When life throws unexpected challenges our way, making adjustments to our financial plans can be crucial. If you're currently navigating a situation that requires extending your loan, you're not alone and there is a way to approach it calmly and effectively. Crafting a clear and concise request can make all the difference in ensuring your lender understands your circumstances. Curious about how to create the perfect letter for requesting a loan extension? Read on to discover essential tips and a handy template!

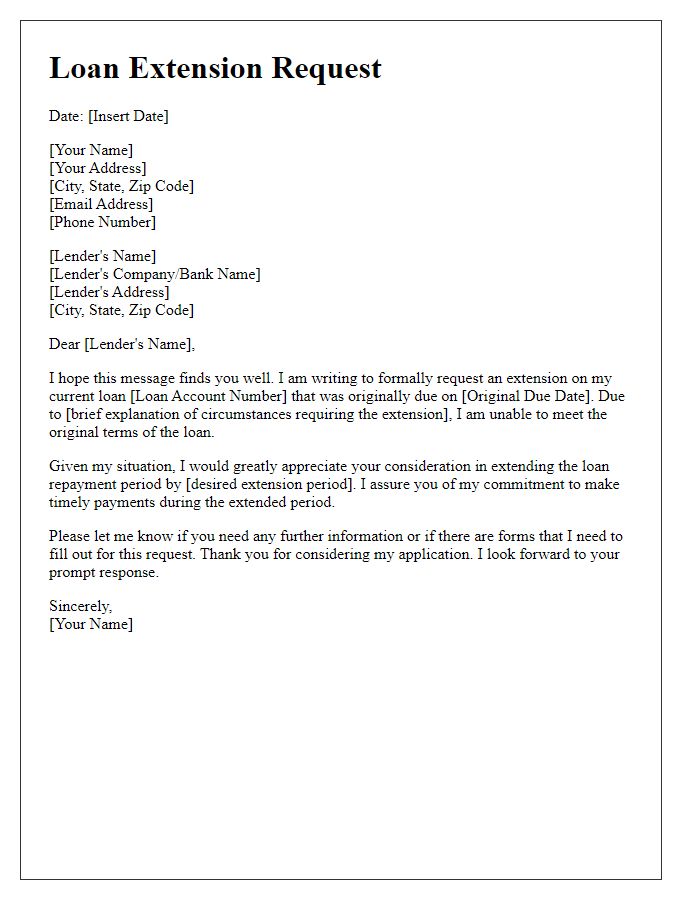

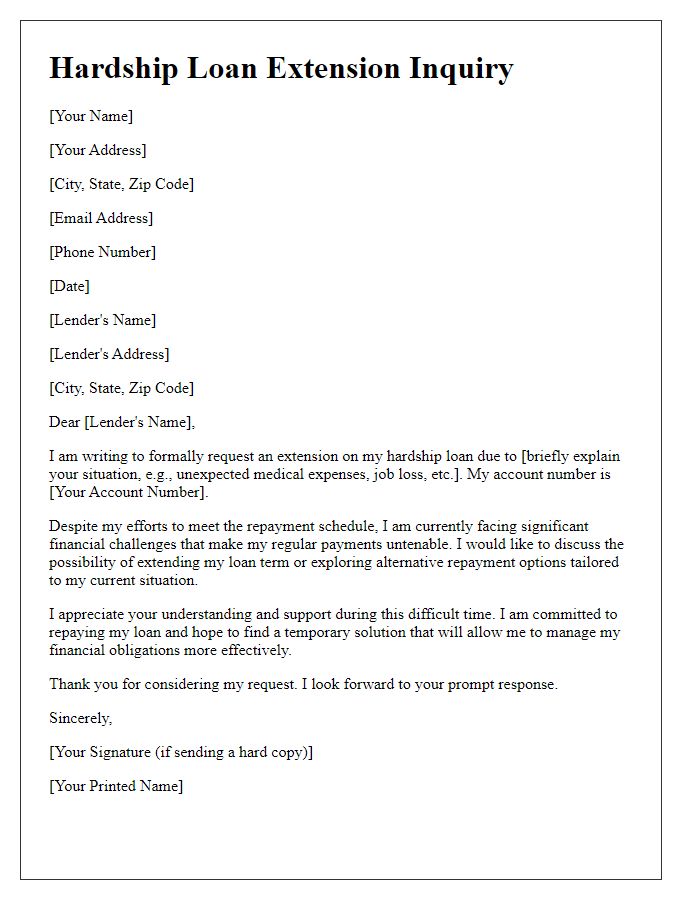

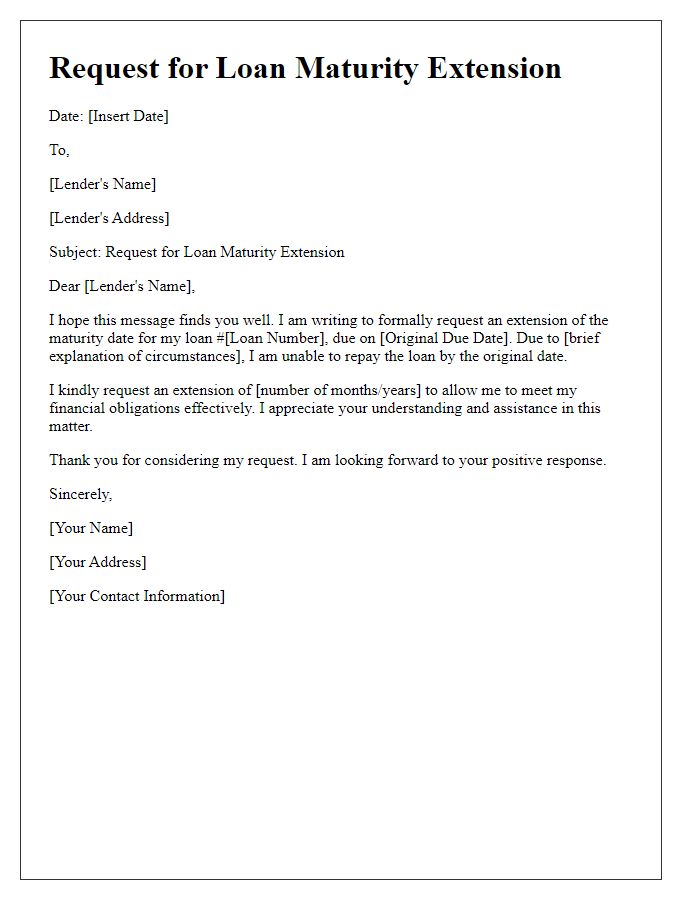

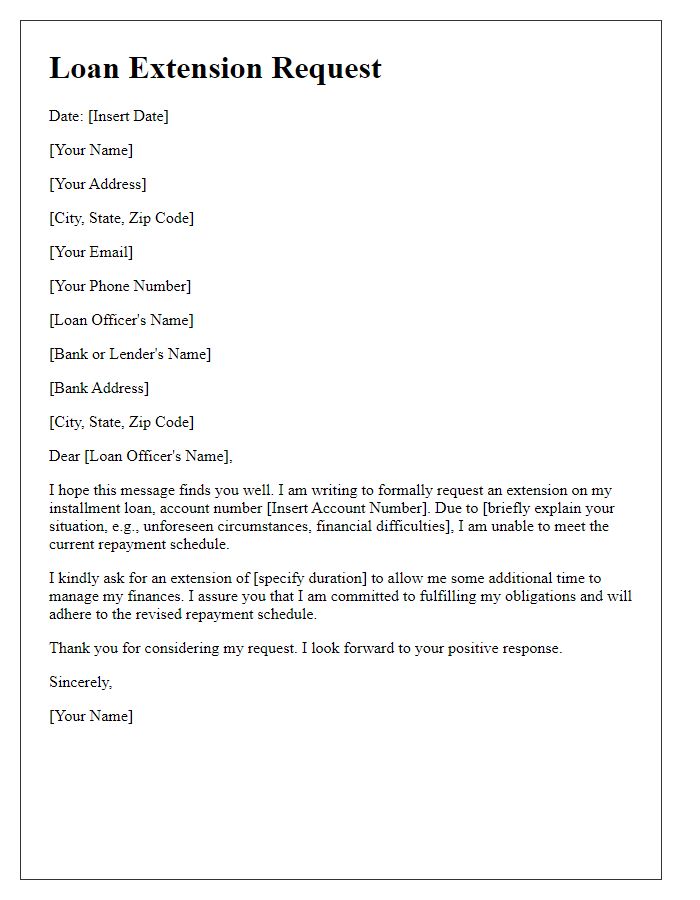

Polite and Formal Language

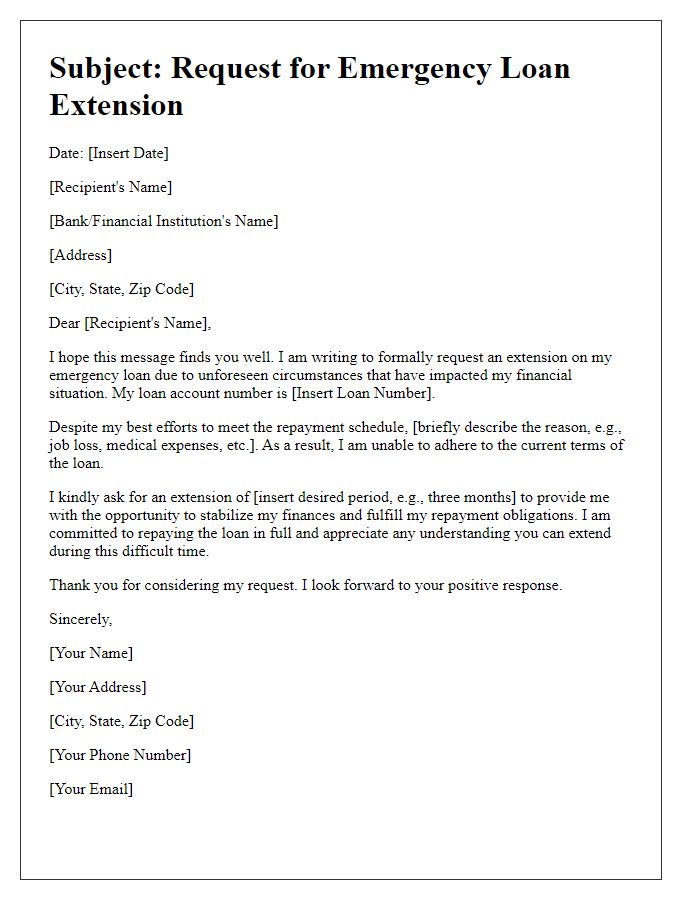

The loan extension request process often involves various formalities and documentation. An individual facing difficulties in repaying a loan, perhaps a personal loan from a local bank or credit institution, may need additional time. Specific reasons such as unexpected medical expenses or job loss can contribute to this request. Clear communication is essential, detailing the current financial situation, proposed new repayment terms, and assurance of commitment to fulfilling the loan obligations. A well-structured letter can facilitate discussions and potentially lead to a favorable outcome for both the borrower and the lender.

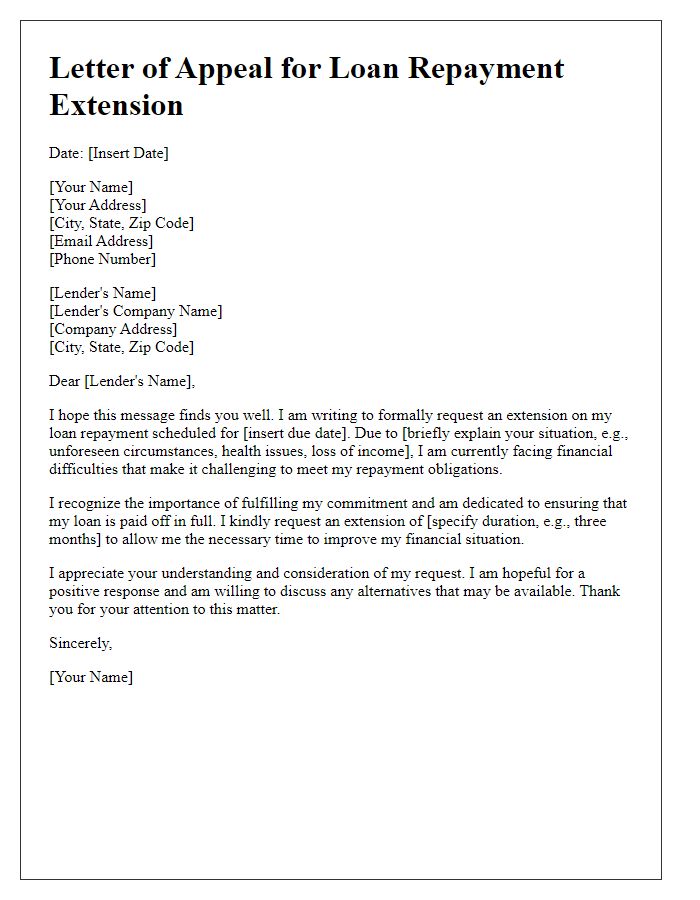

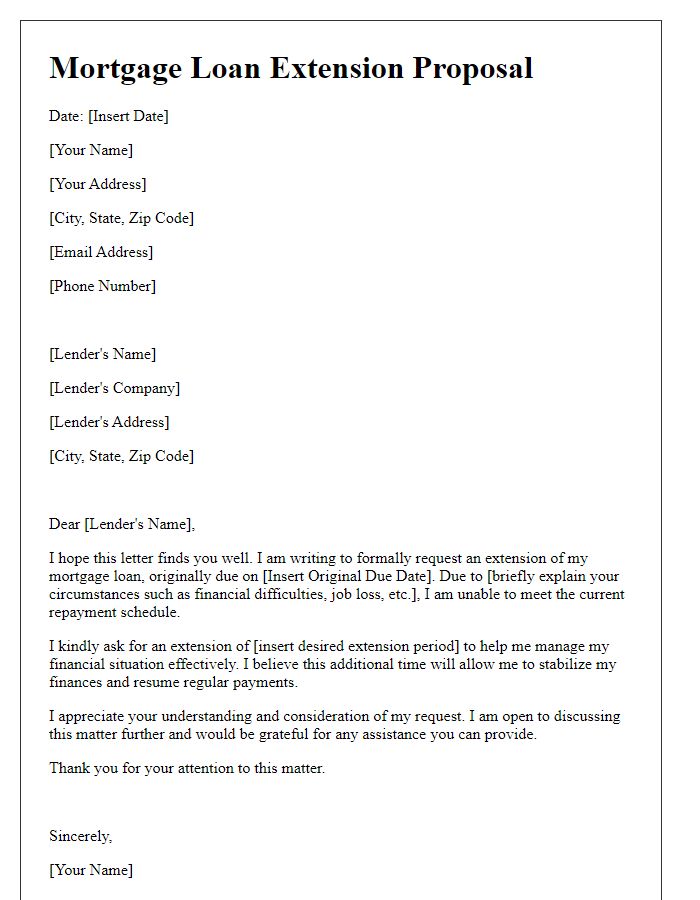

Clear Reason for Extension

Financial obligations often necessitate a loan extension to maintain stability. A personal loan, for instance, may require an extension due to unforeseen expenses such as medical bills that exceed $5,000 or unexpected job loss affecting monthly income. Additionally, current inflation rates surpassing 8% can strain budgets, causing difficulty in meeting repayment schedules. Clear documentation, including updated income statements and a detailed plan for future payments, strengthens the request. Establishing communication with the lending institution, such as ABC Bank with a branch in Springfield, can facilitate understanding of the situation. An extension ensures continued financial responsibility and avoids potential penalties or a negative impact on credit scores, which can fall below 600 if payments are missed.

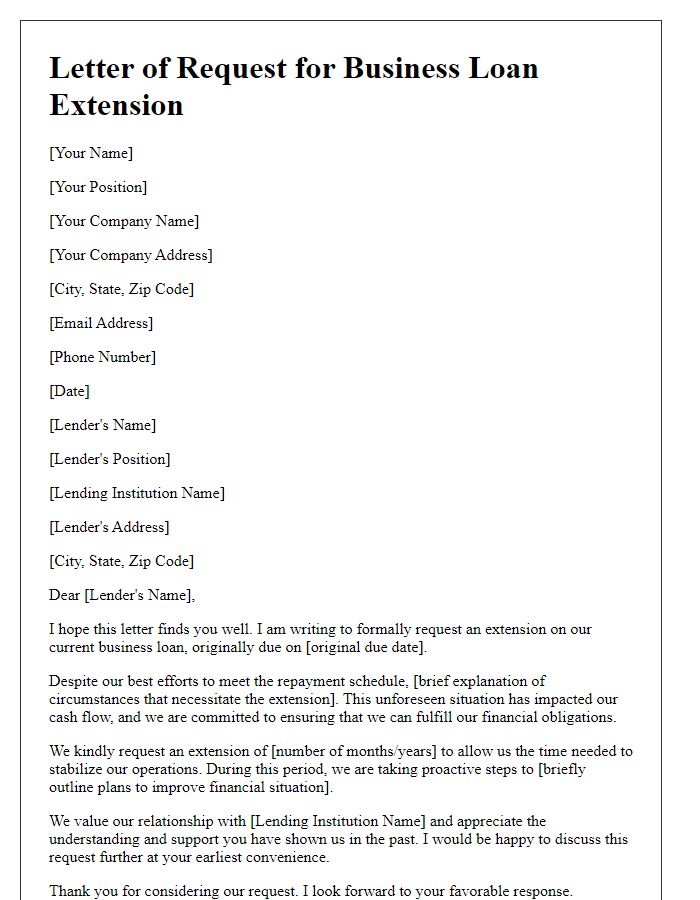

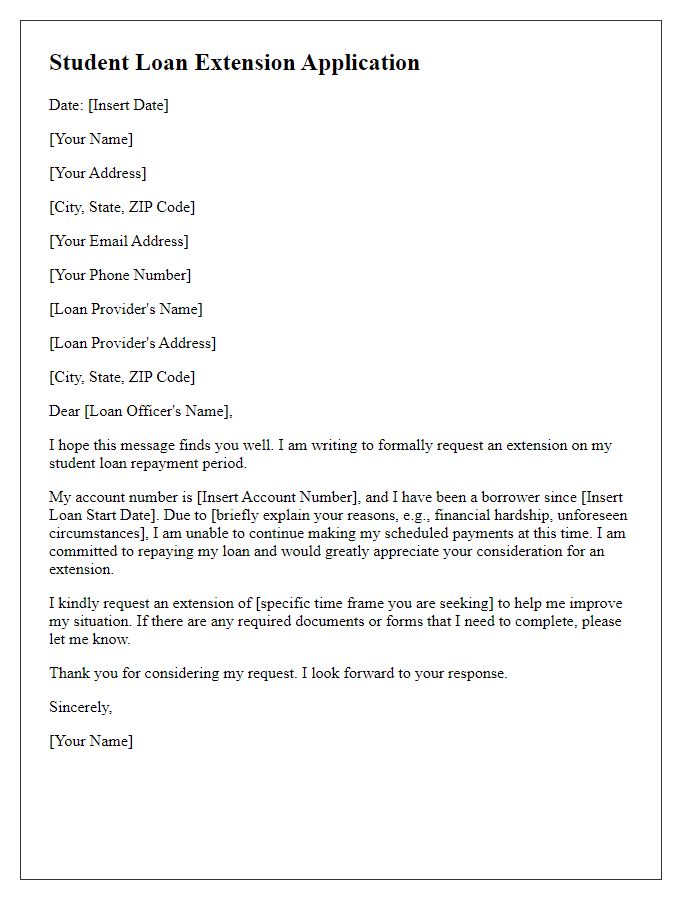

Loan Details Mentioned

Loan extension requests often arise due to unforeseen financial difficulties. Individuals may seek modifications to their loan agreement to extend the repayment period for various reasons such as job loss or medical emergencies. For instance, a personal loan of $5,000 taken at a 7% interest rate, originally scheduled for repayment over two years, might require a six-month extension due to unexpected expenses. Borrowers should provide clear details including their account number, original loan terms, and any relevant changes in financial circumstances. Clear communication helps lenders understand the request and determine their ability to accommodate the extension.

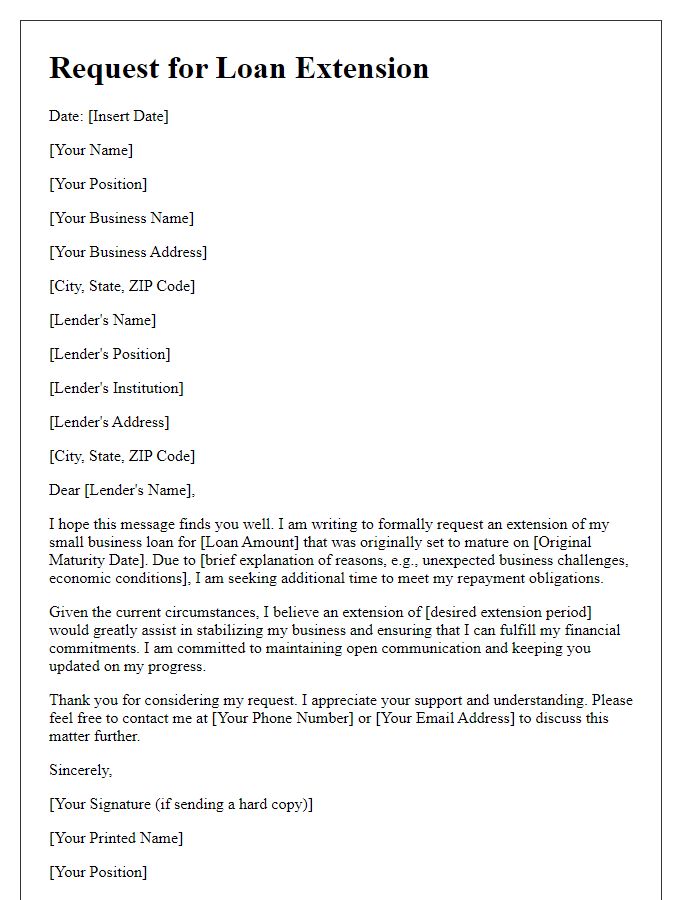

Proposed New Terms

When requesting a loan extension, borrowers typically provide a clear outline of the proposed new terms to facilitate discussion with the lender. Key terms may include the requested extension period (such as an additional six months), revised monthly payment amounts adjusted based on the new timeline, any additional interest rates (especially if different from the original agreement), and specific dates for when payments will resume. It's essential to also detail the reason for the extension, such as financial hardship due to job loss or unexpected medical expenses that have made the original repayment schedule challenging to maintain. Providing a complete picture of the borrower's financial situation, along with any additional supporting documents (like income statements or budgets), can strengthen the request for extension consideration.

Contact Information for Follow-up

The process of requesting a loan extension requires careful consideration of several key factors. Begin by documenting specific contact information, such as phone numbers (like a direct line or customer service number) and email addresses, to facilitate follow-up communication. Include the name of the lending institution, date of the original loan agreement (which could be from 2022), and the current loan balance. Additionally, clarify the reason for the extension request, whether due to unforeseen financial hardships (like job loss during the 2023 economic downturn) or health-related expenses. Provide a detailed repayment plan, outlining proposed new terms to demonstrate commitment towards meeting financial obligations after the extension. Ensuring all pertinent information is organized will foster better understanding and responsiveness from the lender.

Comments