Are you navigating the often confusing waters of charitable organization tax status? Understanding the intricacies of tax exemptions and the regulations surrounding them can be quite daunting. Whether you're starting a new nonprofit or seeking to confirm your existing status, it's essential to get the right information. Join us as we dive deeper into how to effectively inquire about your charitable organization's tax status and ensure you're on the right track.

Organization's Name and Contact Information

Charitable organizations must adhere to specific regulations to maintain their tax-exempt status, such as compliance with IRS requirements outlined in Internal Revenue Code Section 501(c)(3). Proper documentation, including ongoing annual filings like Form 990, is necessary to confirm qualification for tax-deductible contributions. The application process requires submitting Form 1023 to the IRS, ensuring that all relevant data regarding the organization's mission, operational structure, and financial information is accurately represented. Regular checks with the IRS database can verify an organization's current tax status, providing transparency for donors and stakeholders. Addressing any discrepancies or inquiries promptly helps maintain credibility and trust within the community.

Inquiry Purpose and Specific Questions

A charitable organization's tax-exempt status can significantly influence its operational capabilities and funding opportunities. Understanding the specifics involves clarifying key concepts like 501(c)(3) status under the Internal Revenue Code, which applies to organizations focused on religious, charitable, educational, or scientific purposes. It is essential to inquire about the duration of the organization's tax-exempt status, recent changes in IRS regulations, implications of non-profit status on fundraising activities, and the renewal process for compliance. Additionally, questions about permitted lobbying efforts and the reporting obligations regarding financial transparency can provide insights into maintaining or enhancing the organization's charitable credibility and public trust.

Reference to Relevant Tax Codes or Regulations

Charitable organizations often rely on tax-exempt status to operate effectively. The Internal Revenue Service (IRS) grants this status under section 501(c)(3) of the Internal Revenue Code, which includes guidelines for qualifying organizations. Section 170 provides for tax deductions for contributions made to these entities, encouraging philanthropic support. Compliance with state regulations, like those in California under the Nonprofit Public Benefit Corporation Law, is essential. Regular financial reporting, adhering to the Form 990 requirements, ensures transparency and accountability. Organizations with pending inquiries into their tax status may face delays in receiving donations, impacting operations significantly. Awareness of the nuances in tax regulations can aid in successful navigation through complex legal landscapes.

Request for Documentation or Confirmation

Charitable organizations must maintain compliance with federal tax regulations to retain their tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Requesting documentation or confirmation about one's status involves sending a formal inquiry to the Internal Revenue Service (IRS), specifically to the Exempt Organizations division. Essential information includes the organization's Employer Identification Number (EIN), the official name, and the address as registered with the IRS. The response can clarify the current standing of the organization, confirming whether it is designated as a tax-exempt entity and eligible to receive tax-deductible contributions. Maintaining proper documentation is crucial for fundraising activities and ensuring ongoing compliance with state and federal laws.

Assurance of Compliance and Contact for Follow-Up

Charitable organizations must maintain compliance with IRS regulations to retain their tax-exempt status. These nonprofit entities, such as 501(c)(3) organizations, are required to adhere to specific guidelines regarding fundraising and expenditures. The IRS enforces strict requirements on the use of funds to ensure that resources primarily benefit the public. Regular audits, conducted by both internal governance bodies and external entities, are essential to verify adherence to these regulations. Organizations are also encouraged to maintain clear communication with stakeholders and ensure updated records are accessible. Contacting the IRS directly for clarification on compliance standards could provide further assurance for future operations and donor confidence.

Letter Template For Charitable Organization Tax Status Inquiry Samples

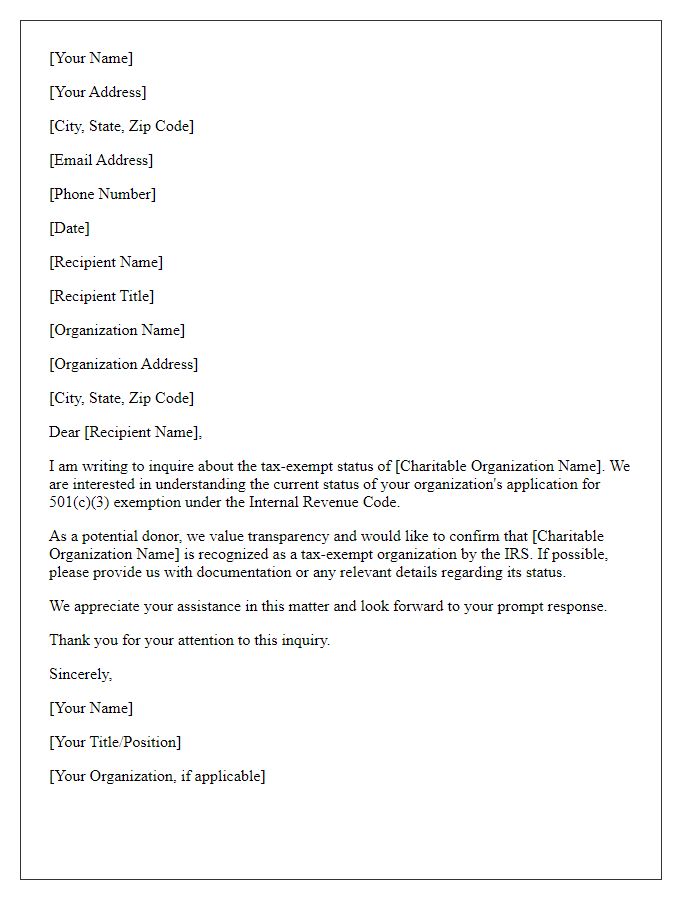

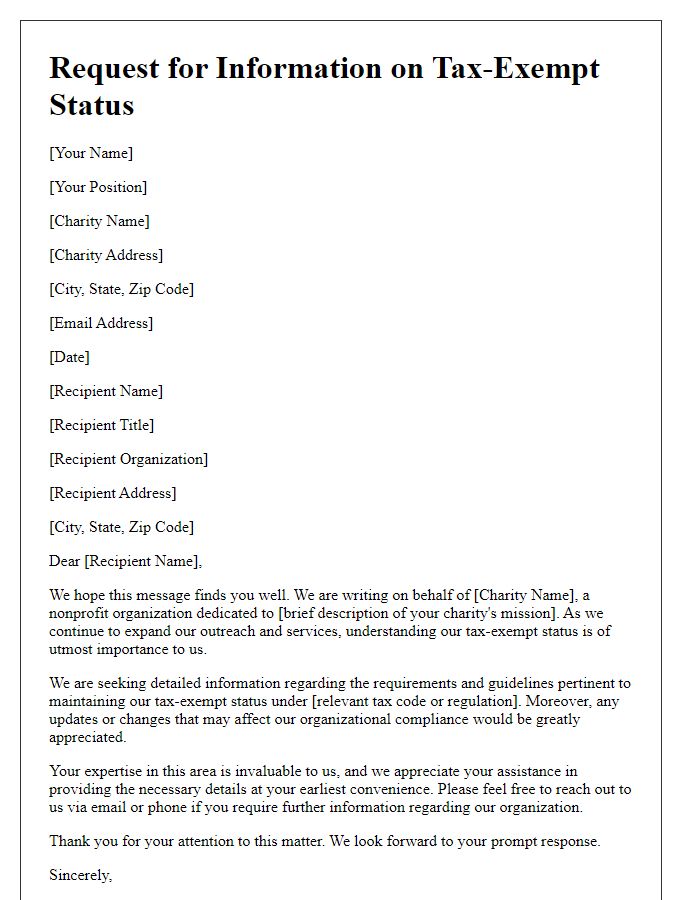

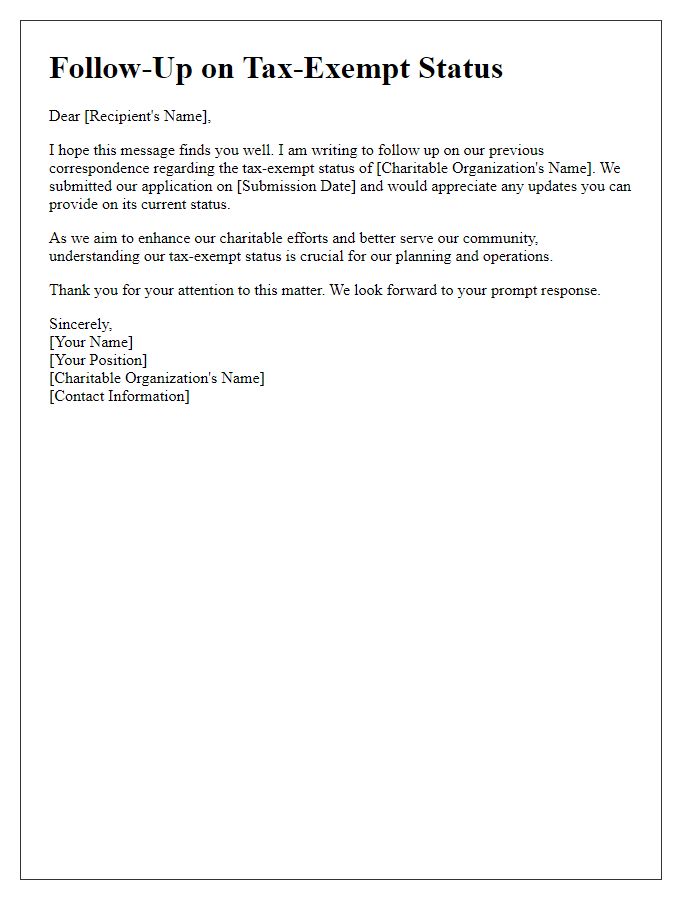

Letter template of inquiry regarding tax-exempt status for charitable organization

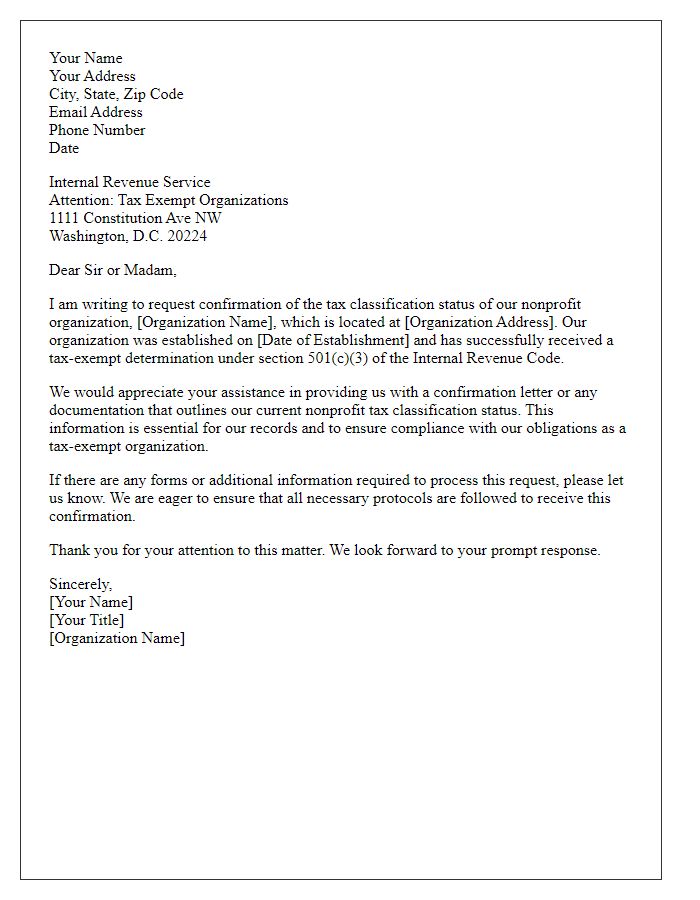

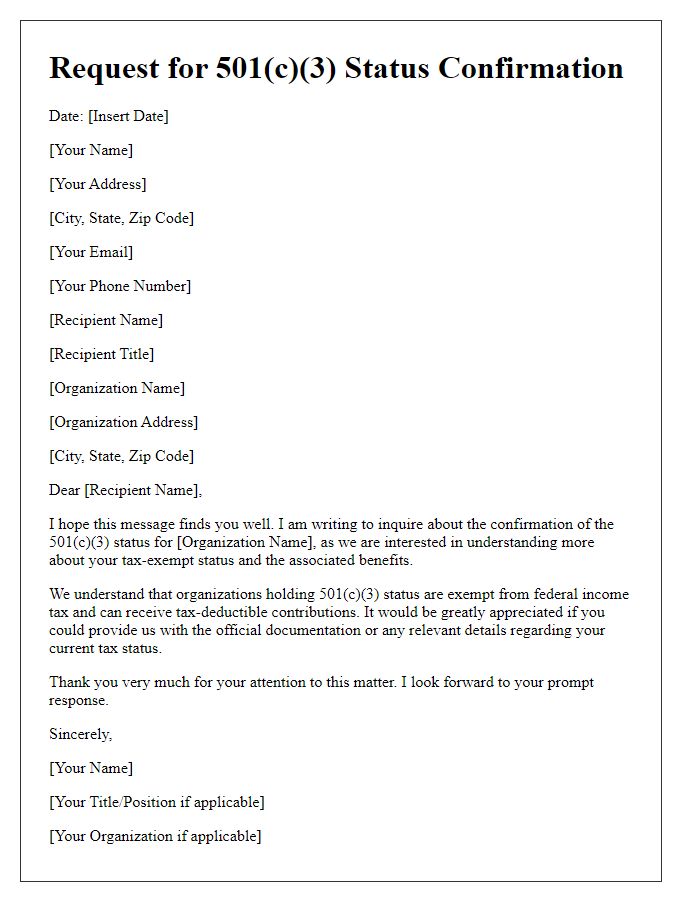

Letter template of request for confirmation of nonprofit tax classification

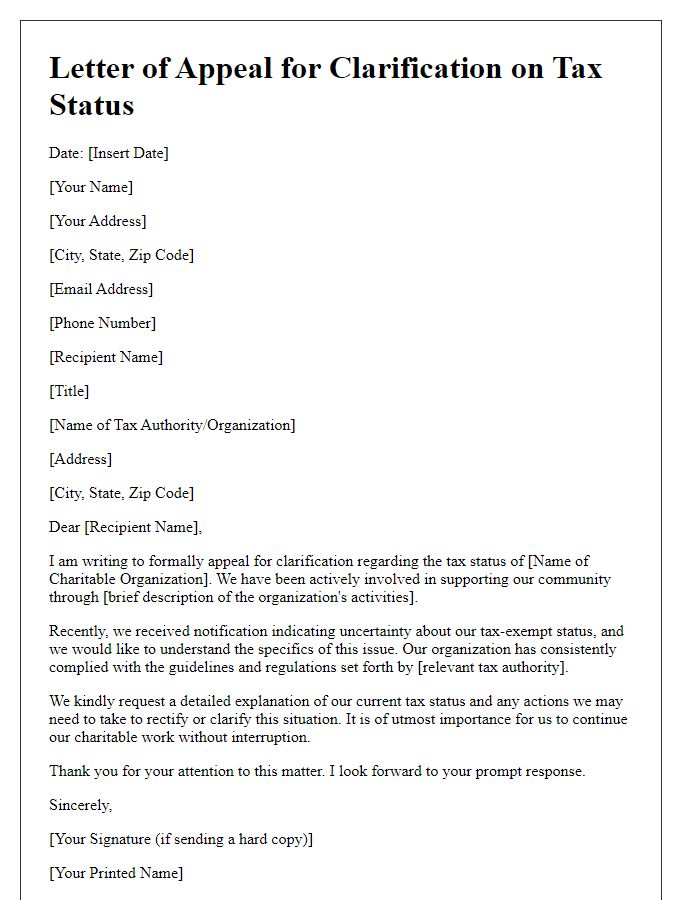

Letter template of appeal for clarification on charitable organization’s tax status

Letter template of solicitation for details on tax-exempt status for our charity

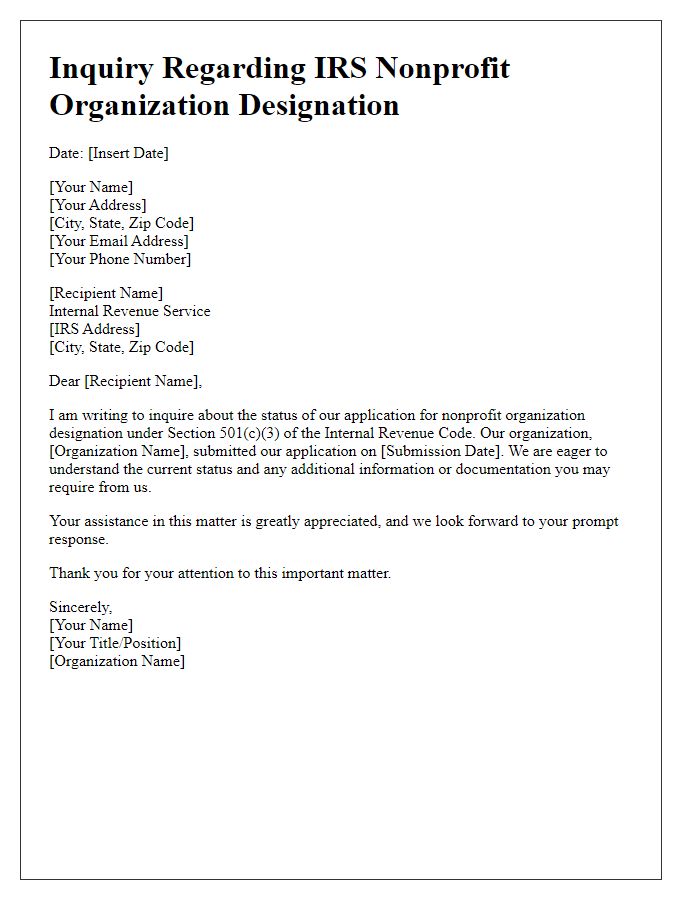

Letter template of inquiry about IRS designation for nonprofit organization

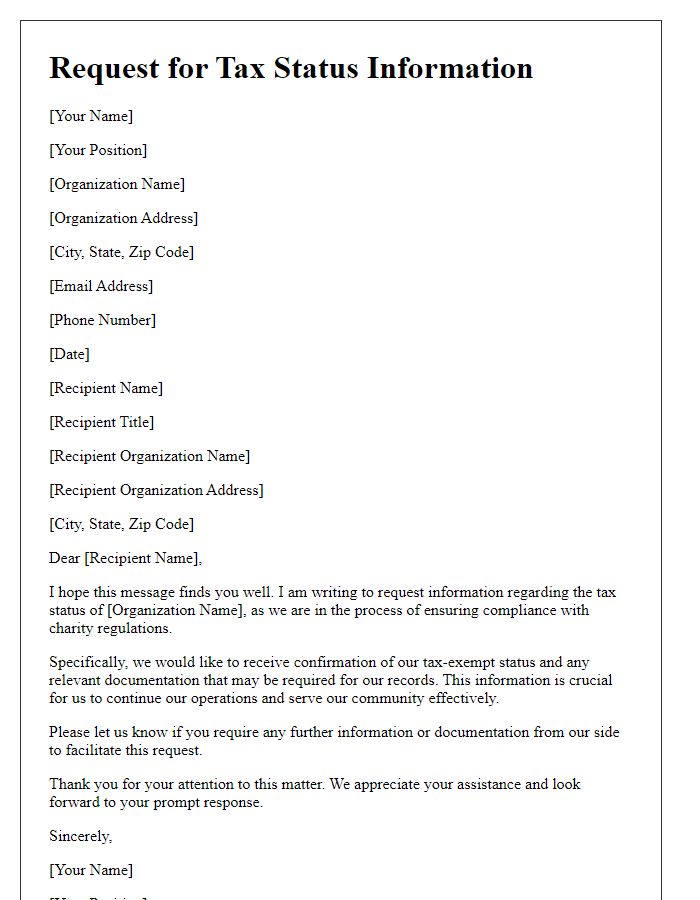

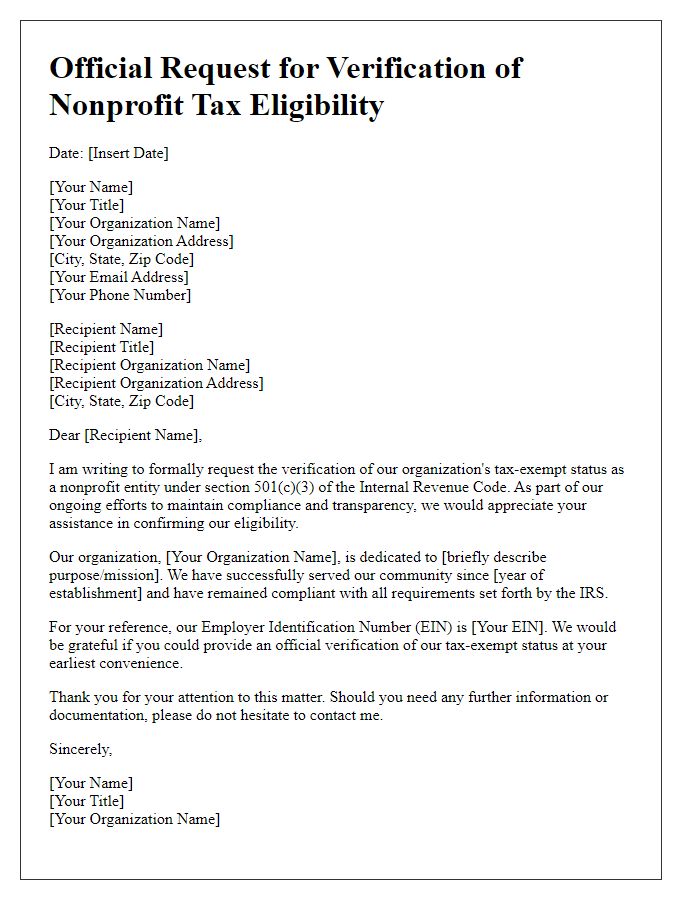

Letter template of request for tax status information for charity compliance

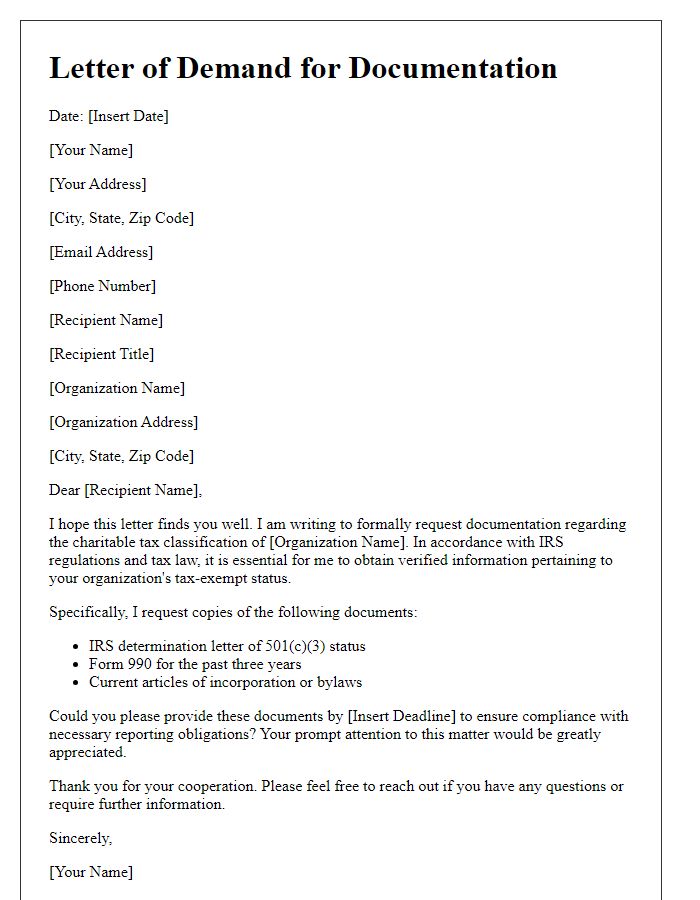

Letter template of demand for documentation of charitable tax classification

Letter template of follow-up on charitable organization’s tax-exempt status

Comments