Are you feeling overwhelmed by the complexities of capital gains tax? You're not alone! Many individuals find that navigating these regulations can be a challenge, especially when it comes to requesting a waiver. In this article, we'll provide you with a comprehensive letter template to help you articulate your request effectively, so you can take the first step towards financial relief. Read on to discover the best practices for crafting your letter!

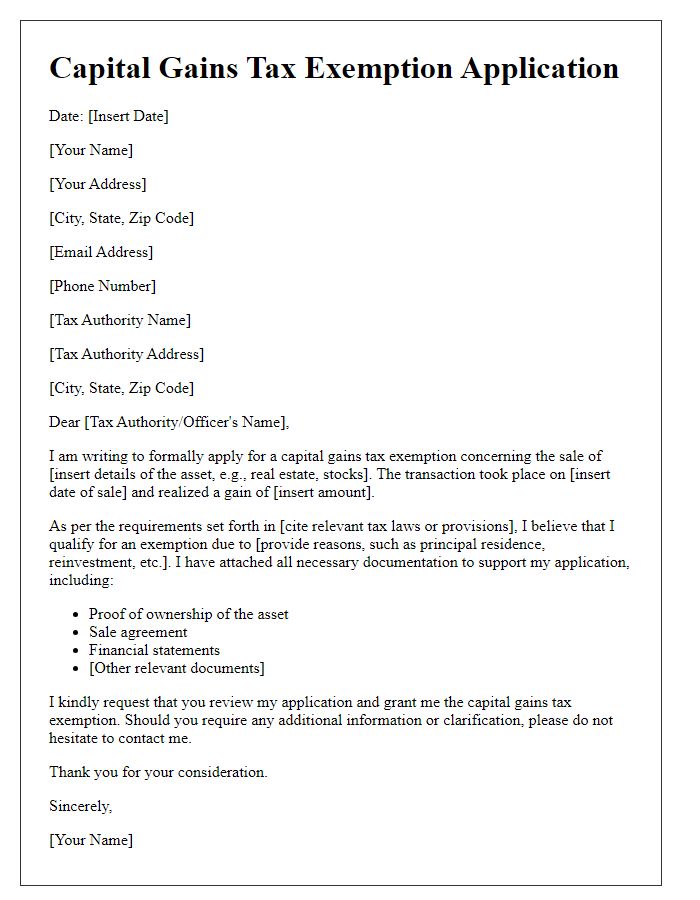

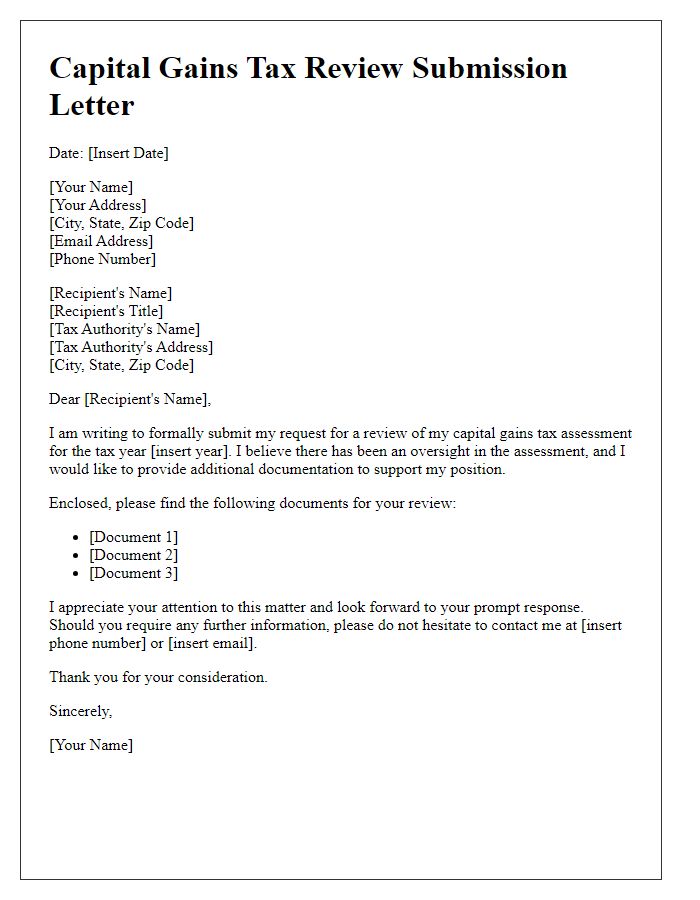

Taxpayer Identification and Contact Information

Taxpayer identification numbers serve as unique identifiers for individuals or entities within tax systems, often assigned by the Internal Revenue Service (IRS) in the United States. Contact information includes essential details such as name, address, phone number, and email, which facilitate communication between taxpayers and tax authorities. Submission of a capital gains tax waiver request may relate to significant financial events like property sales or investment transactions, where capital gains may exceed certain thresholds. Properly formatted contact information ensures efficient processing and reduces delays during the review of such requests.

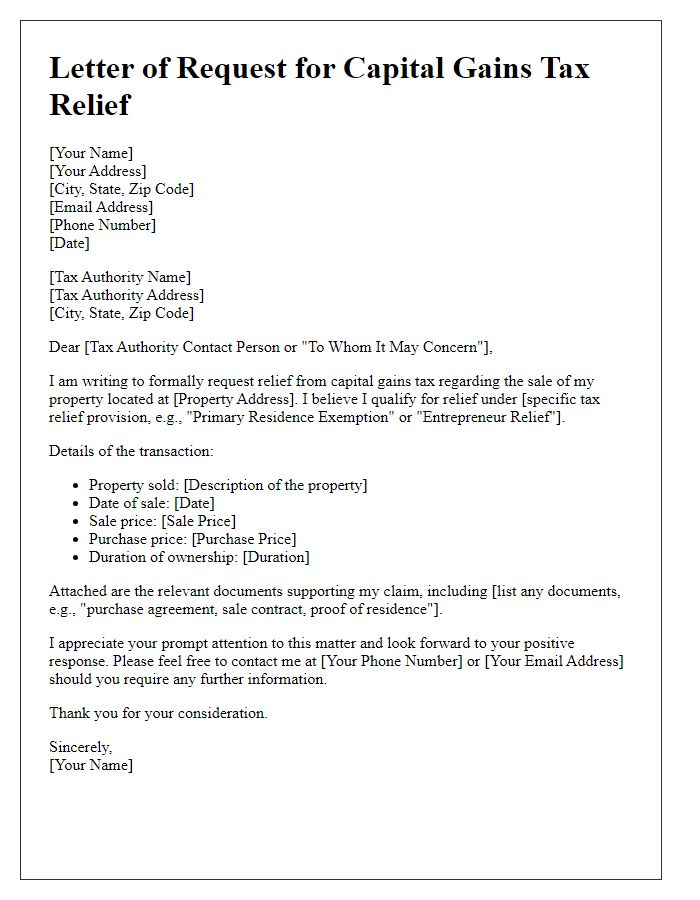

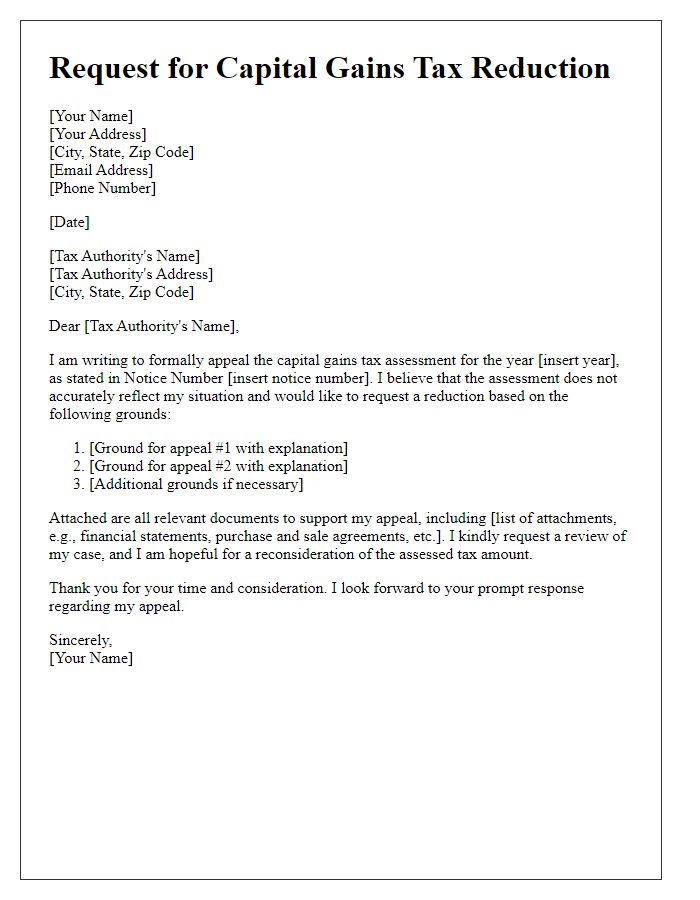

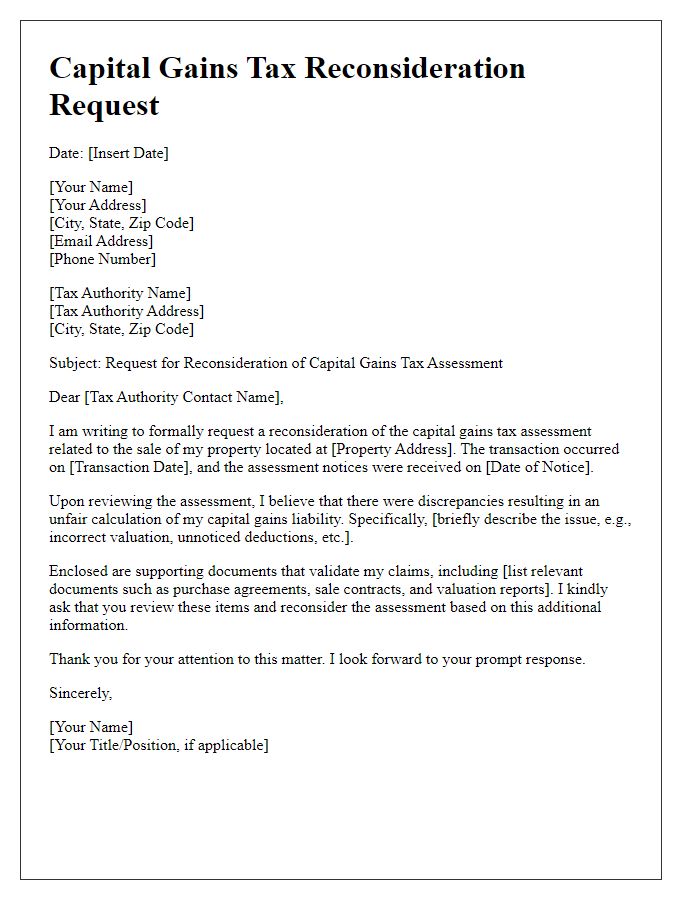

Detailed Explanation of Circumstances

The process of requesting a capital gains tax waiver can be complex, often necessitating a detailed explanation of individual circumstances that justify the request. For instance, individuals may have experienced significant financial hardships such as job loss, medical expenses, or natural disasters, which can impact their ability to pay taxes. In particular, those who sold properties during economic downturns (for example, the 2008 financial crisis) could demonstrate that their capital gains were minimal or non-existent due to drastic declines in property values. Supporting documentation plays a crucial role; tax returns from previous years, bank statements, and letters from financial advisors can substantiate claims. It's also beneficial to highlight any extraordinary personal circumstances, like serious illness or caregiving responsibilities, which may further complicate financial situations. Each case should be meticulously detailed to provide a clear narrative of financial struggle and justify the need for a tax waiver.

Supporting Documentation and Evidence

When requesting a capital gains tax waiver, it is essential to compile comprehensive supporting documentation and evidence. This typically includes recent tax returns, such as the IRS Form 1040, reflecting income fluctuations, and forms like IRS Schedule D, which details capital gains and losses. Additionally, attached documentation might encompass purchase and sale agreements for the assets in question, such as real estate or stocks, with dates and amounts clearly indicated. Fair market value appraisals, conducted by licensed professionals, can substantiate claims of decreased asset value due to unforeseen circumstances. Statements from financial institutions and investment accounts underline transaction history and support capital gains calculations. Finally, letters of hardship or contextual explanations of financial situations add personal narratives to strengthen the request for consideration from tax authorities.

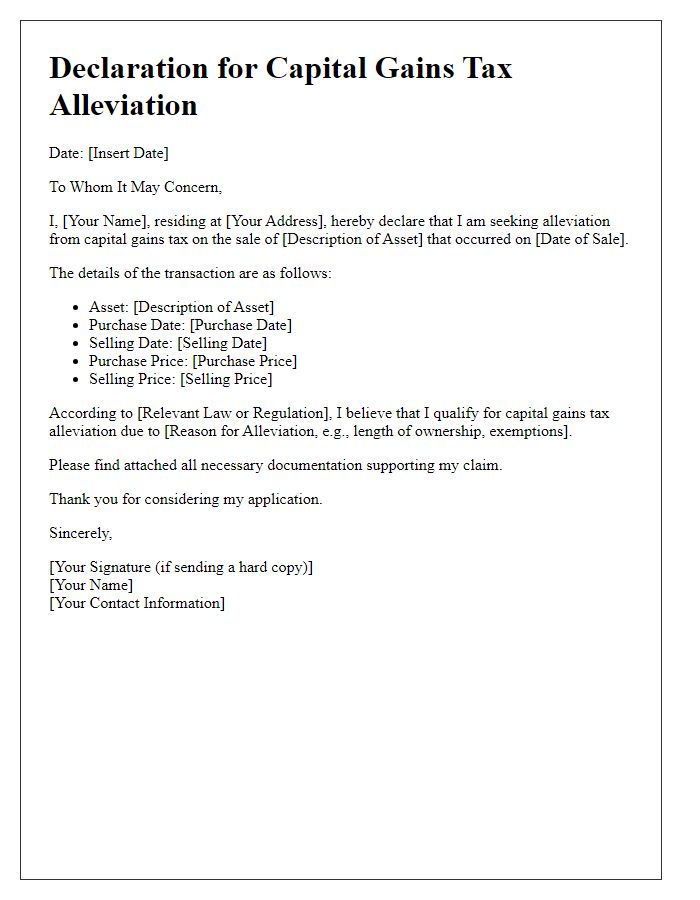

Specific Tax Code Provisions Cited

Capital gains tax waivers are crucial for individuals and businesses looking to reinvest in their operations or personal finances without heavy taxation. Section 121 of the Internal Revenue Code, for instance, allows homeowners to exclude up to $250,000 in capital gains (or $500,000 for married couples filing jointly) when selling their primary residence, provided they meet ownership and use requirements. In jurisdictions like California, Proposition 60 and Proposition 90 enable eligible seniors to transfer their property tax base to a new home, mitigating financial burdens. Additionally, Section 1031 facilitates tax deferral on like-kind exchanges, encouraging real estate investment without immediate tax implications. By understanding these specific tax code provisions, individuals can strategically plan their financial futures.

Formal Request Statement and Conclusion

The capital gains tax waiver request involves various financial considerations influenced by regulatory frameworks. Affected individuals often submit formal requests to tax authorities, detailing their unique circumstances, such as property sales, investment timelines, and any relevant financial hardship. The rationale behind seeking a waiver may stem from significant life events like the 2020 global pandemic which disrupted numerous financial markets, notably real estate. The appeal process includes specific documentation, such as tax returns from prior years, transaction records, and supporting evidence of compliance with existing tax laws. Ensuring clarity and specificity in the request can significantly impact the outcome of the waiver application, determining the potential relief from taxes owed, which in some instances can amount to thousands of dollars based on the accrued gains within a financial year. Additionally, engaging with local advisors well-versed in the Internal Revenue Service's regulations can facilitate a smoother application process.

Comments