Are you feeling overwhelmed by the complexities of business expense tax deductions? You're not aloneâmany entrepreneurs find navigating the intricacies of tax regulations to be a daunting task. In this article, we'll walk you through some essential pointers, helpful tips, and even sample letter templates to streamline your inquiry process. So, grab a cup of coffee and join us as we break it all down for you!

Business purpose justification

When conducting an expense tax deduction inquiry, clarity on business purpose justification is paramount. Expenses must align with activities directly related to business operations, such as travel costs for client meetings or equipment purchases necessary for production. Supporting documentation, like receipts (which should ideally detail the date, amount, and purpose of the transaction) and relevant invoices, reinforces claims. For travel expenses, guidelines recommend keeping records of destinations, mileage logged, and meetings attended. Proper categorization, such as office supplies, utilities, or subscription services for software, aids in distinguishing between personal and business use, ensuring compliance with tax regulations set forth by the IRS. Specificity in justifying expenses enhances the likelihood of successful deduction claims.

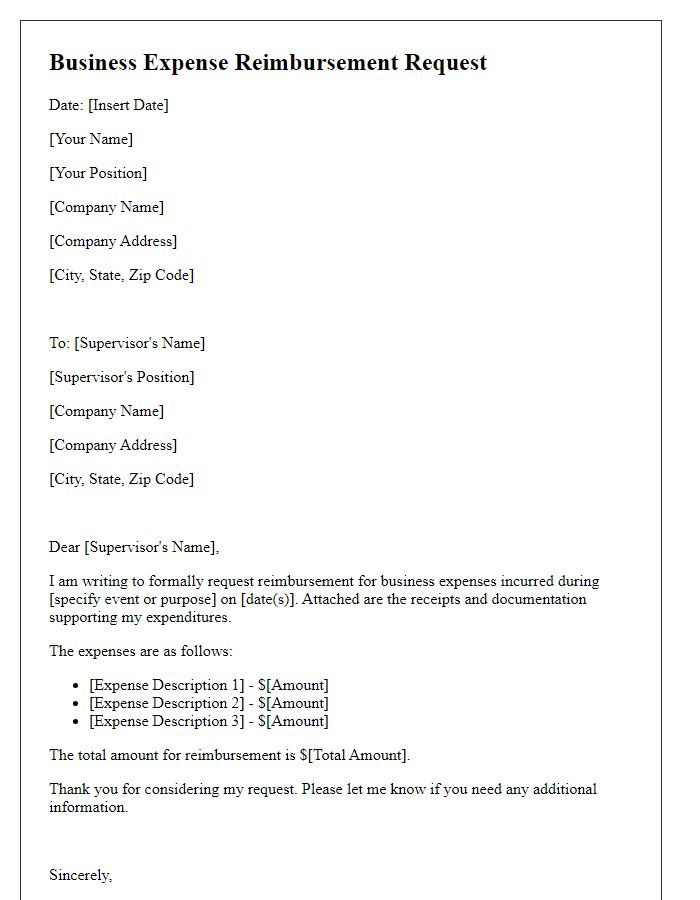

Detailed expense breakdown

A business expense tax deduction inquiry typically requires a detailed expense breakdown to ensure compliance with IRS regulations. Detailed breakdowns frequently include categories like travel expenses (airfare, lodging, meals), office supplies (stationery, technology), utilities (electricity, internet services), and employee wages. Each category should include supporting documents such as receipts, invoices, and credit card statements to validate the expenses incurred during specific business activities. It's crucial to maintain records that indicate the purpose of each expense, ensuring they align with the criteria for tax-deductible expenses, such as ordinary and necessary costs required to operate your business effectively. This detailed documentation aids in substantiating claims during tax audits or inquiries by the IRS, ensuring adherence to tax laws and maximizing deduction potential.

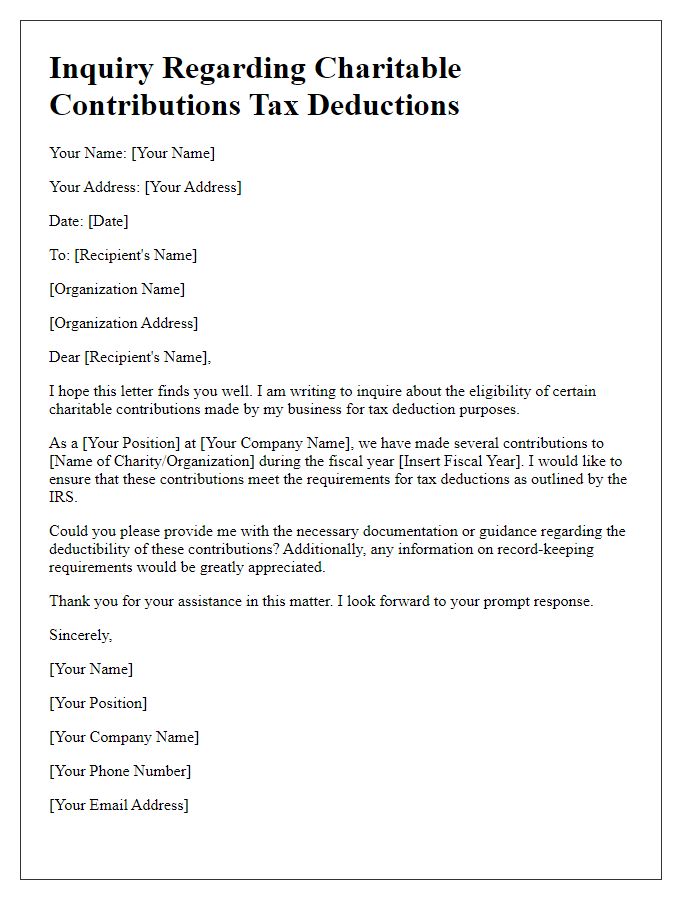

Relevant tax codes and regulations

Inquiring about business expense tax deductions involves understanding relevant tax codes and regulations that govern deductions. The Internal Revenue Service (IRS) in the United States outlines guidelines under Section 162 of the Internal Revenue Code (IRC), which allows businesses to deduct ordinary and necessary expenses incurred during operations. These can include expenses for supplies, utilities, salaries, and travel. Additionally, the IRS Publication 535 provides specific information regarding business expenses, including limitations on certain deductions such as meals and entertainment. Compliance with local state regulations is crucial, as each state may have its own rules regarding allowable deductions. Keeping thorough records, such as receipts and invoices, is essential for substantiating claims during tax filings or audits. Consulting a certified public accountant (CPA) can ensure adherence to all relevant tax codes and help maximize eligible deductions for businesses.

Documentation and receipts

For business expense tax deductions, proper documentation and receipts play a crucial role in compliance with tax regulations. The IRS (Internal Revenue Service) requires clear proof of expenses exceeding $75 to qualify for deductions, including itemized receipts from purchases or service invoices. Adequate records must also include the date of the transaction, the amount spent, the business purpose, and the names of involved parties. Maintaining electronic copies of receipts can safeguard against loss or damage, ensuring better tracking of expenses, particularly for small business owners or freelancers, who may require substantiation during an audit. Additionally, organized documentation allows for streamlined preparation for tax filings, maximizing eligible deductions and minimizing the risk of errors or disputes with tax authorities.

Contact information for follow-up

Businesses often seek clarification regarding the requirements for tax deductions related to operational expenses. The IRS provides guidelines that detail eligible deductions, which include costs directly associated with running a business, such as supplies, employee wages, and advertising. A recent survey indicated that approximately 71% of small business owners claimed deductions, leading to significant tax savings, estimated at around $10,000 annually on average. It is essential to keep accurate records, including receipts and invoices, to substantiate claims during audits. For specific inquiries, accountants or tax professionals can provide individualized guidance, ensuring compliance with relevant tax codes in places like California or New York.

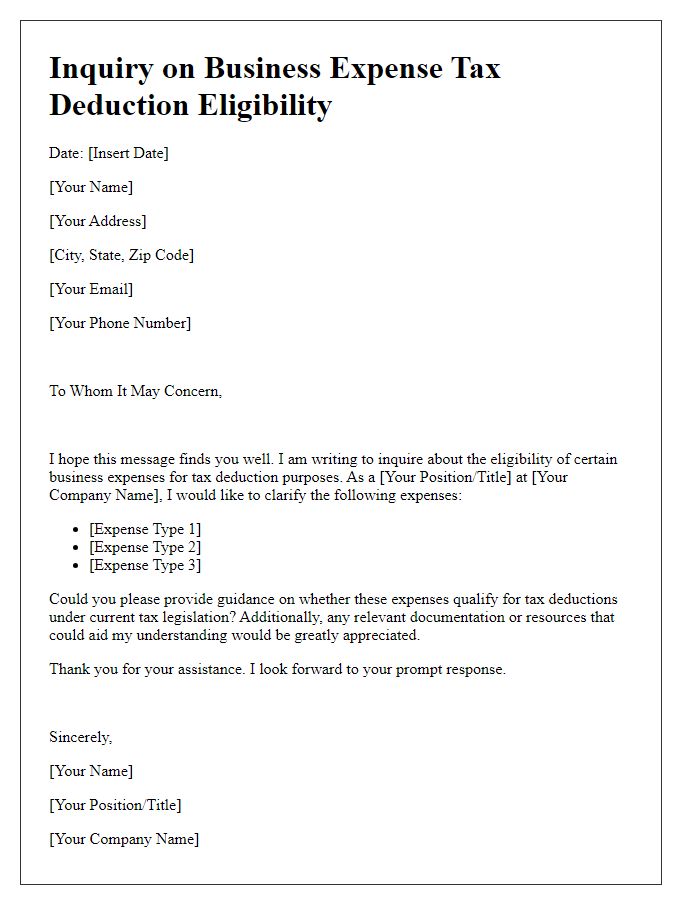

Letter Template For Business Expense Tax Deduction Inquiry Samples

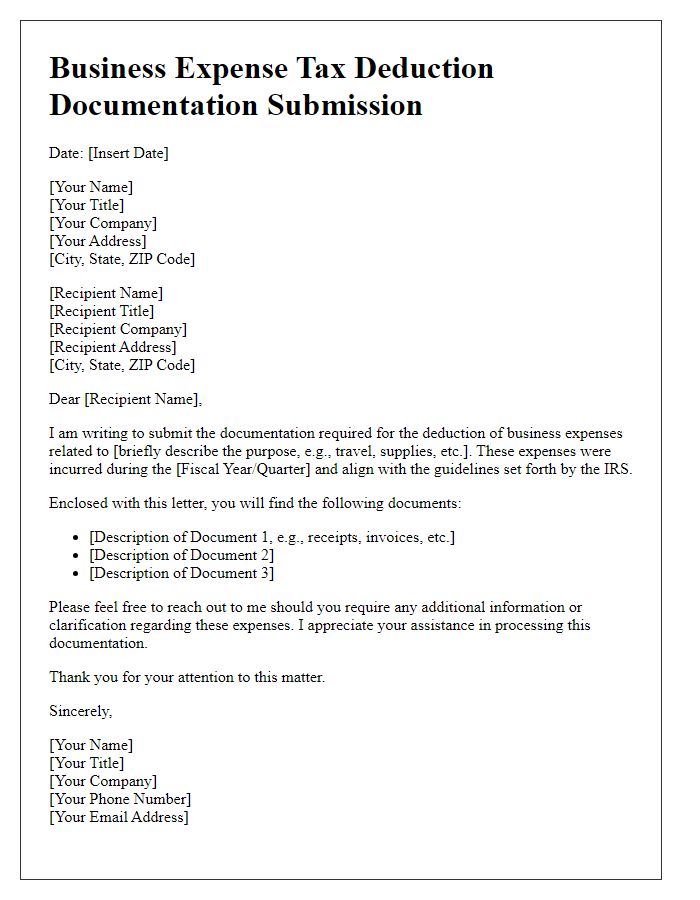

Letter template of business expense tax deduction documentation submission

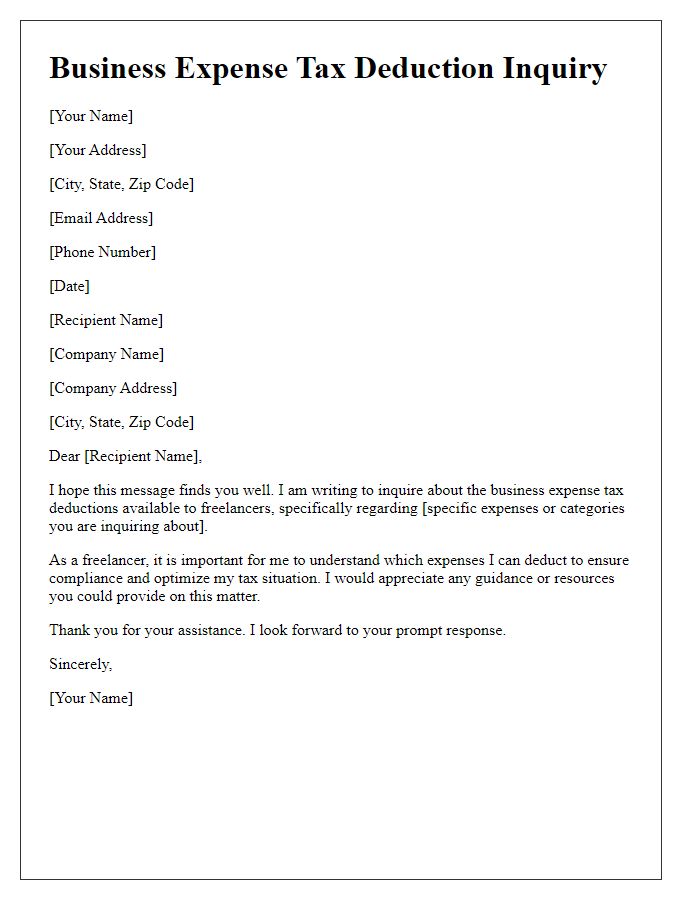

Letter template of business expense tax deduction inquiry for freelancers

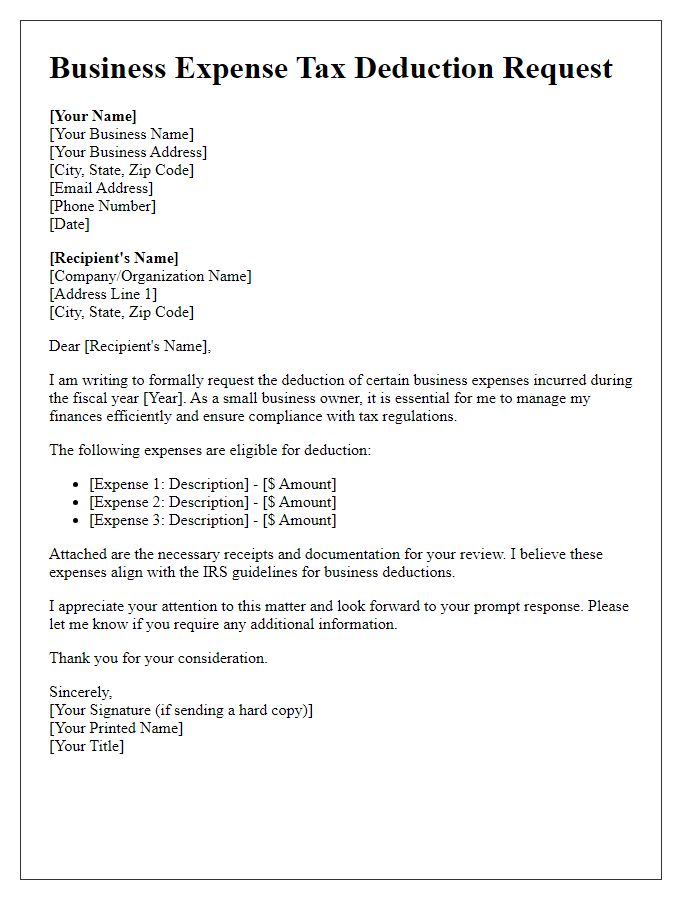

Letter template of business expense tax deduction for small business owners

Comments