Hey there! If you're feeling a bit overwhelmed by the final tax assessment appeal deadline, you're not alone. Navigating the complexities of tax assessments can be tricky, but understanding your options is the first step toward ensuring you're treated fairly. Dive into our article where we break down the essential steps you need to take before that deadline hits, and how you can effectively make your appeal. Let's get started!

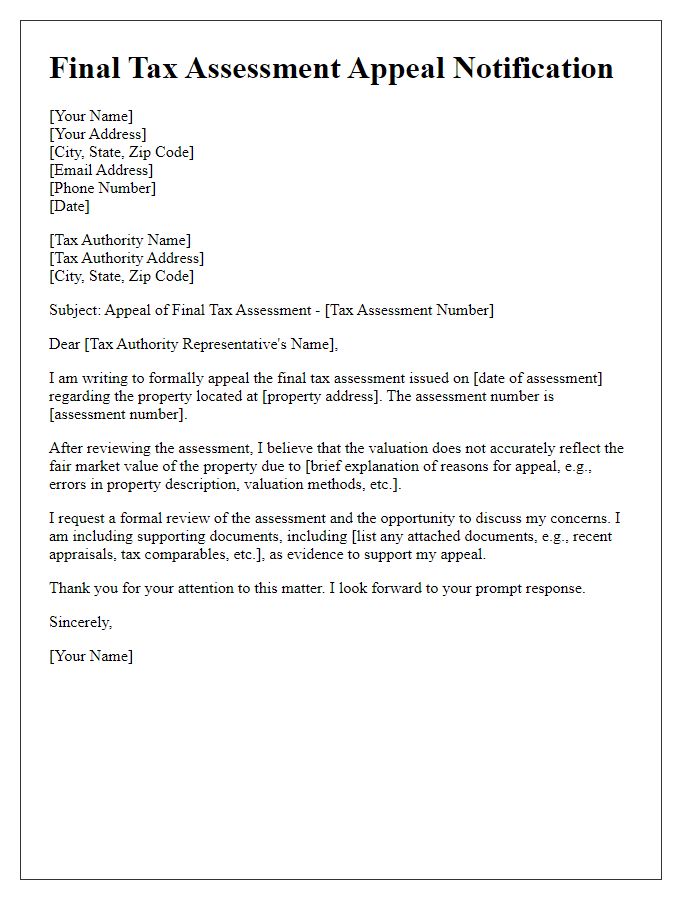

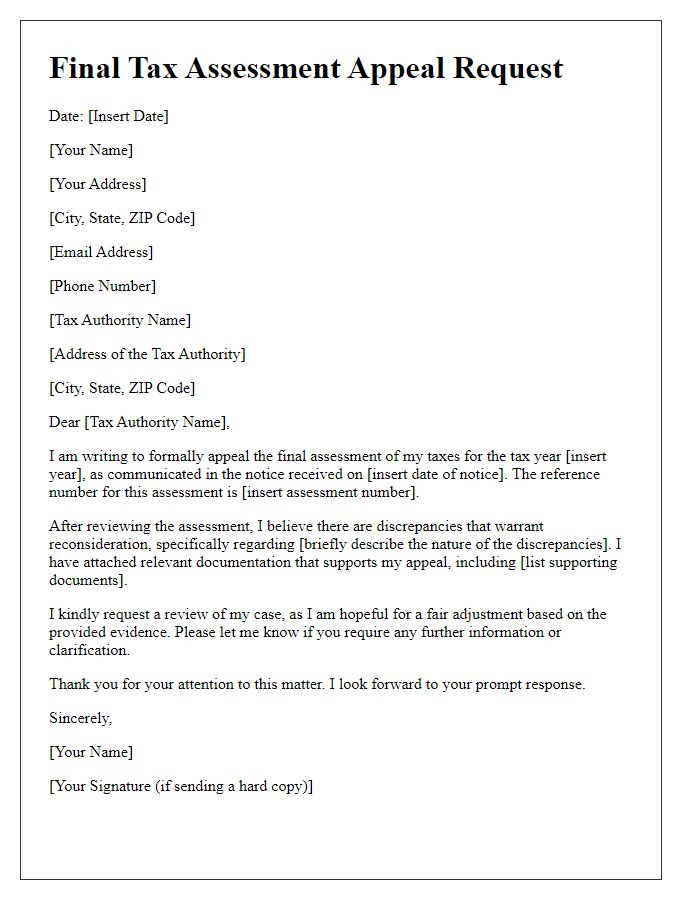

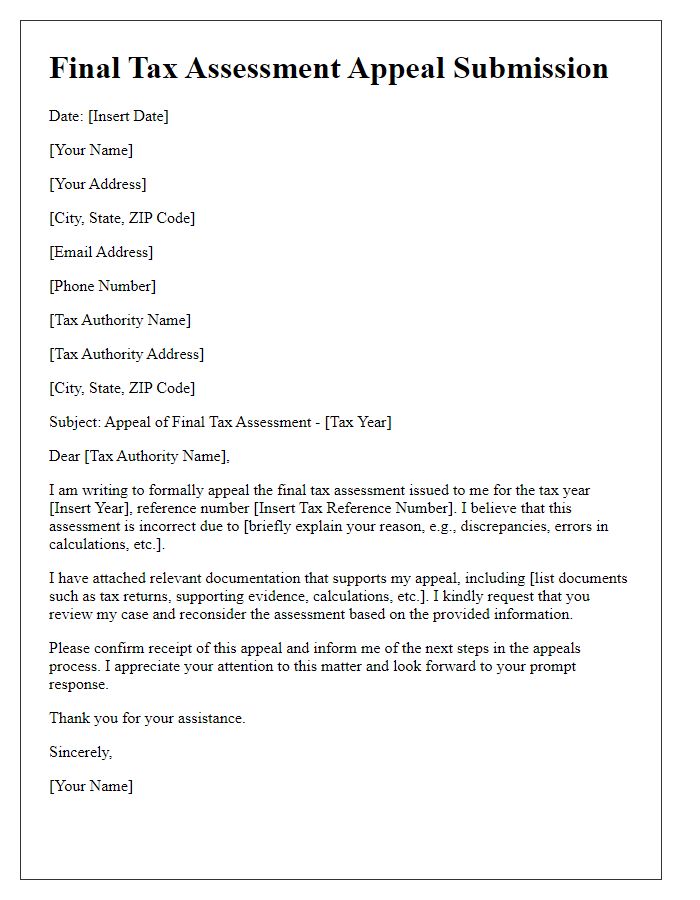

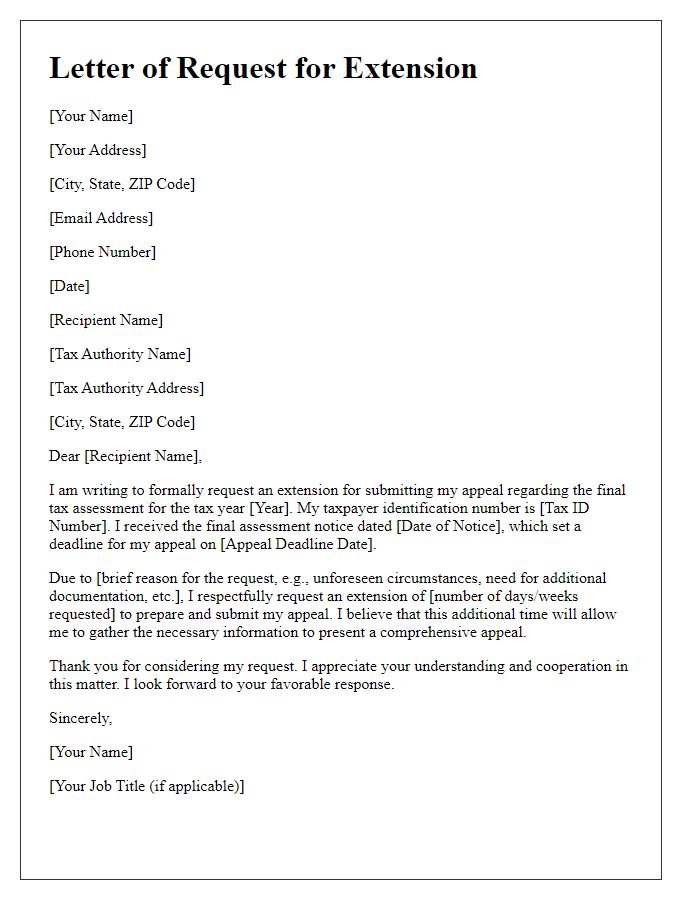

Personal Information (Name, Address, Tax ID)

Final tax assessment appeal deadlines are critical for taxpayers looking to contest their tax liabilities. In the United States, taxpayers must submit their appeals typically within 30 days of receiving the final notice from the Internal Revenue Service (IRS). Key information required includes personal details, such as full name (e.g., John Doe), mailing address (e.g., 123 Main St, Springfield, IL), and Tax Identification Number (TIN or SSN, e.g., 123-45-6789). Failure to meet this deadline may result in the loss of the right to contest the assessment, leading to potential financial consequences, including enforced collection actions or additional penalties. It is essential to refer to specific state regulations for nuances in deadlines and procedures, as they may vary significantly from federal guidelines.

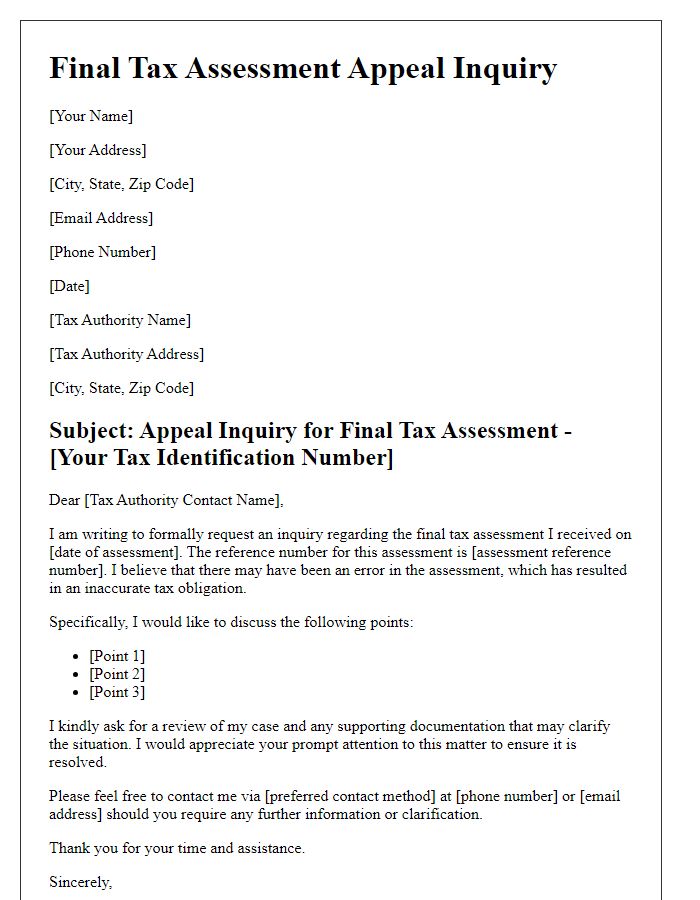

Reference to Tax Assessment Notice

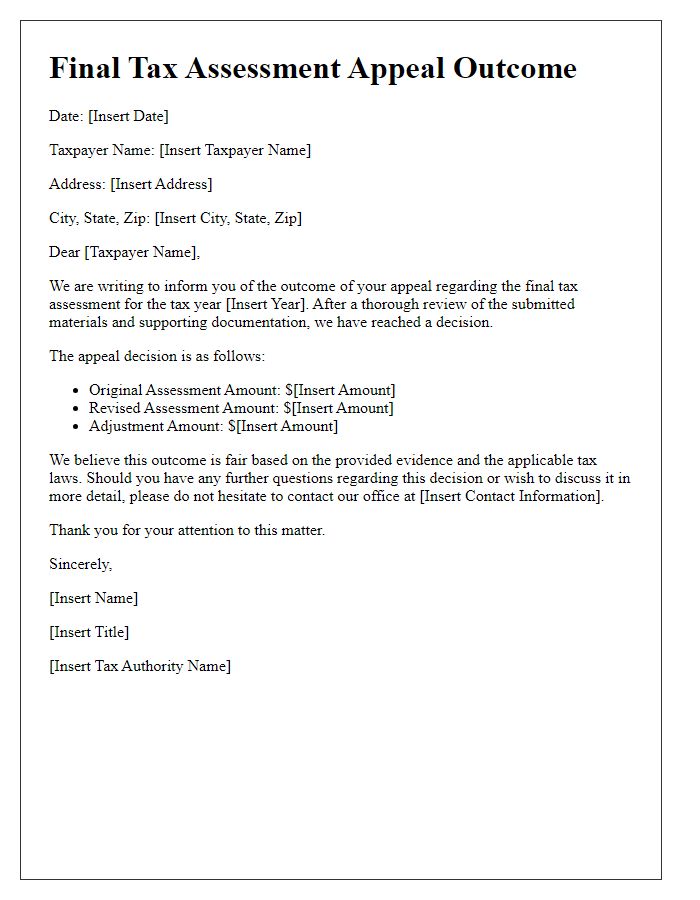

The final tax assessment appeal deadline is crucial for taxpayers aiming to contest their tax assessment. This deadline often falls within 30 days following the issuance of the Tax Assessment Notice, an official document detailing the tax owed for the fiscal year, typically delivered by local tax authorities. Missing this deadline can prevent taxpayers from appealing to higher authorities like the Tax Court, where cases regarding potential discrepancies can be reviewed. In many jurisdictions, the Tax Assessment Notice includes key figures such as the assessed property value, taxable income, and associated penalties, which can significantly impact household finances. Timely submission of an appeal requires careful review of both the notice and related financial documents, ensuring all relevant discrepancies are thoroughly documented.

Explanation of Appeal Grounds

The final tax assessment appeal deadline, crucial for taxpayers seeking reconsideration, often falls within a 30 to 90-day window after the assessment notice date. The appeal grounds may include discrepancies in reported income, erroneous deductions, and incorrect property valuations. For instance, a taxpayer could argue that their property, located in Madison County, should be valued at $250,000 instead of the assessed $300,000 based on comparable sales data from the last fiscal year. Furthermore, taxpayers can contest the application of tax credits which, if misapplied, can lead to inflated tax liabilities. Supporting documents, such as financial statements, property appraisals, and prior tax returns, play a vital role in substantiating claims during the appeal process.

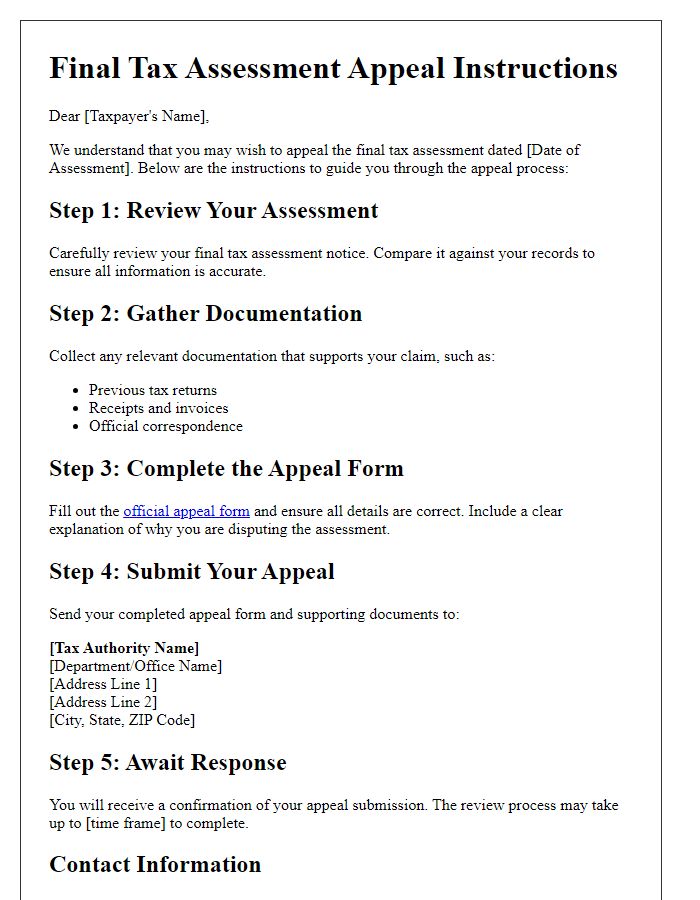

Supporting Documentation List

The final tax assessment appeal process is crucial for taxpayers seeking to contest decisions made by the tax authority. Key documents in this process include the taxpayer's original tax return, detailed income statements (such as W-2s or 1099s) from the previous fiscal year, evidence supporting deductions or credits claimed (including receipts or invoices), correspondence received from the tax authority stating the assessment decision, and any legal notices, such as those related to property valuations, if applicable. Additionally, an itemized list of discrepancies between the taxpayer's figures and those reported by the tax authority, as well as supporting ledgers or bank statements, may enhance the appeal. Timely submission of these documents is essential to meet the deadline set by the tax authority.

Contact Information and Preferred Communication Method

Final tax assessment appeals require timely communication to ensure proper handling. Taxpayers should provide detailed contact information, including full name, mailing address, telephone number, and email address. Preferred communication methods, such as direct phone calls or email correspondence, must be clearly indicated to facilitate efficient dialogue with tax authorities. Submission deadlines demand strict adherence, often specified by jurisdictions, such as 30 days from the assessment notice date. Clear documentation of previous assessments or appeals enhances the argument and clarifies any discrepancies encountered. The appeal documentation should be sent to the appropriate tax office or authority location, ensuring that all materials are addressed correctly to avoid delays in processing.

Comments