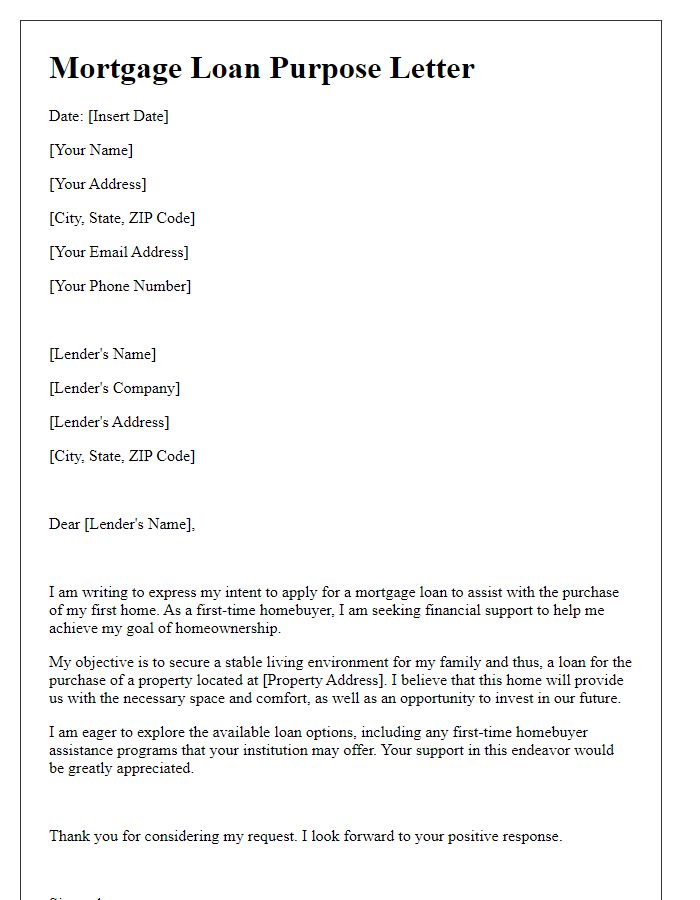

Are you considering taking out a mortgage loan but unsure of the specifics? Crafting a detailed letter can make all the difference in clearly communicating your purpose. In this article, we'll walk you through a straightforward template that outlines exactly what information to include and how to convey your intentions effectively. Ready to learn more about how to structure your mortgage loan purpose letter? Let's dive in!

Loan Purpose Explanation

A mortgage loan serves multiple purposes, primarily enabling individuals to purchase residential properties such as single-family homes, condominiums, or multi-family units. The average mortgage amount in the United States typically ranges from $200,000 to over $1 million, depending on factors like location (e.g., metropolitan areas like San Francisco or New York City) and property type. Borrowers may utilize a loan for home renovations, improving property value by investing in updates such as kitchen remodels or bathroom upgrades, which can yield substantial returns. Additionally, refinancing options allow homeowners to lower interest rates, reduce monthly payments, or pull equity, enhancing financial flexibility. Mortgages can also support investment properties, providing opportunities for rental income in thriving markets. Events such as interest rate changes or economic conditions significantly influence mortgage applications, compelling borrowers to reassess their financial strategies in response to market fluctuations.

Borrower Financial Overview

A comprehensive borrower financial overview outlines essential aspects of an individual's financial situation regarding a mortgage loan application. Key components include the borrower's credit score, which significantly influences loan eligibility, typically ranging between 300 (poor) and 850 (excellent). Annual income must be clearly stated, with documentation such as pay stubs and tax returns, reflecting the borrower's earning capacity. Existing liabilities, like credit card debts, student loans, and other mortgage obligations, should be enumerated, revealing the borrower's debt-to-income ratio (DTI), ideally below 36%. Verification of assets, including savings accounts, retirement funds, and real estate holdings, provides insight into the borrower's financial stability and ability to proceed with loan payments. The overview should address the intended purpose of the mortgage, whether for purchasing a primary residence, refinancing an existing loan, or investing in rental properties, enhancing clarity for lenders on the borrower's intentions.

Property Details and Appraisal Information

The mortgage loan purpose revolves around acquiring residential real estate, specifically a three-bedroom, two-bathroom home located at 123 Maple Street, Springfield, valued at $350,000. This property, built in 2015, encompasses 1,800 square feet and is situated in a rapidly developing neighborhood, enhancing its market appeal. Recent comparable sales, or "comps," in the vicinity indicate a fair market value based on properties that sold for similar pricing in the last six months. The pending appraisal scheduled for October 15, 2023, aims to confirm this valuation while assessing factors such as property condition, location amenities, and community features. Important to note are the recent renovations, including a new roof and upgraded kitchen appliances, that enhance the property's overall worth and desirability, further supporting mortgage loan approval.

Repayment Plan and Financial Capability

A well-structured mortgage repayment plan outlines the strategy for managing monthly obligations, ensuring financial stability. Assessing financial capability involves evaluating monthly income, which should comfortably exceed necessary expenses like housing, utilities, and food. Lenders often look for a debt-to-income ratio below 36%, including the new mortgage payment. Emergency savings, ideally covering three to six months of expenses, bolster financial security. Understanding the loan terms, such as interest rates varying between 3% and 5% for fixed-rate mortgages, informs budgeting decisions. Additionally, the local housing market trends, particularly in areas like Austin, Texas, can influence property value retention, affecting long-term repayment ability.

Supporting Documentation and Legal Compliance

Mortgage loans serve a significant purpose in facilitating homeownership; essential supporting documentation includes proof of income, tax returns, and credit history. These elements verify applicants' financial stability and payment capability. Legal compliance demands adherence to established regulations, ensuring fair lending practices under the Equal Credit Opportunity Act (ECOA) and the Truth in Lending Act (TILA). Regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) monitor compliance to protect borrowers from predatory lending. Documentation such as the Loan Estimate and Closing Disclosure provides transparency regarding loan terms and costs, safeguarding consumer interests throughout the mortgage process.

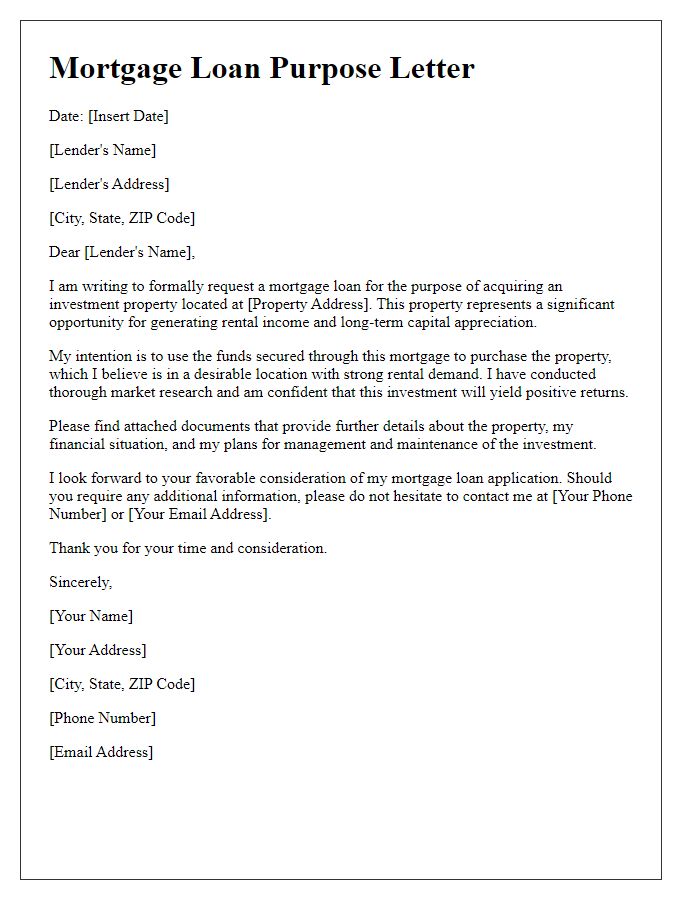

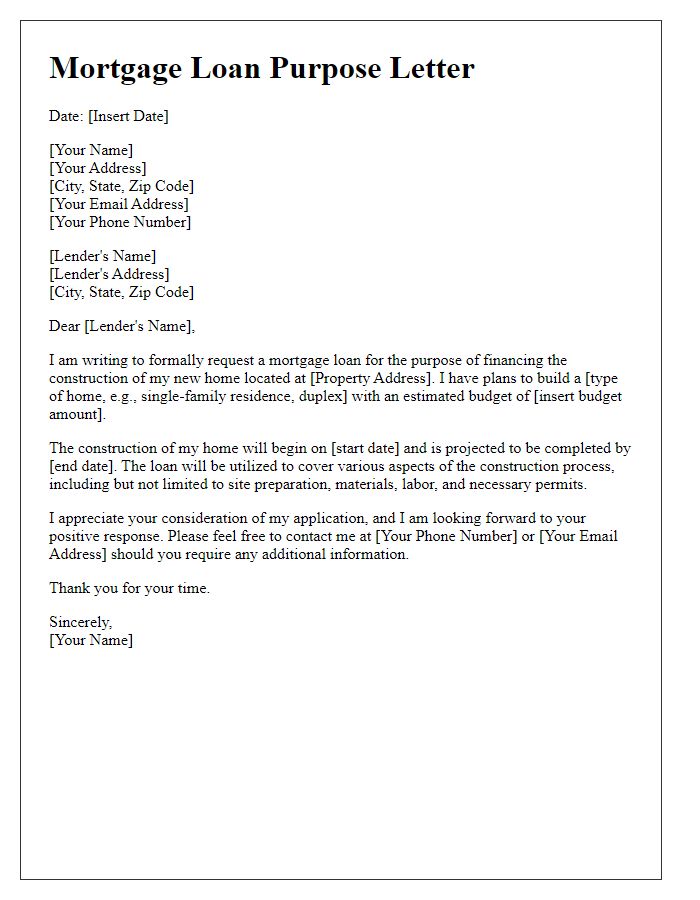

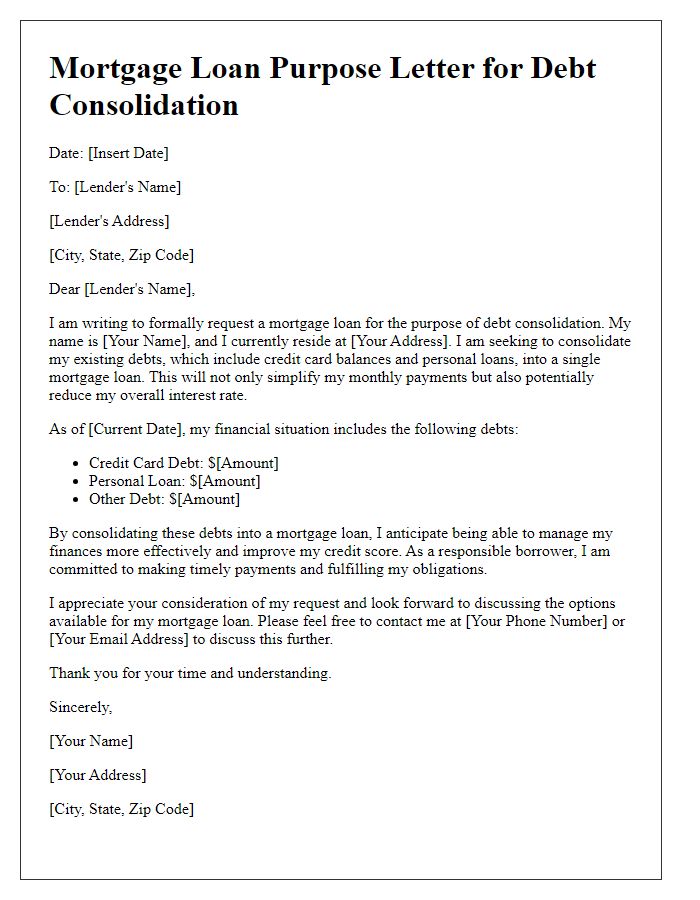

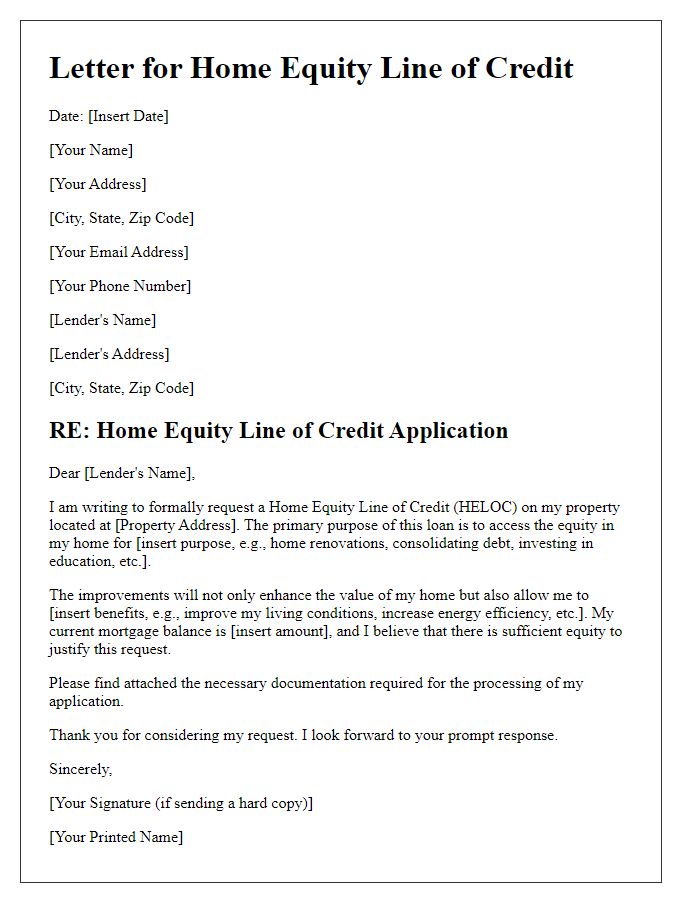

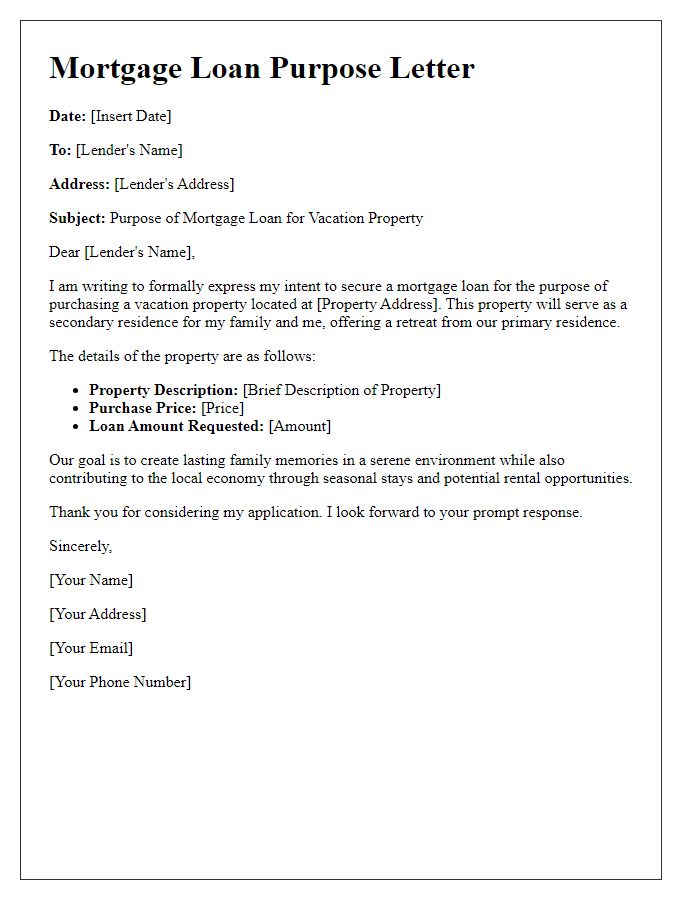

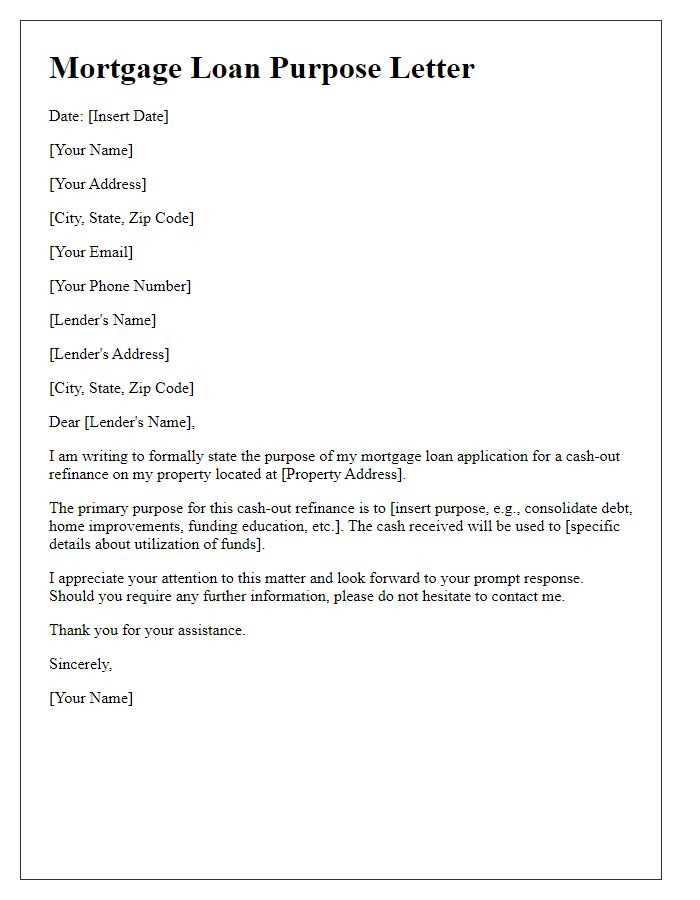

Letter Template For Detailing Mortgage Loan Purpose Samples

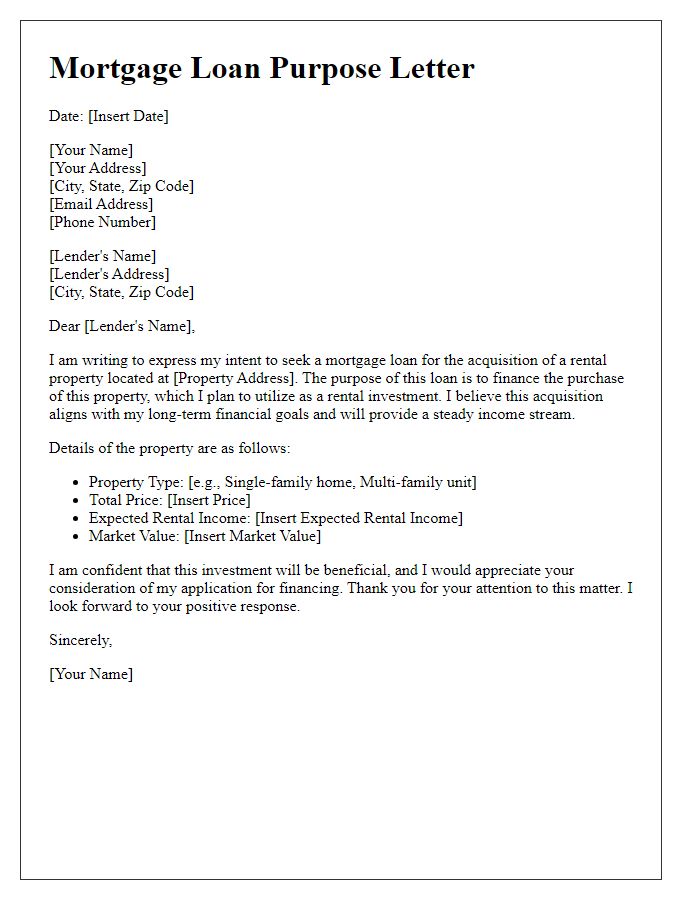

Letter template of mortgage loan purpose for rental property acquisition

Comments