Are you looking to make a positive impact while also benefiting from potential tax credits? Charitable donations not only help those in need but can also provide you with financial incentives come tax season. Understanding how to properly document and report your contributions can maximize these benefits. If you'd like to learn more about effectively navigating charitable donation tax credits, keep reading!

Donor's full name and address

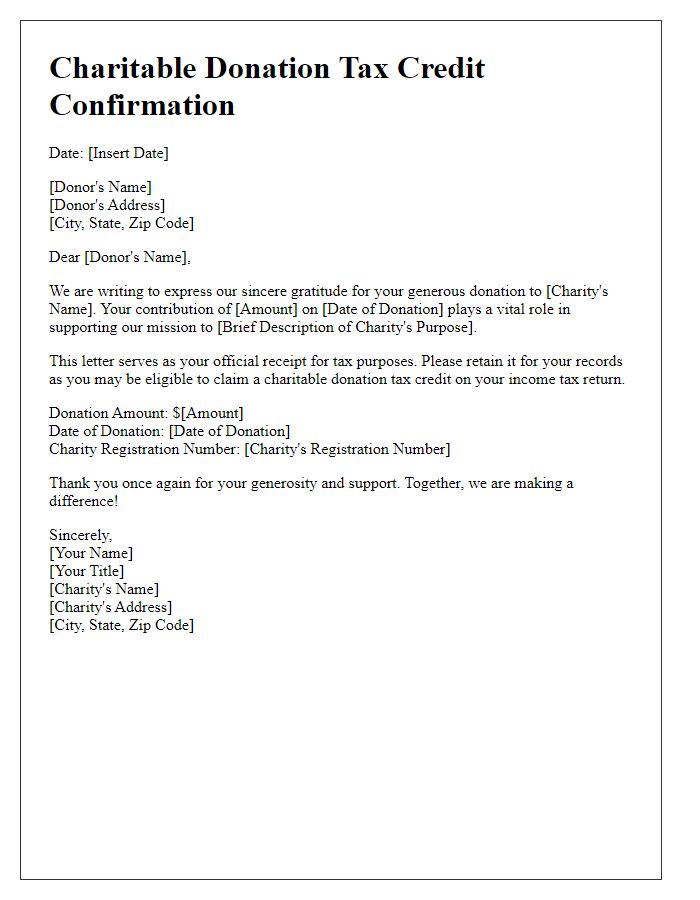

Charitable donations provide a significant tax advantage, with individuals eligible for tax credits based on contributions. Specific organizations, such as registered charities or qualified non-profit entities, can receive monetary support, often marked by a limited donation amount per year (e.g., $10,000 maximum in some jurisdictions). Donors should ensure record-keeping, including receipts or acknowledgment letters, to substantiate contributions during tax filing. Additionally, charitable organizations must provide their registration number for donors to claim the tax credit accurately. The impact of charitable donations extends beyond tax benefits, supporting vital community services, educational initiatives, and crucial health programs that rely on generous contributions to operate effectively.

Donation amount and date

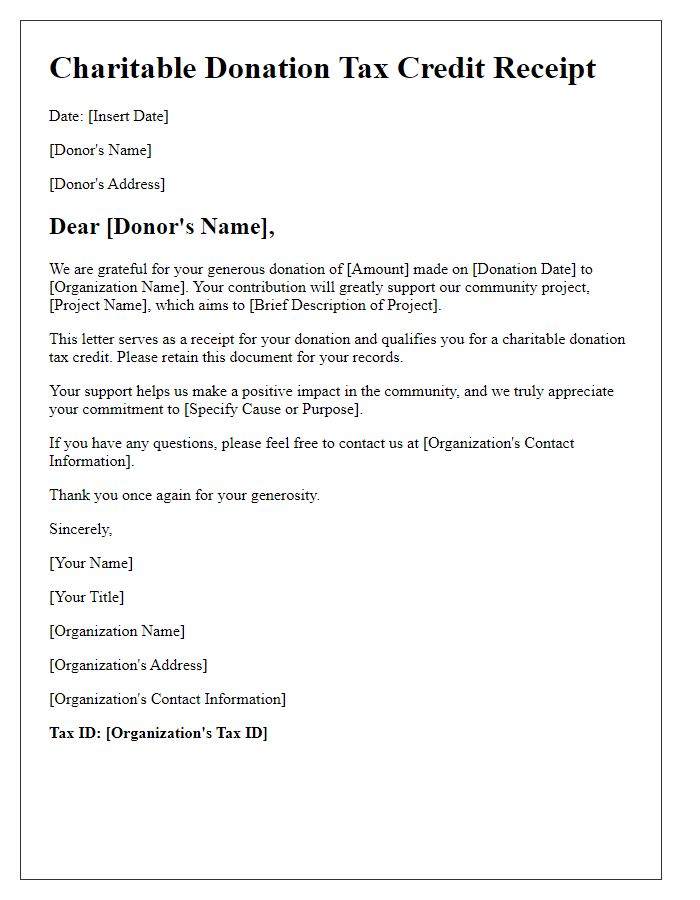

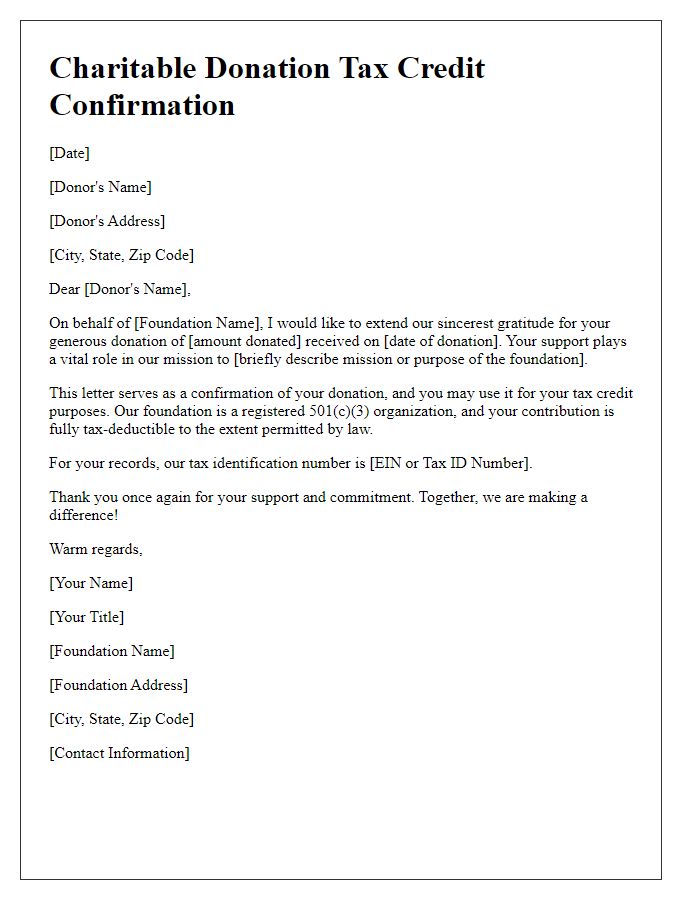

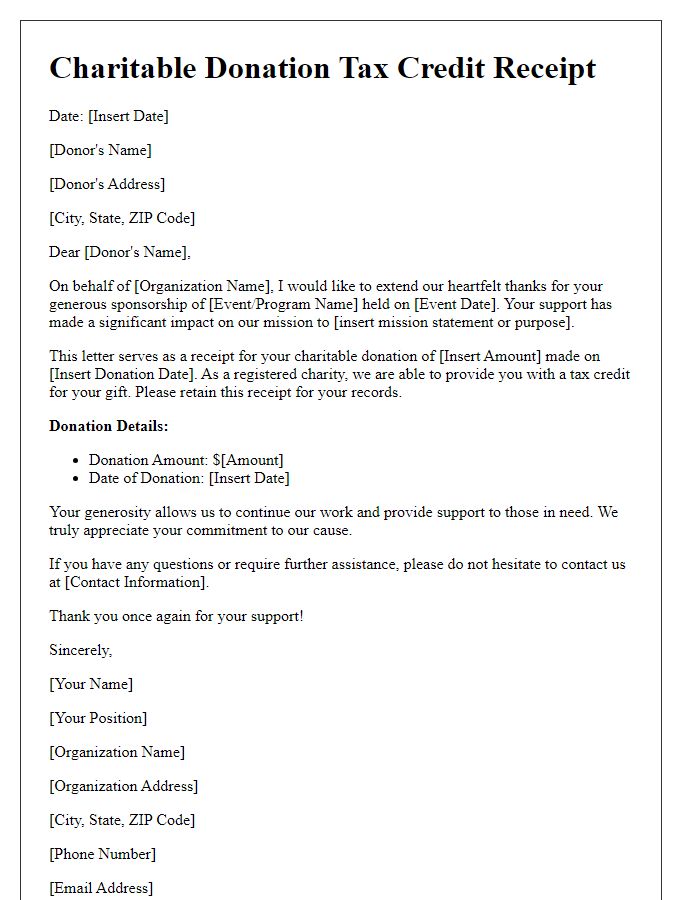

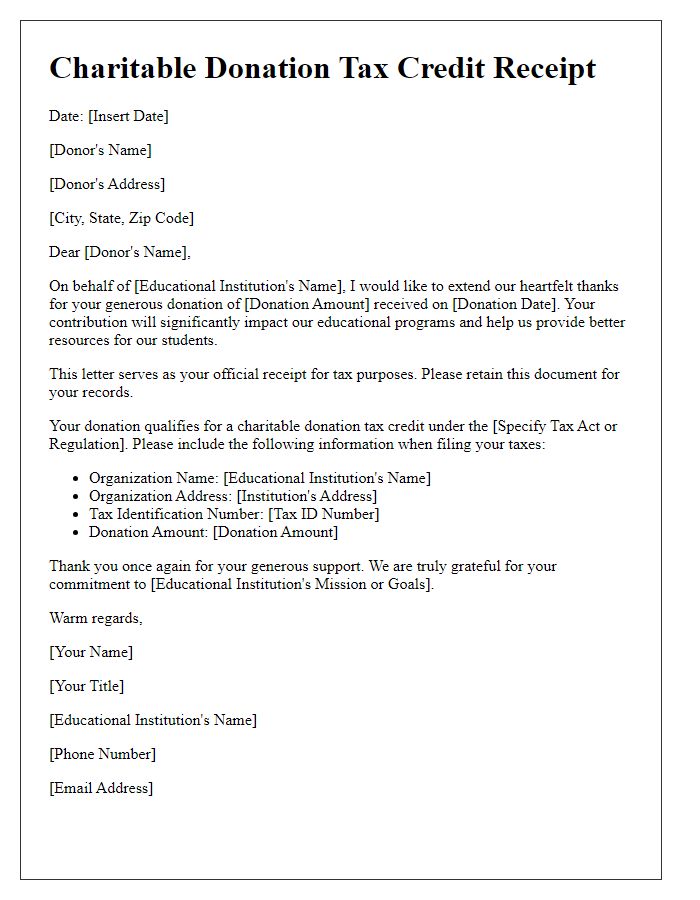

Charitable organizations often issue donation receipts that specify the donation amount, date of contribution, and the charity's official name. Donations made to registered entities (e.g., 501(c)(3) organizations in the United States) are eligible for tax deductions. For example, a donation of $500 made on December 15, 2023, to the Hope Foundation, a nonprofit focused on providing education to underprivileged children, can be claimed during tax filing. Proper documentation, including the charity's tax identification number, is essential for claiming the charitable donation tax credit on your income tax return.

Tax-exempt status and organization EIN

Donating to a charitable organization not only helps those in need but also allows donors to benefit from tax deductions under Section 501(c)(3) of the Internal Revenue Code. A valid tax-exempt organization must possess a unique Employer Identification Number (EIN), which serves as a distinct identifier for tax purposes. This number, typically nine digits long, is crucial for filing tax returns and is often required when claiming charitable contribution deductions. Donors should ensure that the organization is registered with the IRS and has maintained compliance to preserve its tax-exempt status. Proper documentation, such as a receipt or donation letter, should include the organization's EIN and confirm the donation amount to facilitate the tax credit claiming process during tax season.

Statement of no goods or services received

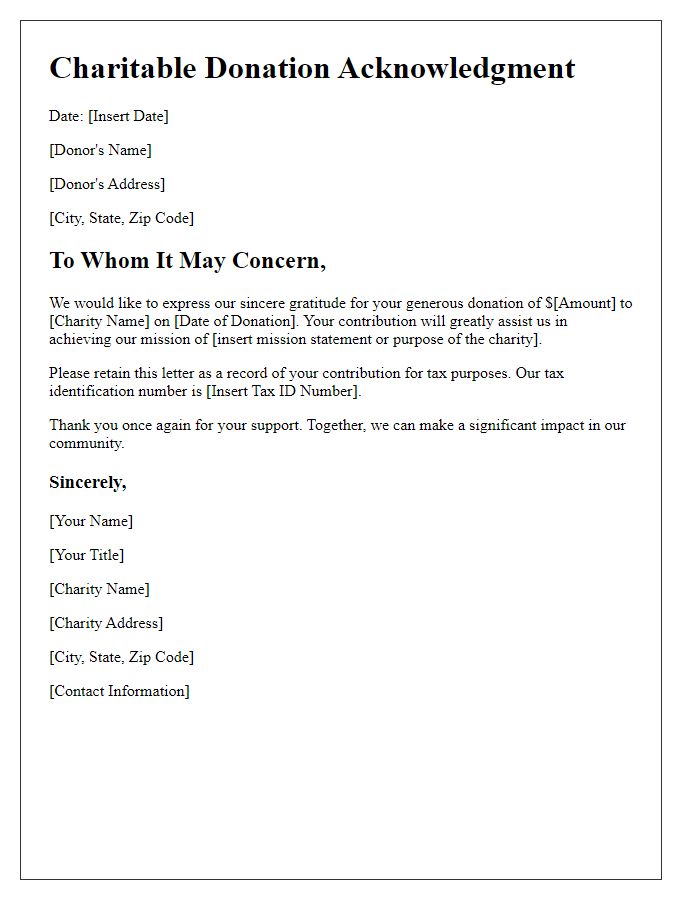

Charitable organizations provide vital support to communities, and donations play a crucial role in sustaining their operations. A Statement of No Goods or Services Received serves as an important document for donors, confirming that contributions made, such as monetary gifts or in-kind donations, did not result in the exchange of goods or services. This statement is essential for tax purposes, allowing donors to claim charitable donation tax credits. Organizations typically issue this statement at the end of the fiscal year, ensuring compliance with IRS regulations outlined in Section 170 of the Internal Revenue Code. Donor awareness about these requirements enhances transparency and encourages continued support for non-profit entities striving to make a difference.

Organization's contact information and authorized signature

Charitable donations to qualified organizations often provide tax benefits for individuals and corporations. The process begins with a donation receipt issued by the organization, which includes essential details such as the organization's name, address, and tax identification number (EIN). An authorized representative, typically the organization's director or treasurer, must sign the receipt, confirming the donation's authenticity. For example, a nonprofit organization located in San Francisco, California, with an EIN of 123-4567890, would issue a receipt that explicitly states the donation amount, date, and purpose, vital for tax credits under IRS guidelines. This documentation is crucial during tax season to support deductions and ensure compliance with federal regulations.

Letter Template For Charitable Donation Tax Credit Samples

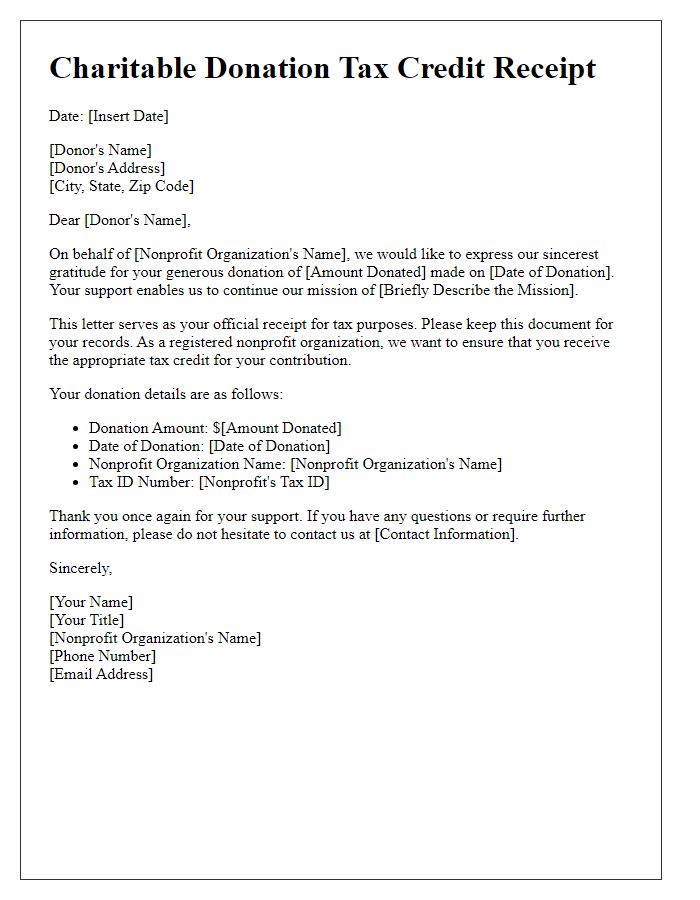

Letter template of charitable donation tax credit for nonprofit organizations.

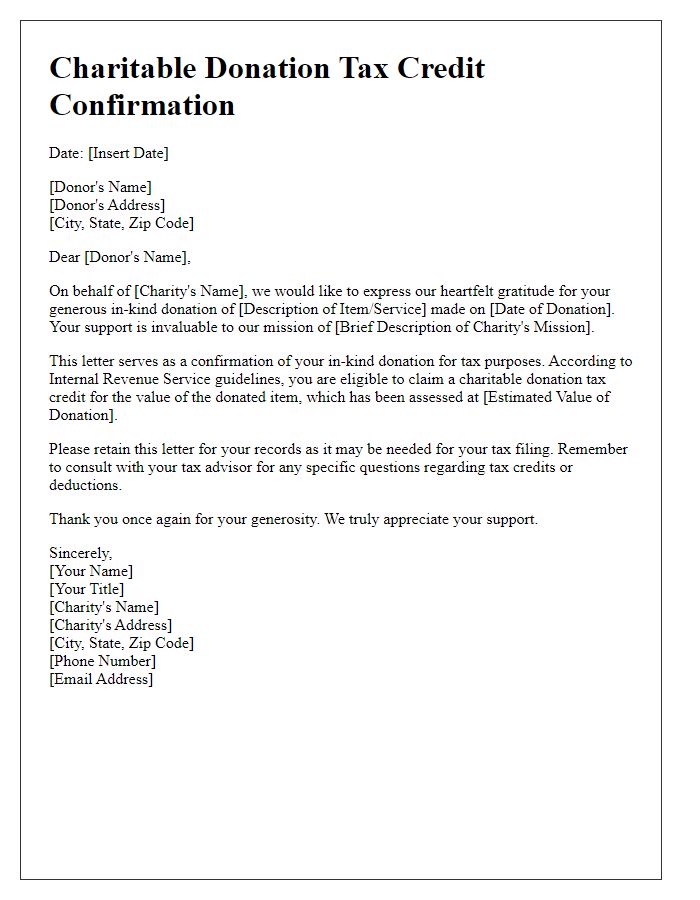

Letter template of charitable donation tax credit for in-kind donations.

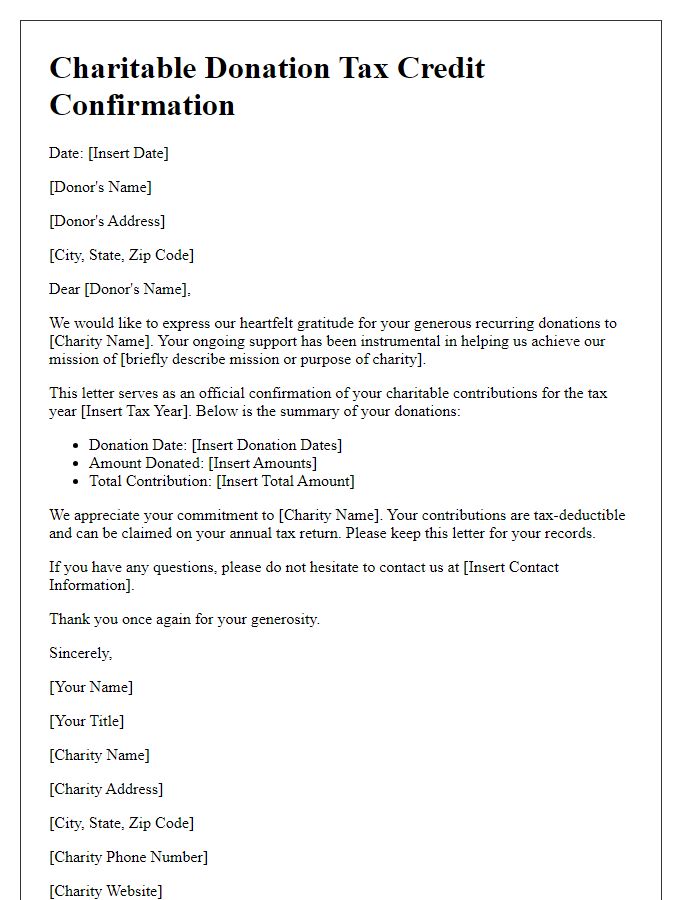

Letter template of charitable donation tax credit for recurring donations.

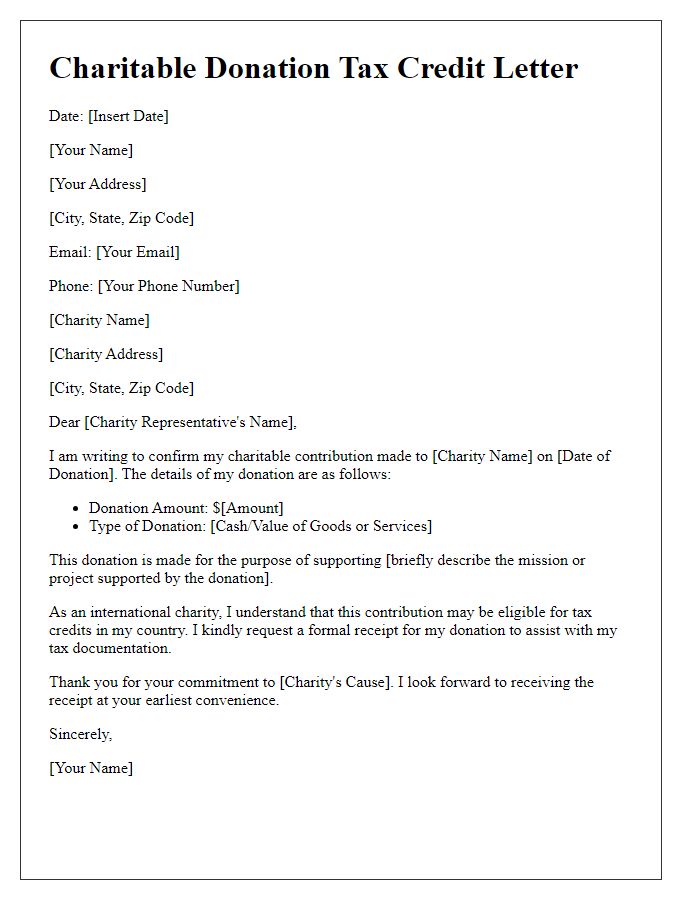

Letter template of charitable donation tax credit for international charities.

Letter template of charitable donation tax credit for community projects.

Comments