Are you feeling overwhelmed by the complexities of inheritance tax settlements? You're not alone; many people find navigating these financial obligations to be a daunting task. Thankfully, understanding your responsibilities can make the process much smoother and less stressful. Read on to discover some helpful tips and insights that will guide you through your inheritance tax settlement journey!

Clear subject line

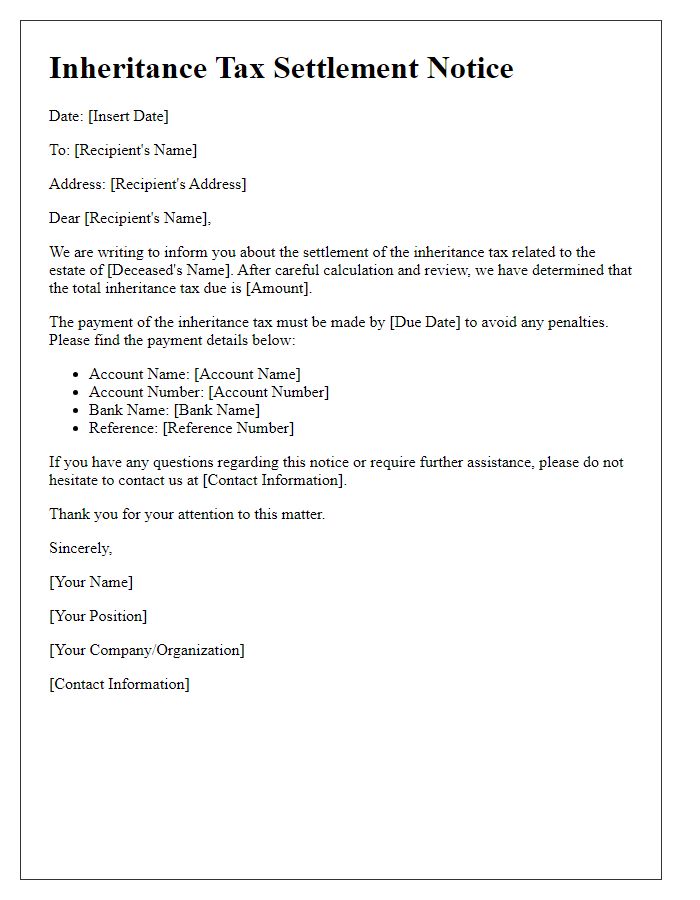

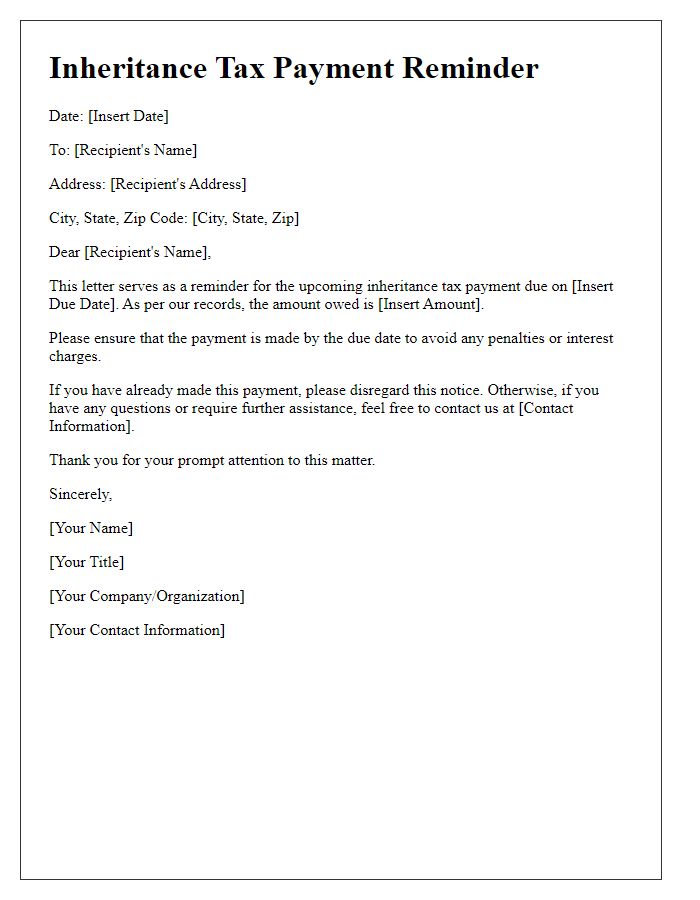

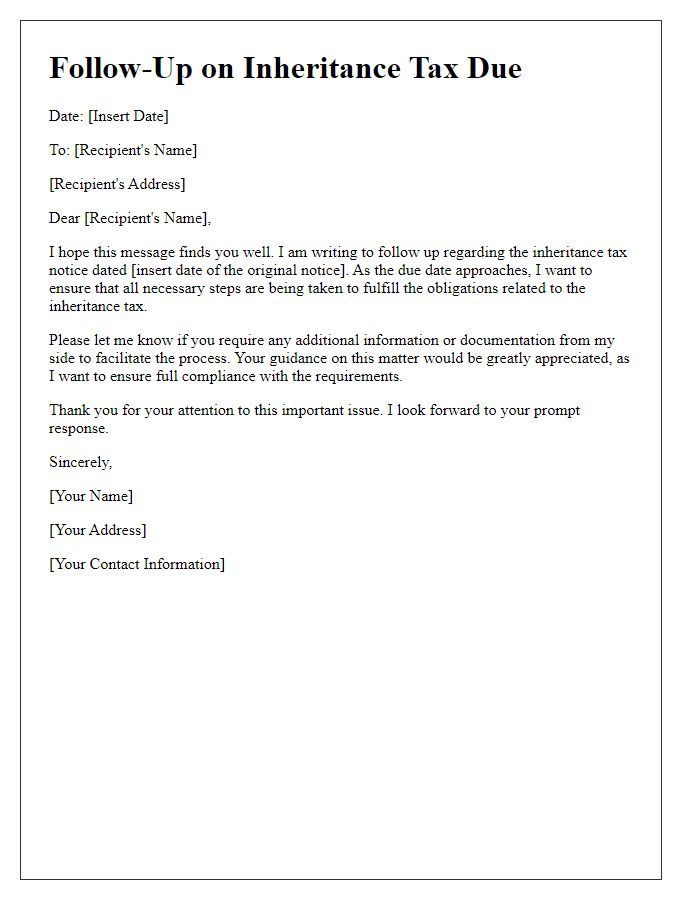

Inheritance tax settlement reminders serve to notify heirs, beneficiaries, or executors of their obligations pursuant to estate administration. These tax obligations, applicable following the death of an individual, must be settled in accordance with local laws without delay. In many jurisdictions, including the United Kingdom and the United States, specific deadlines exist, often around six months post-death, for tax payments to avoid penalties. Clear communication detailing the outstanding amount owed, relevant deadlines, and payment methods is crucial for compliance. Such reminders can also provide guidance on necessary documentation, such as estate tax returns or appraisals of estate assets. Additionally, professional assistance from tax advisors or estate planners is advisable to navigate complex tax regulations effectively.

Contact information

Inheritance tax settlements often require timely response to avoid penalties. A notification may include details about the estate, such as the decedent's name, date of death (often significant for tax calculations), and the estimated value of the estate (which may exceed thresholds triggering tax obligations). Contact information should encompass specific entities involved in the process, such as the local tax authority (for instance, HM Revenue & Customs in the UK), estate attorney, and financial advisors. Therefore, provide accurate phone numbers, email addresses, and physical addresses related to these professionals and authorities to ensure efficient communication regarding tax assessments and deadlines.

Deadline for response

Inheritance tax settlements require timely responses to avoid penalties. The final deadline for submission often falls within six months after the decedent's passing (typically marked by the probate court's ruling). Accurate valuation of estate assets (including real estate, stock portfolios, and personal belongings) is crucial, as miscalculations can lead to underpayment or overpayment of taxes. Ensure all documentation, such as Form IHT400 (often required for estates exceeding the nil rate band threshold of PS325,000), is completed correctly. Promptly addressing any inquiries from the HM Revenue and Customs (HMRC) can expedite the settlement process and minimize delays in inheritance distribution to beneficiaries.

Required documents list

Inheritance tax settlement requires careful preparation of key documents to ensure compliance with legal obligations. Essential items include the death certificate (official document verifying the deceased's passing, usually issued by a hospital or local authority), will (legal document outlining the deceased's wishes regarding asset distribution), estate inventory (detailed list of all assets, including property, bank accounts, and personal belongings), financial statements (bank statements, investment records, and any outstanding debts), and tax identification numbers (for both the deceased and heirs). Additional documents may include property deeds (legal documents proving ownership of real estate) and any relevant agreements (such as prenuptial or partnership agreements affecting asset distribution). Timely submission of these documents can facilitate a smooth settlement process and minimize potential penalties.

Consequences of non-compliance

Failure to comply with inheritance tax obligations can lead to severe financial penalties and legal repercussions. The UK government enforces strict inheritance tax laws, with rates reaching up to 40% on estates valued above PS325,000. Delays in filing the necessary documentation can result in interest accumulating at a rate of 3% above the Bank of England base rate, significantly increasing the amount owed over time. Furthermore, non-compliance may trigger investigations by HM Revenue and Customs (HMRC), which can uncover additional liabilities and result in further financial penalties. In extreme cases, personal representatives could face criminal charges for failing to report the true value of the estate, leading to legal proceedings and potential imprisonment. Regular reminders and diligent management of inheritance tax obligations are essential to avoid these negative outcomes, ensuring compliance contributes to smoother estate settlement processes and peace of mind for beneficiaries.

Comments