Are you considering participating in a voluntary tax disclosure program? This initiative offers a chance to come forward and settle any unpaid taxes without the severe penalties that often accompany tax issues. By joining, you can clean the slate and feel confident in your financial footing moving forward. Dive into this article to explore the benefits and learn how you can take advantage of this opportunity.

Subject line optimization

Subject line optimization for a voluntary tax disclosure program focuses on clarity and urgency. "Act Now: Participate in the Voluntary Tax Disclosure Program for Compliance Benefits" highlights immediate action and benefits. "Maximize Your Tax Compliance: Join Our Voluntary Disclosure Initiative Today" emphasizes the advantages of participation. "Avoid Penalties: Engage in the Voluntary Tax Disclosure Program" addresses potential consequences while encouraging involvement. These subject lines utilize keywords like "voluntary," "tax compliance," and "program" to enhance visibility and engagement.

Clear identification of taxpayer information

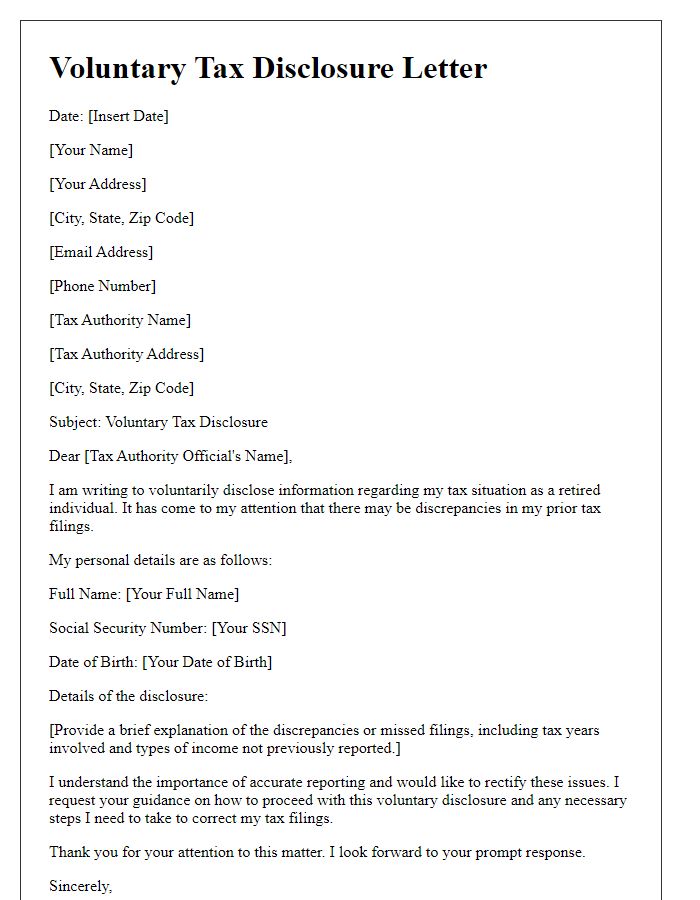

Clear identification of taxpayer information is crucial for effective participation in a voluntary tax disclosure program. Taxpayer Identification Numbers (TIN) serve as unique identifiers, ensuring accurate processing of disclosures. Additionally, full names, residential addresses, and contact information are required to establish rightful ownership of tax obligations. Documentation such as Social Security Numbers (SSN) and Employer Identification Numbers (EIN) provide additional verification. Information regarding past tax filings, including years and amounts owed, must be clearly outlined, enabling tax authorities to assess the extent of discrepancies. Proper identification fosters trust between taxpayers and tax authorities, facilitating a smoother resolution process.

Detailed disclosure of undeclared income or assets

Voluntary tax disclosure programs enable individuals and businesses to report previously undeclared income or assets without facing penal consequences. Participants in these programs can disclose income such as wages, rental income, or investment gains that have not been reported to the IRS (Internal Revenue Service in the United States). This program can include assets like offshore accounts, real estate properties, or valuable collectibles. By coming forward voluntarily, taxpayers may benefit from reduced penalties and the chance to settle their tax obligations. The geographic scope of these disclosures often spans international borders, particularly in cases involving foreign bank accounts. Additionally, successful participation in such programs can help individuals align their financial practices with compliance regulations set forth by tax authorities like the IRS, leading to potential future reductions in audit risks.

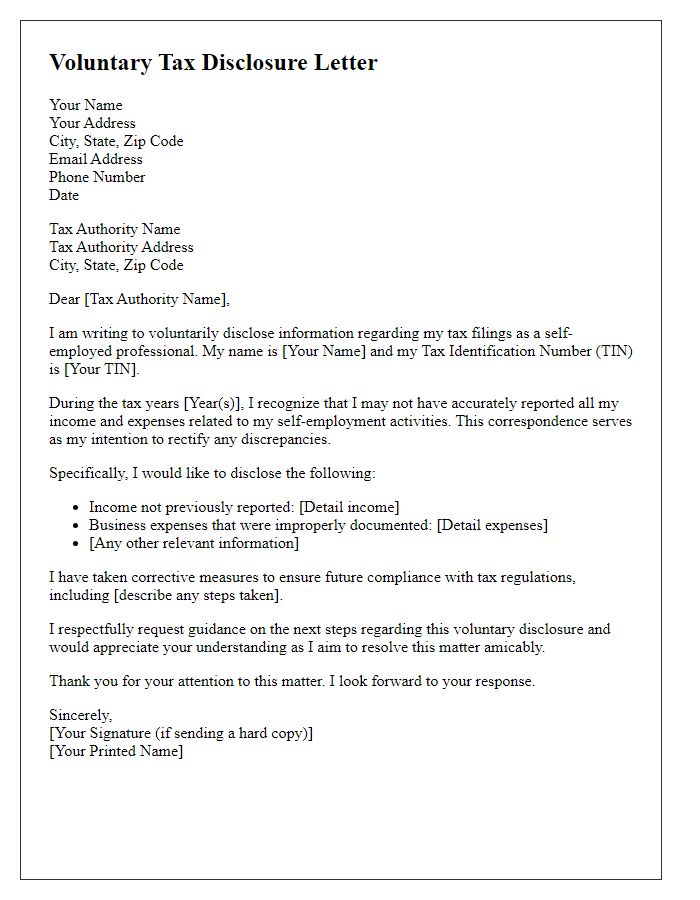

Explanation of voluntary compliance and acknowledgment of errors

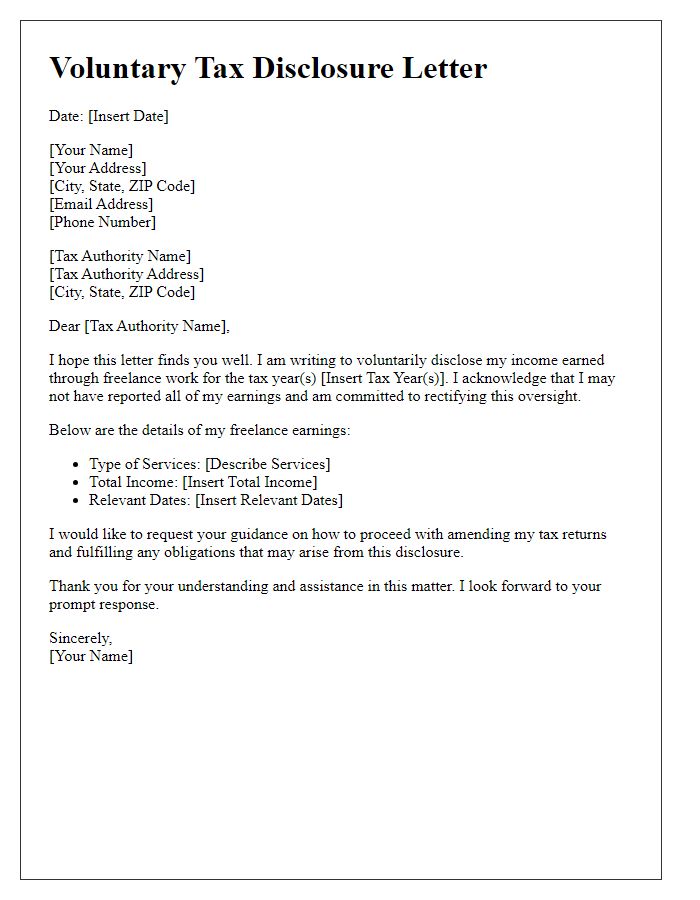

Voluntary tax disclosure programs allow taxpayers to proactively correct past tax filing errors or omissions without facing harsh penalties. Participants acknowledge unintentional mistakes in reporting income or claiming deductions, which may have occurred due to misinterpretations of complex tax laws or oversight of new regulations. This approach fosters a collaborative relationship between taxpayers and tax authorities, encouraging self-reporting of discrepancies. By participating in this program, individuals can settle their tax obligations, potentially reducing fines, thus facilitating compliance with revenue laws and maintaining financial integrity. Taxpayers must provide detailed documentation of previously unreported income, including wages, investment earnings, or freelance income, to ensure transparency during the rectification process. Properly executed, voluntary compliance can lead to a renewed sense of trust and accountability in fiscal responsibilities.

Explicit request for relief or penalty reduction

The Voluntary Tax Disclosure Program (VTDP) provides taxpayers with an opportunity to come forward and disclose any unreported income or unpaid taxes without facing the harsh penalties commonly associated with undisclosed liabilities. Participants in this program may request relief from penalties typically levied for late payments and unfiled returns. Engaging with this initiative can result in significant tax liability reductions, promoting compliance. Taxpayers who seek to formally request penalty reductions through the program must provide comprehensive documentation detailing their financial circumstances, including specific amounts owed and reasons for previous non-compliance. This process ultimately aims to foster transparency and enables the taxpayer to rectify past mistakes while minimizing financial repercussions.

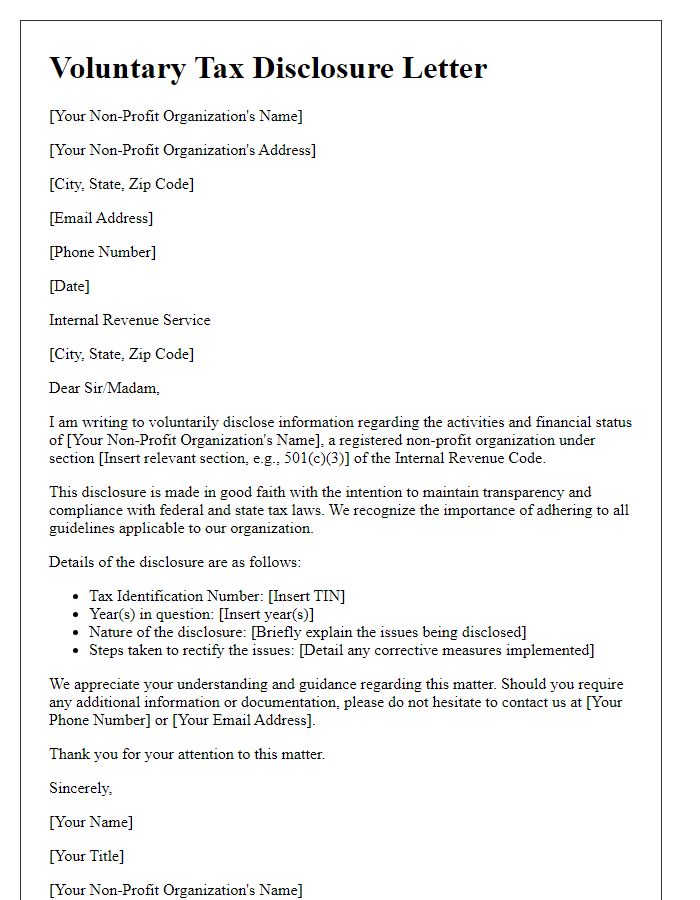

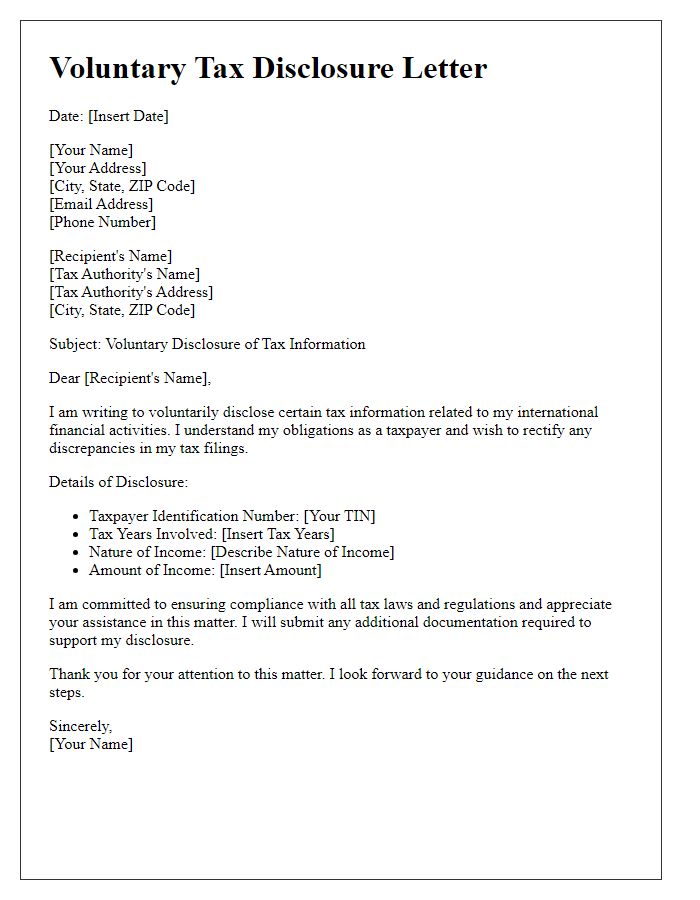

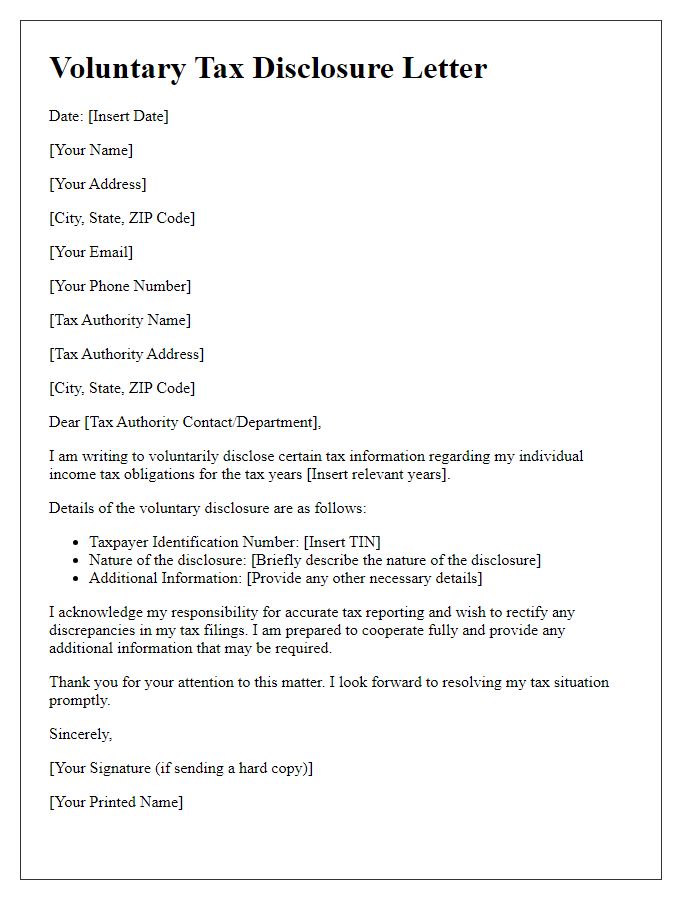

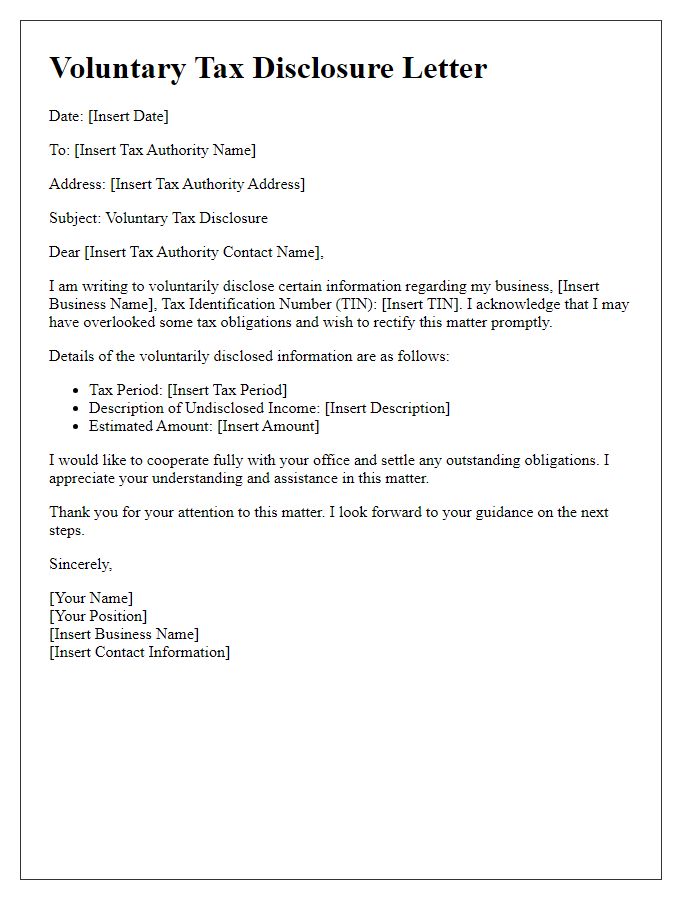

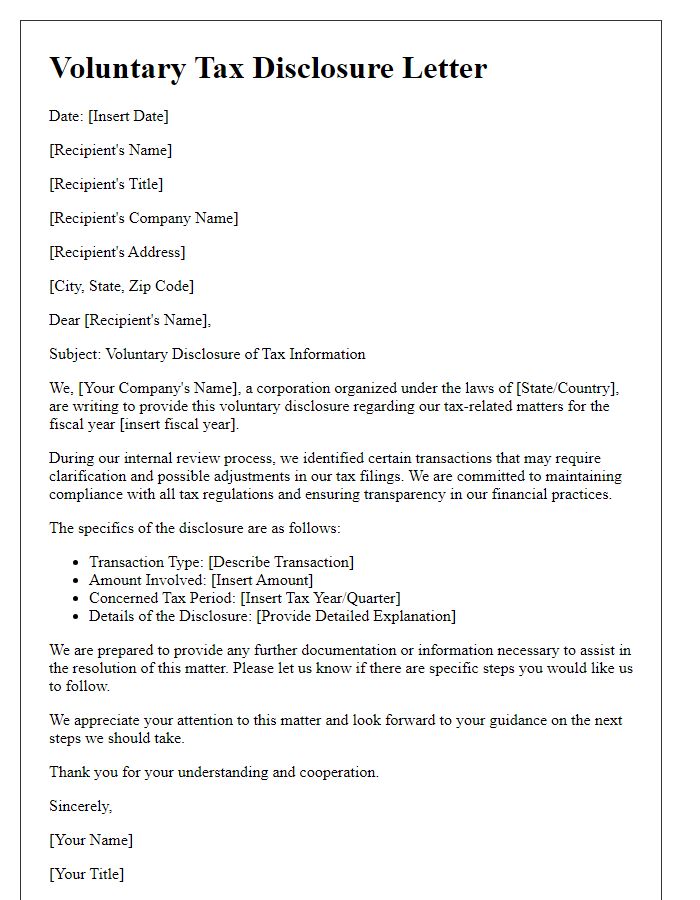

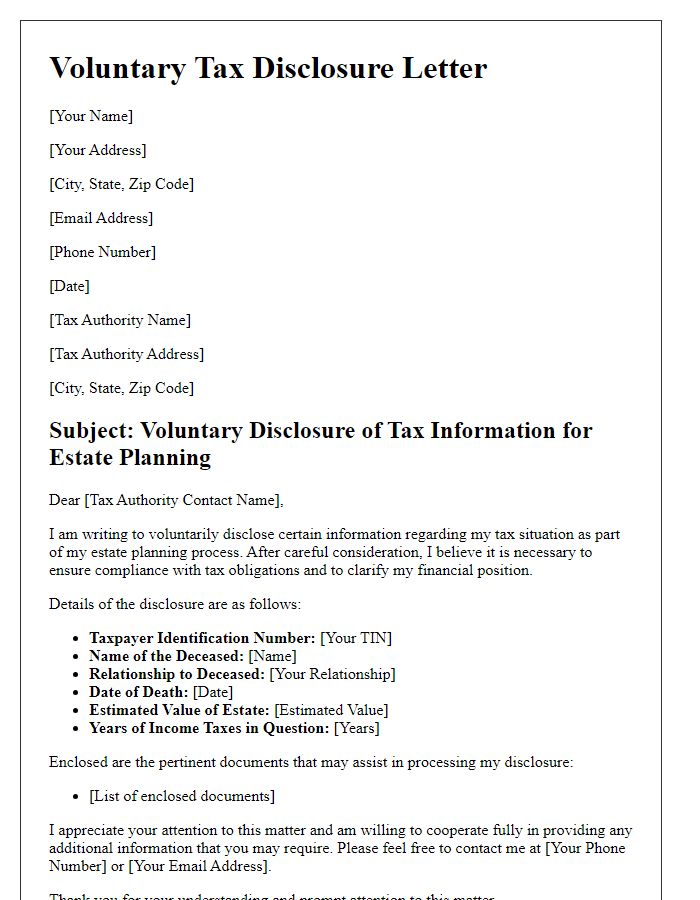

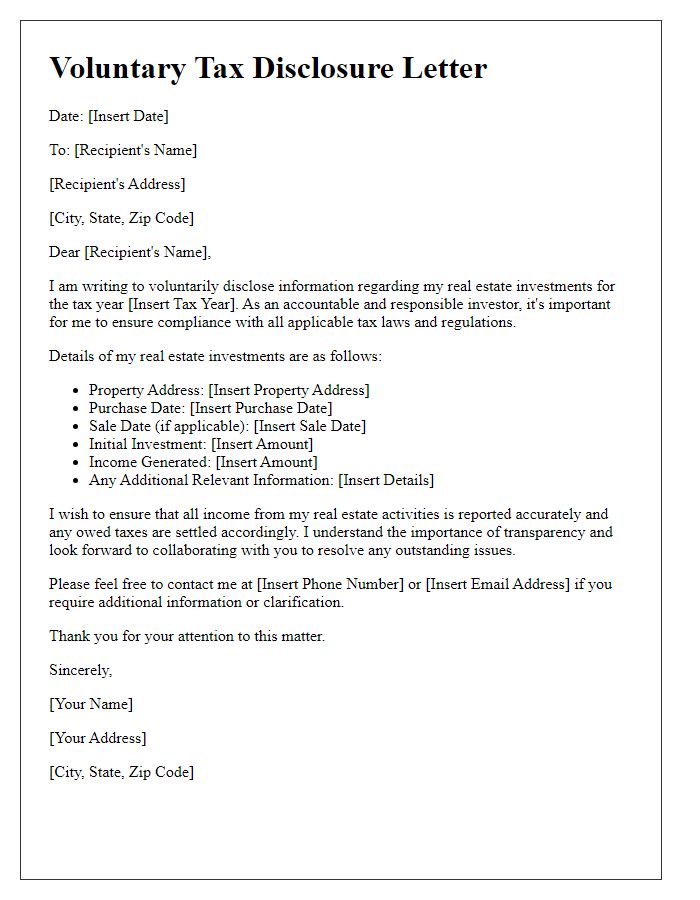

Letter Template For Voluntary Tax Disclosure Program Samples

Letter template of voluntary tax disclosure for non-profit organizations.

Letter template of voluntary tax disclosure for international taxpayers.

Comments