Hey there! As we approach the end of the fiscal year, it's that time again to get our ducks in a row for annual tax compliance obligations. Navigating through the maze of tax regulations can be daunting, but staying organized and informed will make the process much smoother. Whether you're a seasoned pro or a first-timer, we've got some essential tips to help you tackle your tax responsibilities like a champ. So, grab a cup of coffee and join us as we break it all down for you!

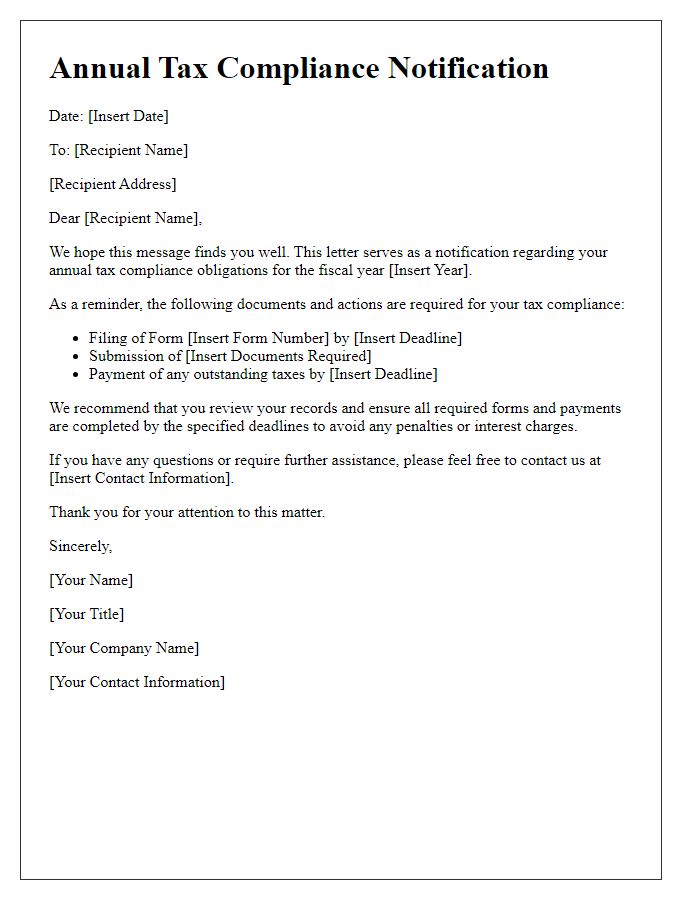

Recipient's information

Annual tax compliance obligations require meticulous documentation and clear communication regarding recipient information for accurate reporting. Essential details include the recipient's legal name, which must match official identification records, and the tax identification number (TIN), crucial for ensuring the proper classification for tax purposes. Additionally, the recipient's mailing address, often used for correspondence regarding tax documents, should be precise to avoid delays in communication. Including the recipient's contact information, such as email and phone number, facilitates efficient resolution of any queries related to tax obligations. Accurate capture of this information is essential for adherence to regulations, such as those enforced by the IRS in the United States.

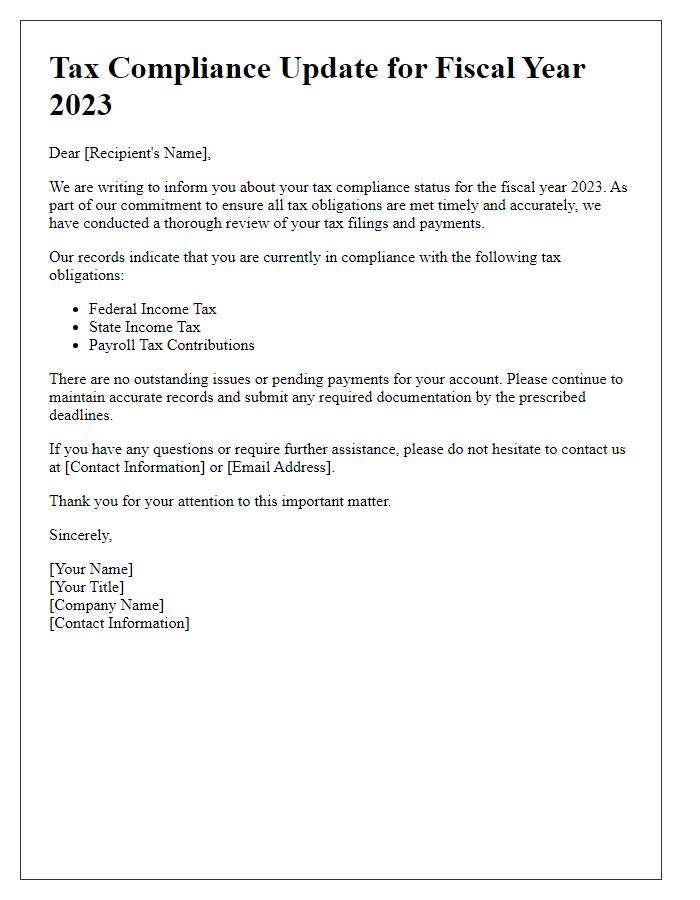

Purpose of the letter

The annual tax compliance obligation serves as a crucial reminder for individuals and businesses to fulfill their responsibilities regarding tax filings. This is an essential process occurring at the end of each financial year, typically concluded on April 15th in the United States, requiring taxpayers to report income, claim deductions, and calculate tax liabilities. The Internal Revenue Service (IRS) oversees this process, ensuring adherence to tax laws and regulations. Compliance ensures that government services receive necessary funding while avoiding potential penalties, interest, or audits that can arise from late submissions or inaccuracies. Timely compliance also fosters a culture of accountability and transparency in financial dealings.

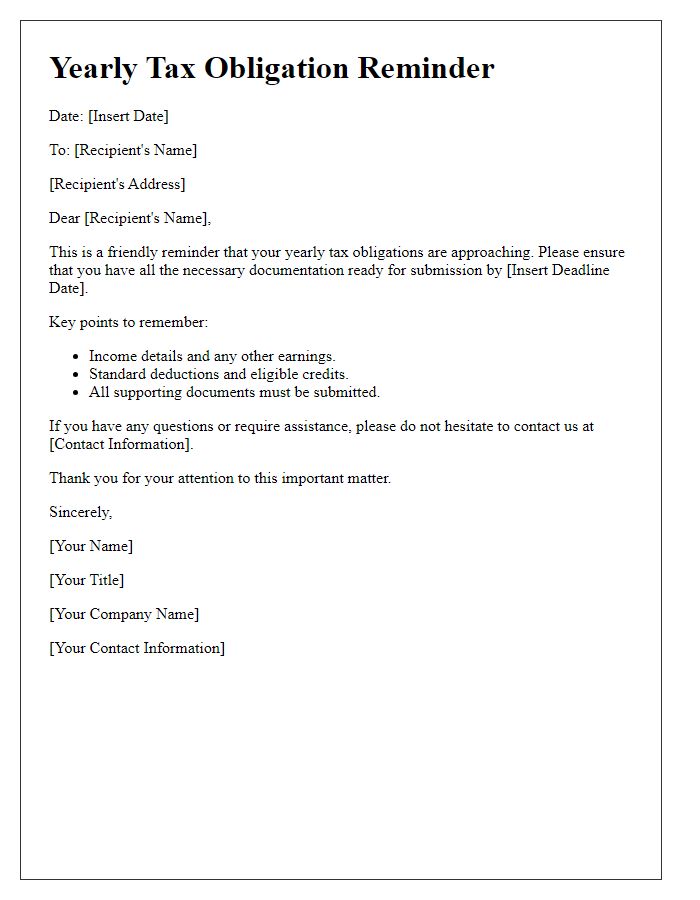

List of required documents

The annual tax compliance obligation for individuals requires several essential documents to ensure accurate filing and adherence to regulations set by the Internal Revenue Service (IRS). Tax return forms, specifically IRS Form 1040 or Form 1040-SR, must be completed. Additionally, W-2 forms from employers provide crucial information regarding wages earned and withheld taxes. Self-employed individuals must include 1099-MISC forms and Schedule C for detailing business income and expenses. Furthermore, bank statements from financial institutions are necessary for reporting interest income. Documentation of deductible expenses, such as mortgage interest statements (Form 1098) and receipts for charitable contributions, bolster claims. Lastly, prior year tax returns serve as a reference point for current filings, ensuring consistency and accuracy. Ensuring all these documents are collected by the tax deadline, typically April 15th, streamlines the compliance process.

Submission deadline

The annual tax compliance obligation requires taxpayers in the United States to submit their tax returns to the Internal Revenue Service (IRS) by April 15 each year, with exceptions for weekends and holidays that may extend deadlines. Taxpayers must ensure accurate reporting of income, deductions, and credits on forms such as the 1040 or 1120 for corporations. Failure to comply with the submission deadline can result in penalties ranging from 5% to 25% of unpaid tax, calculated monthly until the tax is paid in full. Additionally, taxpayers seeking an extension can file Form 4868, which grants an extra six months, though estimated taxes must still be paid by the original deadline to avoid interest and penalties.

Contact information for assistance

Annual tax compliance obligations require accurate reporting and timely submissions. Various deadlines, such as the federal tax return due date (typically April 15), must be adhered to. Local tax authorities, such as the Internal Revenue Service (IRS) in the United States, provide resources for assistance. Tax professionals, including certified public accountants (CPAs), can offer expertise in navigating complex regulations. Online resources, such as the IRS website, offer guidelines and tools, including interactive calculators for estimated taxes. Consulting with these professionals ensures compliance and minimizes penalties associated with late filings.

Comments