Hey there! If you've received a recent notice about tax rate changes, you're not alone. Many individuals and businesses are feeling a bit confused about how these adjustments might impact their finances. In this article, we'll break down what these changes mean and how you can prepare for them. So, let's dive in and explore the details together!

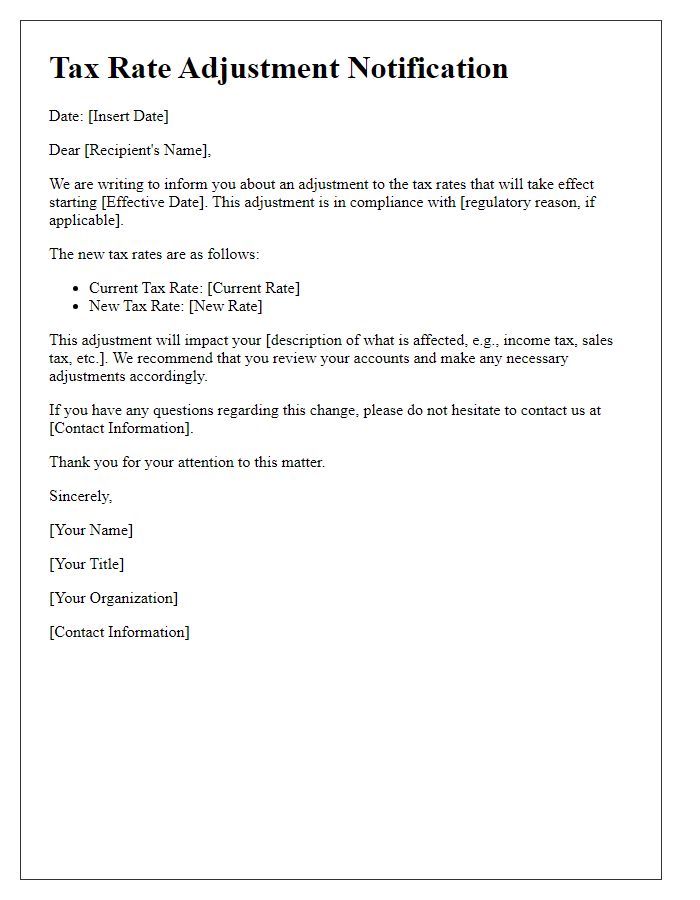

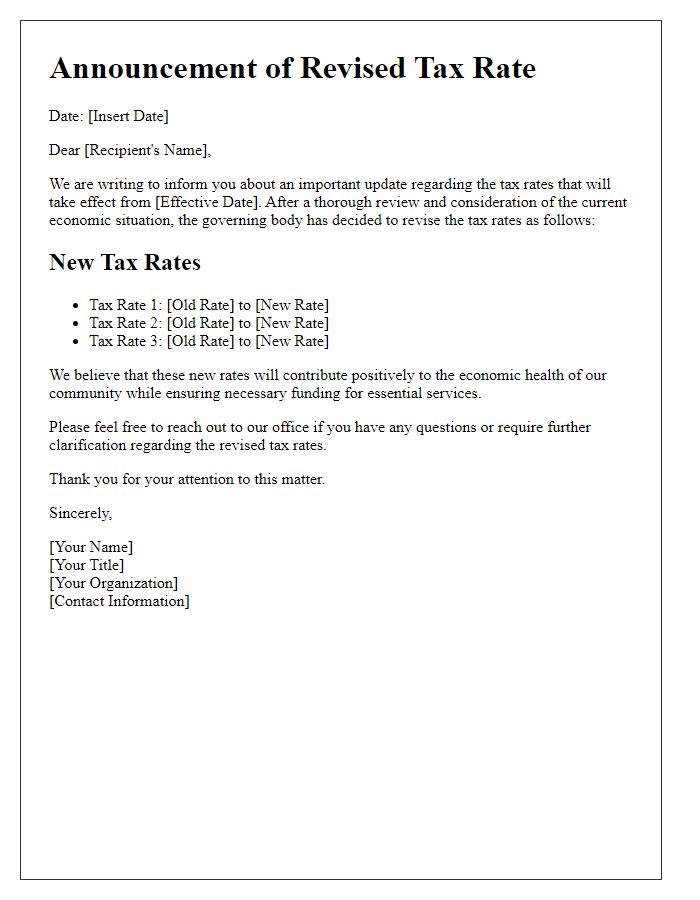

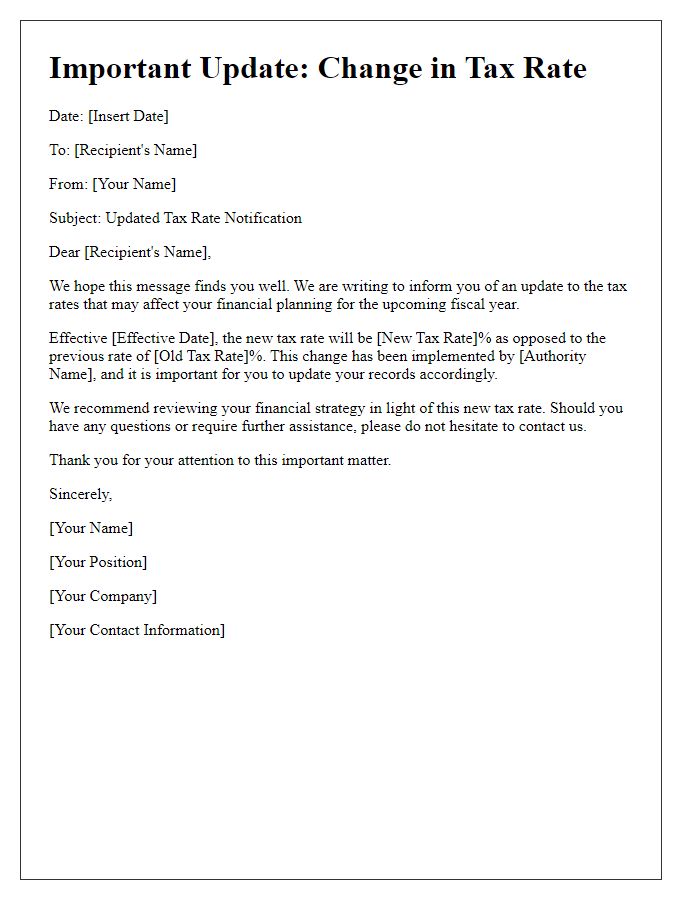

Clear subject line

Tax rate changes can significantly impact financial planning for businesses and individuals alike. Effective communication is essential for timely adjustments and compliance. Notices about changes, for instance, local property tax rates in New York City or sales tax rates in Los Angeles, must provide clear explanations of the new percentages, effective dates, and relevant regulatory authorities. Furthermore, details regarding potential implications for tax returns, deadlines for payments, and available resources for assistance can enhance understanding and preparation. Notifying stakeholders, such as small business owners or homeowners, ensures they can adapt to the new tax landscape proactively.

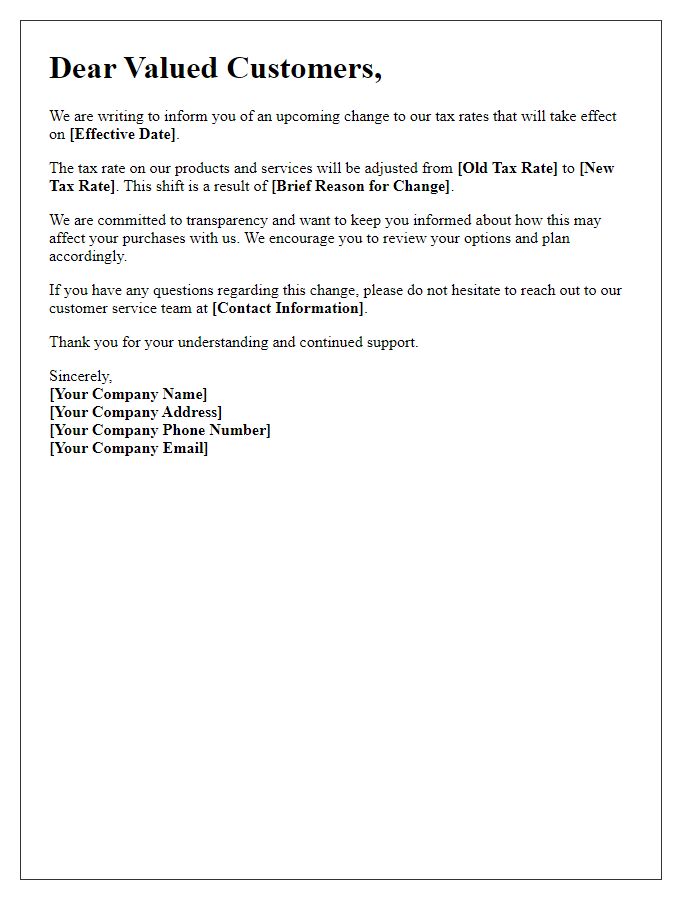

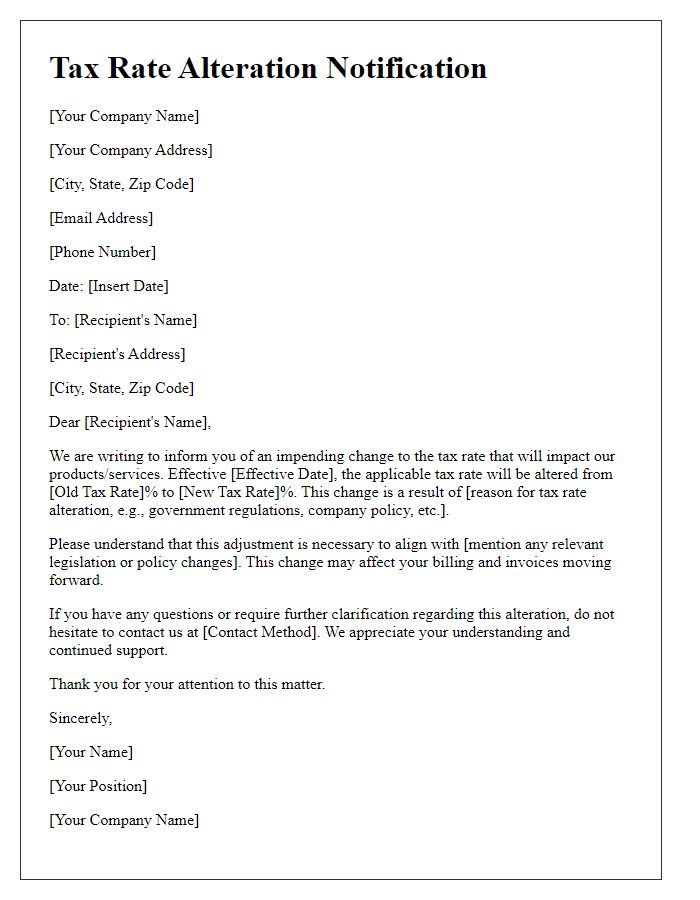

Salutation

Tax rate changes can significantly impact individuals and businesses. The announcement of these adjustments usually originates from fiscal authorities such as the Internal Revenue Service (IRS) in the United States. Effective dates, typically scheduled for January 1st, can alter income tax rates or sales tax percentages, affecting financial planning and budgeting for the fiscal year. Stakeholders, including taxpayers and accountants, need to stay informed to ensure compliance with new regulations, particularly in complex tax jurisdictions like California or New York where rates may fluctuate annually. Failing to account for these changes can result in penalties or overpayments.

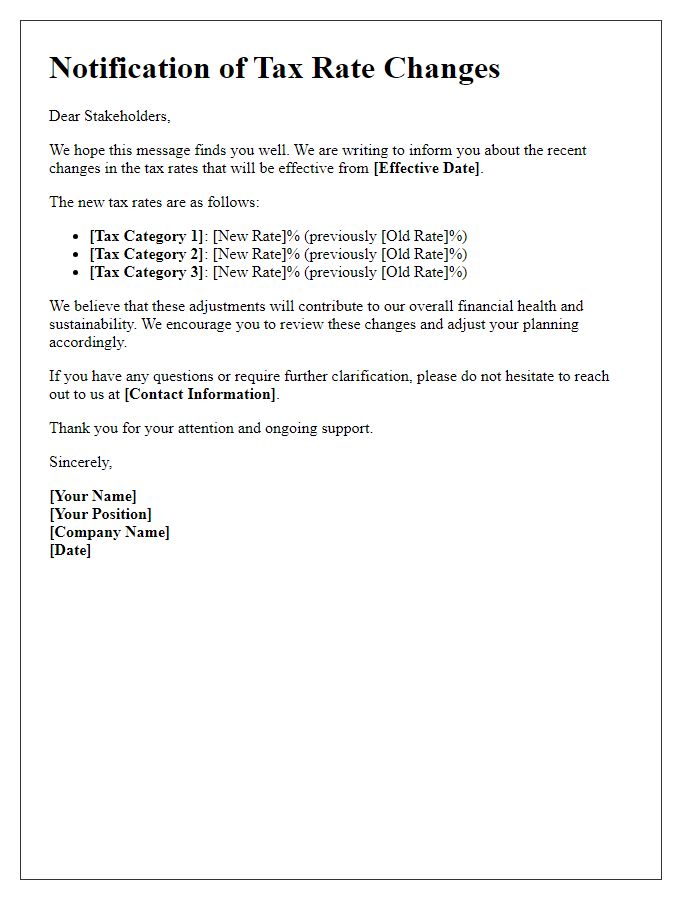

Purpose of notification

Notification of tax rate changes is essential for maintaining transparency between governmental tax authorities and citizens, ensuring that individuals and businesses are adequately informed about modifications in taxation policies. Tax rate adjustments can vary significantly based on locality, such as state (income, sales, property) or federal (capital gains, corporate taxes) regulations. For instance, a local government in California may adjust property tax rates by 1.25% to fund education initiatives, while federal adjustments could see capital gains tax move from 15% to 20%. Timely notifications allow taxpayers to recalibrate their financial planning strategies, meet compliance obligations, and avoid potential penalties associated with outdated tax information.

Detailed explanation of changes

The notification regarding tax rate changes, effective from January 1, 2024, outlines significant alterations to the taxation structure established by the Federal Government of the United States. The corporate tax rate will increase from 21% to 27%, impacting companies with a revenue exceeding $5 million, while small businesses with revenues under that threshold will maintain a reduced rate of 15%. Additionally, sales tax rates will vary by state, with California increasing its state sales tax to 8.25%, up from 7.25%, and New York adopting an additional local sales tax for counties, raising the total to 8.875%. This adjustment aims to enhance public funding for infrastructure projects across urban areas, such as New York City and Los Angeles, ultimately addressing growing demands for public services. Property tax assessments will also see a rise, with a proposed increase of 2% in metropolitan regions, predominantly impacting residential owners in urban districts. Property owners are advised to review their assessments by the deadline of March 15, 2024, to ensure compliance with the new regulations.

Contact information for inquiries

Tax rate adjustments for the fiscal year 2024 have been implemented, affecting property tax rates across various municipalities. The City of Chicago, for instance, has increased the residential property tax rate by 1.5%, while New York City has introduced a 2% increase for commercial properties. Residents and business owners should prepare for these changes reflected in their upcoming tax bills. For questions, stakeholders are encouraged to reach out to their local tax assessor's office, which is typically available from 9 AM to 5 PM on weekdays, providing assistance with any inquiries regarding the new rates. Relevant contact information typically includes phone numbers, email addresses, and office locations for easy accessibility.

Comments