Navigating the world of social security tax adjustments can feel overwhelming, but understanding the process is essential for your financial well-being. In this article, we'll break down the key elements of social security tax adjustments, making it easier for you to comprehend what changes may affect your benefits. From updated regulations to important deadlines, we'll cover everything you need to know in a straightforward, conversational manner. So, grab your coffee, settle in, and let's dive deeper into the details!

Recipient's full name and address

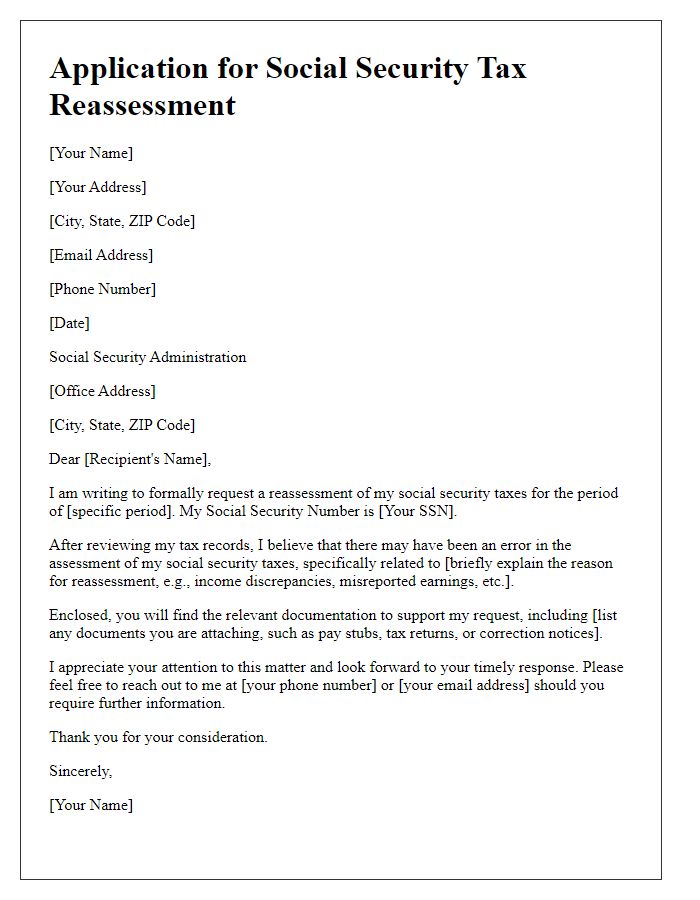

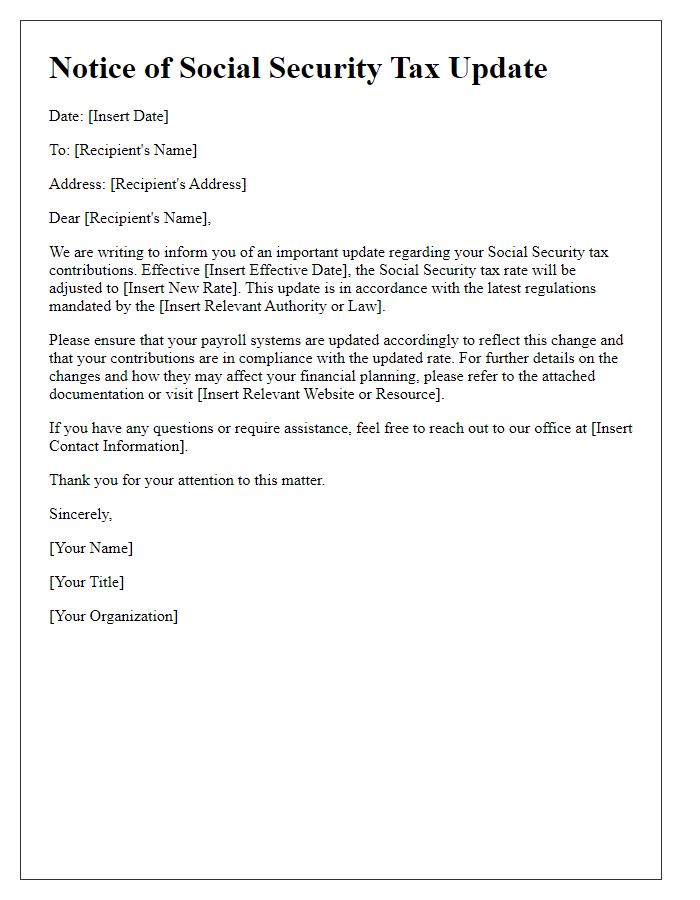

The social security tax adjustment process affects individuals significantly, particularly in regions like California, where high living costs and varying income levels come into play. The Federal Insurance Contributions Act (FICA) mandates a tax rate of 6.2% for social security on employee earnings up to a wage base limit of $147,000 for the year 2022. This adjustment is especially pertinent during the annual tax filing season, which occurs between January and April, as individuals receive Form W-2 detailing their earnings and withheld taxes. Key records, like the 1040 tax form, are used to reconcile potential overpayments or underpayments, ensuring accurate financial reporting for tax obligations. Understanding adjustments can help residents navigate the complexities of their fiscal responsibilities effectively.

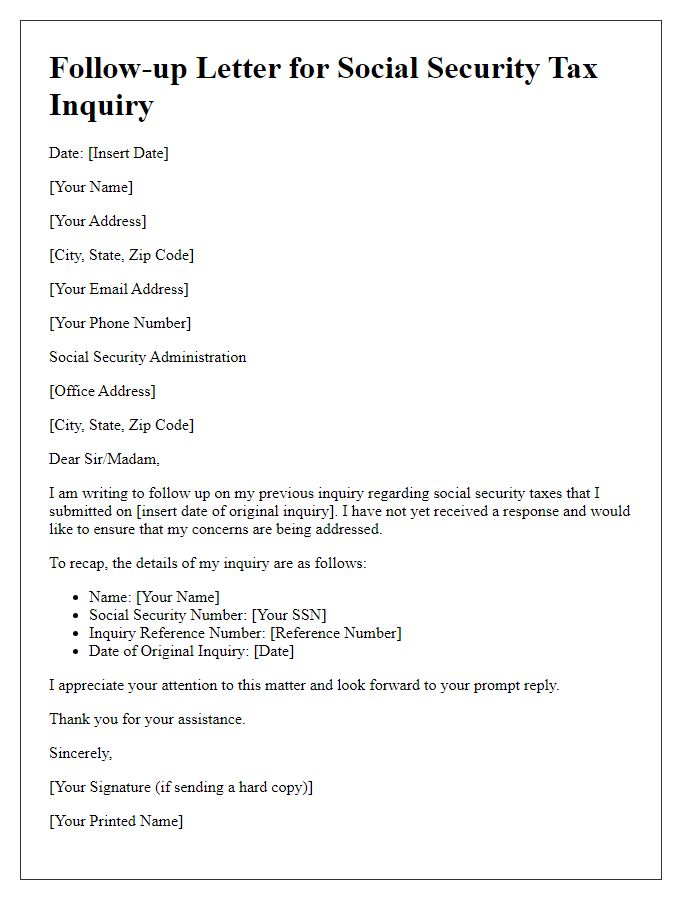

Taxpayer Identification Number (TIN) or Social Security Number (SSN)

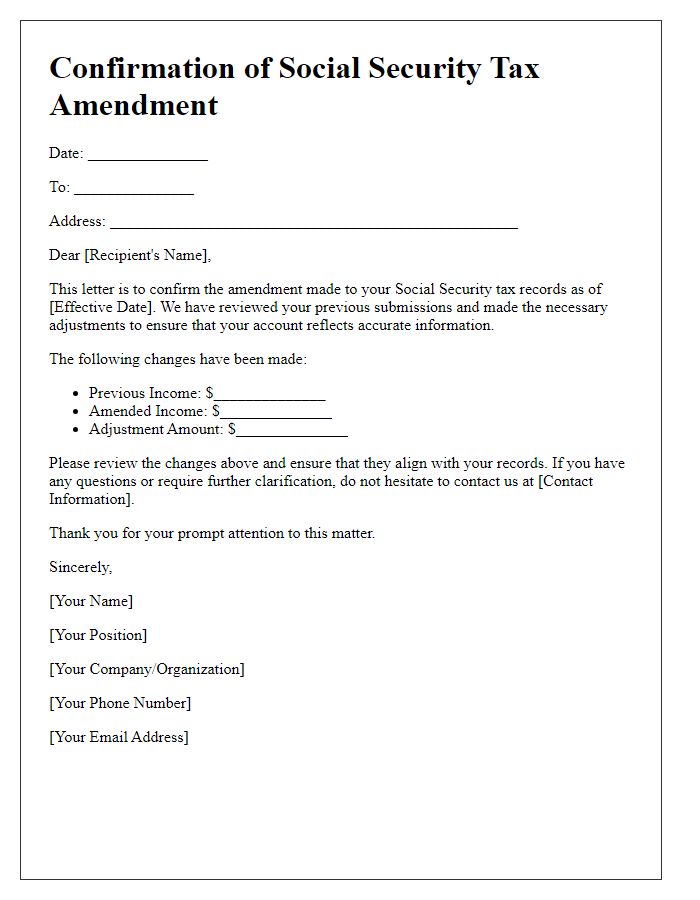

Taxpayer Identification Numbers (TIN) or Social Security Numbers (SSN) are essential for managing individual tax records and ensuring accurate reporting to the Internal Revenue Service (IRS). An adjustment in social security tax can occur due to various reasons such as changes in income levels, employment status, or eligibility for specific deductions and credits. For instance, individuals earning over $142,800 in 2021, the threshold for Social Security wages, might notice adjustments in their contributions due to overpayment or changes in withholding. These adjustments are critical for accurate benefit calculations, affecting future retirement and disability benefits associated with the Social Security Administration (SSA). Filing timely forms like the W-2 or 1099 is crucial for maintaining updated records that reflect any tax adjustments made throughout the fiscal year.

Reason for adjustment request (e.g., error correction or change in income)

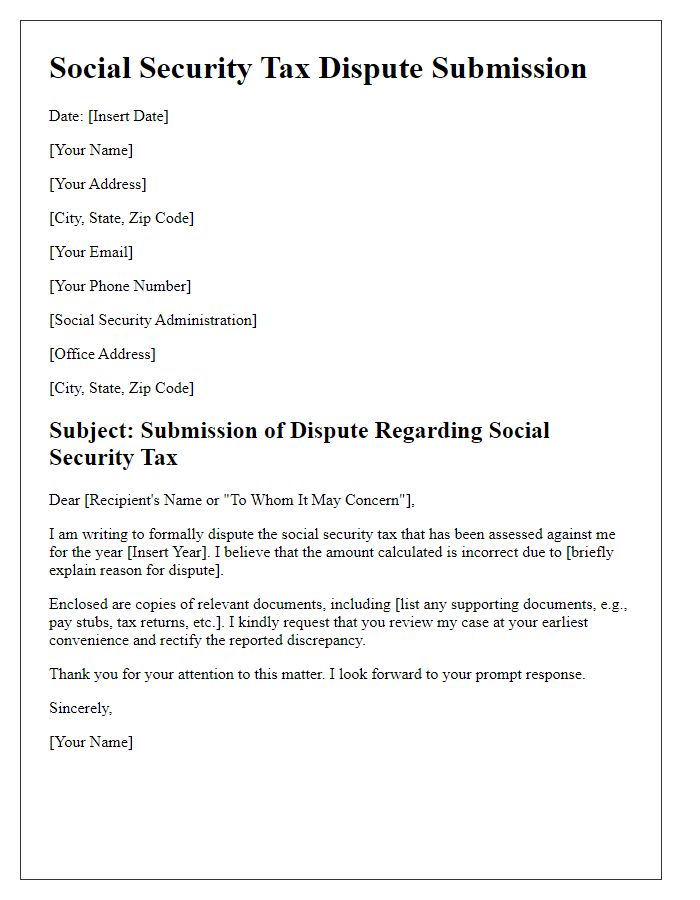

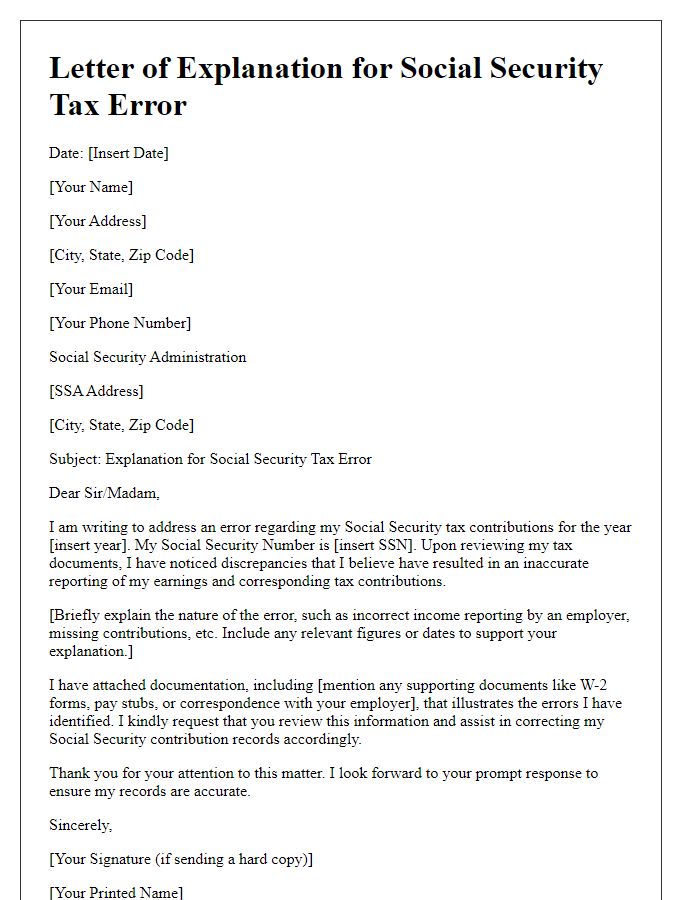

Errors in Social Security tax contributions can significantly impact an individual's benefits and overall financial stability. Accurate reporting of income, as defined by the Internal Revenue Service (IRS), is crucial for determining the correct tax obligations. A discrepancy due to adjustments in reported earnings or incorrect payroll data can lead to overpayment or underpayment of taxes. This situation often necessitates a formal request for adjustment, especially in cases of income changes resulting from job transitions, salary updates, or corrections required due to employer misreporting. Timely resolution of these matters is essential to ensure that individual entitlements and benefits remain intact and accurately calculated according to updated earnings records.

Desired outcome or correction details

A social security tax adjustment entails a reevaluation of previously reported earnings and contributions to the Federal Insurance Contributions Act (FICA) taxes, specifically addressing discrepancies that may have arisen from payroll mistakes or misclassifications. This process typically involves thorough documentation of income statements, such as W-2 forms, and may require communication with the Internal Revenue Service (IRS). Adjustments can lead to increased or decreased future benefits based on corrected earnings, impacting individuals' retirement plans and disability coverage. Accurate reflection of wages is essential for ensuring fair benefit calculations throughout one's working life in the United States.

Contact information for further correspondence

To address the issue of social security tax adjustment, it is crucial to provide accurate contact information for effective communication. Include full name, mailing address (including city, state, postal code), and phone number for direct inquiries. Email address should also be noted for quicker correspondence. This information ensures that the relevant departments can reach out for clarification or further documentation required during the adjustment process, enhancing efficiency and reducing delays. Timely responses may also be facilitated by providing a preferred contact time or method to streamline communication.

Comments