Are you feeling overwhelmed by mortgage arrears? You're not aloneâmany homeowners face this challenge, and finding a repayment solution can be daunting. A well-structured mortgage arrears repayment agreement can provide the clarity and security you need to regain control of your finances. Read on to discover useful tips and a sample letter that can help you craft an effective agreement with your lender.

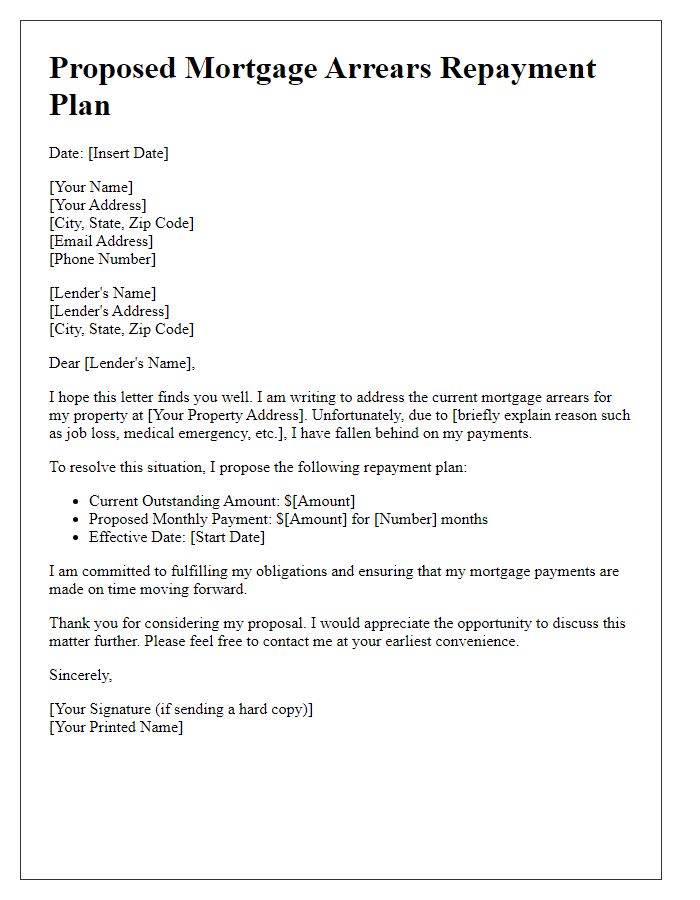

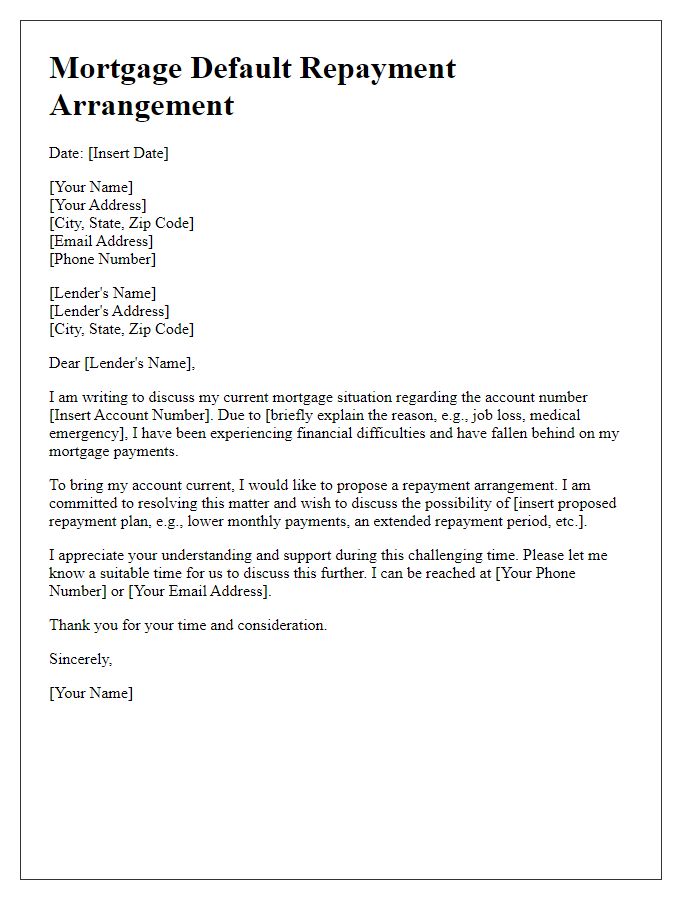

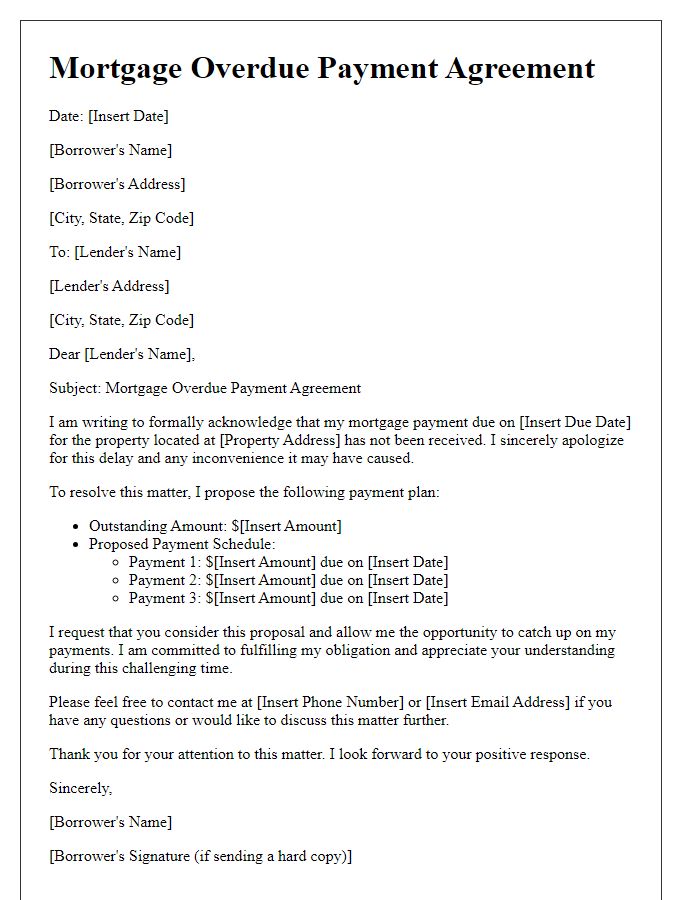

Clear identification of parties involved

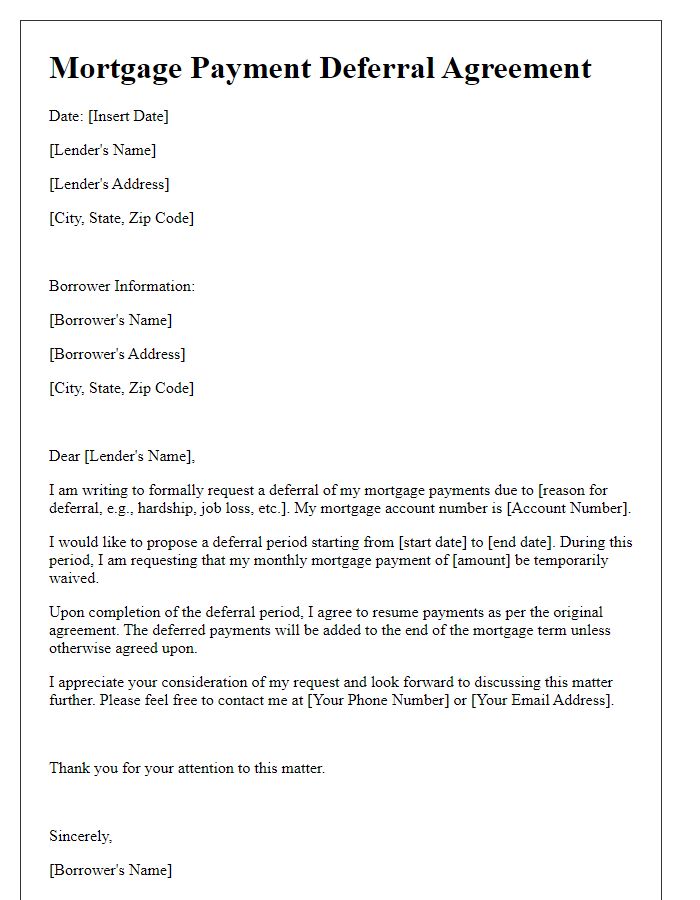

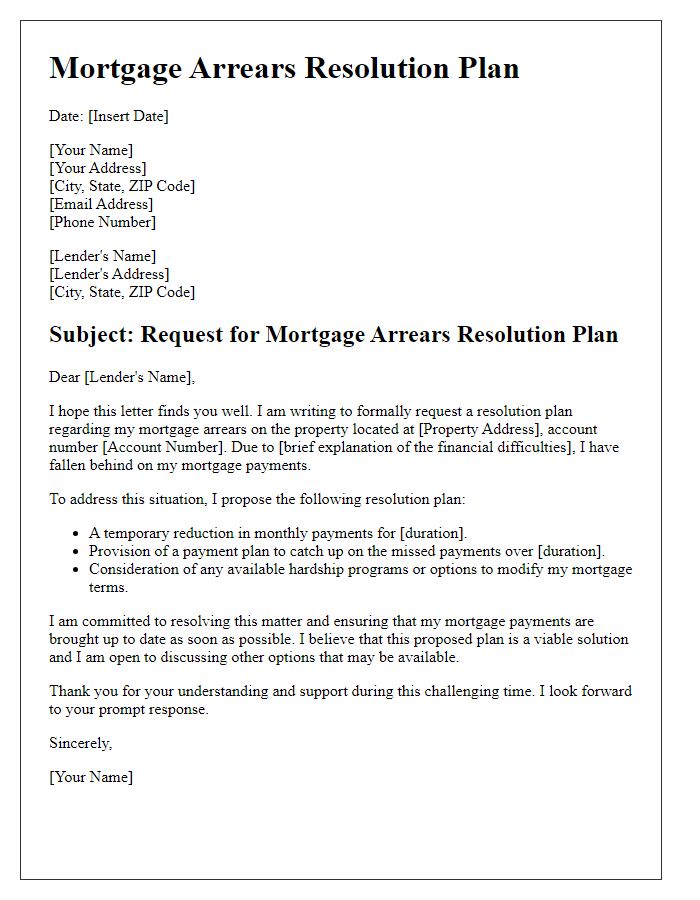

In a mortgage arrears repayment agreement, the parties involved include the Borrower, who is the individual or entity that took out the mortgage loan and is responsible for repayment, and the Lender, which can be a financial institution or individual providing the loan secured by the property, often in the form of a mortgage deed. Both parties must be clearly identified with full legal names, addresses, and contact information. The agreement should specify the property involved--typically a residential home or commercial property--highlighting the property address and any legal descriptions pertinent to the mortgage. Key loan details including the original loan amount, outstanding balance, interest rate, and terms of the original loan are also essential for clarity. The document should outline the repayment terms for the arrears, including specific amounts due, timelines for payments, and any agreed-upon conditions concerning additional fees or penalties.

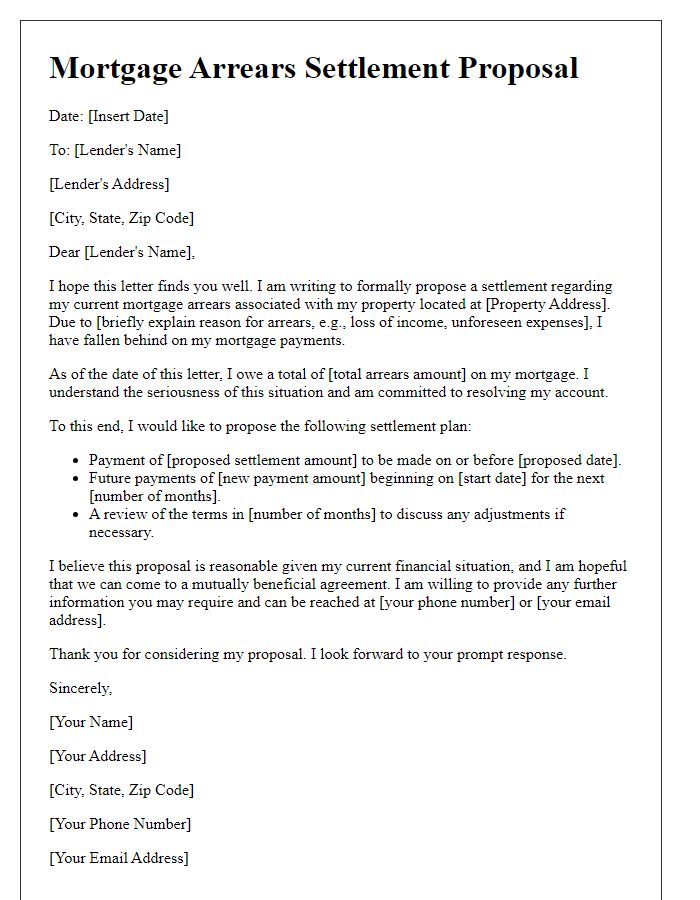

Detailed explanation of arrears amount

Mortgage arrears occur when a borrower fails to make scheduled payments on their mortgage loan, creating an outstanding balance due. The arrears amount reflects the total unpaid mortgage payments, often including the principal, interest, and potentially late fees. For instance, if a homeowner, due to unforeseen circumstances like job loss, misses three monthly payments of $1,500 each, the total arrears would amount to $4,500, excluding any additional fees incurred. Furthermore, mortgage agreements typically stipulate that these amounts accumulate interest, leading to higher overall obligations over time. Local laws may impact the remedies available to lenders, and borrowers should understand their rights under these regulations. Regular communication with lenders, as seen in specific repayment agreements, can aid in addressing these arrears and establishing a feasible repayment plan that prevents foreclosure.

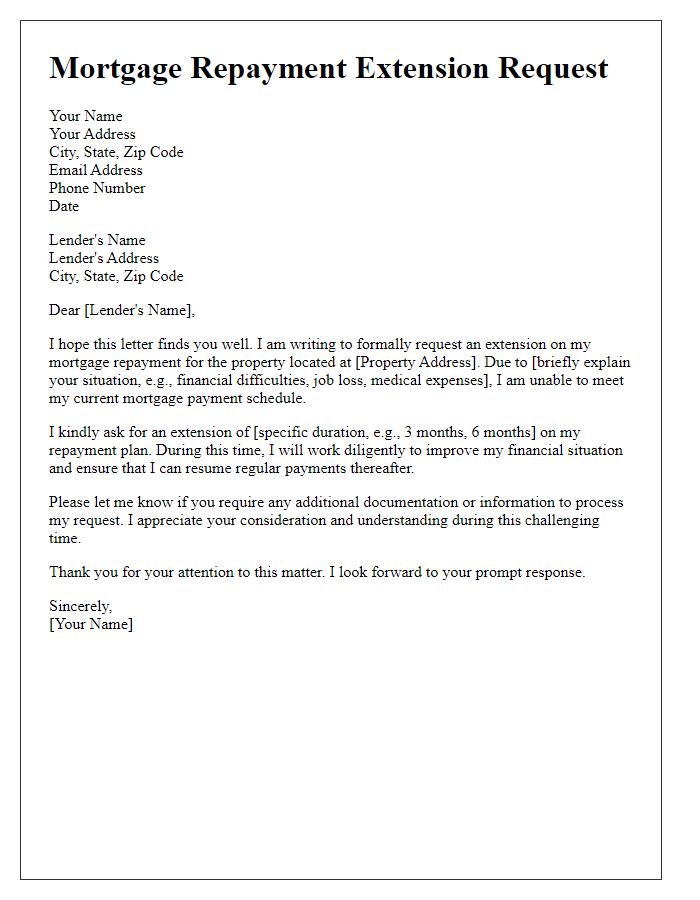

Agreed repayment plan terms

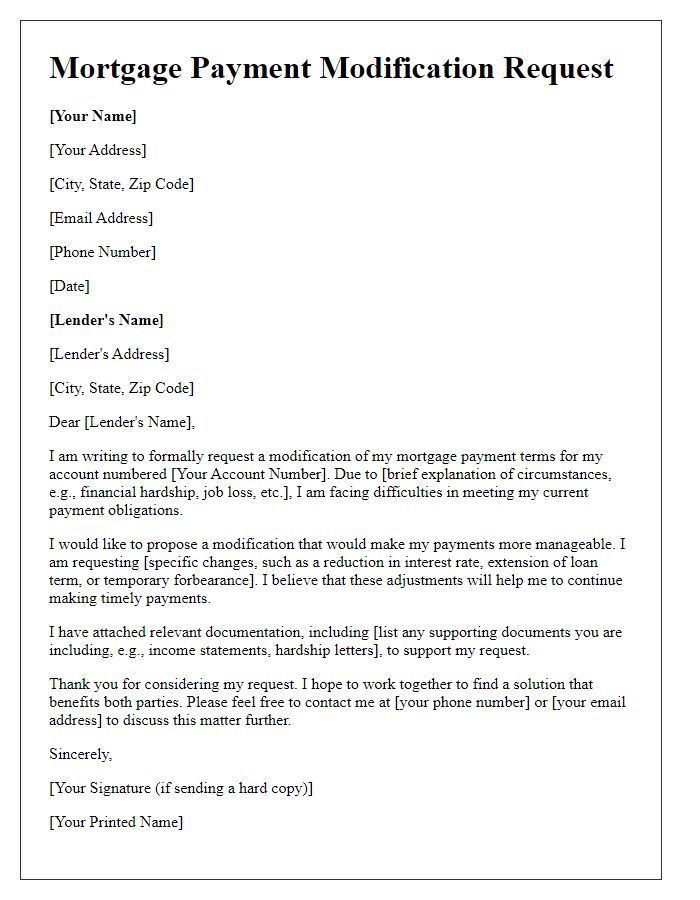

Mortgage arrears can cause significant distress to homeowners, often leading to potential foreclosure. Establishing an agreed repayment plan is crucial for individuals facing financial difficulties in managing their mortgage obligations. Key terms of the repayment agreement may include specifics such as the total arrears amount, which could range from thousands to tens of thousands of dollars, and the duration of the repayment period, often spanning several months or years based on individual circumstances. Regular payment frequency could be outlined, monthly installments being a standard option, while the payment amount should be tailored to the homeowner's budget, taking into account their monthly income and expenses. Additional provisions might include the possibility of a reduced interest rate or a temporary forbearance on payments during financial hardship. Legal references may also be documented, citing specific compliance with regulations set by the Department of Housing and Urban Development (HUD) to protect both lender and borrower interests.

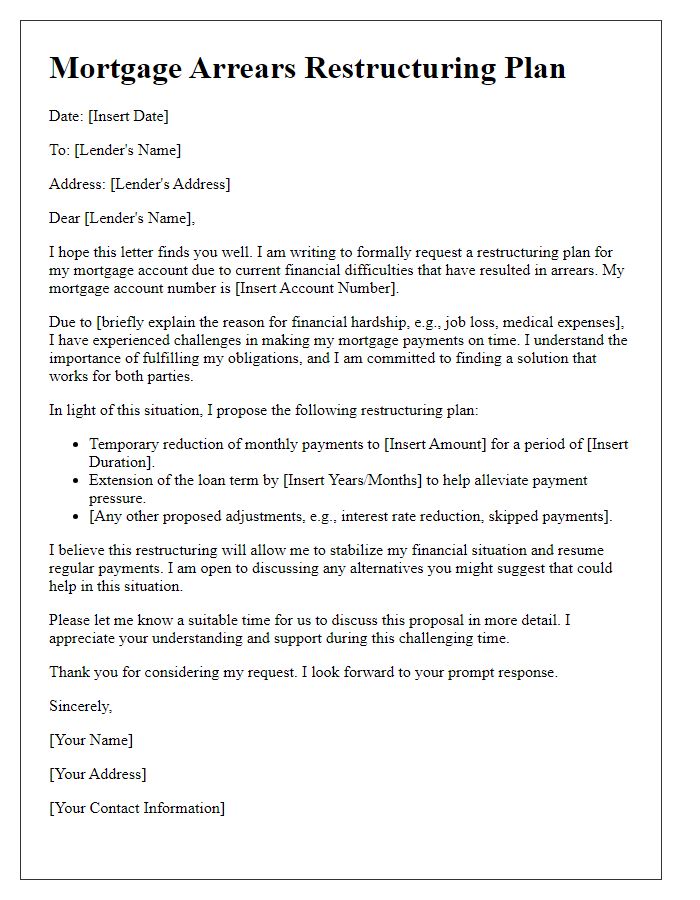

Consequences of default

Mortgage arrears can lead to severe financial repercussions for homeowners. Failure to meet repayment obligations, commonly defined as a mortgage default, may result in foreclosure, a legal process where lenders reclaim properties due to unpaid debts. Such consequences can manifest swiftly, often within three to six months after missed payments, depending on loan terms and lender policies. Credit scores can significantly decline, leading to a drop of 100 points or more, affecting future borrowing capabilities. Additionally, heightened stress and potential legal fees associated with foreclosure proceedings can impose further financial strain, making it essential for borrowers to establish a repayment agreement promptly to mitigate these risks.

Contact information for further assistance

Mortgage arrears typically arise when homeowners fall behind on their monthly payments, leading to potentially serious consequences such as foreclosure. A repayment agreement allows homeowners to address their outstanding balance while maintaining their property, often involving negotiations with lenders regarding a feasible payment plan. Key entities in this context include mortgage lenders, usually large banks or specialized financial institutions, and homeowners, who may also engage with credit counseling agencies for support. Important numbers to consider in such arrangements often include interest rates (ranging from 3% to over 7% depending on market conditions) and the total amount owed, which can significantly impact monthly repayment terms. Homeownership rates in the United States in recent years hover around 65%, indicating a significant number of Americans could potentially face these challenges.

Comments