Are you looking to draft a professional letter to confirm the receipt of a tax payment? Crafting the perfect letter can not only help maintain clear communication but also provide peace of mind about your financial obligations. Whether it's for personal or business taxes, having an official confirmation is crucial for your records. Read on to discover a simple yet effective template that you can customize for your needs!

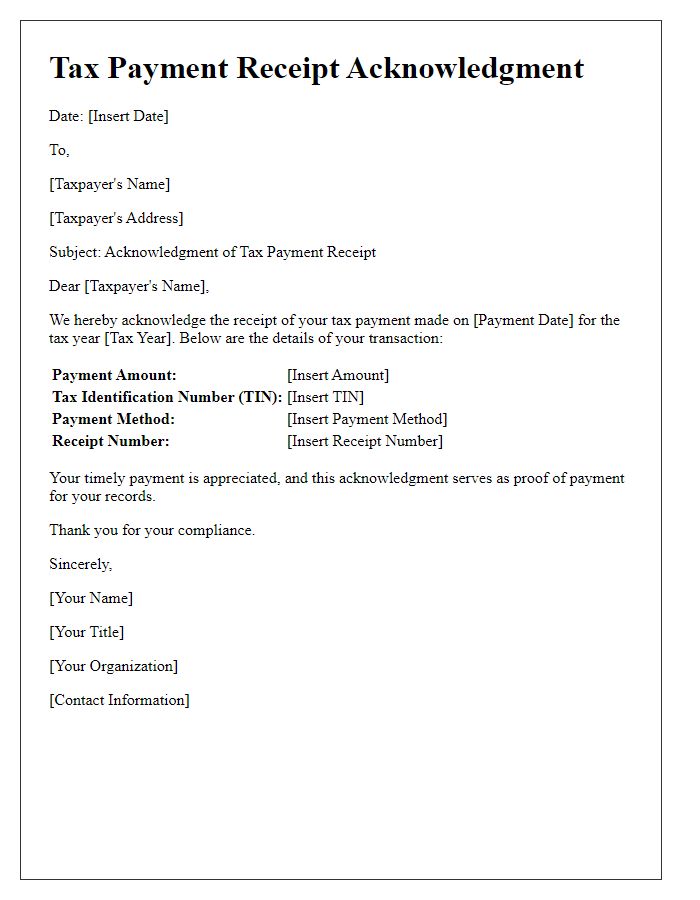

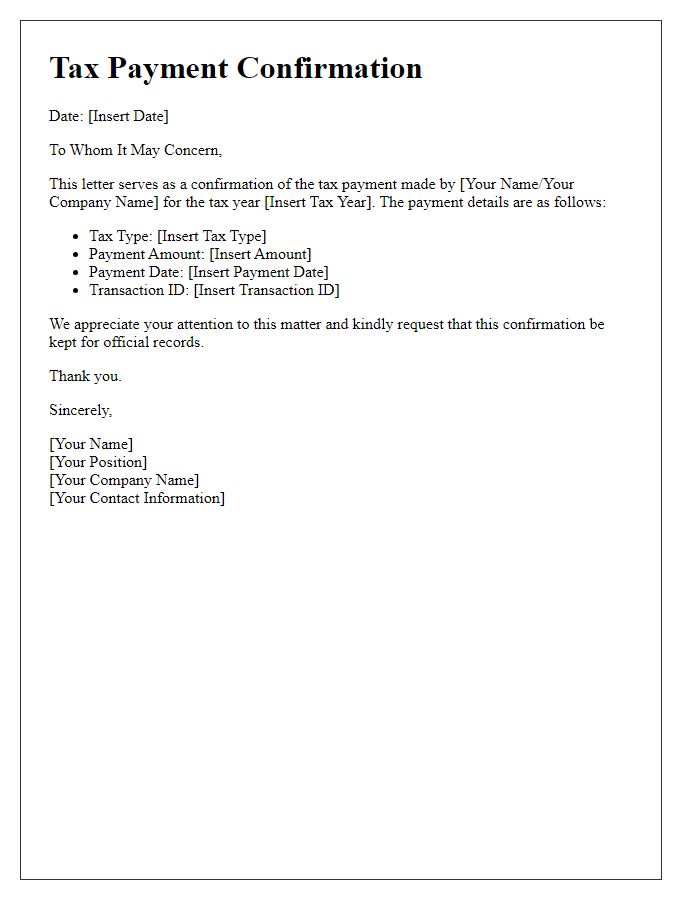

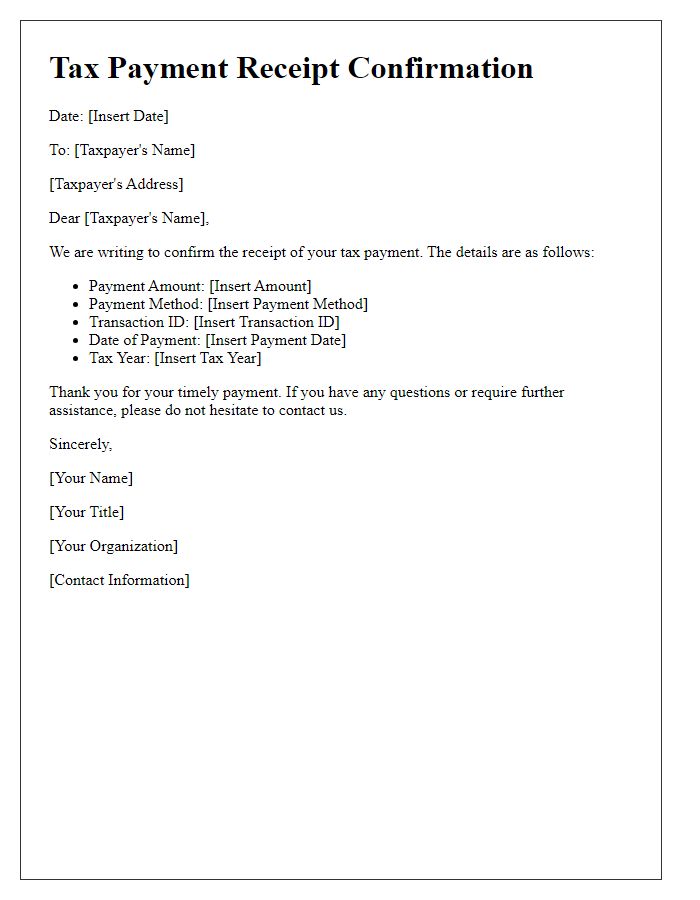

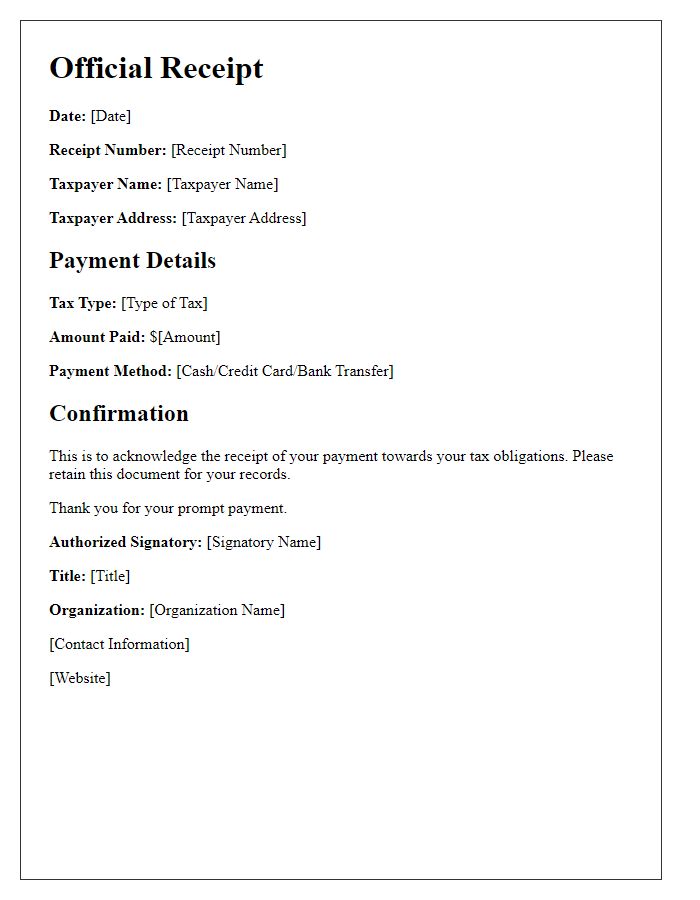

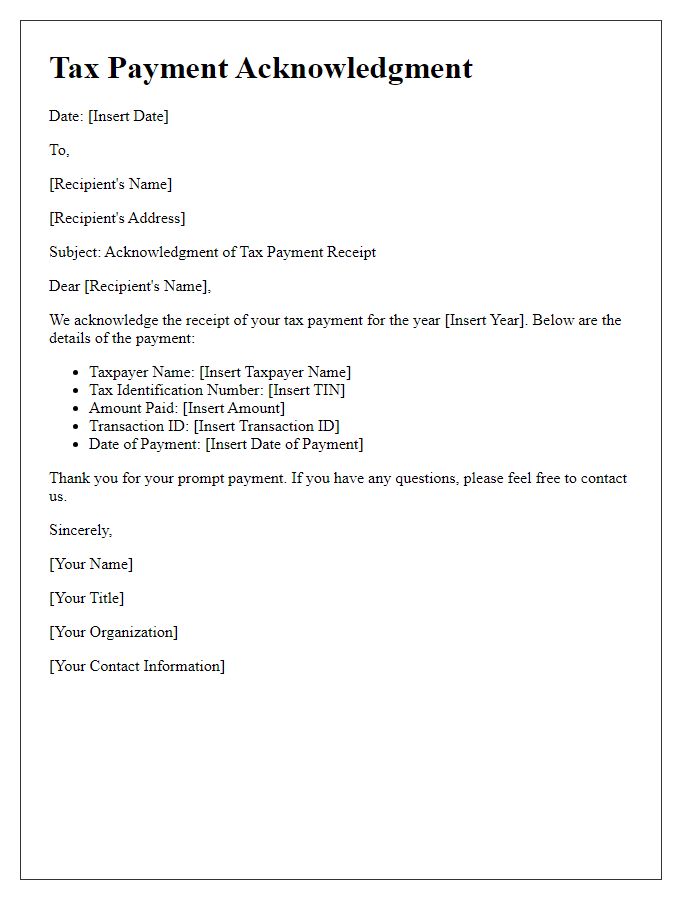

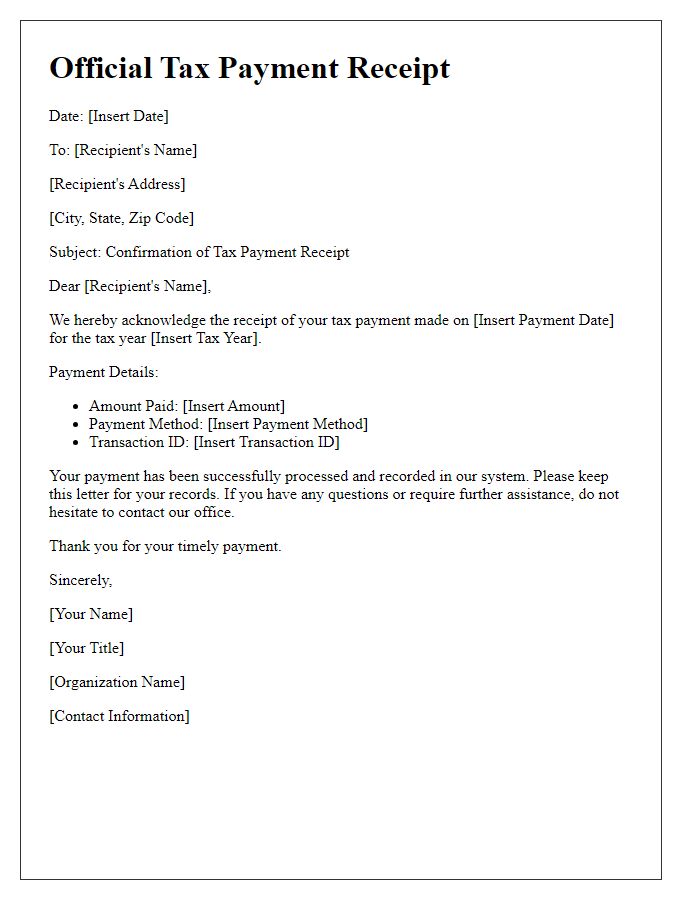

Payment Reference Number

The official tax payment receipt confirmation serves as a crucial document for verifying transactions related to tax payments made by individuals or entities to government authorities. This confirmation, identifiable through its unique Payment Reference Number (PRN), typically includes essential details such as the payment date, amount paid, taxpayer identification, and the tax period covered. Accurate record-keeping enhances financial transparency and compliance with tax regulations. Furthermore, taxpayers must retain this confirmation for future reference, particularly during audits or tax return preparations, which can occur several years after payment.

Taxpayer's Full Name and Address

The official tax payment receipt confirmation displays the Taxpayer's Full Name, which is essential for identifying the individual or entity responsible for the tax obligation. It also includes the complete address, providing necessary context for determining the jurisdiction and local tax authority relevant to the payment. Clear identification ensures proper allocation of funds and compliance with regulations set forth by the relevant governmental department. This documentation serves as an important record for both the taxpayer and the authority, facilitating future reference and ensuring transparency in tax matters.

Amount Paid and Payment Date

Official tax payment receipts serve as critical documentation for financial accountability. A receipt typically includes essential details such as the amount paid, which may vary based on local tax regulations, and the payment date, often recorded to the specific day, month, and year. For instance, individuals or businesses might pay property taxes amounting to several hundred or thousands of dollars, with the payment date marking essential deadlines set by local tax authorities, such as April 15th for income tax in the United States. Accurate recording of these specifics ensures compliance with taxation laws and simplifies future references for audits or legal inquiries.

Receiving Authority's Contact Information

The official tax payment receipt confirmation document includes vital details pertaining to the receiving authority, such as their official name, which may refer to a local tax office or national revenue agency. The contact information section typically specifies the mailing address, consisting of street name, number, city, and ZIP code, allowing taxpayers to correspond directly with the authority. Phone numbers, including area codes, are essential for immediate inquiries regarding tax payments or related issues. Email addresses are also significant, facilitating swift digital communication. Additionally, the document may list office hours, indicating when taxpayers can expect prompt assistance, ensuring clarity in interactions with the tax authority.

Acknowledgement and Confirmation Statement

The official tax payment receipt confirmation processes ensure that taxpayers receive an acknowledgment after submitting their payments. Upon completion, a confirmation statement is generated, detailing the payment date, amount paid, and corresponding tax identification number. This statement serves as proof of payment and can be crucial for individual records or audits. Local tax authorities like the Internal Revenue Service (IRS) in the United States require this documentation for verification purposes. Taxpayers should retain this confirmation for future reference, particularly during filing seasons or when discrepancies arise related to their tax accounts.

Comments