Are you curious about the tax holiday eligibility and how it can benefit you? Understanding the ins and outs of tax exemptions can seem overwhelming, but it doesn't have to be! In this article, we'll break down the essential information you need to know to determine if you qualify for these potential savings. So, let's dive in and explore what this means for youâkeep reading to discover more!

Clear Subject Line

Eligibility for Tax Holiday: Important Information & Instructions. Clear communication regarding eligibility criteria, deadlines, and necessary documentation is essential for individuals and businesses seeking to benefit from tax holidays during specific events, such as state sales tax exemptions or designated disaster recovery periods, often outlined by government entities like state departments of revenue. Understanding applicable dates, qualifying purchases, and filing requirements can significantly impact financial outcomes for stakeholders. Timely submission and accuracy in paperwork remain pivotal in ensuring compliance and maximizing the advantages offered by tax relief initiatives.

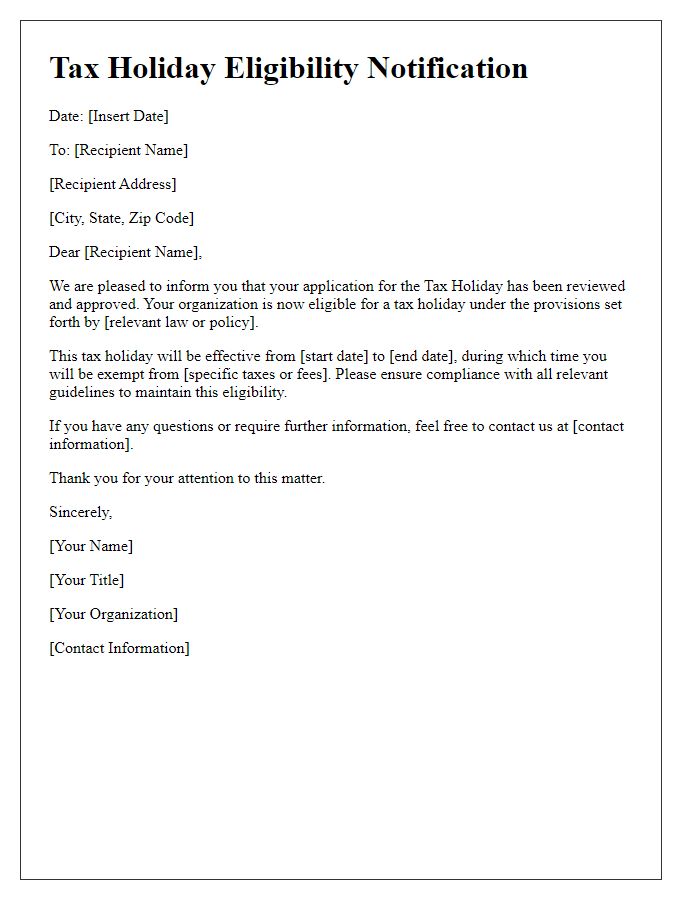

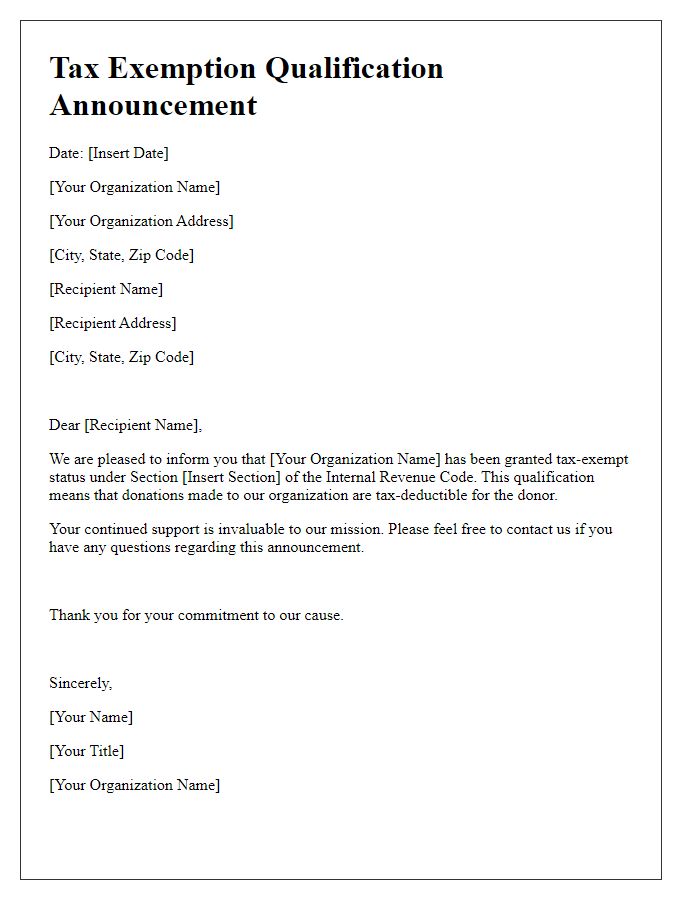

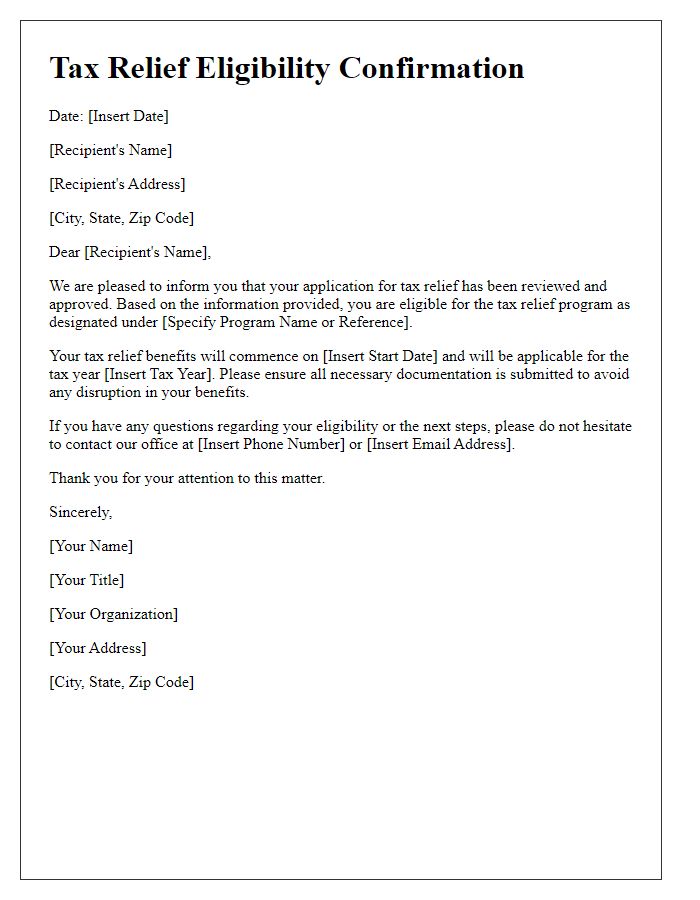

Salutation and Recipient's Name

Tax holiday eligibility can provide significant financial relief for businesses and individuals during specified periods designated by government entities. Various regions, such as the United States, impose this measure on particular dates, often coinciding with back-to-school seasons or holiday shopping periods. For example, in July 2023, states like Texas and Florida implemented tax-free weekends, allowing shoppers to purchase clothing and school supplies under certain price thresholds without incurring sales tax. Eligibility criteria may vary, often requiring specific documentation to validate tax-exempt purchases. Awareness of these benefits can encourage consumer spending and stimulate local economies, especially in jurisdictions that rely heavily on sales tax revenue.

Purpose of the Letter

The purpose of the communication is to inform individuals or businesses about eligibility criteria for the tax holiday program, which provides temporary relief from specific taxes to encourage economic growth and support financial stability. The program, introduced by local governments in various regions, offers exemptions or reductions on certain taxes such as sales tax or property tax during designated periods. This initiative aims to stimulate consumer spending and investment in affected communities, alleviate financial burdens, and promote economic recovery initiatives, particularly in regions impacted by recent economic downturns or exceptional events like natural disasters. Detailed eligibility requirements, application processes, and deadlines are typically outlined to ensure compliance and maximize participation in this beneficial program.

Eligibility Criteria Overview

Tax holiday eligibility criteria determine which individuals or businesses qualify for temporary relief from certain tax obligations. Typically, criteria may include income levels, business size (such as the Small Business Administration designating firms with fewer than 500 employees), and specific economic zones like Opportunity Zones designated by the U.S. government. Tax holidays often target specific sectors, such as retail or tourism, especially during critical periods like the back-to-school season or disaster recovery efforts. Compliance with local regulations may also play a role, requiring businesses to maintain certain documentation to validate their eligibility. It is essential to monitor dates and specific conditions to ensure proper participation and maximize potential tax savings.

Contact Information and Assistance

Tax holiday eligibility communication provides essential guidelines for individuals and businesses seeking tax relief during specific periods designated by local authorities. Tax holidays can apply to various goods or services, with no sales tax charged, facilitating consumer spending and economic growth. Local government websites, such as the New York State Department of Taxation and Finance, offer implementation details and eligibility criteria. Assistance resources include hotline numbers (often toll-free) and trained representatives available in offices across major cities, ensuring taxpayers receive timely support and information on navigating the application process for tax exemptions. Understanding deadlines, specific qualifying products, and documentation requirements proves vital in maximizing benefits during these tax relief periods.

Comments