Are you feeling overwhelmed by your recent property tax assessment? If the numbers seem off and you believe your property has been unfairly evaluated, you're not alone. Navigating the appeal process can seem daunting, but with the right guidance and strategies, you can successfully challenge the assessment and potentially lower your tax bill. Join us as we explore essential tips and a comprehensive letter template that will help you make your case effectively!

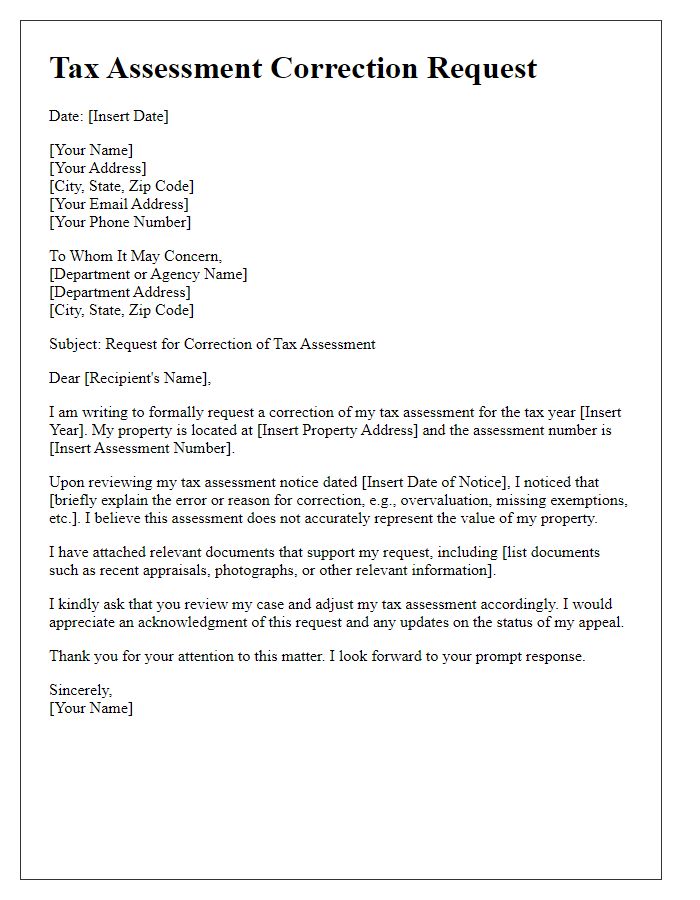

Accurate Property Details

Inaccurate property details can significantly impact property tax assessments in cities like San Francisco, where residential properties are typically appraised based on square footage and specific amenities. For instance, a single-family home with a reported area of 2,000 square feet may be assessed at a higher tax bracket compared to the accurate measurement of 1,800 square feet. Furthermore, discrepancies in property features, such as the number of bedrooms, bathrooms, and whether a finished basement or garage is included, can lead to inflated tax bills. Accurate records of these details are essential for a fair appeal process, particularly when engaging with local taxing authorities such as the San Francisco Office of the Assessor-Recorder, which reviews assessment challenges and makes adjustments where necessary. Accurate submissions, with supporting documentation such as photographs and measurement reports, can ensure that property owners are charged appropriately based on the true value of their property.

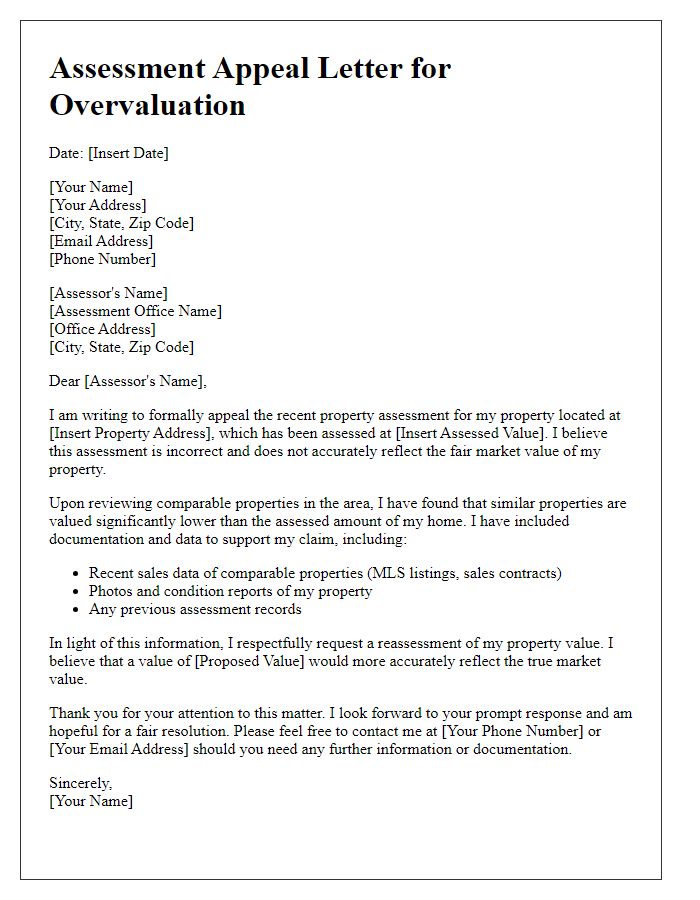

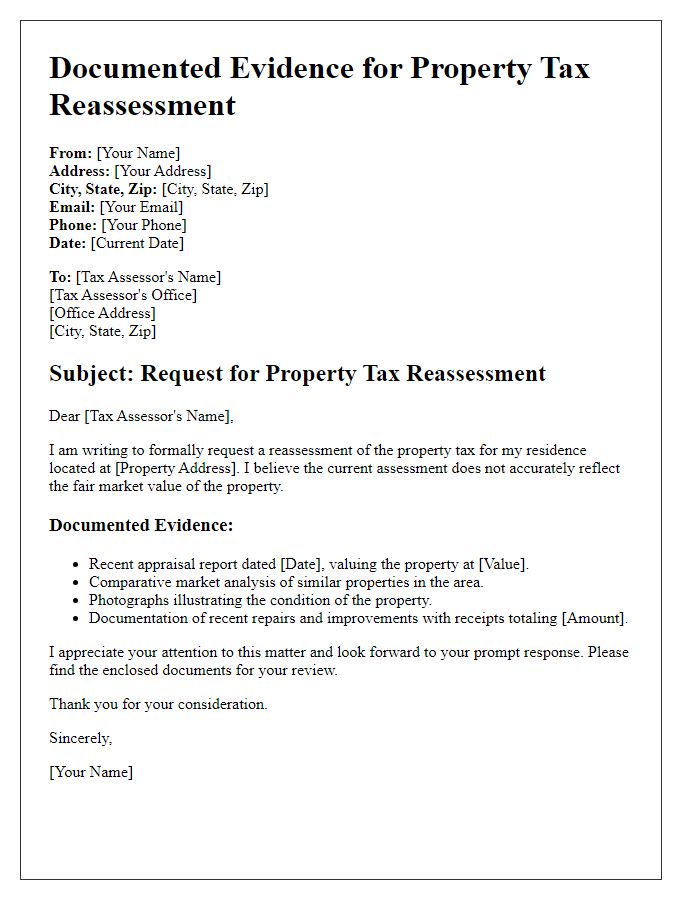

Comparable Property Values

Comparable property values serve as a critical benchmark for evaluating the fairness of property tax assessments conducted by local authorities, such as county assessors. When appealing a property tax assessment, it is essential to gather data on similar properties, often referred to as "comps," located within the same neighborhood or jurisdiction, such as suburban areas in Atlanta, Georgia. These properties should share equivalent characteristics, including square footage, number of bedrooms, year built, and recent sales prices, typically within the last six months. Data on recent transactions, supplemented with comparative market analysis reports and valuation tools, will establish a compelling case. In 2022, the average sale price for comparable homes in the area was approximately $350,000, which contrasts sharply with the assessed value of $450,000 for the subject property, indicating a potential assessment error that warrants review.

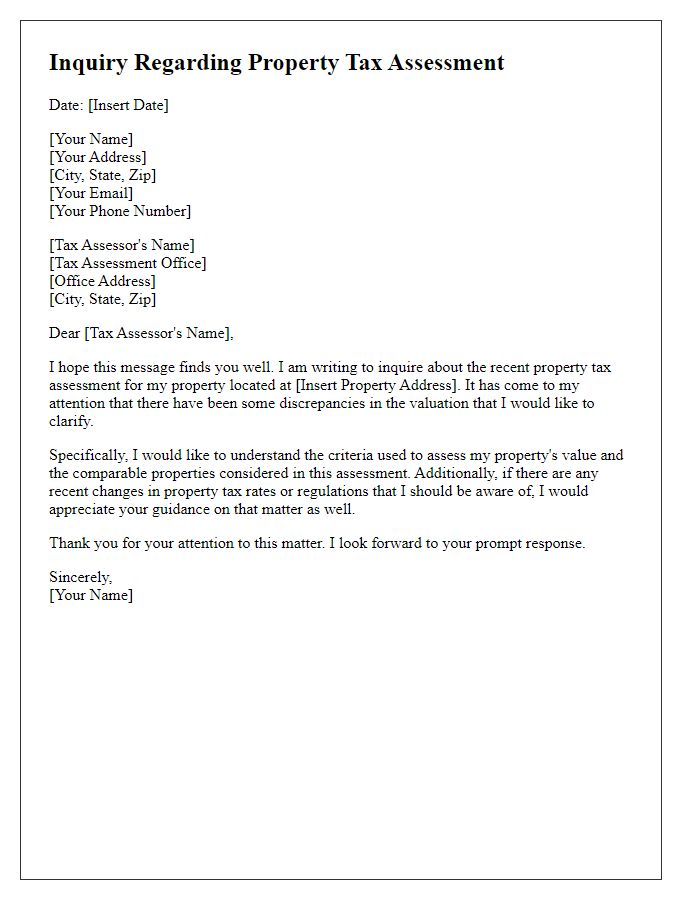

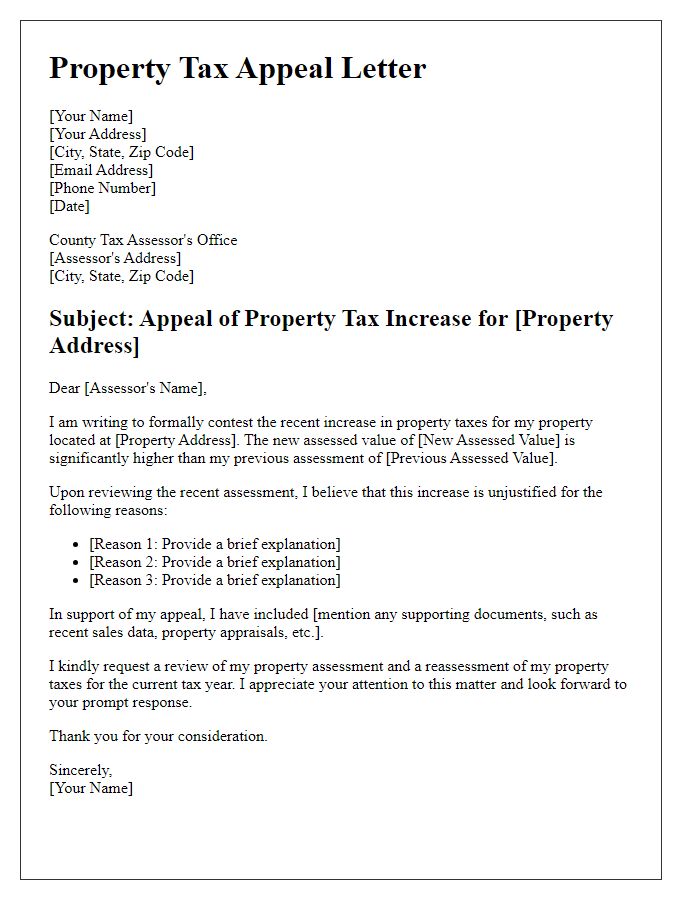

Detailed Supporting Evidence

Property tax assessment appeals require comprehensive supporting evidence to challenge current valuations effectively. Property tax assessments, conducted annually by local municipalities such as county assessors, determine the value of real estate properties like single-family homes or commercial buildings. Essential evidence includes recent comparable sales data (ideally from the last six months) of similar properties within the neighborhood, often referred to as "comps," showcasing lower sales prices. Additional documents such as independent appraisals from certified appraisers can further substantiate valuation discrepancies, emphasizing factors like market trends or property condition. Photographic evidence highlighting any deficiencies in the property's condition, such as roof damage or outdated kitchens, can also strengthen the case. Furthermore, local zoning changes or economic shifts impacting property values, including neighborhood crime rates or school district rankings, should be documented to illustrate the assessment's flawed basis. All evidence presented must be well-organized and clearly labeled, providing a concise narrative that supports the appeal against the original property tax assessment amount.

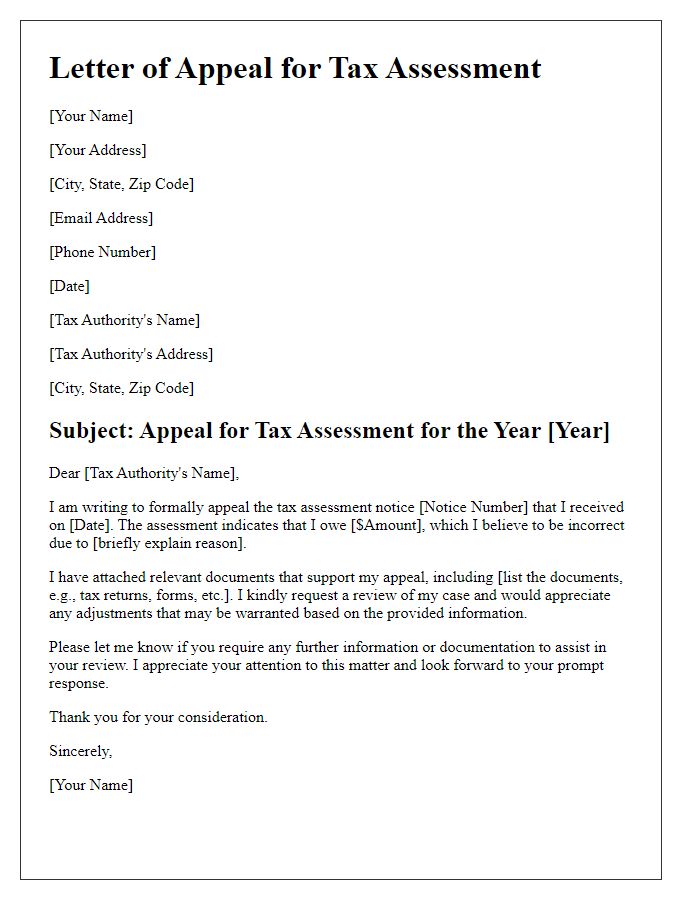

Clear Explanations and Justifications

Property tax assessment appeals often require clear explanations backed by justifications to effectively convey the case. The process involves reviewing property value comparisons with similar properties in the same tax district. Assessors often utilize sales data from the previous year to determine fair market value, so highlighting discrepancies in valuation is critical. Documentation such as recent sales prices, current neighborhood market trends, and specific property characteristics, including square footage, number of bedrooms, and land size, can serve as compelling evidence. Furthermore, detailing any substantial changes or renovations that have been made to the home can illustrate a potential misclassification. Engaging local tax assessment offices and reviewing state regulations on appraisal processes ensures adherence to procedural standards during the appeal. Providing a comprehensive understanding of these factors is essential for a successful challenge of the assessed property value.

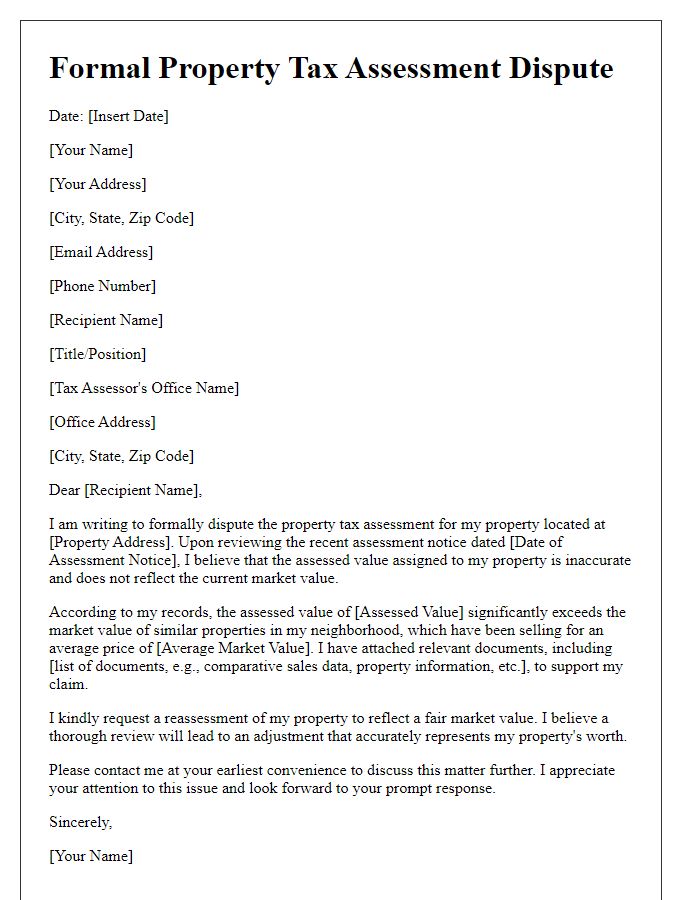

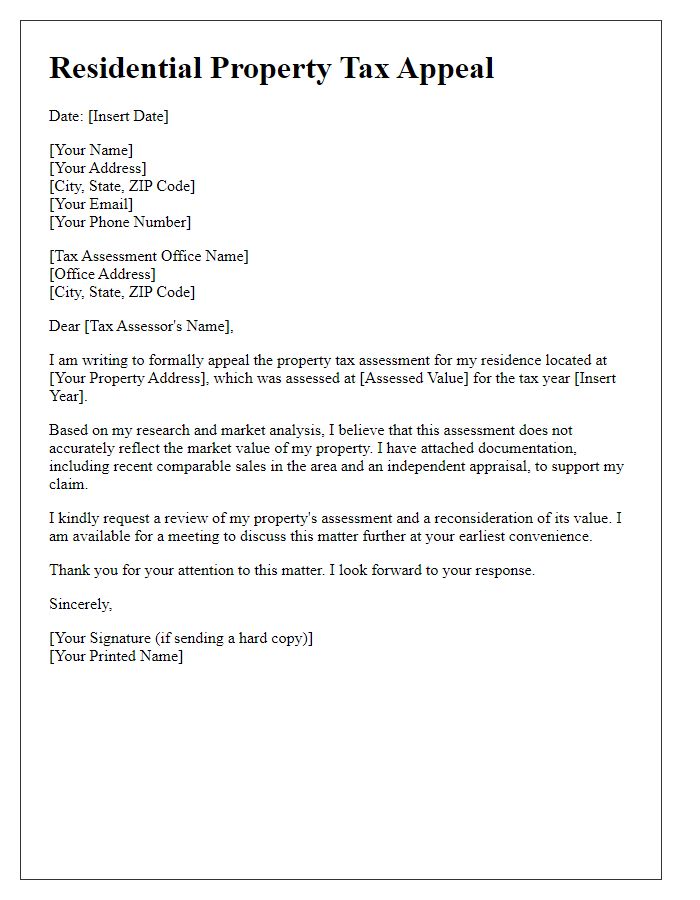

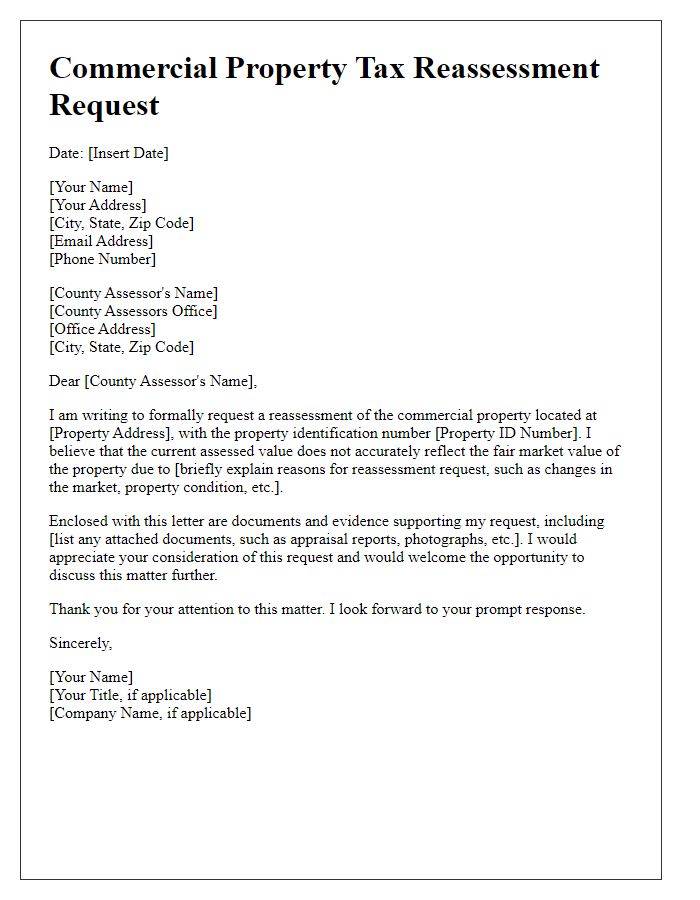

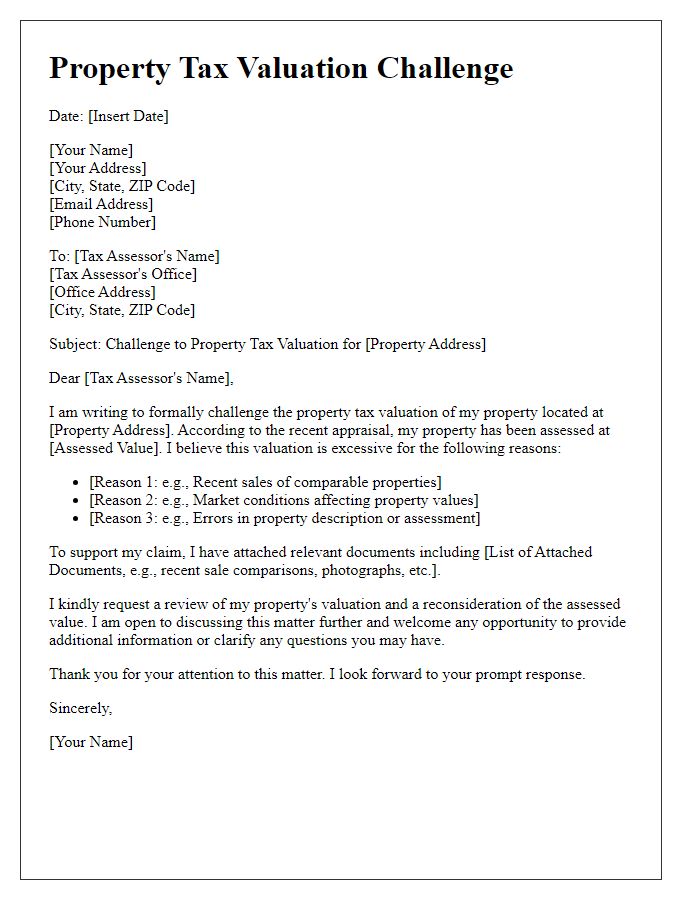

Professional and Polite Tone

A property tax assessment appeal requires a detailed approach based on factual information. Property owners often face challenges when facing discrepancies in property valuations. A well-structured appeal must include specific details such as the property address, current assessed value, and comparable properties that illustrate the argument for a lower assessment. Clear and concise language is essential, as is a professional tone. Documentation supporting the claim, such as recent sales data or current market conditions in the neighborhood, strengthens the case. Ultimately, a focused and respectful presentation of the facts helps in conveying the validity of the appeal to the assessing authority.

Comments