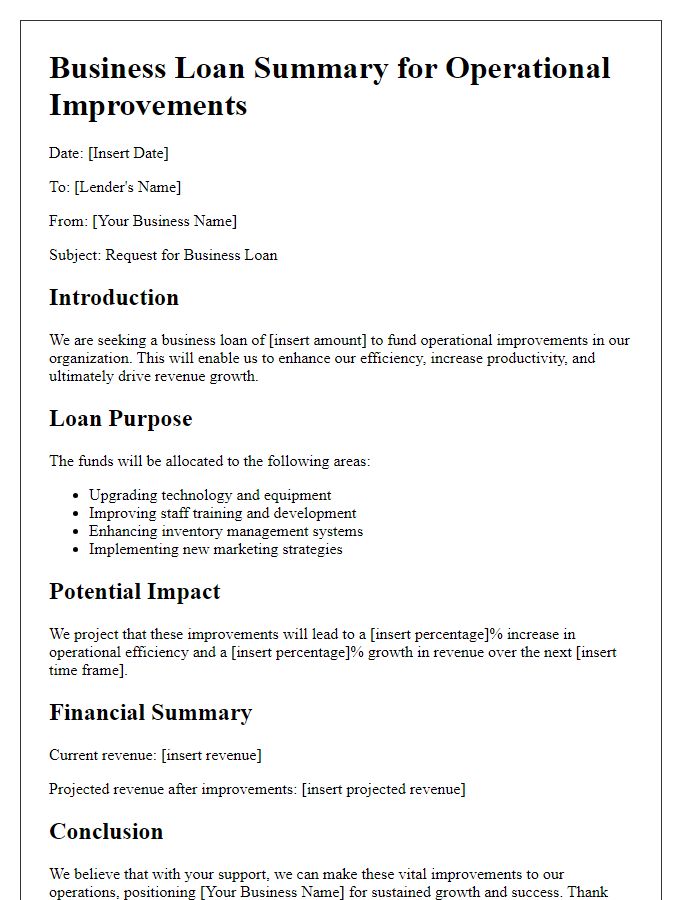

Letter Template For Explaining Business Loan Purpose Samples

Letter template of business loan justification for inventory acquisition

Comments