Are you feeling a bit overwhelmed about scheduling your tax audit appointment? You're not aloneâmany individuals find the process daunting and confusing. But don't fret! In this article, we'll walk you through a simple letter template that makes setting up your tax audit appointment a breeze. So, grab your pen and let's get started; you won't want to miss the helpful tips ahead!

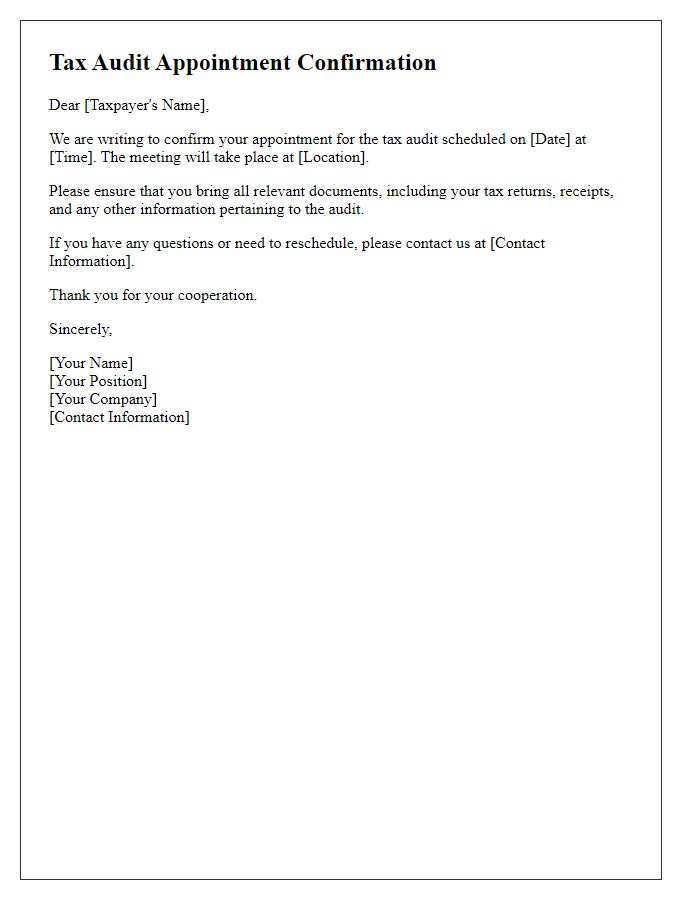

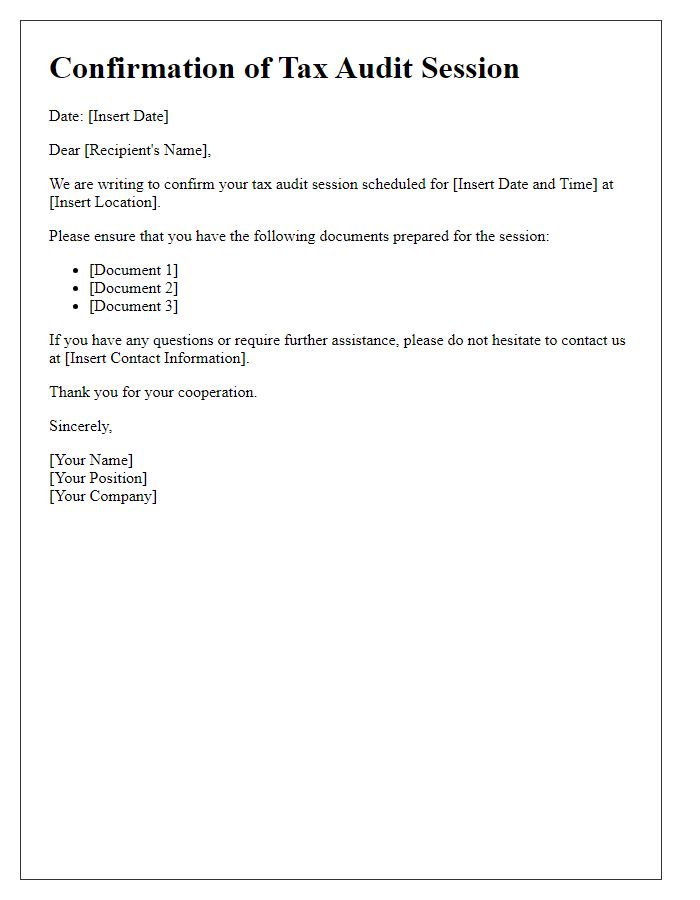

Official greeting and taxpayer identification.

A tax audit appointment can be a critical event for any taxpayer, often requiring careful scheduling with the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States. The taxpayer identification number (TIN), a unique nine-digit number, is crucial for the auditing process, serving as the primary identifier for individuals or businesses during the audit. For larger corporations, additional identifiers like the Employer Identification Number (EIN) may be used. It's essential to include the official greeting, which sets a formal tone for correspondence, ensuring professionalism and clarity. The scheduling details, including possible dates and times for the audit, should be precise to facilitate efficient planning and avoid delays in the audit process. Proper documentation and timely communication can significantly impact the outcome and experience of the audit appointment.

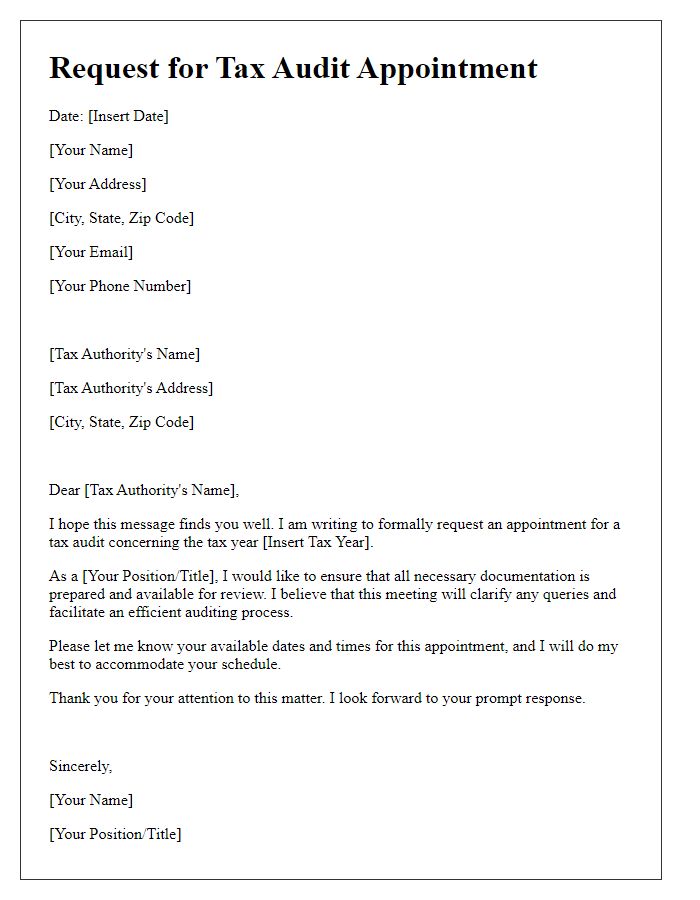

Purpose and details of the audit.

A tax audit appointment serves as a critical process for assessing compliance with tax laws and regulations. Tax audits typically involve reviewing financial statements, receipts, and transaction records to ensure accuracy in reported income and deductions. The audit may concern a specific tax year, often within a three-year examination period, depending on the nature of discrepancies or random selection. Auditors may require access to financial records, bank statements, and supporting documentation to validate claims. The appointment may take place at designated offices, such as the Internal Revenue Service (IRS) in the United States, or through virtual platforms depending on circumstances. Essential details surrounding the audit purpose, expected duration, and required documents will be communicated to the taxpayer ahead of the appointment, ensuring transparency and preparedness.

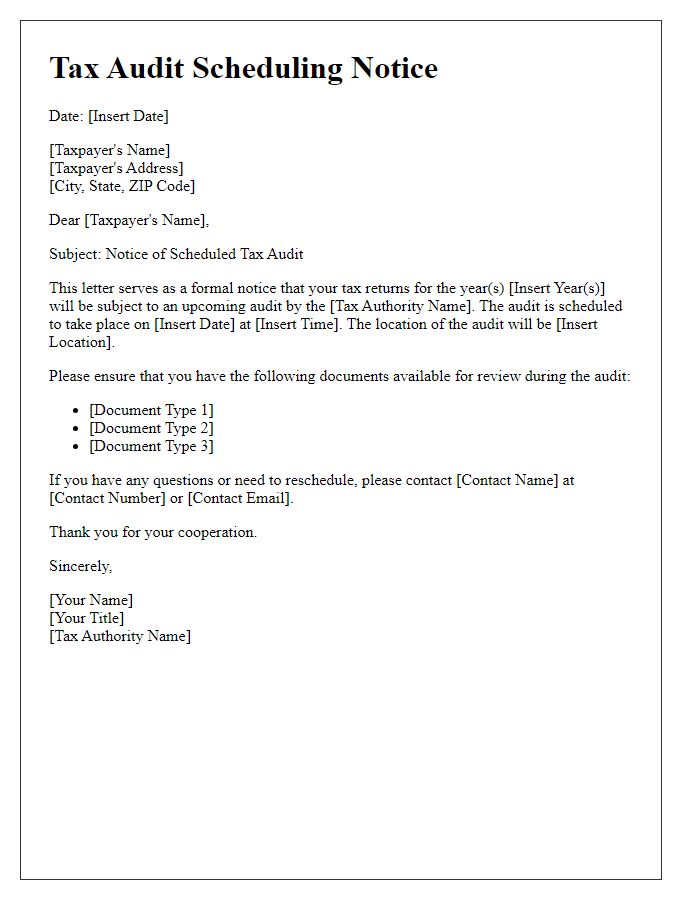

Proposed date, time, and location.

To schedule a tax audit appointment, it is important to select a proposed date, time, and location. Ensure the date falls within the designated audit period, which typically spans several weeks leading up to the filing deadline. Optimal time slots, such as late mornings or early afternoons, can enhance focus and productivity during discussions. Choose a location that is convenient for all parties involved, such as an office meeting room or a neutral venue that offers private space for sensitive discussions. Availability confirmation from all parties is vital to ensure smooth coordination for this critical meeting.

Required documents and preparation instructions.

Tax audits require meticulous preparation to ensure compliance and accuracy. Documents such as prior year tax returns (including 1040 forms for individuals or 1120 for corporations), W-2 and 1099 forms (income verification from employers or contractors), bank statements (detailed records of all transactions), and receipts (evidence of deductible expenses) should be gathered. Additionally, note the specific appointment date and time with the auditing agency (such as the Internal Revenue Service, IRS) to avoid any scheduling conflicts. Prepare any correspondences related to the audit (notifications from IRS concerning the audit process) and create a binder to organize these documents systematically. Consultation with tax professionals (certified public accountants or tax advisors) might be necessary to navigate complex areas. Remember to bring identification (such as a government-issued ID) and power of attorney documentation if applicable.

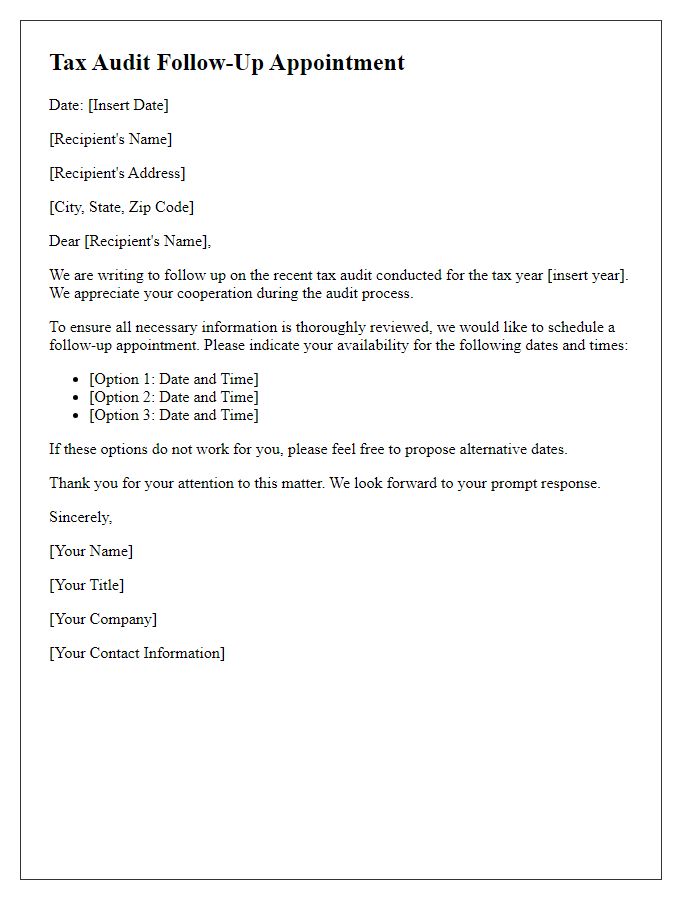

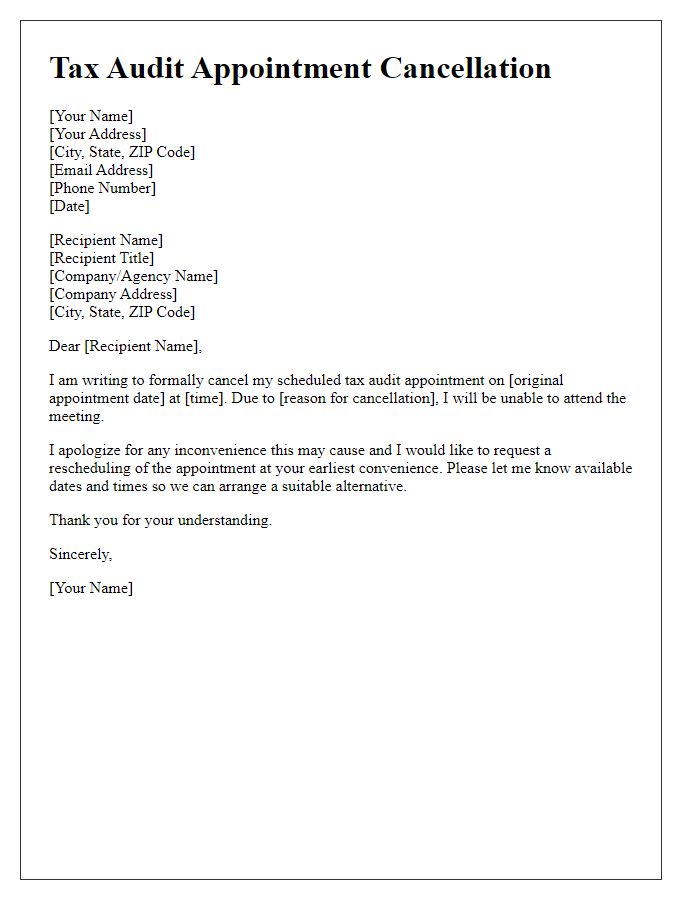

Contact information for queries and rescheduling.

During a tax audit, scheduling appointments effectively is crucial for smooth communication between taxpayers and tax officials. Tax audit appointments often require specific documentation, including financial records, receipts, and previous tax returns. The appointment typically takes place at designated Tax Offices, such as the Internal Revenue Service (IRS) locations in major cities like Washington D.C. Timely communication is essential; therefore, providing clear contact information for any queries or necessary rescheduling is vital. Taxpayers can reach out to official helplines or designated email accounts for queries, ensuring quick response times, usually within 24 to 48 hours during business days. Rescheduling requests must be made at least a week in advance to accommodate the auditor's calendar.

Comments