Are you feeling overwhelmed by the complexities of tax withholding certificates? You're not alone! Many people find themselves needing to adjust their tax withholding due to changes in their financial situation or personal circumstances. Don't worryâit's easier than you think, and in this article, we'll guide you through the steps to request a change to your tax withholding certificate, ensuring you keep more money in your pocket when it matters most. Ready to dive in? Let's get started!

Personal Identification Information

To update personal identification information on a tax withholding certificate, ensure the inclusion of essential details. Individuals need to provide their full name, including middle initial if applicable, current residential address (ensuring accuracy for correspondence), Social Security Number (SSN, a nine-digit number for tax identification), and date of birth (month, day, year format). It is crucial to mention the specific form being amended, such as IRS Form W-4 for employee's withholding allowance certificate or Form W-9 for taxpayer identification. Clarity in this information guarantees proper processing by the Internal Revenue Service (IRS) and helpful adjustments in tax withholding amounts from income. Ensure all fields are completed and checked for any errors to avoid delays in processing.

New Tax Withholding Details

Tax withholding adjustments are essential for accurate financial planning, particularly for employees navigating the complexities of the IRS regulations. New tax withholding details typically involve changes in exemptions, additional withholdings, or adjustments according to recent tax law updates. The IRS Form W-4 (Employee's Withholding Certificate) must be completed to inform employers about these changes. For instance, a taxpayer may declare fewer allowances to increase the amount withheld from their paychecks, thereby avoiding a tax bill at year's end. Precise communication with the payroll department, usually located in the Human Resources sector of large corporations, ensures timely updates reflecting these changes in the following pay cycles. Regular reviews and updates of these details are crucial, especially in light of major life events like marriage, home purchases, or birth of a child which can significantly impact withholding needs.

Reason for Request

A request for a tax withholding certificate change may arise due to various significant reasons, such as changes in employment status, marital status, or adjustments in income levels. For instance, an employee transitioning from part-time to full-time work might need to update their withholding to reflect a different tax bracket. Additionally, a change in marital status, such as a recent marriage or divorce, affects tax liabilities and, consequently, withholding allowances. Adjustments in income levels, whether due to a raise or loss of income, prompt the need to reassess withholding amounts to ensure compliance with federal and state revenue requirements. Moreover, life events like the birth of a child may also warrant a revision to appropriately account for additional tax credits and deductions.

Effective Date of Change

A tax withholding certificate change can significantly impact an individual's financial situation. The effective date of change, usually noted as the date when new withholdings become applicable, is crucial for aligning payroll adjustments with IRS regulations, such as the W-4 form modifications. Accurate reporting ensures compliance with tax obligations, facilitating correct deductions from employee paychecks. For instance, changes may apply to various tax statuses (single, married) or allowances, directly influencing net pay and tax liabilities for the fiscal year, which could lead to potential refunds or underpayment penalties. It is essential to update employers promptly to avoid discrepancies in withholding amounts, potentially resulting in a tax audit or additional burdens at year-end.

Contact Information for Queries

Updating a tax withholding certificate requires clear communication to relevant tax authorities. Include essential contact information such as a direct phone number (e.g., (555) 123-4567) for inquiries related to the withholding status. Provide an email address (e.g., updates@taxagency.com) where stakeholders can submit questions regarding their changes. Specify a physical address, like 123 Tax Lane, Suite 100, Finance City, ST 45678, for mailed documents or formal requests. Ensure that business hours (e.g., Monday to Friday, 9 AM to 5 PM) are noted for optimal accessibility by concerned parties. This clarity fosters efficient resolution and supports accurate tax processing for individuals and employers alike.

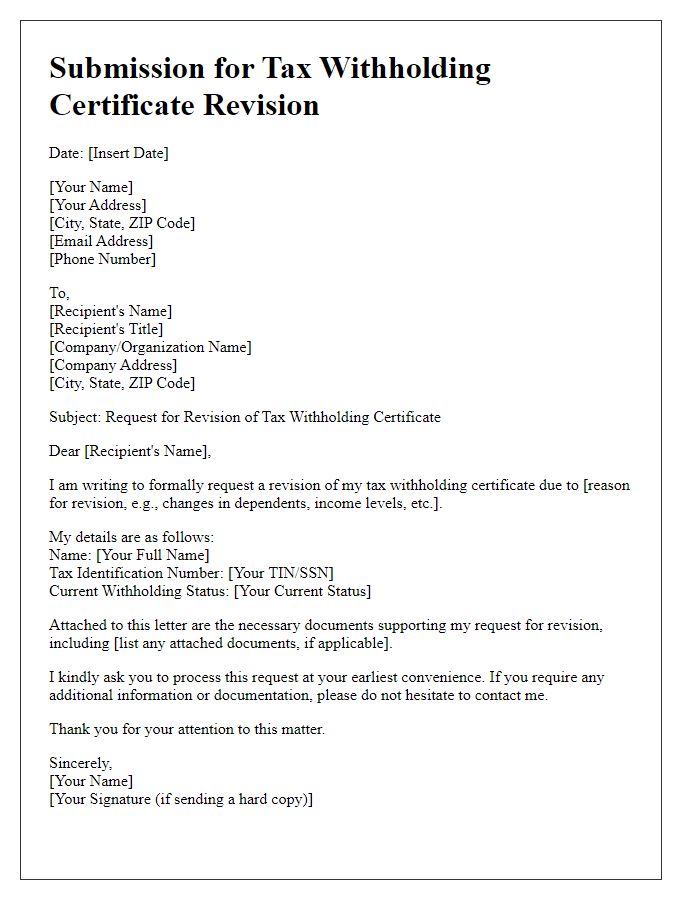

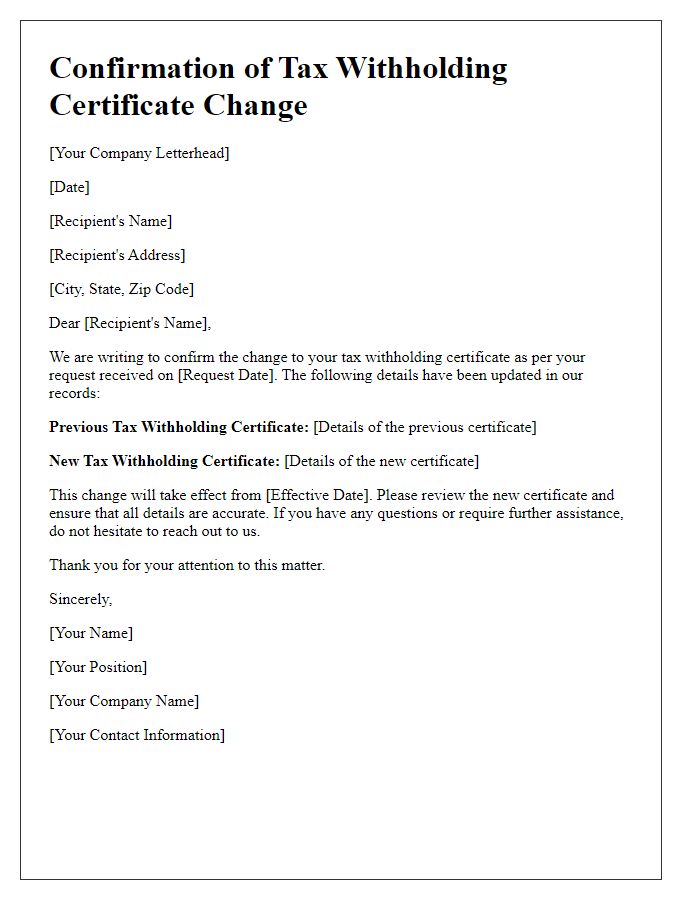

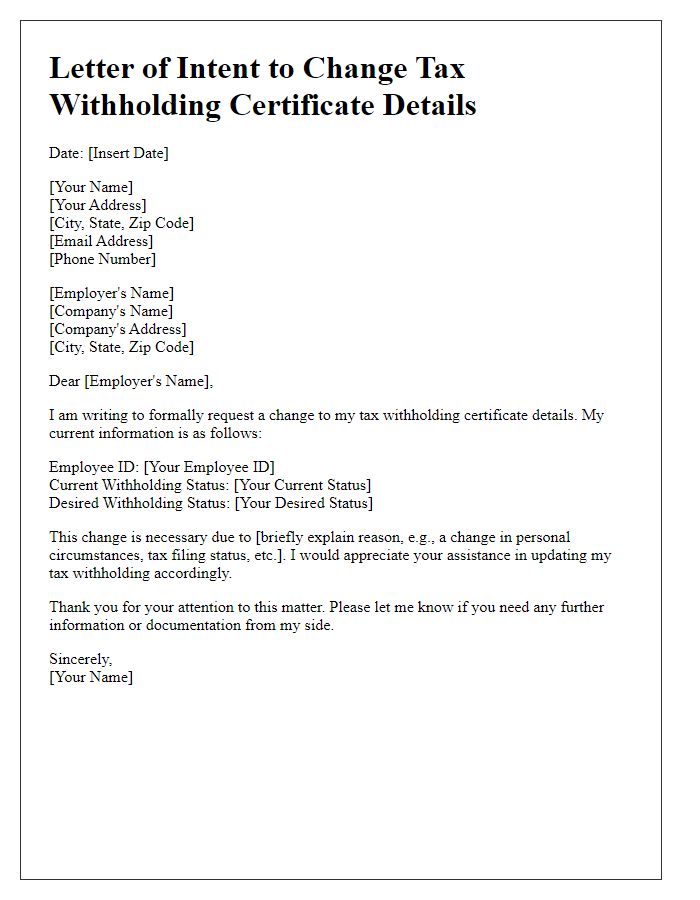

Letter Template For Tax Withholding Certificate Change Samples

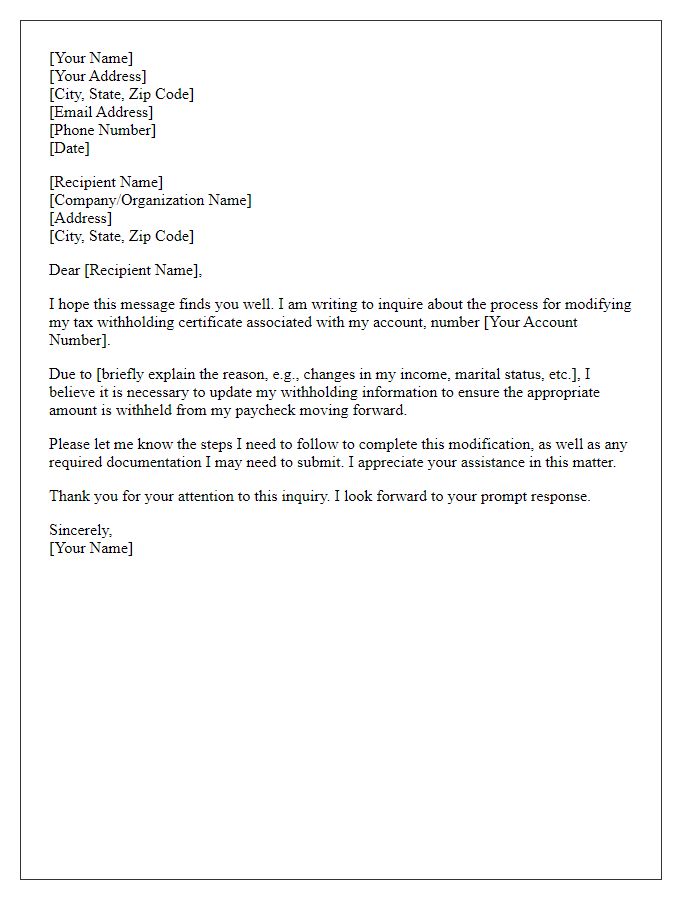

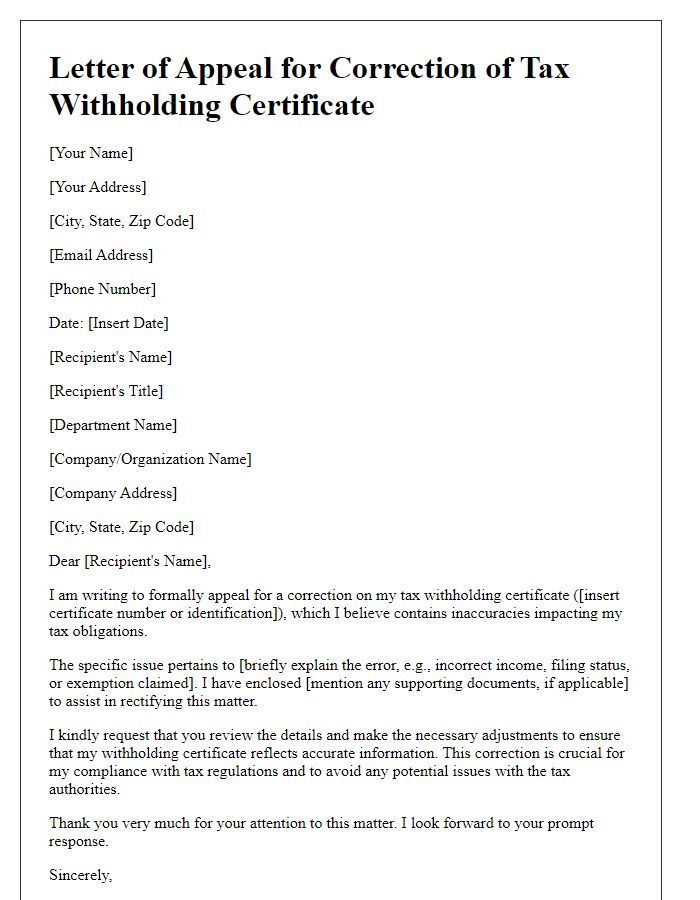

Letter template of inquiry regarding tax withholding certificate modification

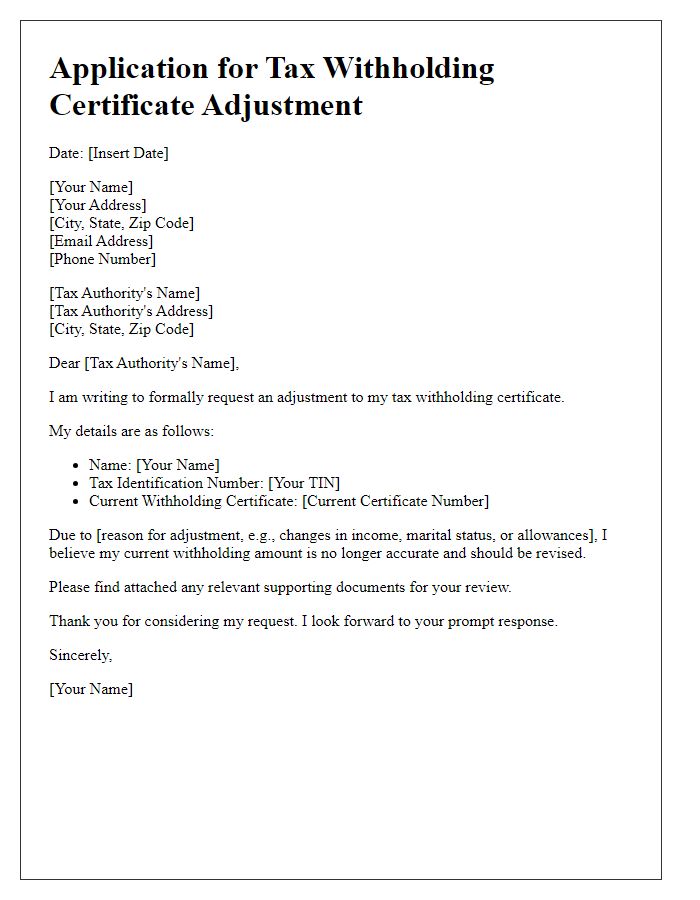

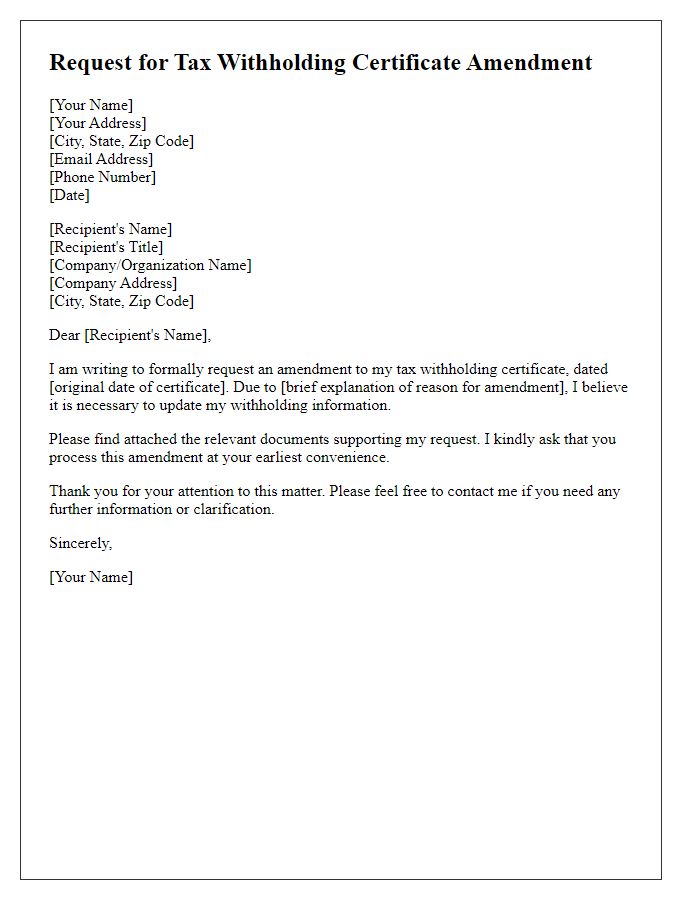

Letter template of application for tax withholding certificate adjustment

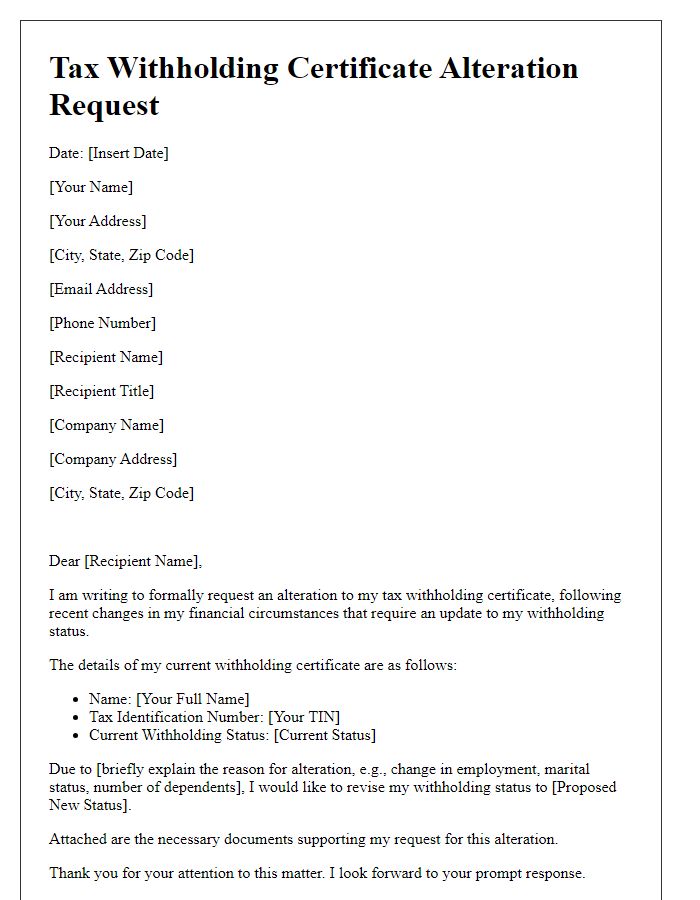

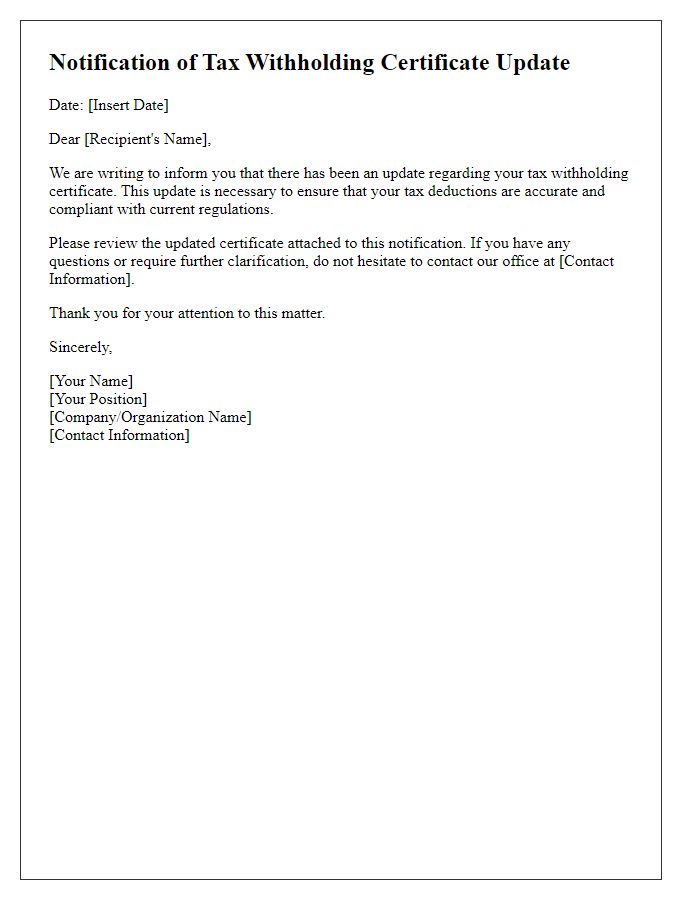

Letter template of explanation for tax withholding certificate alteration

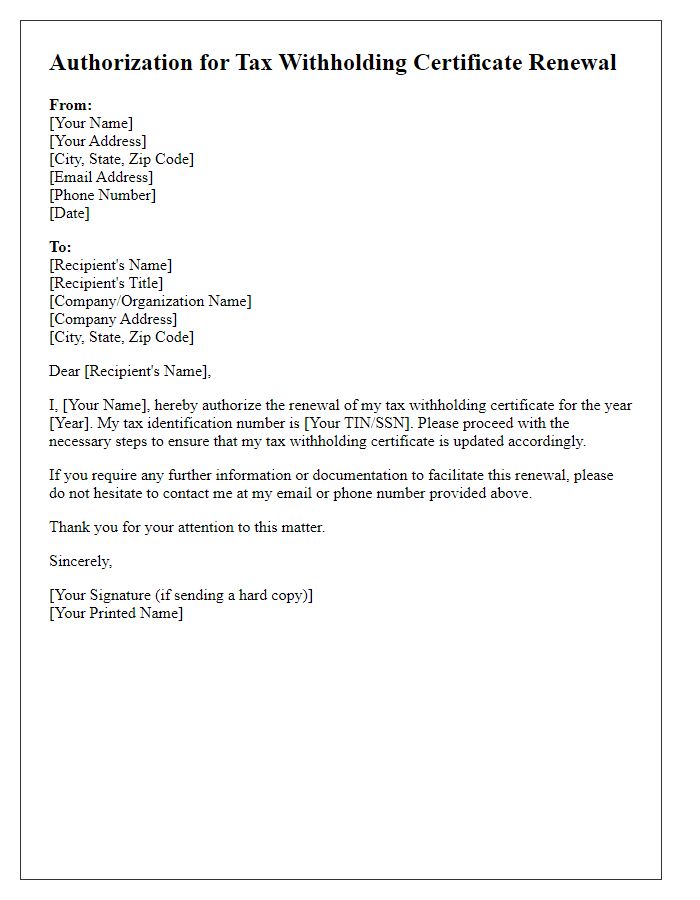

Letter template of authorization for tax withholding certificate renewal

Comments