Are you looking to formalize collateral for a business loan? Drafting a letter that clearly outlines the terms and conditions of your collateral agreement is crucial for protecting both you and the lender. It's essential to include details such as the type of collateral, its estimated value, and any obligations tied to the loan. If you're curious about creating an effective document that covers all bases, keep reading for valuable tips and a helpful template!

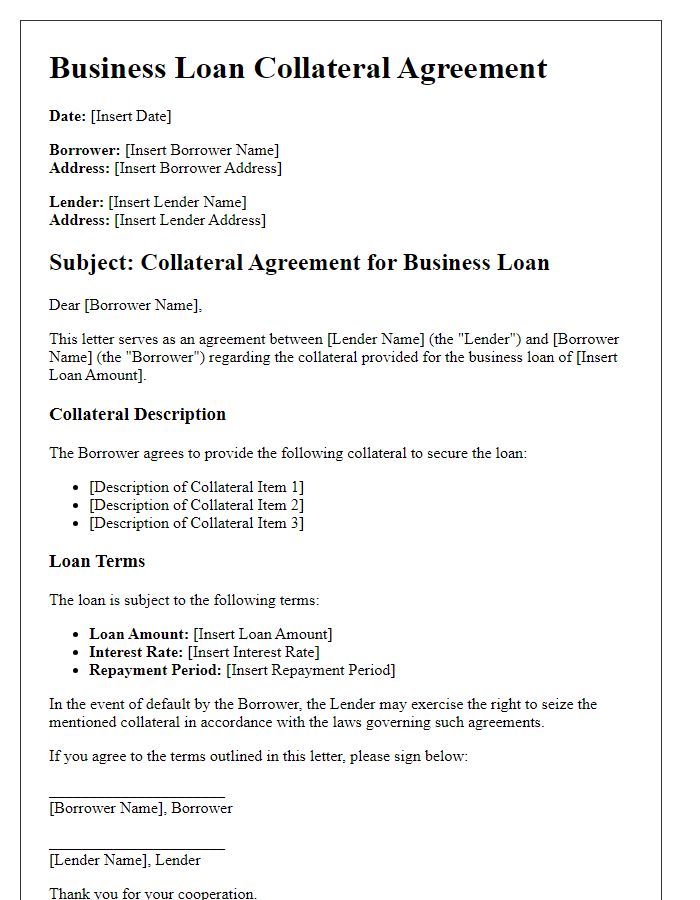

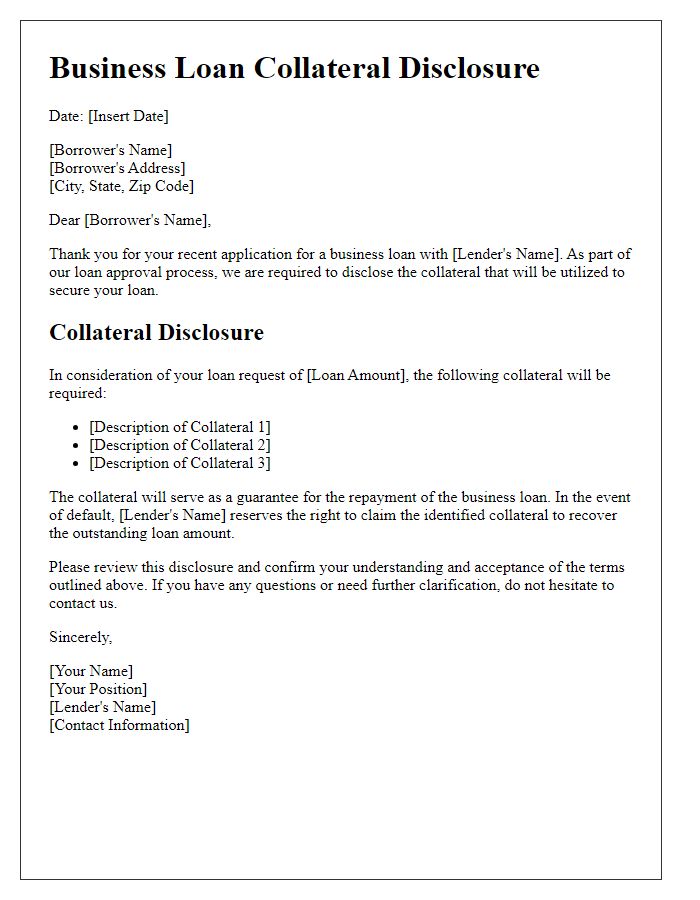

Introductory Statement and Purpose

When formalizing a business loan collateral arrangement, a well-crafted introductory statement and purpose are essential. The statement should clearly outline the intention of the document, which is to secure a loan through collateral while providing assurance to the lender. The purpose includes establishing the specifics of the collateral being offered, such as real estate properties, machinery, or inventory, ensuring that both parties understand the terms and conditions surrounding the collateralized asset. This lays the groundwork for a transparent transaction, fostering trust and clarity in the financial relationship between the borrower and lender.

Detailed Description of Collateral Assets

The collateral assets for the business loan include three key components: commercial real estate, inventory, and equipment. The commercial real estate consists of a 5,000 square foot office building located at 123 Business Lane, Springfield, valued at approximately $750,000, confirmed by a recent appraisal report. The inventory holds an estimated retail value of $200,000; it comprises various electronic goods, including laptops, smartphones, and accessories, held at the warehouse at 456 Commerce Ave, Springfield. The equipment consists of specialized machinery, including a CNC machine valued at $150,000 and office equipment worth $25,000, essential for operational efficiency in daily manufacturing processes. These assets, collectively valued at over $1.12 million, will serve as security for the loan, demonstrating financial stability and commitment to business growth.

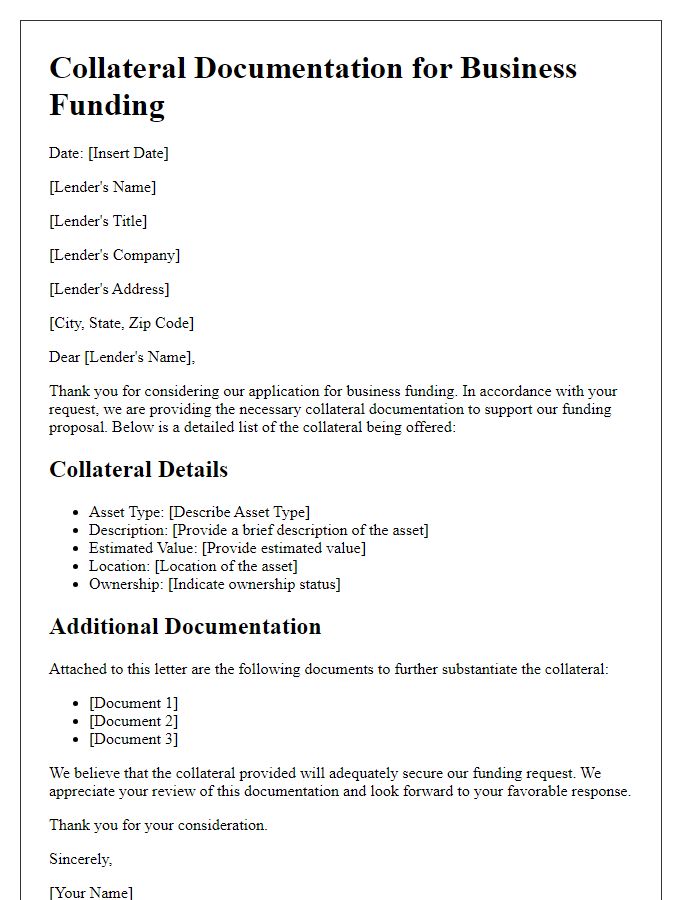

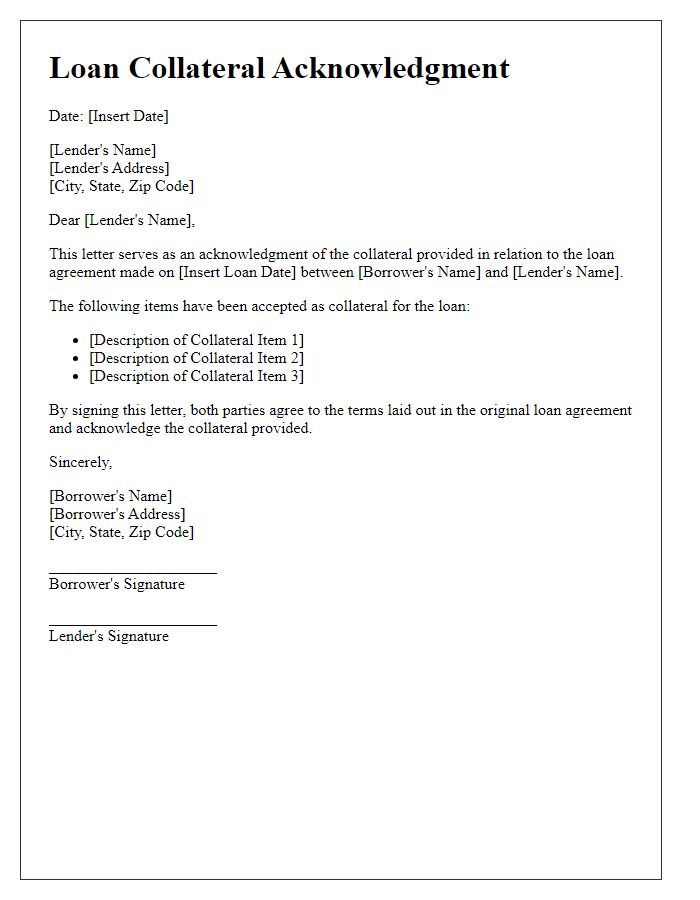

Legal and Ownership Information

Formal business loan collateral documentation is essential for establishing security interests in tangible assets such as real estate (commercial properties or warehouses) and intangible assets including accounts receivable (invoices owed by customers) or inventory (goods held for sale). Lenders require comprehensive legal descriptions of collateral items, including their current market values and any existing liens or encumbrances. Ownership details must certify that the borrower (individual or corporate entity) is the rightful owner of the assets pledged. This information should include terms from the appropriate jurisdiction, relevant property identification numbers (like tax identification numbers or registration codes), and supporting legal documents (such as title deeds or lease agreements) to substantiate the borrower's claims. Providing accurate and detailed information aids in mitigating risks for lenders and supports a smoother loan process.

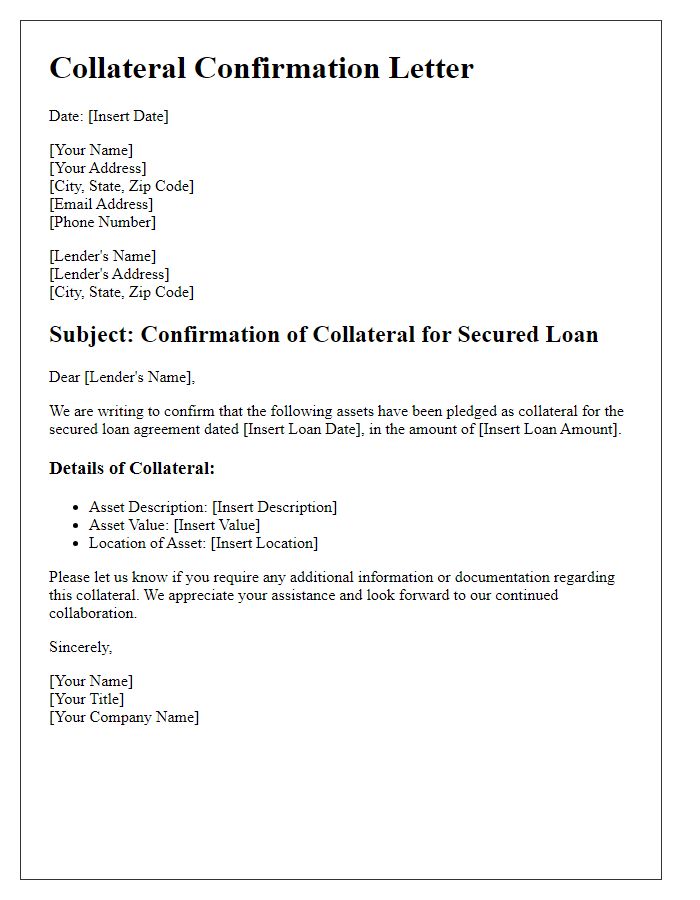

Valuation and Risk Assessment

Valuation of business assets plays a crucial role in securing a loan, particularly in determining collateral worthiness. Assets such as real estate, machinery, and inventory must undergo meticulous evaluation to estimate their market value accurately. The assessment process typically includes appraisals (conducted by certified professionals), alongside comparisons to similar assets in the same industry. For instance, equipment valued at $100,000 could be justifiable collateral for a $50,000 loan, provided it remains operational and relevant in market conditions. Risk assessment evaluates potential challenges that may impact asset value, including economic downturns, changes in market demand, and asset depreciation rates. A comprehensive risk analysis, including factors like business credit score and current liabilities, is essential for lenders to gauge repayment capabilities. Ultimately, robust valuation and risk assessment provide a clear picture of the collateral's security level for lenders, ensuring a well-informed lending decision.

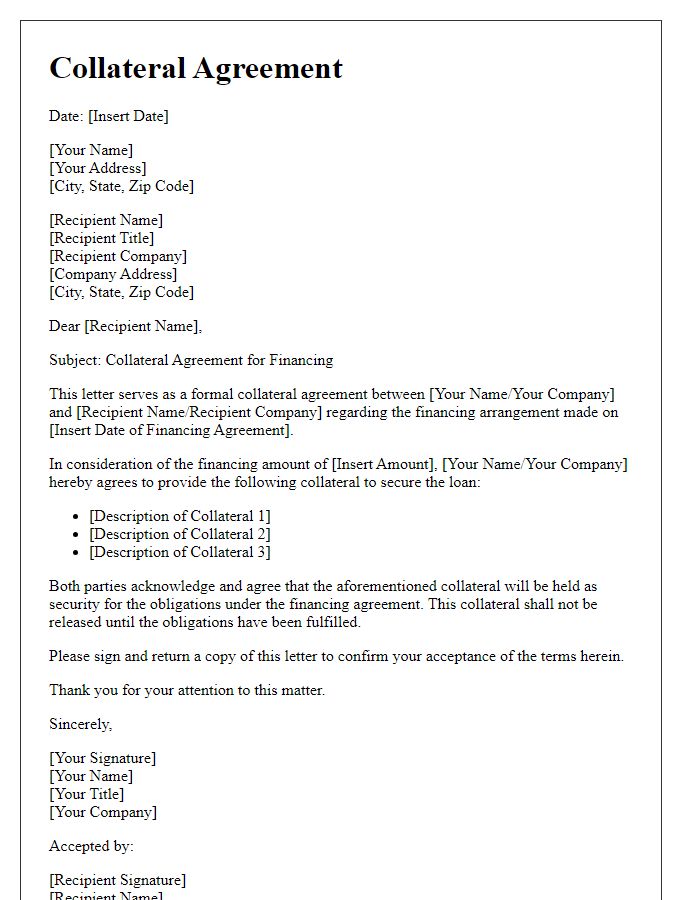

Terms and Conditions of Agreement

A business loan agreement typically outlines specific terms and conditions that govern the collateral securing the loan. Collateral refers to assets that a borrower pledges as a guarantee that they will repay the loan. Common collateral types can include real estate properties, vehicles, equipment, or inventory. The agreement must specify the loan amount (e.g., $50,000), interest rates (e.g., fixed at 6% per annum), repayment timeline (e.g., 5 years), and the consequences of defaulting on the loan, such as the lender's right to seize the collateral. Additionally, it should detail the procedure for asset appraisal and stipulate insurance requirements to protect the collateral's value. Clear definitions of terms such as "default," "collateral release conditions," and "dispute resolution" are crucial for minimizing future conflicts. Specific jurisdictions, like California or New York, may also influence applicable laws governing such agreements.

Comments