Are you feeling overwhelmed by the complexities of self-employment tax payment plans? You're not alone; many individuals navigating this terrain find it challenging to understand their obligations and options. In this article, we'll break down the essentials of setting up an effective payment plan that fits your unique financial situation. So, grab a cup of coffee and let's dive into the details to help you find your wayâread on!

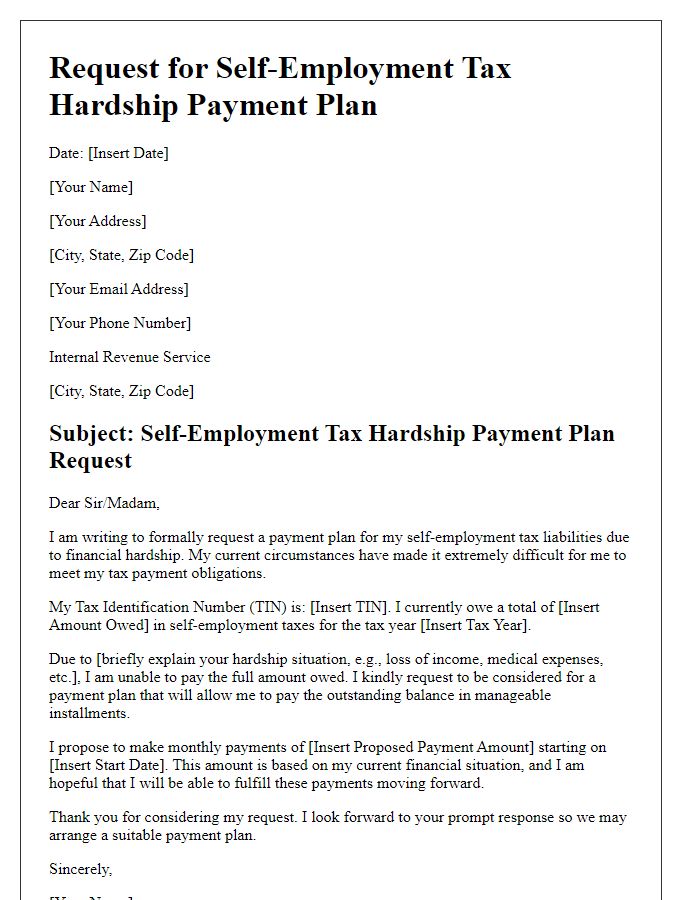

Taxpayer Identification Information

Self-employment tax payment plans require specific taxpayer identification information to ensure accuracy and proper processing. Key elements include the taxpayer's Social Security number (SSN), which uniquely identifies individuals for tax purposes in the United States. Essential also is the Individual Taxpayer Identification Number (ITIN), assigned to nonresident aliens and others ineligible for an SSN. Detailed records including the taxpayer's legal name and address are crucial for correspondence. Additionally, documentation of self-employment income, as reported on Schedule C of Form 1040, supports the proposed payment plan and reflects the taxpayer's financial situation. Taxpayers must also include any correspondence reference number provided by the IRS for previous payments or plans to streamline communication regarding their account status.

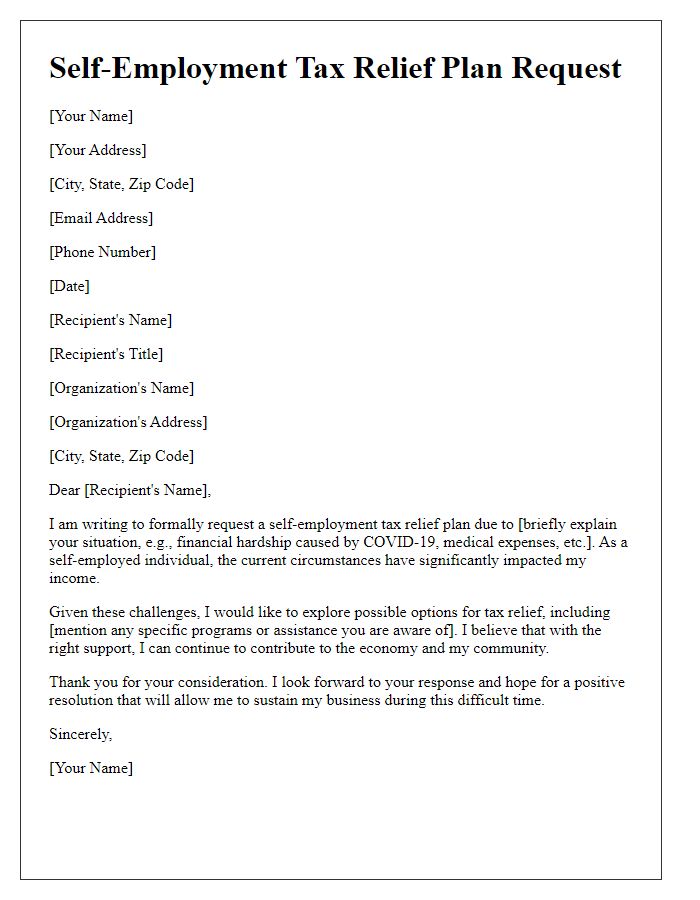

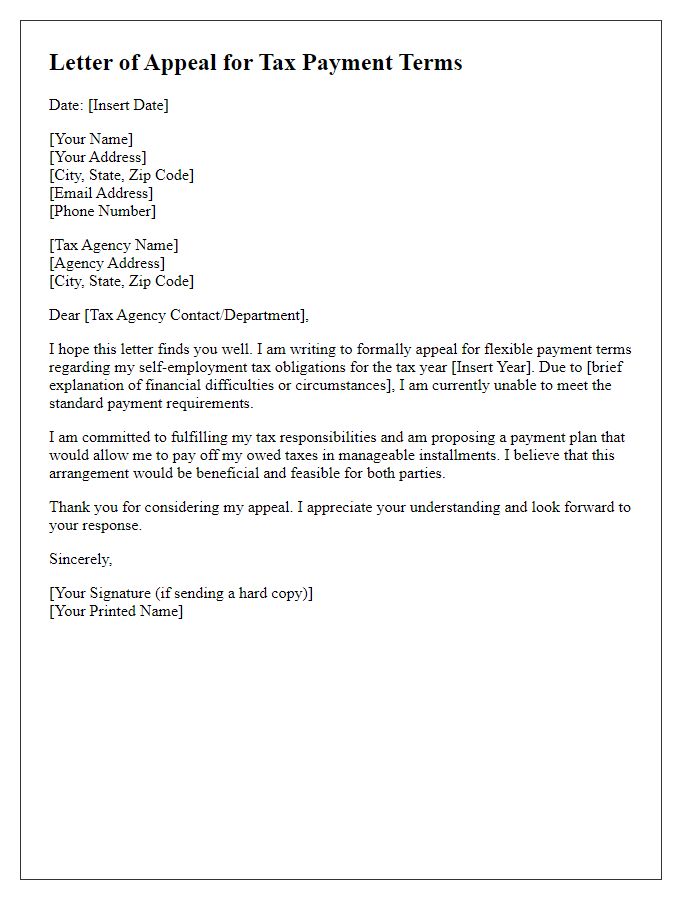

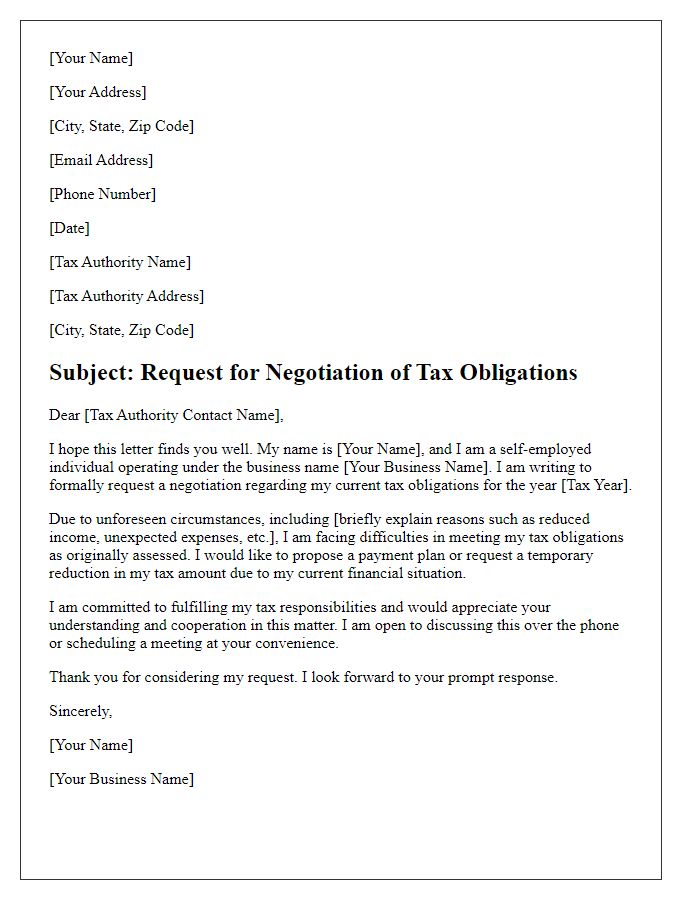

Payment Plan Request Details

Self-employment tax payment plans assist individuals facing difficulties in fulfilling their tax obligations. The Internal Revenue Service (IRS) offers options such as Installment Agreements, allowing taxpayers to pay in monthly installments over time. For example, the threshold for establishing an agreement is generally a balance under $50,000 for individual taxpayers. Requesting a payment plan involves submitting Form 9465, which details the taxpayer's financial situation, including total tax owed, income level, and monthly expenses. Timely communication with the IRS ensures that penalties and interest are minimized, while specific conditions apply to plan durations, often ranging from 24 to 72 months depending on the total tax liability. Keeping accurate records and adhering to the terms of the agreement becomes crucial to maintaining compliance and avoiding legal complications.

Financial Information Summary

Self-employment tax payment plans can significantly impact financial stability for freelancers and small business owners. The self-employment tax rate in the United States is 15.3%, comprising 12.4% for Social Security and 2.9% for Medicare, applicable to net earnings exceeding $400. Maintaining organized financial records, such as quarterly estimated tax payments (IRS Form 1040-ES), ensures compliance and minimizes penalties. It is essential to understand income thresholds; for instance, for tax year 2022, the maximum taxable earnings for Social Security is $147,000. Establishing a payment plan, potentially through the IRS's Online Payment Agreement tool, simplifies managing tax liabilities and alleviates financial stress. Calculating monthly payments based on projected income and business expenses aids in consistent budgeting. Interaction with a tax professional can provide tailored advice, ensuring reasonable estimates and avoiding additional interest or penalties.

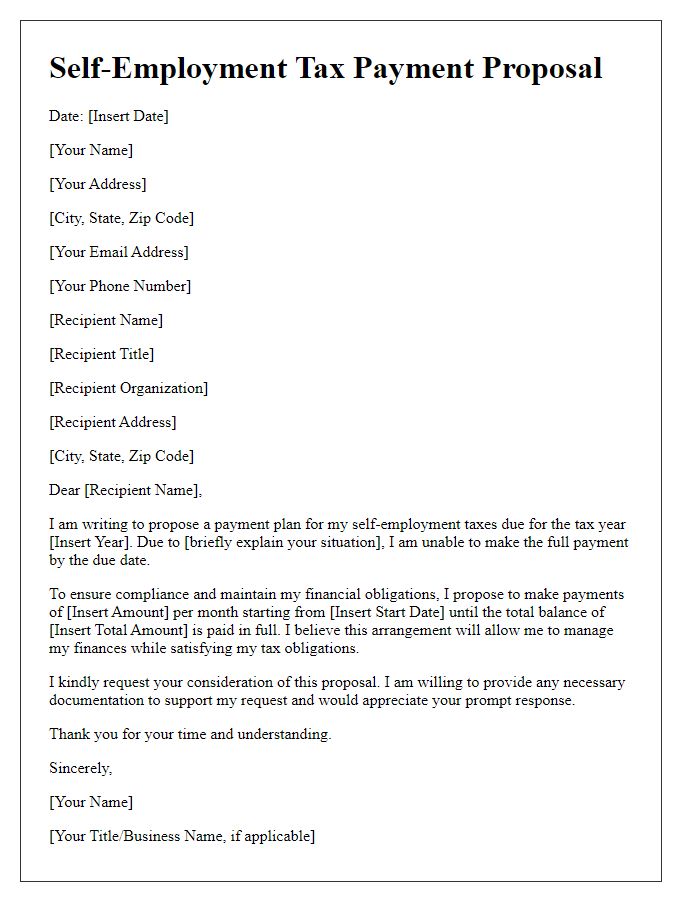

Proposed Payment Schedule

Self-employment taxes are crucial for individuals earning income through freelancing, contracting, or owning a business. The IRS mandates that self-employed individuals pay both the employee and employer portions of Social Security and Medicare taxes, amounting to approximately 15.3% on net earnings. A proposed payment schedule can aid in managing these obligations effectively. For instance, if an individual estimates annual earnings of $50,000, the self-employment tax liability would be around $7,650, ideally divided into quarterly payments of about $1,912.50. By adhering to a structured schedule, such as monthly installments based on projected income, individuals can avoid penalties and streamline their cash flow. This payment plan should also account for potential fluctuations in income and allow adjustments as necessary to align with financial realities.

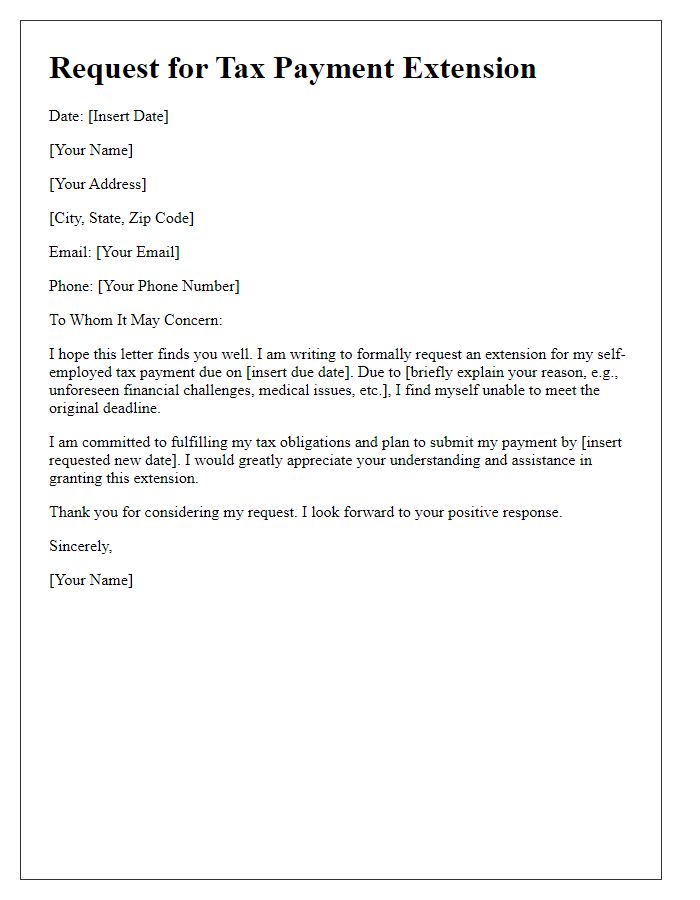

Contact and Follow-up Instructions

Self-employment tax payment plans provide crucial financial structuring for individuals generating income through freelance work or independent contracting. The IRS (Internal Revenue Service) allows self-employed persons to set up installment agreements for outstanding tax liabilities, facilitating manageable payment schedules over time. Individuals can initiate this process via Form 9465, Application for Installment Agreement, ensuring clear and accurate information on their annual earnings, business expenses, and any previous tax payments made. For inquiries or status updates, a phone contact through the IRS helpline (1-800-829-1040) can be utilized to clarify outstanding balances or discuss further options. Keeping thorough records of all correspondence, including dates and representative names, is essential for future reference and compliance.

Comments