Are you looking to navigate the often tricky waters of business tax registration? Getting your tax approval can feel daunting, but it doesn't have to be! In this article, we'll break down the essential steps and key considerations to help you streamline the process. So, let's dive in and uncover everything you need to know for a successful registration experience!

Business Name and Identification

A successful business tax registration approval process requires the submission of specific documentation, including the Business Name, which is the legal name registered with local authorities or the Secretary of State, and the Business Identification Number (BIN), a unique identifier assigned to the business for tax purposes. This identification process may vary by jurisdiction; for instance, in California, businesses must obtain an Employer Identification Number (EIN) from the Internal Revenue Service for tax filings, while some states require additional state-specific registration numbers. Timely completion of all required forms, such as Form SS-4 for EIN, and adherence to local regulations are crucial to avoid delays in processing and ensure compliance with tax obligations.

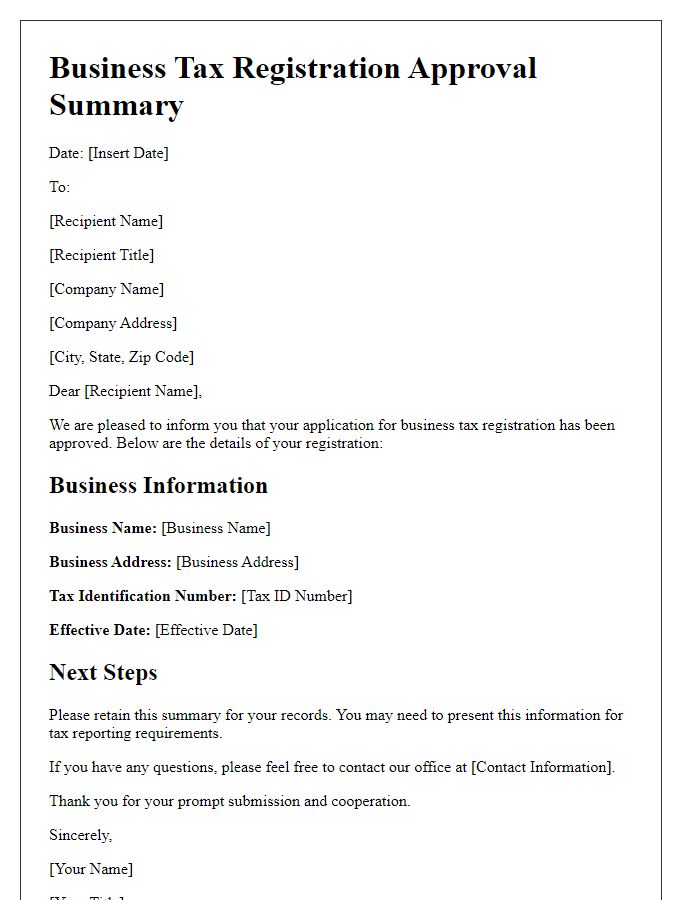

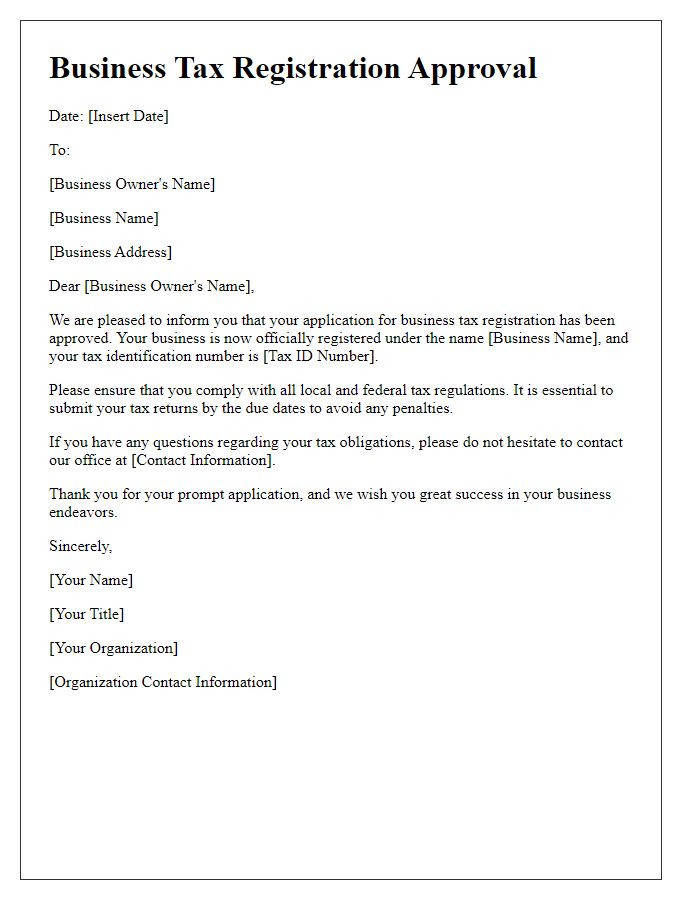

Approval Confirmation Statement

Business tax registration approval confirms compliance with local tax regulations and allows businesses to operate legally within jurisdictions. Approval typically includes unique identification numbers, such as Employer Identification Number (EIN) or State Tax Identification Number, enabling the tracking of tax obligations. Official approval documents are often issued by government entities like the Internal Revenue Service (IRS) in the United States or the local tax authority. Timely registration ensures eligibility for business tax deductions and credits, enhancing financial management and accountability. Additionally, maintaining good standing through regular updates to the registration prevents penalties and supports streamlined operations.

Tax Registration Number

Tax registration plays a crucial role in the operations of businesses, enabling them to legally conduct transactions and fulfill their tax obligations. A Tax Registration Number (TRN) is essential for identifying businesses within the tax system, specifically in jurisdictions like the United States or United Kingdom. Obtaining a TRN often involves submitting various forms and documentation to the applicable tax authority, such as the Internal Revenue Service (IRS) in the U.S. or HM Revenue and Customs (HMRC) in the U.K. Upon approval, businesses gain the ability to collect taxes from customers, claim expenses, and thus maintain compliance with tax regulations, ultimately aiding in their financial stability and growth.

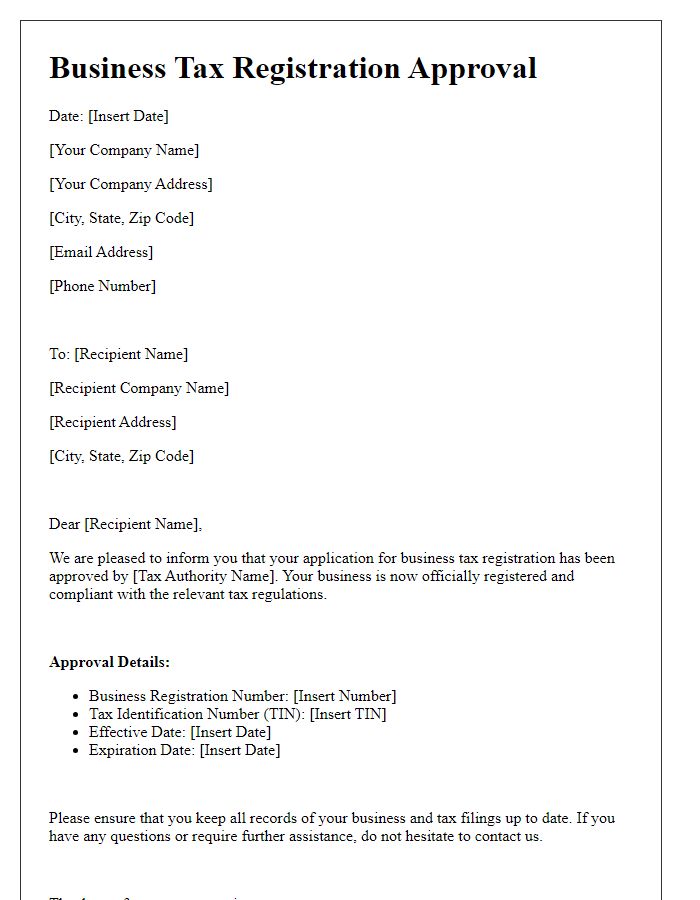

Obligations and Compliance Guidelines

Business tax registration approval involves understanding key obligations and compliance guidelines set by tax authorities, such as the Internal Revenue Service (IRS) in the United States. Businesses must secure a Federal Employer Identification Number (EIN) to manage employee taxes and properly report income. Registration typically includes filing necessary forms like the IRS Form SS-4, which gathers essential business information, including legal structure and number of employees. Adherence to local, state, and federal tax laws is mandatory, with penalties for non-compliance potentially leading to fines or legal issues. Keeping accurate financial records (including invoices, receipts, and payroll documents) from the outset ensures both tracking of tax obligations and ease during audits. Timely submission of quarterly estimated tax payments is crucial to avoid underpayment penalties while maintaining good standing with tax authorities.

Contact Information for Inquiries

Contact information for inquiries regarding business tax registration approval should include essential details such as the phone number (commonly a dedicated line) and email address for quick communication. Physical address (including city and state) of the tax office is crucial for formal correspondence or in-person visits. Response time expectations (typically within 7 to 30 business days) may enhance clarity for applicants. Additionally, providing a specific contact person's name (including their title) may foster a more personal connection and ease the inquiry process for businesses seeking assistance.

Comments