Are you looking to gain clarity on your loan account balance but unsure how to draft that confirmation letter? You're not alone; many people find themselves in need of a clear and concise way to communicate with their lenders. With the right template in hand, you can ensure your inquiry is professional yet friendly, making it easier to receive the information you need. Join me as we explore a simple letter template that effectively confirms your loan account balance and sets the stage for transparent communication!

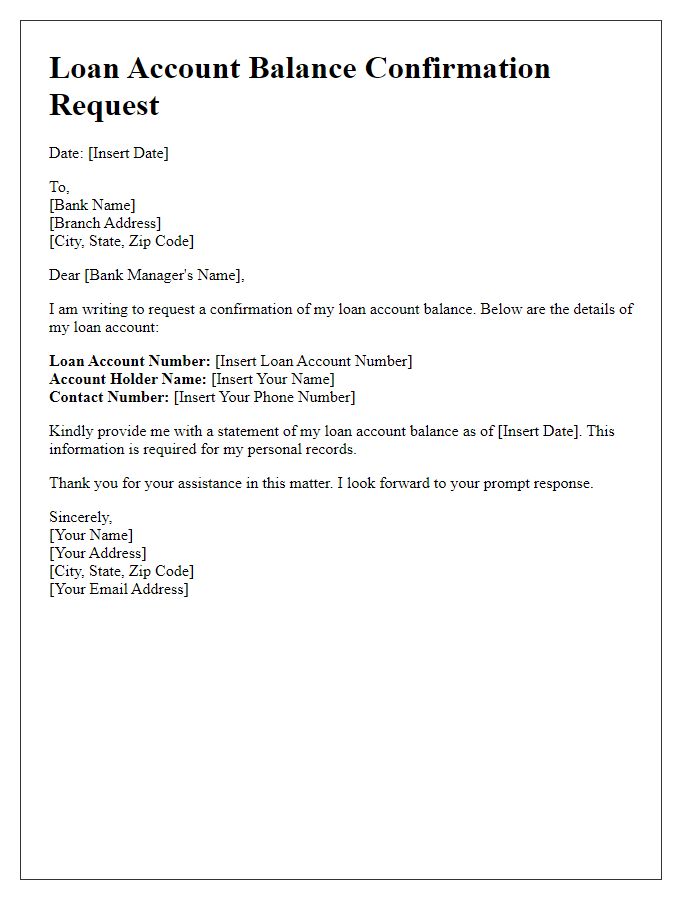

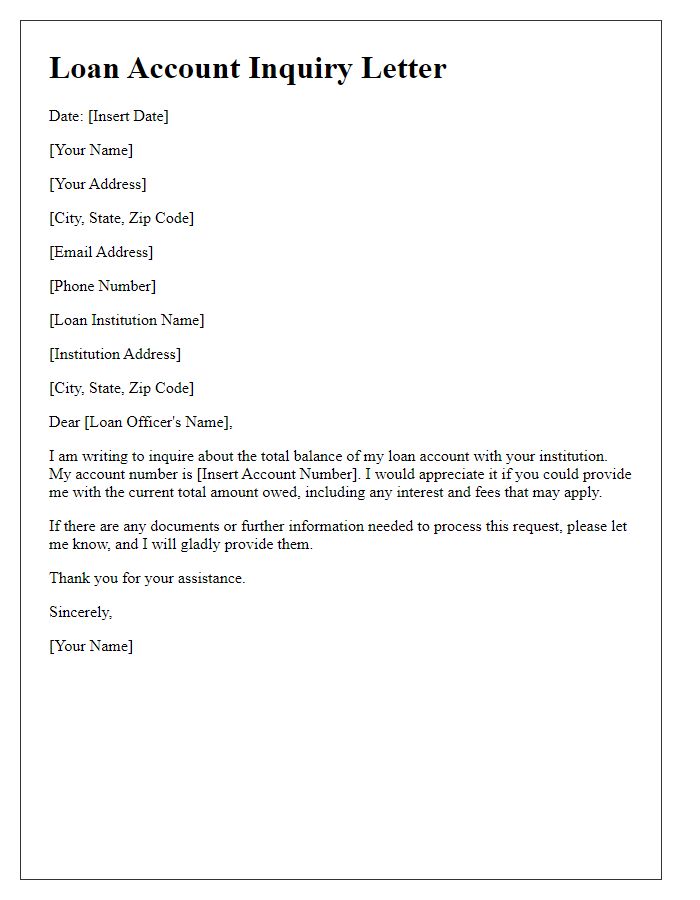

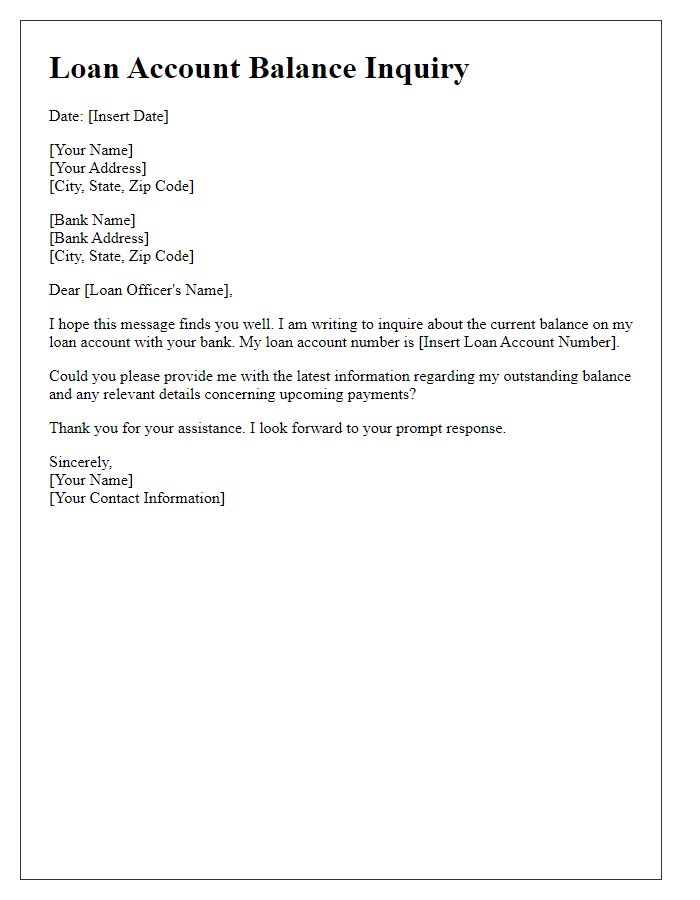

Borrower's Information

Loan account statements provide borrowers with essential information regarding outstanding balances, payment history, and interest rates. Accurate documentation is crucial for maintaining transparency in financial transactions. The borrower's information includes personal details such as full name, address, contact number, and social security number, which together help identify the loan account. Loan details may consist of the principal amount, current balance (noting any fees or accrued interest), payment due dates, and remaining payment schedule, ensuring that the borrower remains informed about their financial obligations. Consistent updates regarding account balances foster trust between the borrower and the lending institution, promoting responsible borrowing practices.

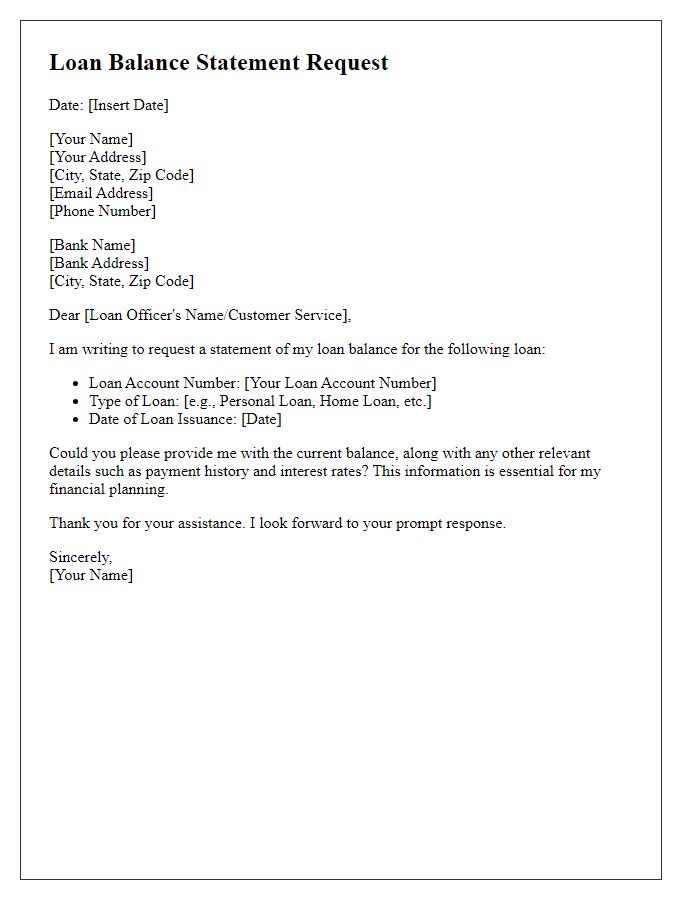

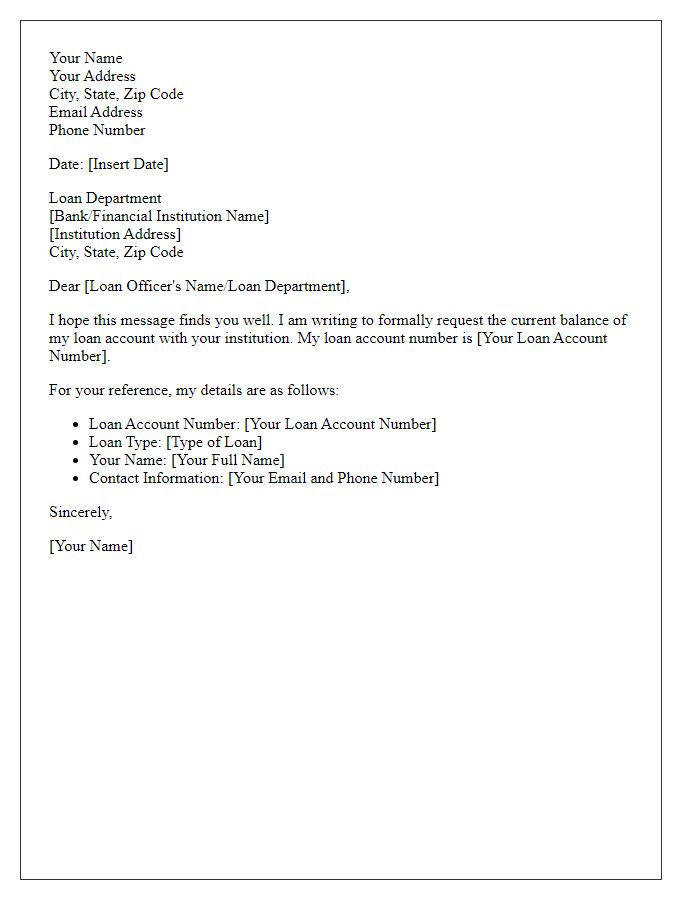

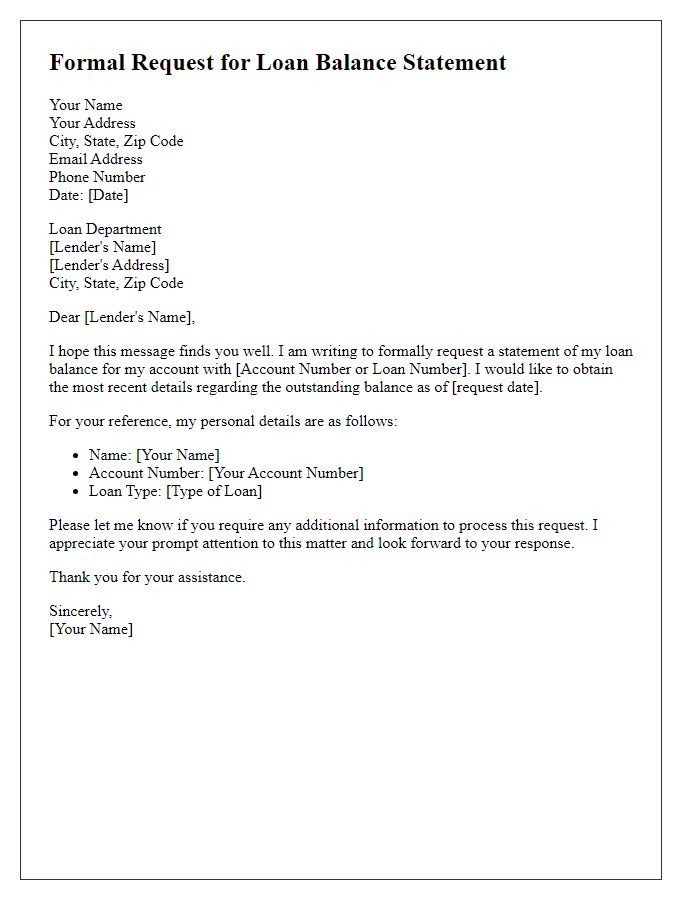

Loan Account Details

A loan account balance confirmation typically includes key information such as the account number, original loan amount, outstanding balance, interest rate, and payment status. For instance, a personal loan account (Account No: 123456789) with an original amount of $10,000 may currently show an outstanding balance of $5,000. The interest rate might be set at 5% per annum, and the account shows regular payment status, indicating timely contributions since the loan initiation date of January 15, 2022. Access to such essential details ensures transparency and aids in effective financial management.

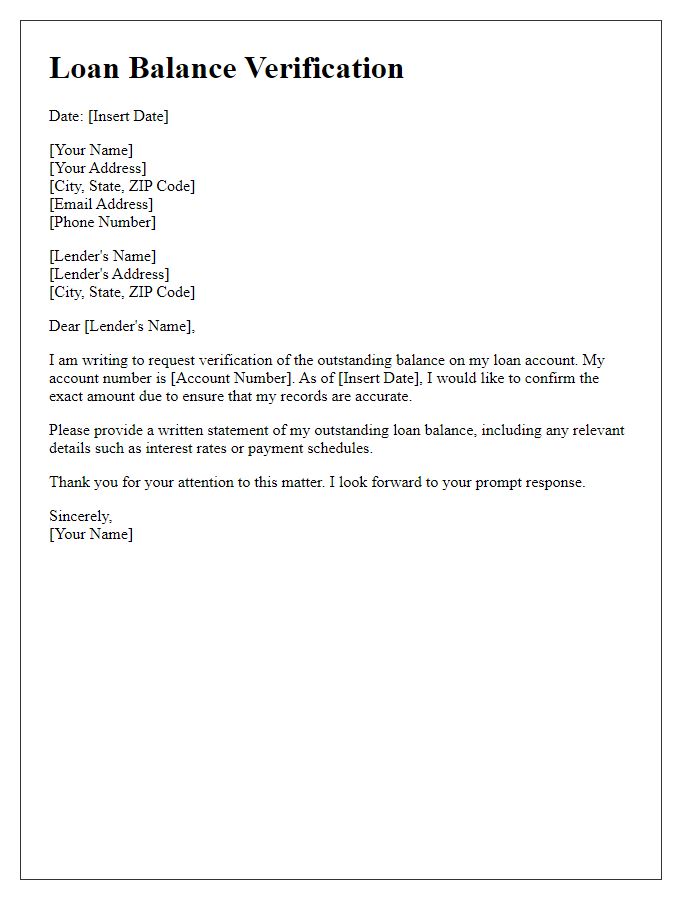

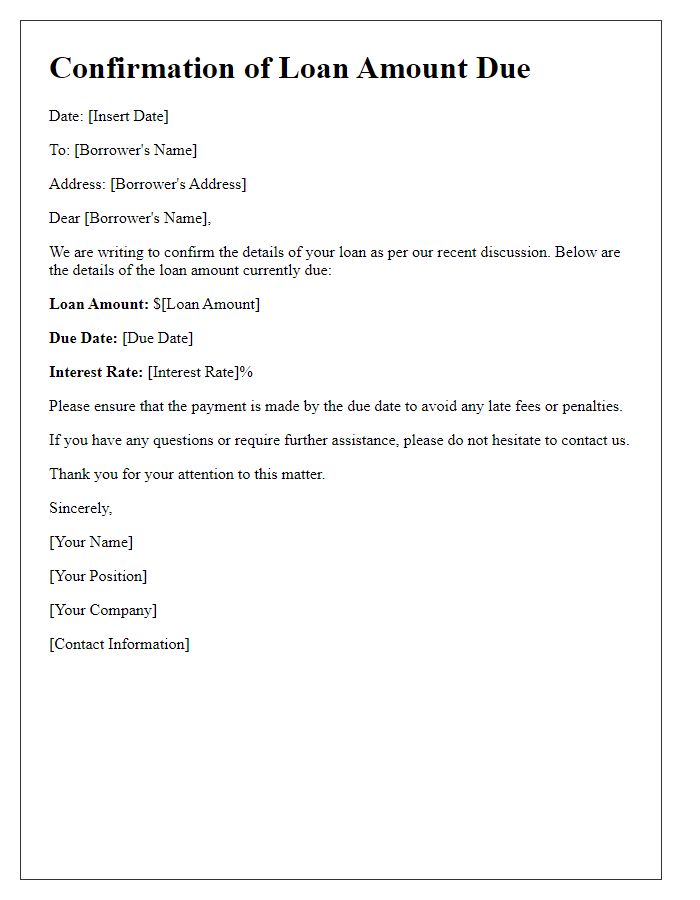

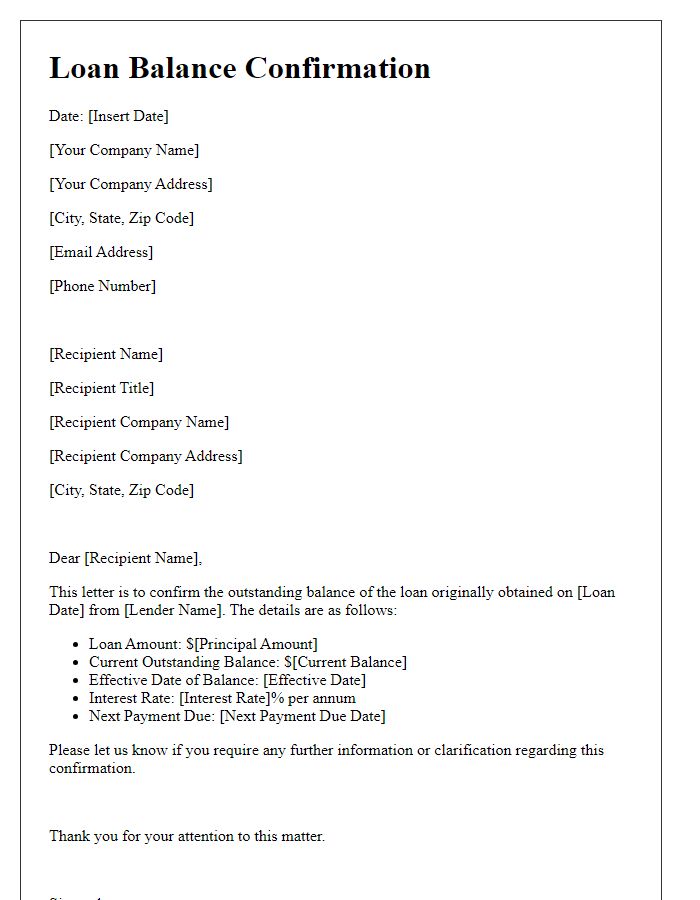

Current Loan Balance

The current loan balance represents the total amount owed on the loan account as of a specific date. For example, as of October 15, 2023, an outstanding balance of $10,500 for a personal loan with a 5% interest rate can be confirmed. This balance includes principal amount, accrued interest, and any applicable fees. Regular monthly payments affect the remaining balance, which can change based on additional payments or modifications to payment terms. Regular statements can provide detailed breakdowns of each transaction impacting the total balance.

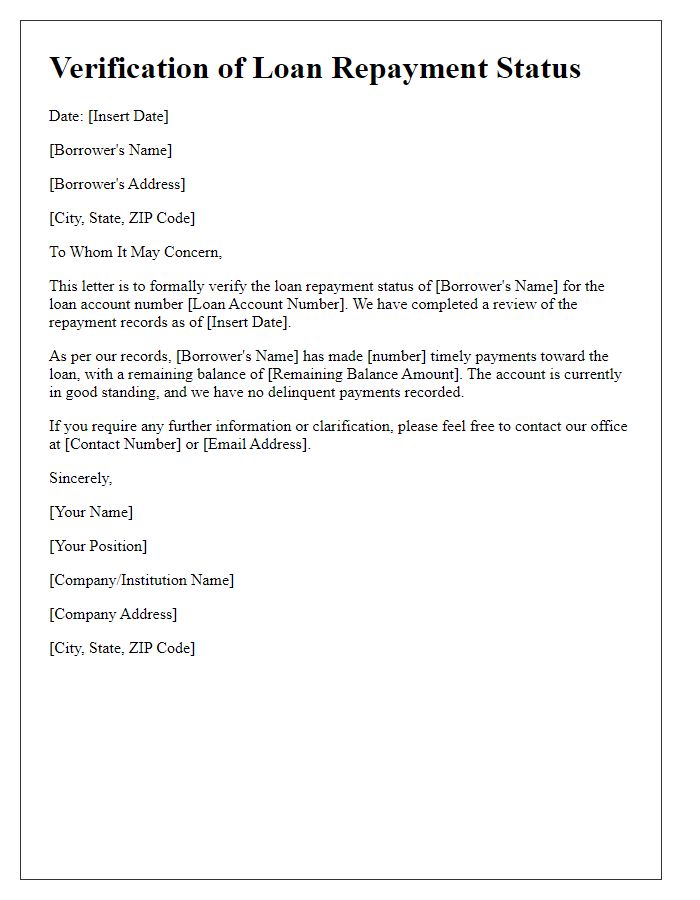

Payment History Overview

This letter outlines the loan account balance for account number [Account Number]. As of [Date], the outstanding balance is [Remaining Amount], which reflects all payments made and charges incurred. The payment history reveals a total of [Total Payments Made] monthly payments, starting from [First Payment Date] to [Last Payment Date]. Each payment was [Amount] with a due date of [Due Date]. Notable events in this period include a late fee incurred on [Date of Late Fee] due to a missed payment and adjustments made on [Adjustment Date]. This comprehensive overview serves as a confirmation of the current balance and payment status on your loan account.

Contact Information for Inquiries

Confirming loan account balances is essential for maintaining financial transparency. Borrowers should always have access to updated information regarding their obligations, such as outstanding amounts, interest rates, and due dates. A loan account, typically held with financial institutions like banks or credit unions, reflects the current balance, which can fluctuate based on monthly payments or accrued interest. For any inquiries related to loan accounts, customers can contact their financial institution's customer service department, which usually operates during standard business hours (9 AM to 5 PM, Monday through Friday). Many institutions provide multiple communication channels, including telephone numbers, email addresses, and online chat options, to assist borrowers with their needs effectively.

Comments