Are you feeling overwhelmed by your current personal loan situation? You're not alone, and many people find themselves searching for ways to negotiate a settlement that can ease their financial burden. In this article, we'll explore a personalized letter template designed specifically for proposing a personal loan settlement. If you're ready to take the steps toward financial relief, keep reading to learn how to craft an effective proposal that can help you in your journey!

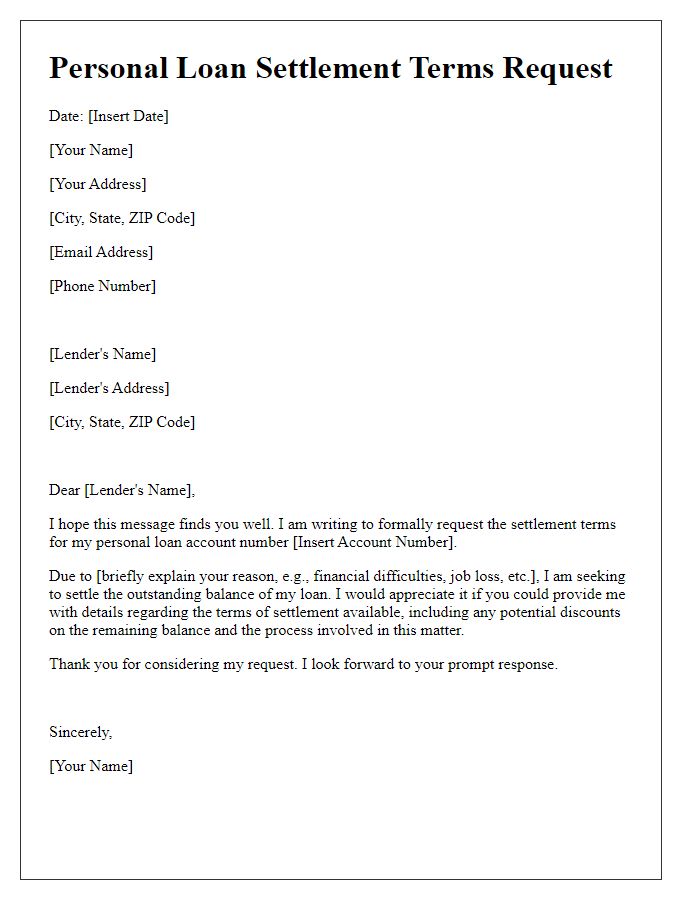

Clear identification of parties involved

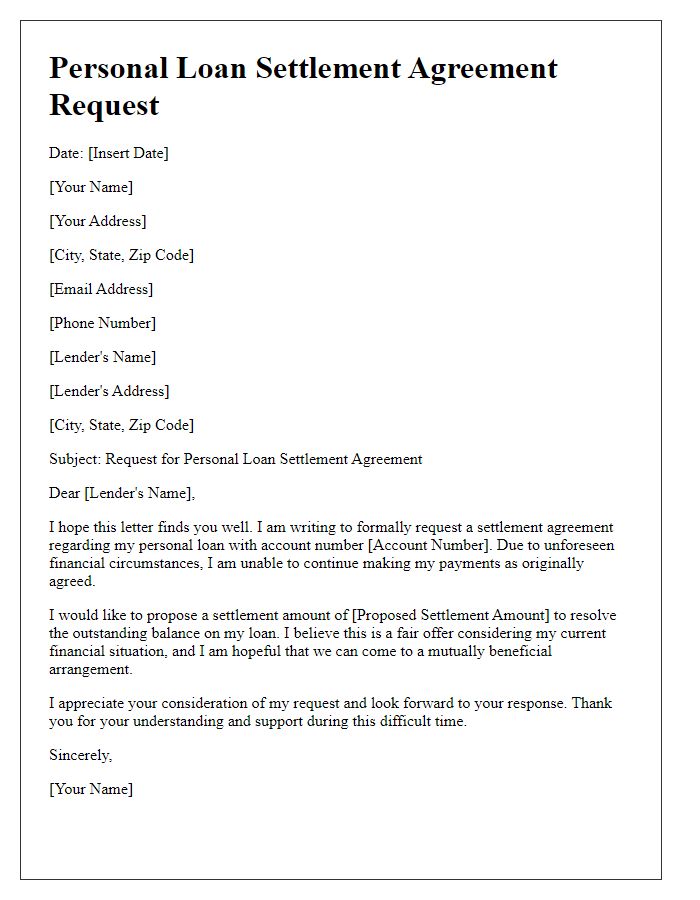

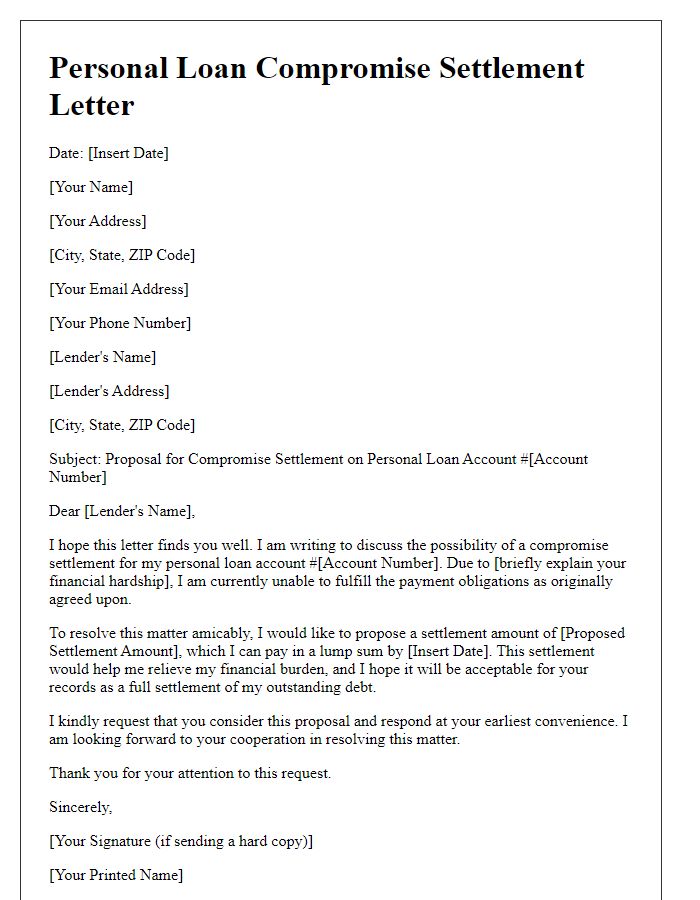

In the context of a personal loan settlement proposal, the document should clearly identify the parties involved, including the borrower (the individual requesting the settlement) and the lender (the financial institution or individual that provided the loan). The borrower, typically named in the loan agreement, should include relevant personal details such as full name, address, and loan account number for precise identification. The lender, which could be a bank like Bank of America or a credit union such as Navy Federal Credit Union, must likewise be identified with the institution's official name, address, and contact information. Clear identification is crucial for legal clarity and ensuring that all terms of the proposed settlement are understood by both parties. This clarity aids in resolving any potential disputes and facilitates effective communication throughout the settlement process.

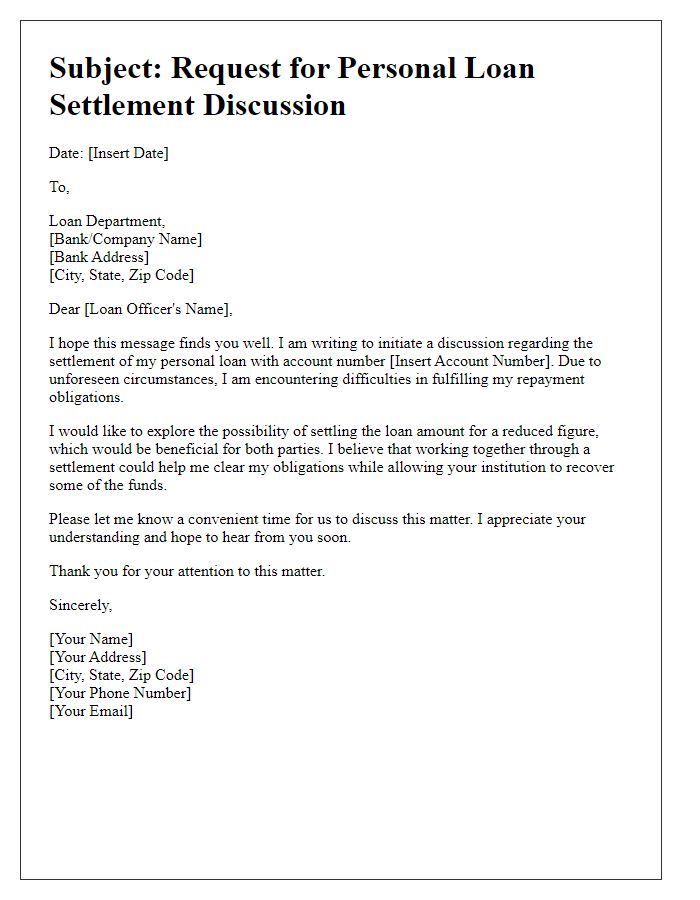

Detailed loan information and outstanding balance

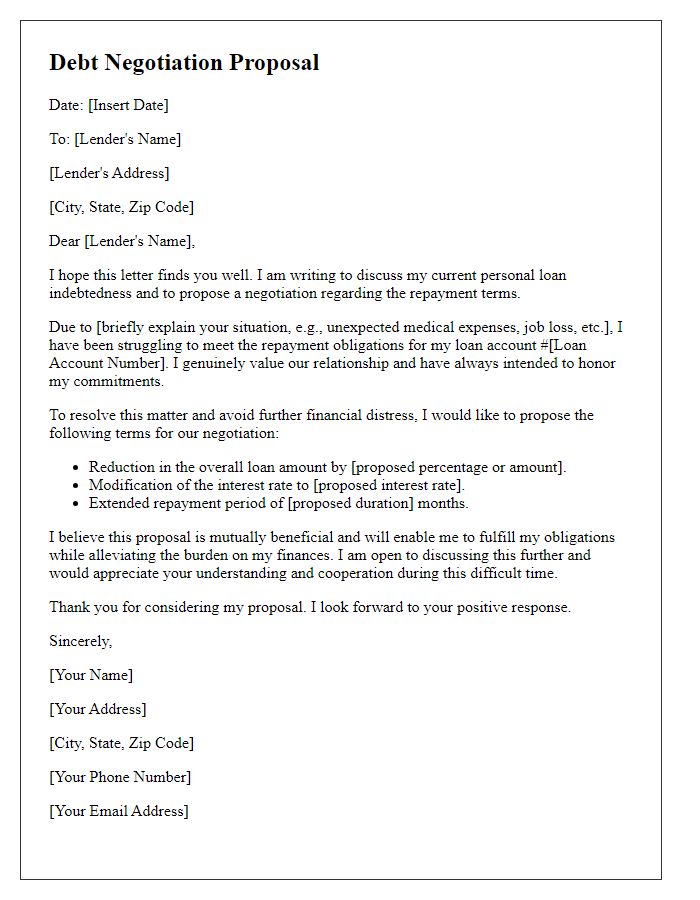

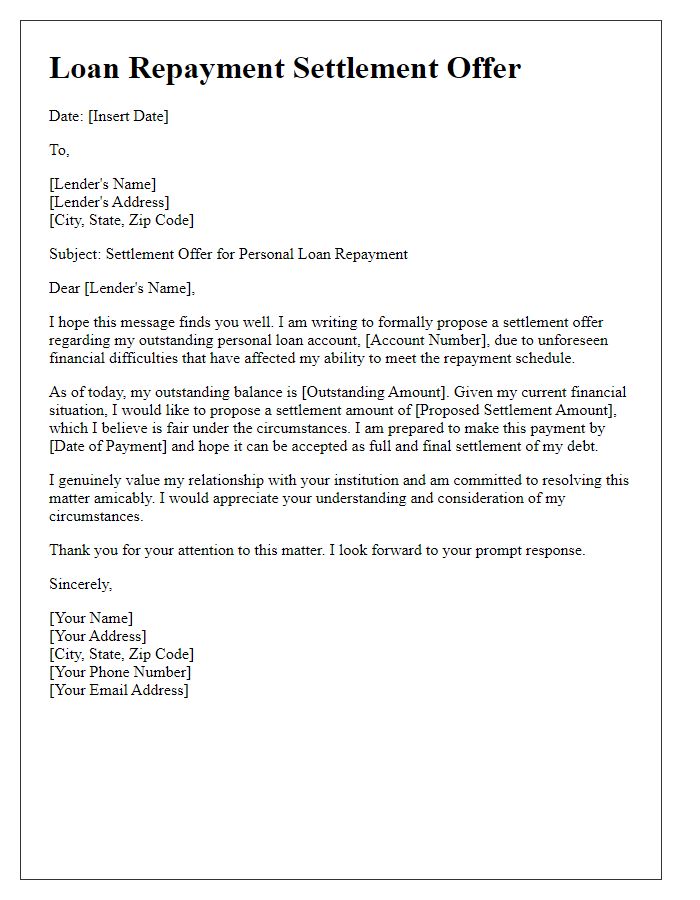

A personal loan settlement proposal outlines the necessary details for negotiating a reduction in an outstanding debt. Key components of this proposal include the loan information, such as the lender's name (e.g., ABC Bank), the original loan amount (e.g., $10,000), the interest rate (e.g., 7% per annum), the loan term (e.g., 5 years), and the start date of the loan (e.g., January 2020). Additionally, the outstanding balance (e.g., $7,500) should be included, highlighting any late fees or accrued interest that have contributed to the total. Providing context about the borrower's financial situation, such as loss of employment or medical emergencies, may help justify the request for a settlement, emphasizing the importance of resolution. Clear communication of the desired settlement amount (e.g., $4,000) and the proposed payment terms (e.g., a one-time payment within 30 days) is crucial for effective negotiation.

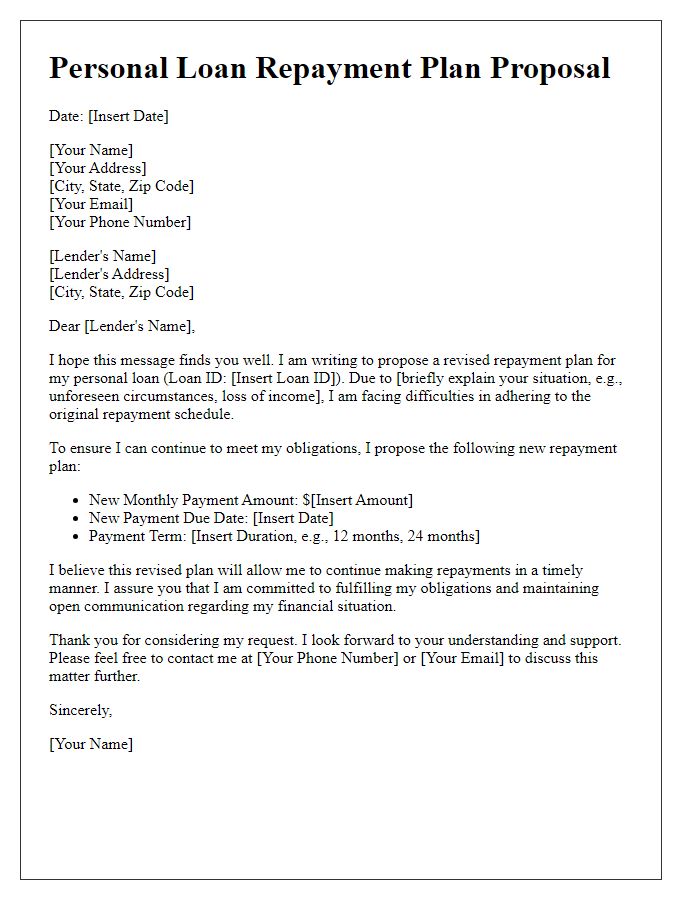

Proposed repayment terms and timeline

A personal loan settlement proposal outlines the terms for repayment and timelines that cater to both the lender's and borrower's needs. The repayment terms may include a reduced lump sum offer, such as 50% of the outstanding balance, contingent upon the principle amount due of $10,000 being negotiated. The timeline for payment execution can establish a 90-day period following acceptance of the offer, ensuring that the first installment of the negotiated amount is paid within 30 days. It can emphasize a final payment due date, aligning with the borrower's financial capabilities and the lender's policies. Documentation such as proof of income may accompany the proposal to substantiate the borrower's ability to fulfill the settlement terms within the designated period.

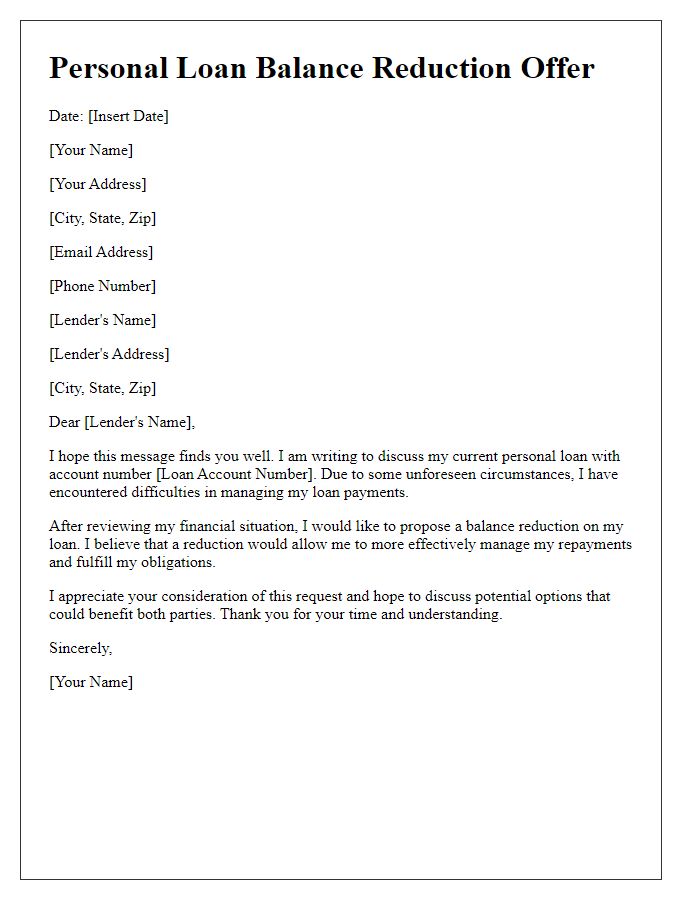

Justification and financial rationale

A personal loan settlement proposal requires a clear understanding of the financial situation surrounding the loan and a rationale for the settlement. The borrower should outline the current outstanding balance of the loan, including details on interest rates and repayment terms. Presenting evidence of financial hardship, such as income reduction or unexpected expenses, strengthens the justification for settlement. Highlighting future income projections, if applicable, can show the ability to make partial payments. Providing a proposed settlement amount, ideally less than the outstanding balance, should reflect what can realistically be paid. Emphasizing the benefits to both parties, such as a quicker resolution and avoidance of default, can bolster the rationale for acceptance.

Formal closing and contact information

A personal loan settlement proposal outlines a negotiated agreement between a borrower and a lending institution. The closing section should include a professional farewell, reinforcing the willingness to cooperate towards a resolution. Contact information must be precise, including the borrower's name, mailing address, phone number, and email address. A clear and respectful tone at the end of the proposal fosters goodwill, encouraging prompt communication from the lender. Adding a date to the correspondence can also provide context for the time frame of the request, aiding in documentation and follow-up efforts.

Comments