Have you ever found yourself in the awkward position of realizing you accidentally overpaid your taxes? It's a frustrating situation, but the good news is that getting a refund for that overpayment is often simpler than you might think. In this article, we'll walk you through the steps to draft a clear and effective letter requesting your tax refund. So grab a cup of coffee, and let's dive in to help you reclaim what's rightfully yours!

Taxpayer Information

Accidental overpayment of taxes can result in significant financial discrepancies for individuals. In the United States, for example, taxpayers may mistakenly remit excess amounts due to miscalculations or misunderstandings of tax obligations. Taxpayer information, such as Social Security Number and filing status, is critical for identifying and resolving these issues quickly with the Internal Revenue Service (IRS). Establishing the precise amount overpaid, along with relevant tax years, facilitates the process of claiming a refund. Promptly addressing overpayment situations through formal channels ensures adherence to tax regulations while expediting recovery of funds. Such measures are vital for maintaining individual financial health and accuracy in federal tax reporting.

Description of Overpayment

Accidental overpayment of taxes occurs when individuals or businesses remit more than their actual tax liability to the Internal Revenue Service (IRS). This may result from miscalculating estimated taxes, entering incorrect amounts on tax returns, or failing to account for credits, deductions, and exemptions. For instance, if a taxpayer mistakenly pays $5,000 instead of the owed $4,200, the $800 excess constitutes an overpayment. Such discrepancies often arise during events like tax preparation, changes in income, or adjustments in tax laws. Refund requests can be initiated once the overpayment is identified, with the IRS typically processing these claims within six weeks. Accurate record-keeping and timely filing are crucial to ensure a smooth refund process.

Request for Repayment

Overpayment of taxes can occur when individuals submit excess amounts, resulting in financial discrepancies. For example, a taxpayer may discover a $1,200 overpayment on their federal tax return due to a miscalculation in estimated tax payments. This discrepancy can cause delays in receiving a refund from the Internal Revenue Service (IRS). To expedite the repayment process, taxpayers should provide detailed information on the overpayment, including account numbers, tax years, and any relevant documentation that substantiates the excess payment. Properly documenting the request aids in securing a timely resolution, ensuring that individuals can receive the funds owed to them efficiently.

Contact Information for Queries

Accidental overpayment of taxes can lead to significant financial discrepancies for individuals. Taxpayers often face confusion and frustration during the refund process. Internal Revenue Service (IRS) guidelines emphasize the importance of accurate reporting and timely communication regarding refunds. Taxpayers may find themselves in need of detailed information regarding their specific case, especially when involving substantial sums such as thousands of dollars. The IRS provides designated contact numbers and office hours to facilitate inquiries, allowing taxpayers to address questions and resolve issues efficiently. Understanding these resources can streamline the process and ensure rightful refunds are processed in a timely manner.

Deadline for Response

Accidental overpayment of taxes can lead to unexpected financial implications, particularly for individuals or businesses in various jurisdictions. The Internal Revenue Service (IRS), the U.S. governmental agency responsible for tax collection, stipulates a response deadline of 30 days from the date of notification for taxpayers to address issues related to overpayments. Failing to respond within this timeframe may result in delayed refunds or further complications. Tax filings submitted by April 15 can often require a detailed audit of any discrepancies, especially when accompanied by documentation such as W-2 forms or 1099s. Taxpayers should ensure accurate record-keeping and monitoring of payments to avoid these situations, particularly during peak tax seasons when demand for clarification and support increases significantly.

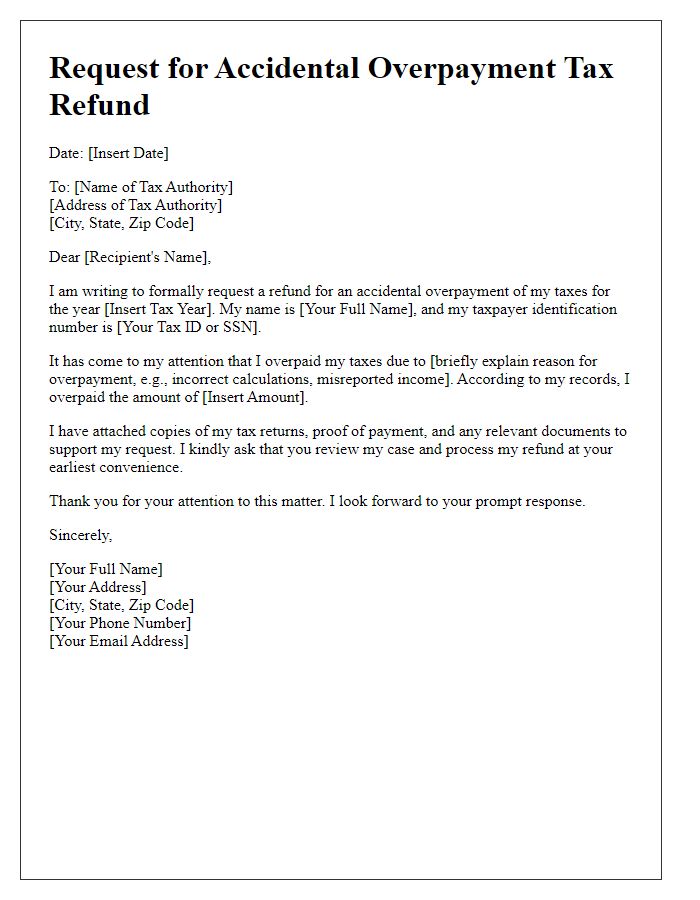

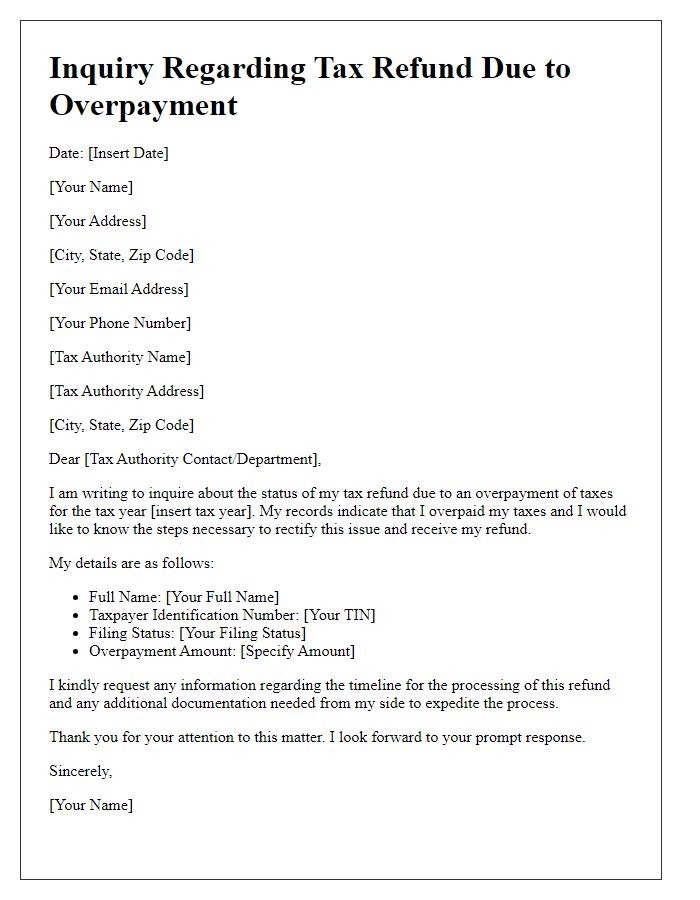

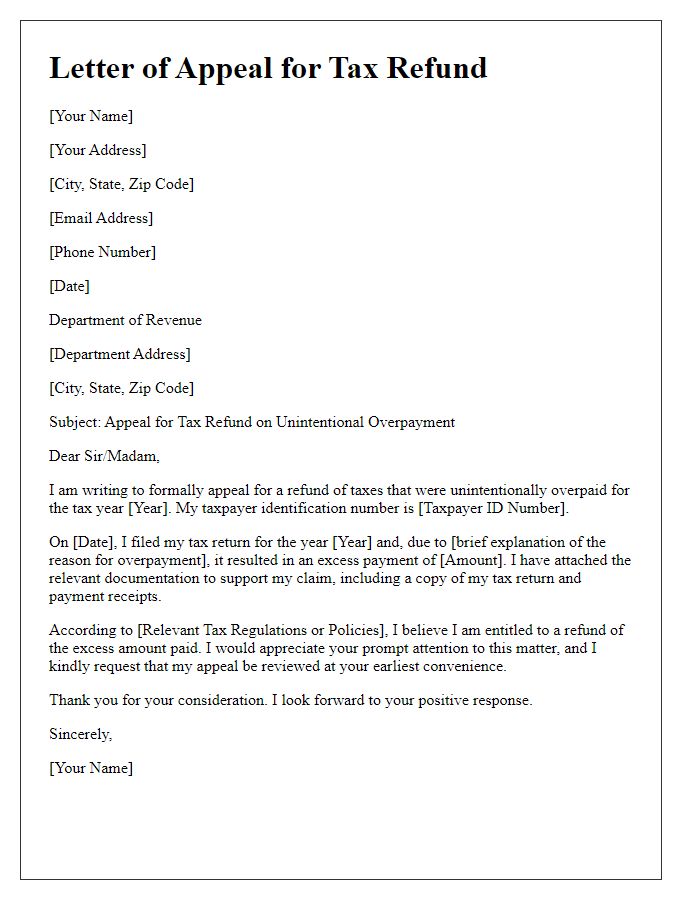

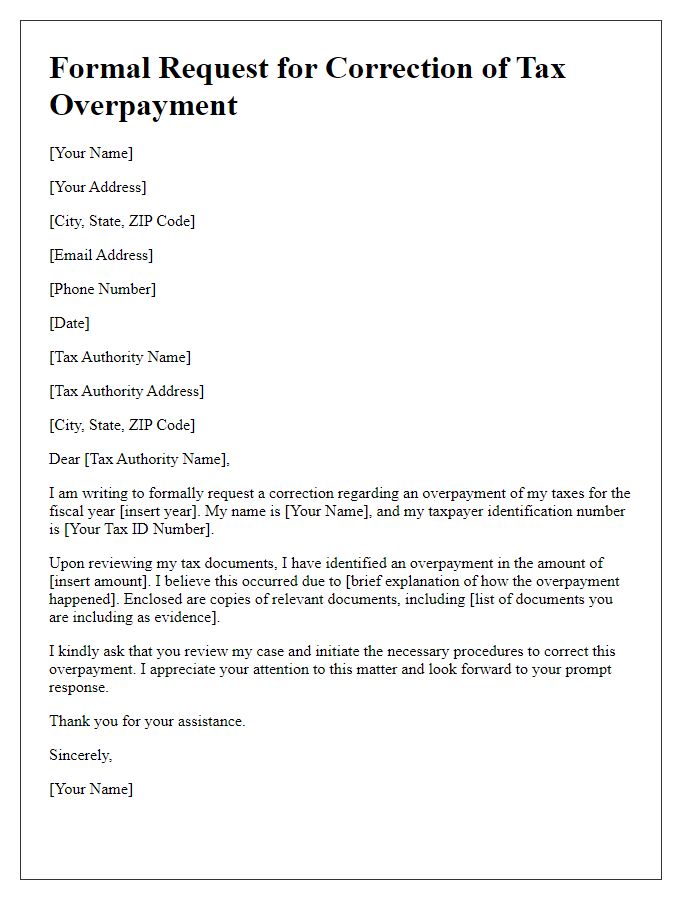

Letter Template For Accidental Overpayment Tax Refund Samples

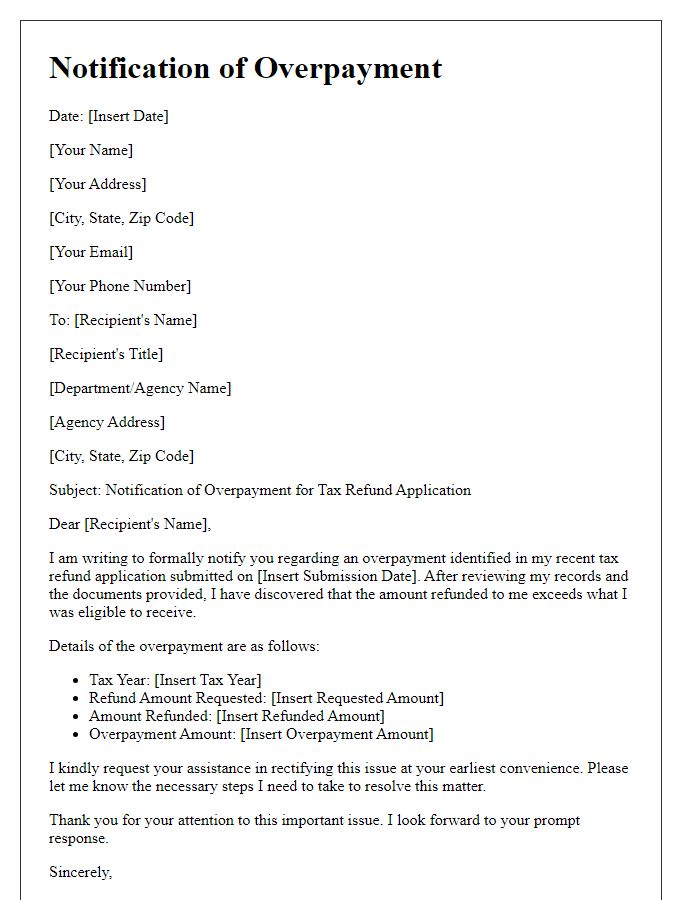

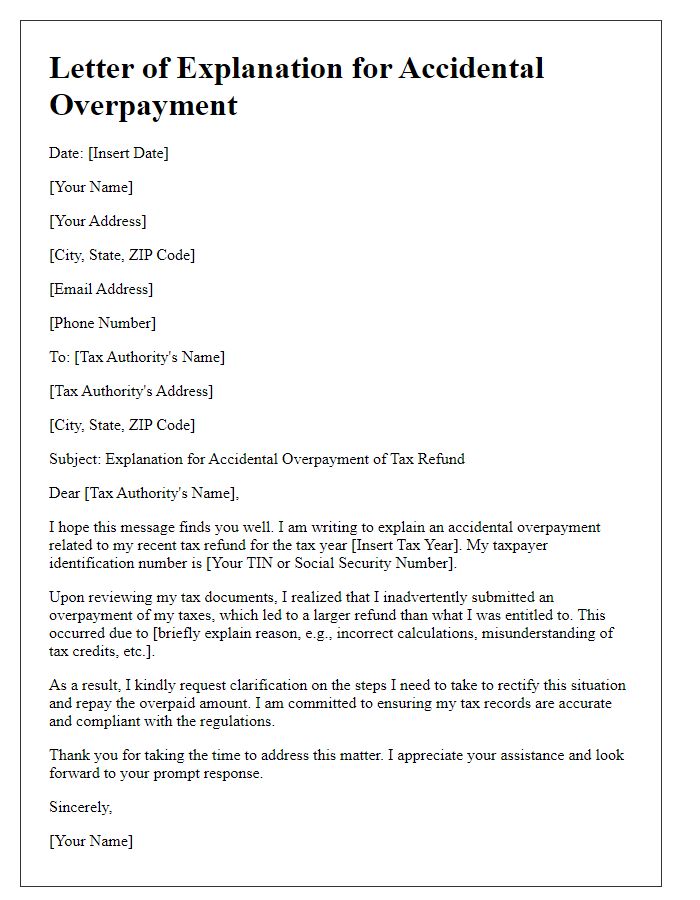

Letter template of notification of overpayment for tax refund application

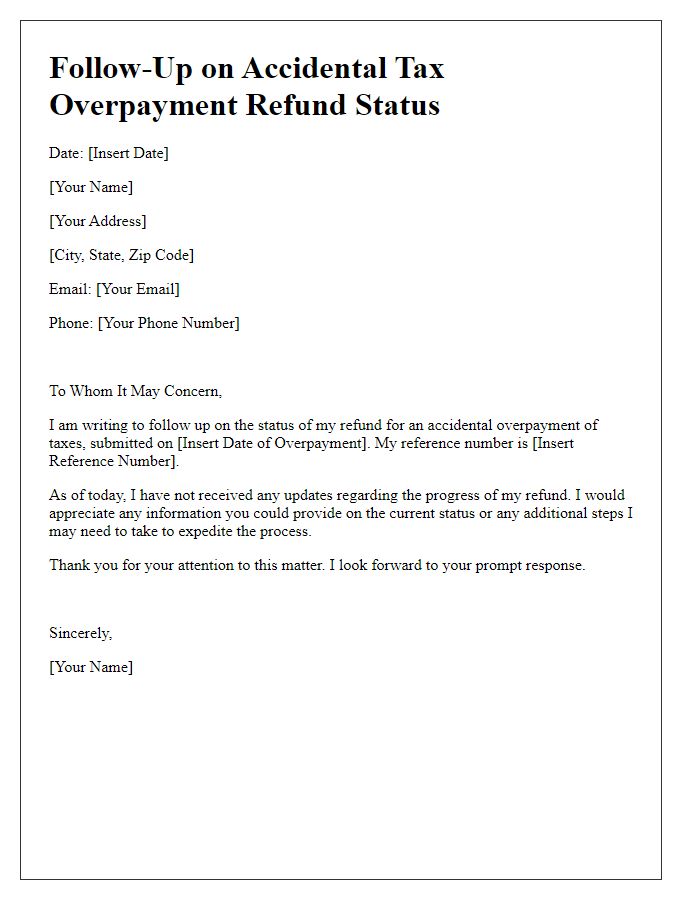

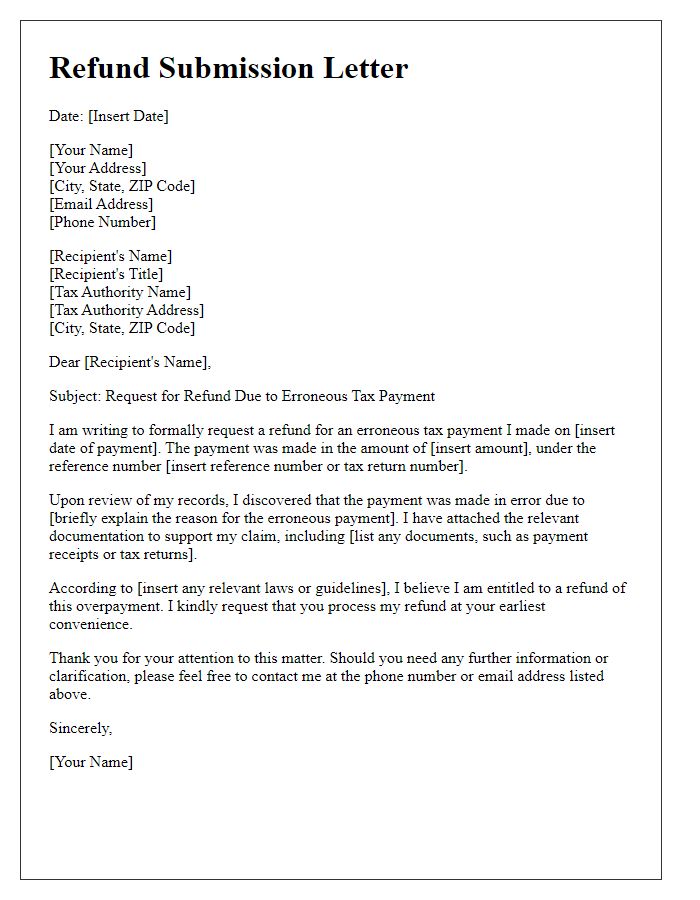

Letter template of follow-up on accidental tax overpayment refund status

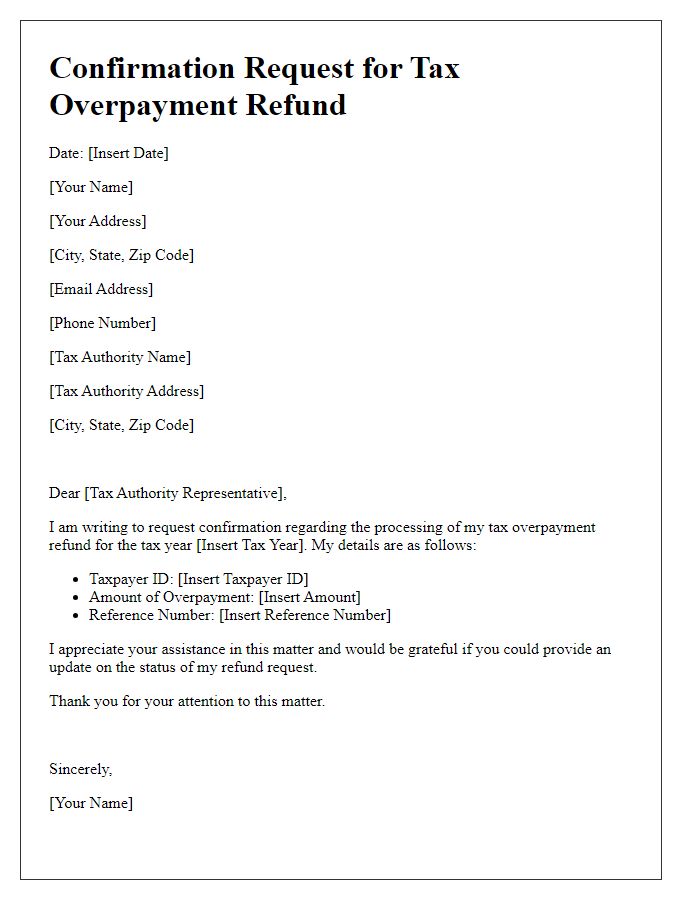

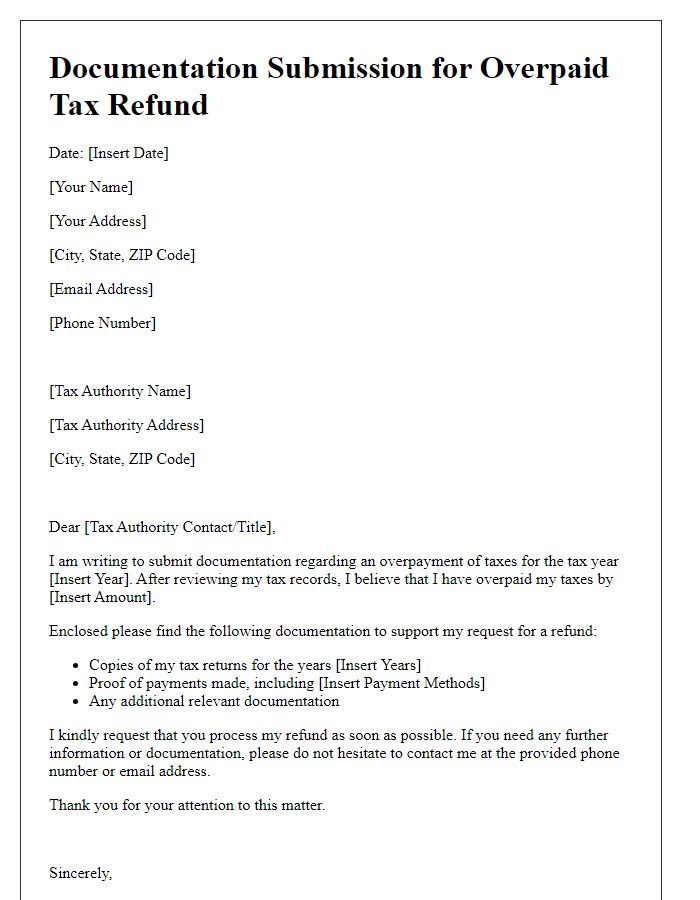

Letter template of confirmation request for processing tax overpayment refund

Comments