Are you feeling puzzled about your monthly tax payment slip? You're definitely not alone, as many people find it tricky to navigate the ins and outs of tax documentation. This article will help clarify common questions and guide you through the process of requesting a replacement or understanding discrepancies. So, stick around and let's unravel the mystery of your tax payment slip together!

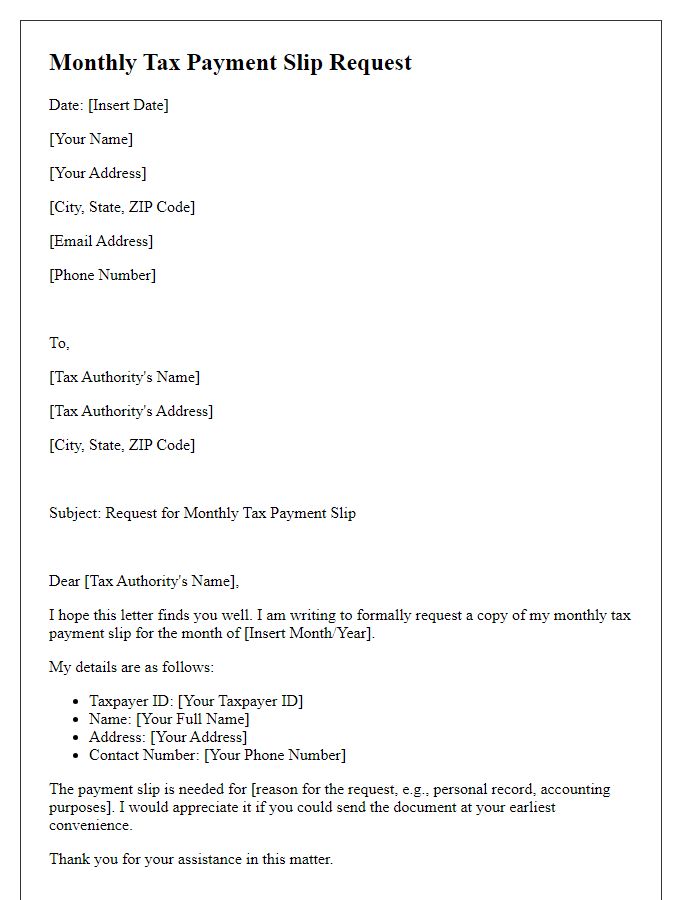

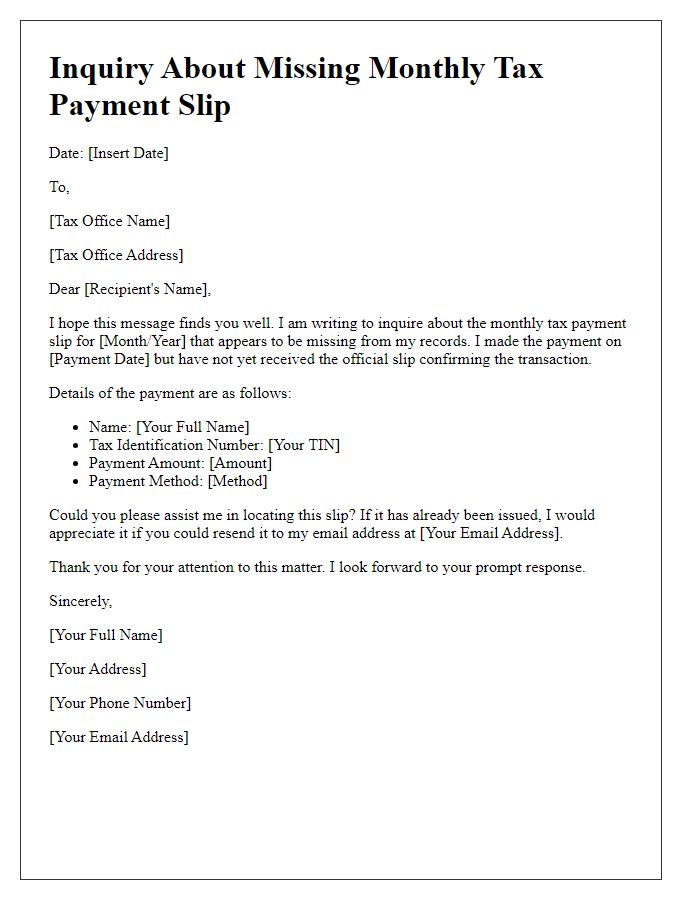

Concise Subject Line

Monthly Tax Payment Slip Inquiry: Request for Clarification

Contact Information

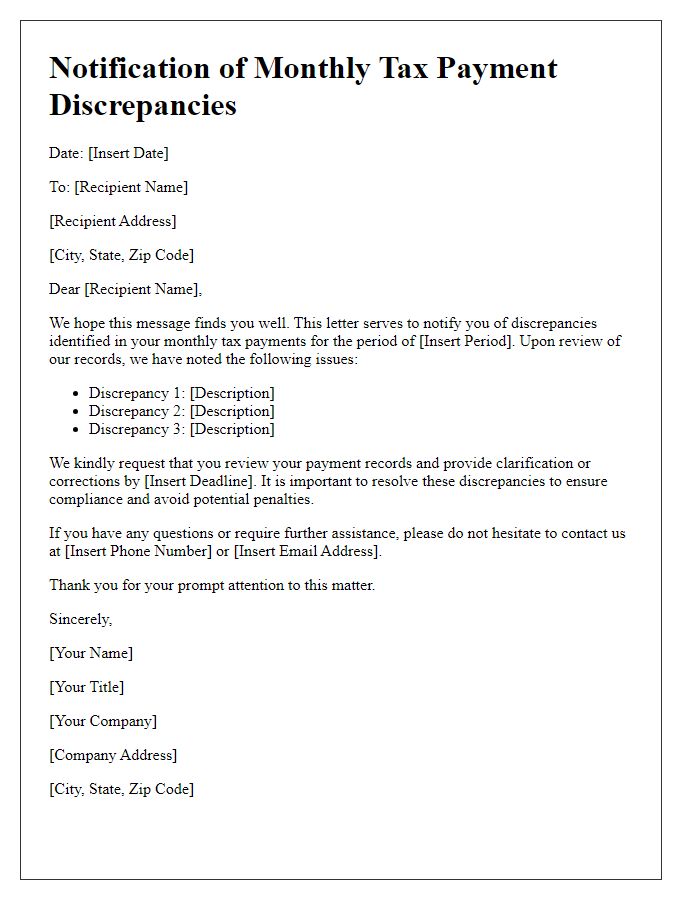

Monthly tax payment slips play a crucial role in ensuring individuals and businesses meet their tax obligations on time. These slips typically include essential information such as taxpayer identification numbers, payment deadlines, and the specific amount due. In many jurisdictions, payment slips are sent before the due date, prompting taxpayers to remit payments without incurring penalties. It's vital for taxpayers to retain copies of these slips for record-keeping purposes, particularly for potential audits from tax authorities like the IRS in the United States. Additionally, discrepancies in payment slips should be reported immediately to avoid complications with tax filings. Accurate and timely communication regarding payment inquiries can streamline the payment process and mitigate the risk of late fees.

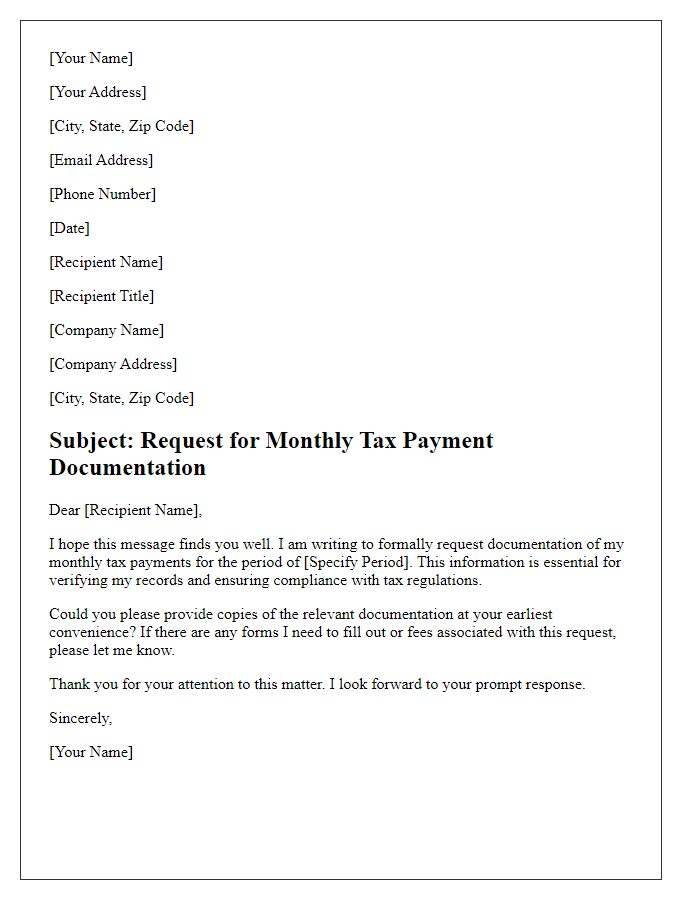

Payment Details

This month's tax payment obligations include various important financial details that residents of the United States must consider. The Internal Revenue Service (IRS) requires taxpayers to report income accurately under the federal tax code. Payment types include estimated quarterly payments and annual filings, both of which must be submitted to designated IRS offices by specific deadlines, such as April 15. Each slip includes essential information such as taxpayer identification number, payment amount, and payment method--typically electronic funds transfer, credit card, or check. Failure to meet these obligations may result in penalties or interest accrual, making it crucial for individuals and businesses to stay informed of their tax liabilities and due dates.

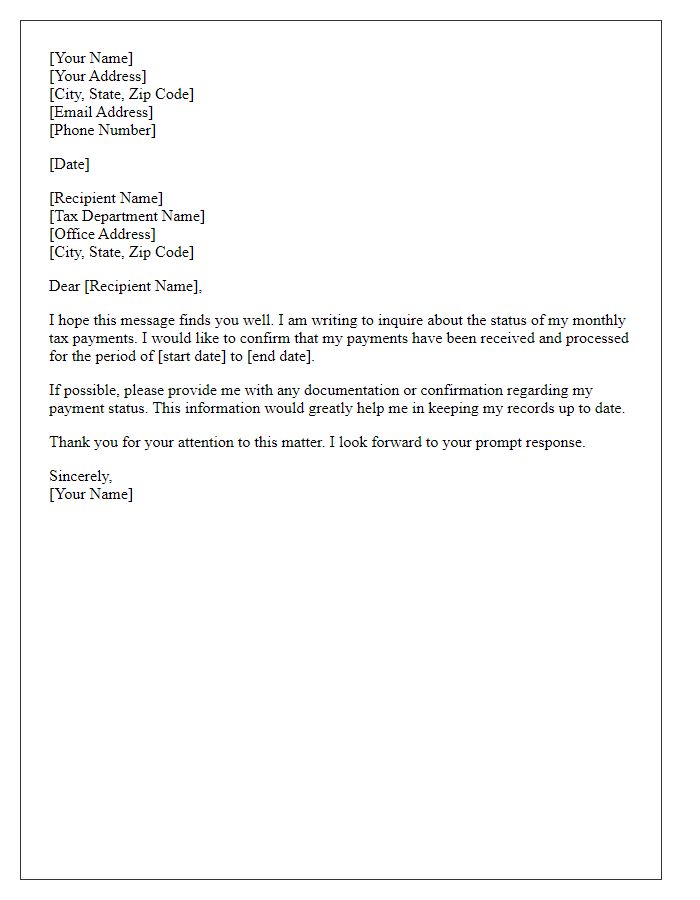

Inquiry Specifics

Regular monthly tax payments serve as financial obligations for individuals and businesses alike. Due dates typically fall on the 15th of each month, based on the IRS regulations stipulated for the USA. Tax slips, which detail payment amounts and date, are crucial for record-keeping and auditing purposes. Inclusion of important identifiers such as Social Security Numbers (SSNs) or Employer Identification Numbers (EINs) ensures proper allocation of payments. Delays in receiving tax slips may lead to accrued interest of around 6% annually, impacting future payment liabilities. Furthermore, discrepancies in the submitted amounts can raise red flags during tax season, prompting audits or additional fees.

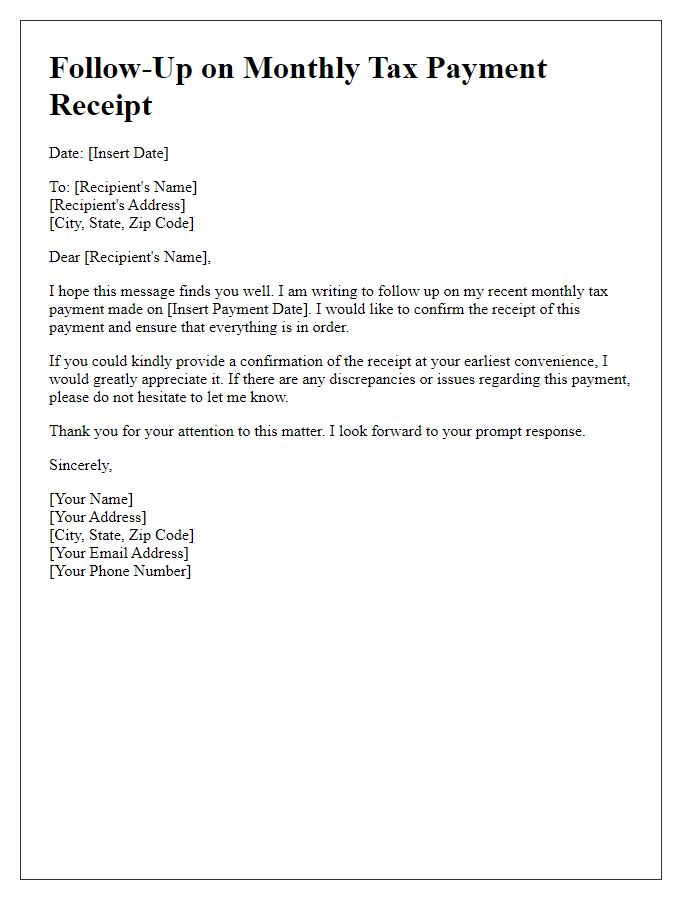

Polite Closing and Contact Request

For an inquiry regarding monthly tax payment slips, the closing remarks often include expressions of appreciation for the recipient's assistance and a prompt for additional contact if there are questions or clarifications. Mention of an email address or phone number encourages further communication. Including specific time frames for a response can also be helpful. Ensure to express gratitude for their attention to the matter in a courteous tone.

Comments