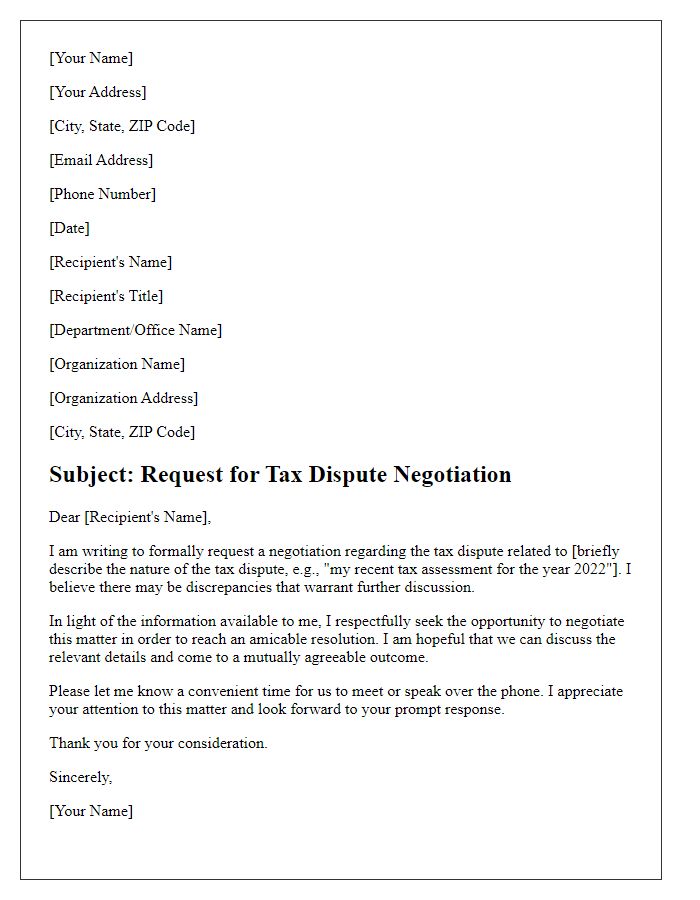

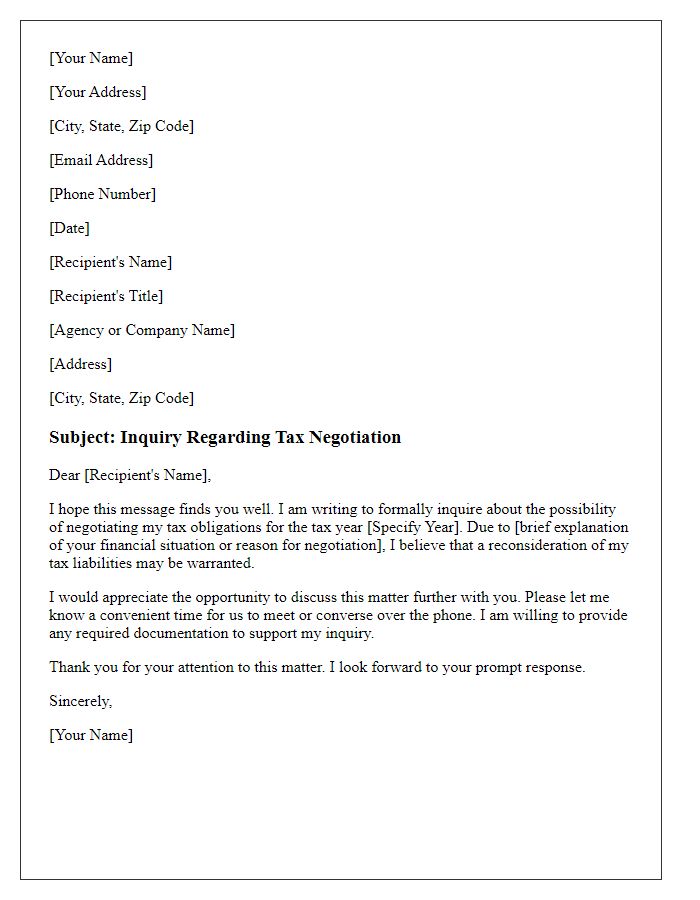

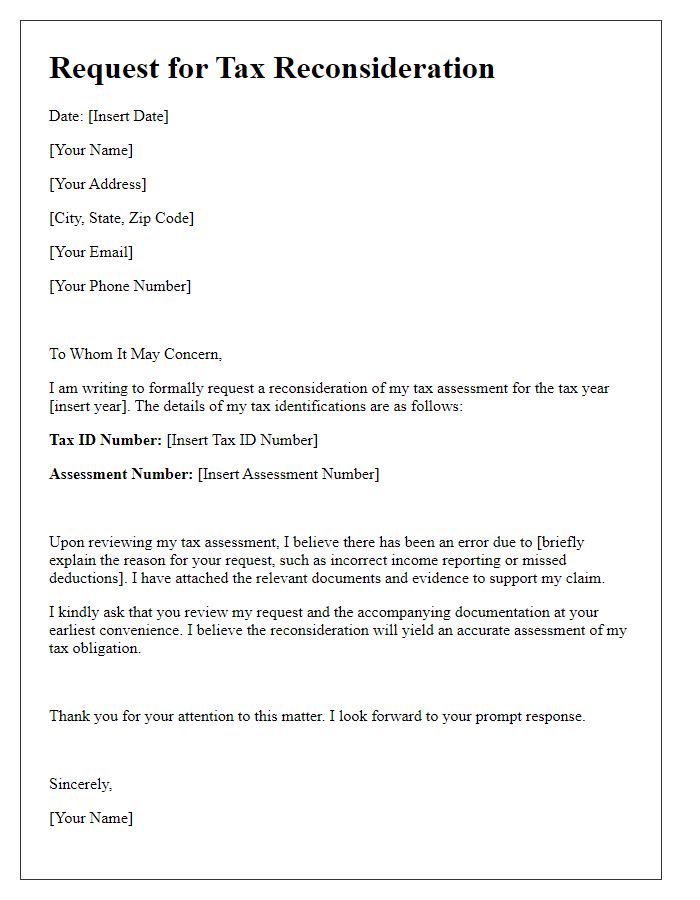

Are you navigating the tricky waters of a tax dispute and looking for a way to negotiate effectively? Tax negotiations can feel daunting, but with the right approach, you can turn the situation to your advantage. In this article, we'll explore essential strategies and a customizable letter template to help you communicate your position clearly and confidently. So, let's dive in and empower you to tackle those tax challenges head-on!

Clear identification of the parties involved

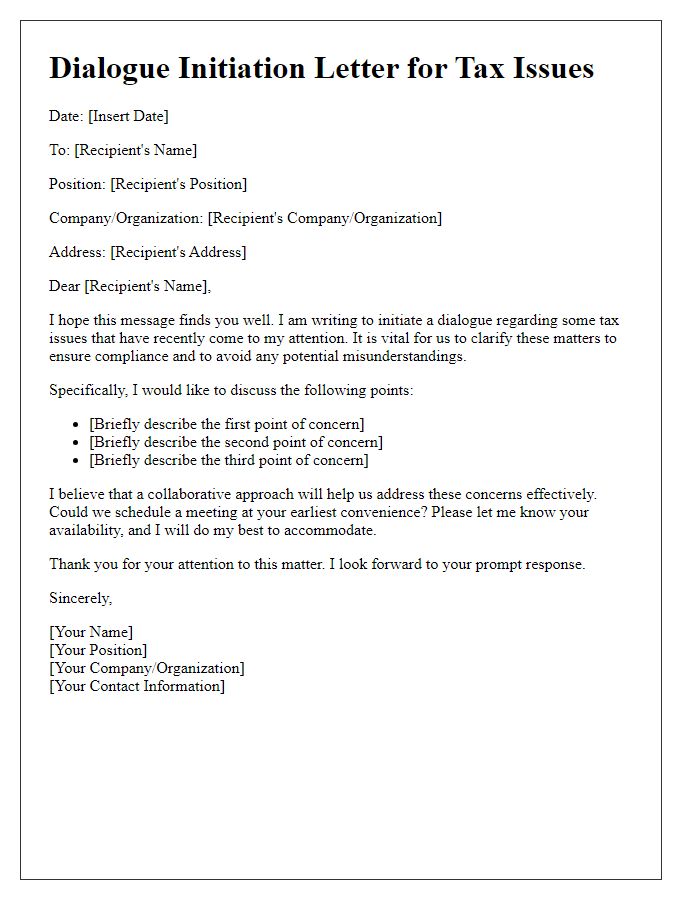

In the complex realm of tax disputes, clear identification of the parties involved is paramount. Taxpayers, including individuals or corporations, often find themselves at odds with government entities such as the Internal Revenue Service (IRS) or local tax authorities. The taxpayer's role encompasses responsibilities such as accurate income reporting and timely payment contributions, while the tax authority administers tax laws, conducts audits, and enforces compliance. Each party's interests can diverge significantly; taxpayers seek to minimize liabilities, while authorities aim to uphold tax regulations and collect revenues. Effective negotiation hinges on understanding these roles, facilitating constructive dialogue, and addressing potential areas of disagreement to reach an equitable resolution.

Specific disputed tax issues

Tax disputes arise frequently within financial frameworks, often involving complex interactions between businesses and government entities regarding taxation policies. A prevalent issue could include discrepancies in reported income, with businesses claiming lower earnings due to various expenses while tax authorities, such as the Internal Revenue Service (IRS) in the United States, assert higher figures based on audits or data analytics. Another contentious point might involve the classification of certain deductions, particularly in industries like construction or technology, where guidelines may not clearly define qualifying expenses, leading to potential adjustments in tax liabilities. Additionally, international tax matters, including transfer pricing regulations between multinational companies, often spark lengthy negotiations over compliance standards and obligations in different jurisdictions. Factors such as local laws, international treaties, and the evolving landscape of digital taxation further complicate these disputes, necessitating detailed discussions and clarifications to reach amicable resolutions.

Relevant financial and legal references

Tax disputes can arise due to various interpretations of financial laws and regulations, leading to potential liabilities for individuals and businesses. The Internal Revenue Code (IRC) specifies provisions such as Section 6013, which addresses the rules for filing joint tax returns by married couples, highlighting the importance of accurate reporting. Significant events, such as IRS audits, often stem from discrepancies in reported income or deductions, requiring careful financial documentation from taxpayers to resolve issues effectively. Legal precedents set by court cases, such as the 2015 Supreme Court decision in United States v. Windsor, underscore the need for compliance with evolving tax regulations, including those affecting same-sex couples. Proper negotiation techniques may involve referencing IRS Publication 556, which outlines the appeals process for individuals contesting IRS decisions, ultimately facilitating a fair resolution based on established financial and legal standards.

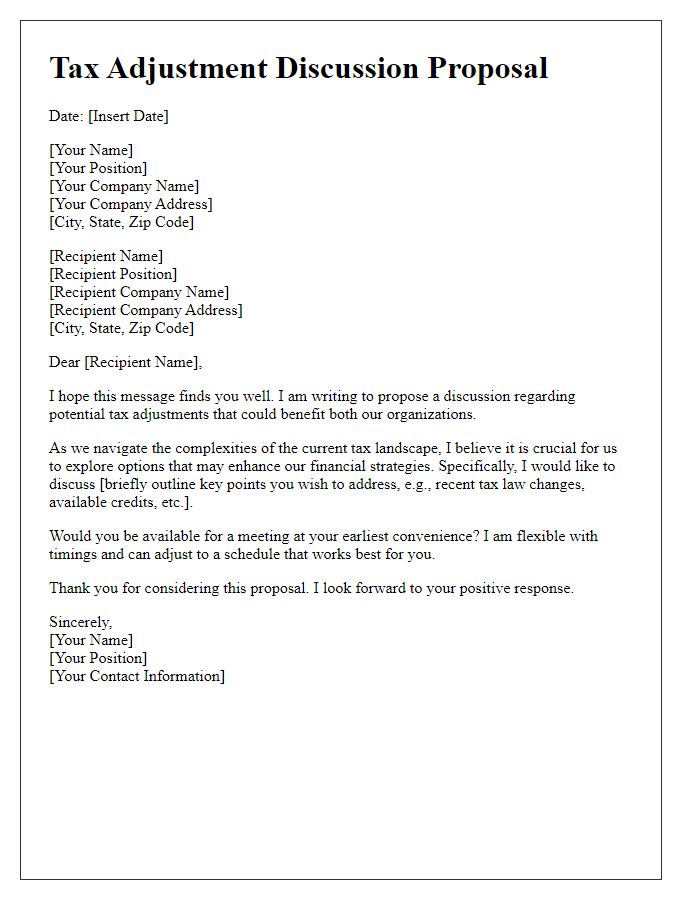

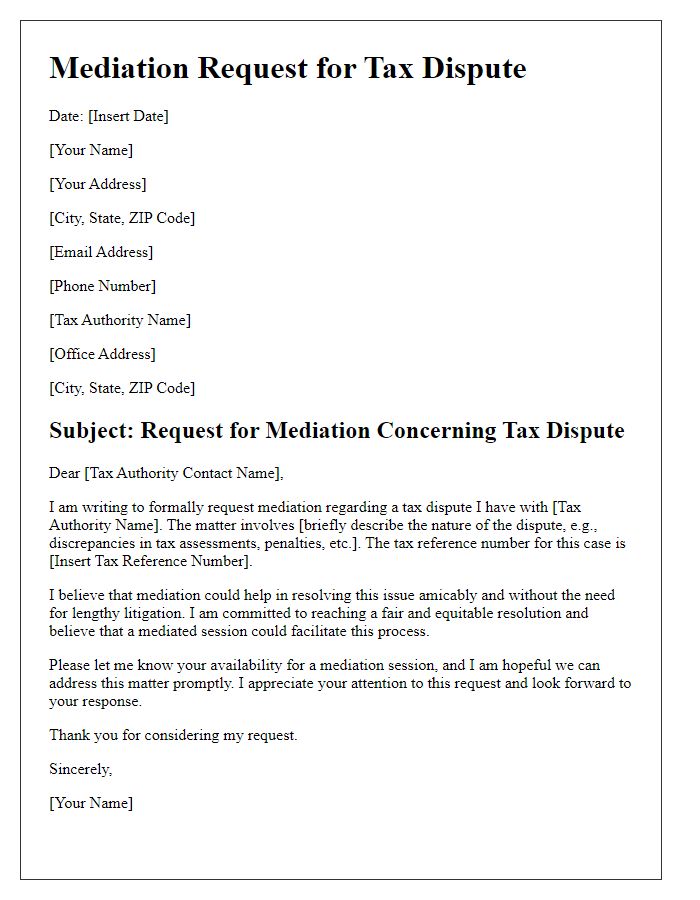

Proposed resolution or compromise

Tax disputes often arise from discrepancies between reported income and the views of tax authorities, leading to assessments of penalties and interest. Negotiation strategies can include a proposed resolution which may involve establishing a payment plan based on the taxpayer's financial situation. Assessing the taxpayer's income statement, with earnings possibly fluctuating around $75,000 annually, can provide grounds for a compromise. Furthermore, a waiver of penalties, due to reasonable cause such as unforeseen medical expenses exceeding $10,000, might be suggested to alleviate financial strain. In turn, demonstrating compliance with future tax obligations can foster goodwill and potentially result in favorable consideration from tax authorities.

Concise and polite tone

Tax disputes can arise from various discrepancies in reported income, deductions, or credits, impacting both individuals and businesses. Engaging with tax authorities, such as the Internal Revenue Service (IRS) in the United States or country-specific revenue agencies, is crucial for resolving these issues amicably. Taxpayers may dispute findings, which often involve specific amounts and tax years, requiring thorough documentation of financial statements, receipts, and correspondence. Open communication is essential to clarify misunderstandings, leading to potential settlements or adjustments that can facilitate compliance and prevent further legal repercussions. Taxpayers should maintain professionalism during negotiations, emphasizing the desire for a fair resolution while adhering to regulatory timelines and procedural requirements.

Comments