Hey there! We understand that the anticipation of a tax refund can evoke a mix of excitement and curiosity. In this article, we'll break down everything you need to know about the tax refund approval process, including what to expect and how to navigate any potential hiccups along the way. So, grab a seat and dive in to learn more about your refund journey!

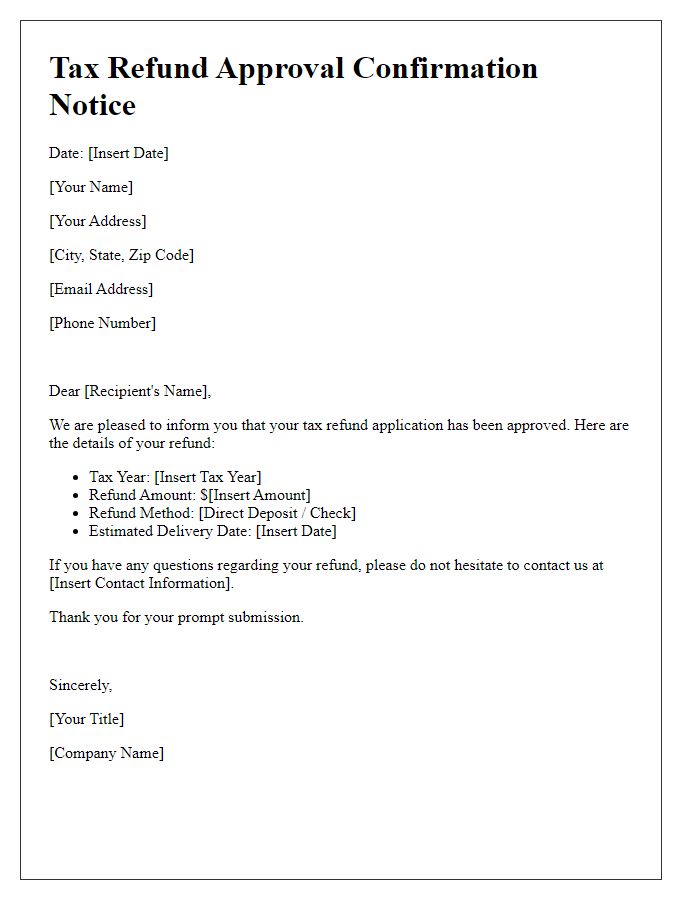

Taxpayer identification and contact details

Taxpayer identification numbers (TIN) serve as unique identifiers for individuals or entities in tax matters, often consisting of nine digits in the United States, such as Social Security Numbers (SSN) or Employer Identification Numbers (EIN). Contact details for notifications include essential information like phone numbers and email addresses, ensuring efficient communication regarding tax matters. This information helps tax authorities accurately process claims and provide updates regarding the status of refunds. Timely notifications of tax refund approvals can provide taxpayers with transparency and peace of mind, confirming the successful processing of their returns.

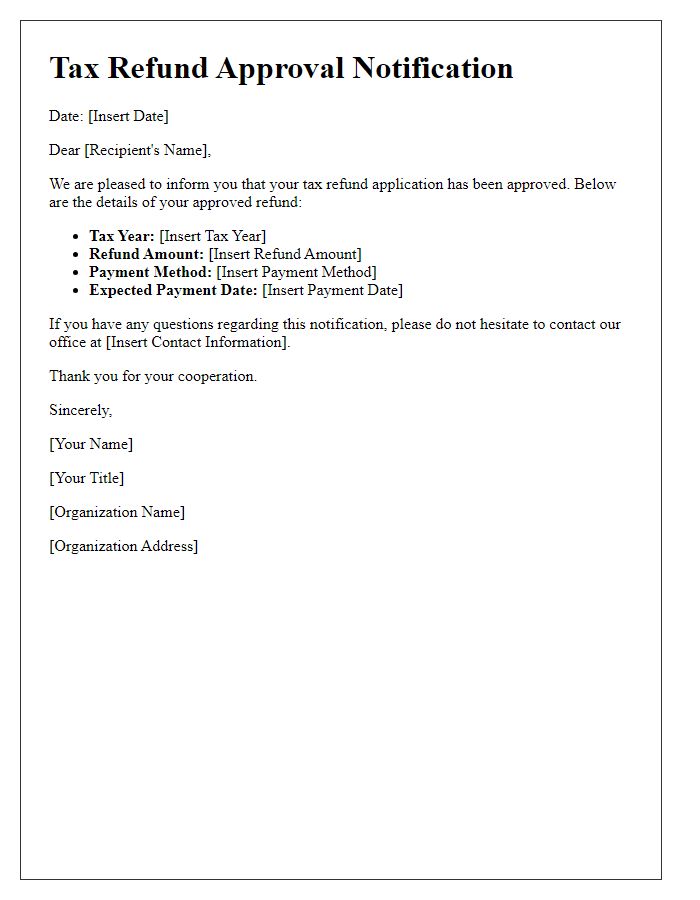

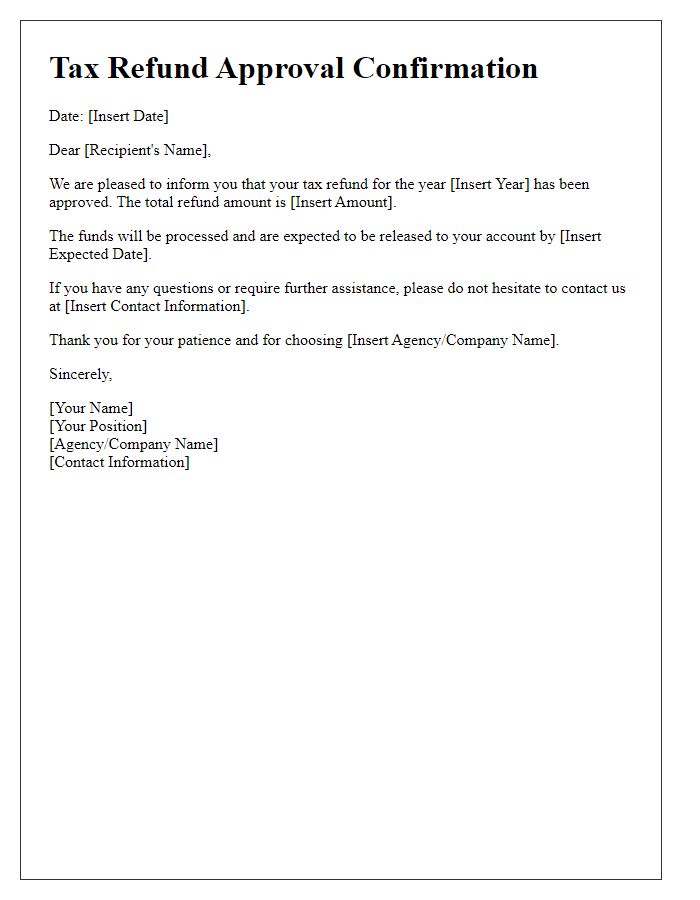

Refund amount and breakdown

Tax refund approvals signify the successful processing of taxpayer submissions by government agencies. The total refund amount, which can vary significantly based on individual circumstances, reflects overpaid taxes during the previous tax year. For example, an average refund amount in the United States for the 2022 tax season reached approximately $3,200, according to IRS statistics. Breakdown details may include line items such as federal income tax withheld, state income tax overpayments, and tax credits, showcasing the specific sources contributing to the overall refund. Notifications often occur through formal letters dispatched from regional tax offices, enhancing transparency and providing taxpayers with a clear understanding of their financial status.

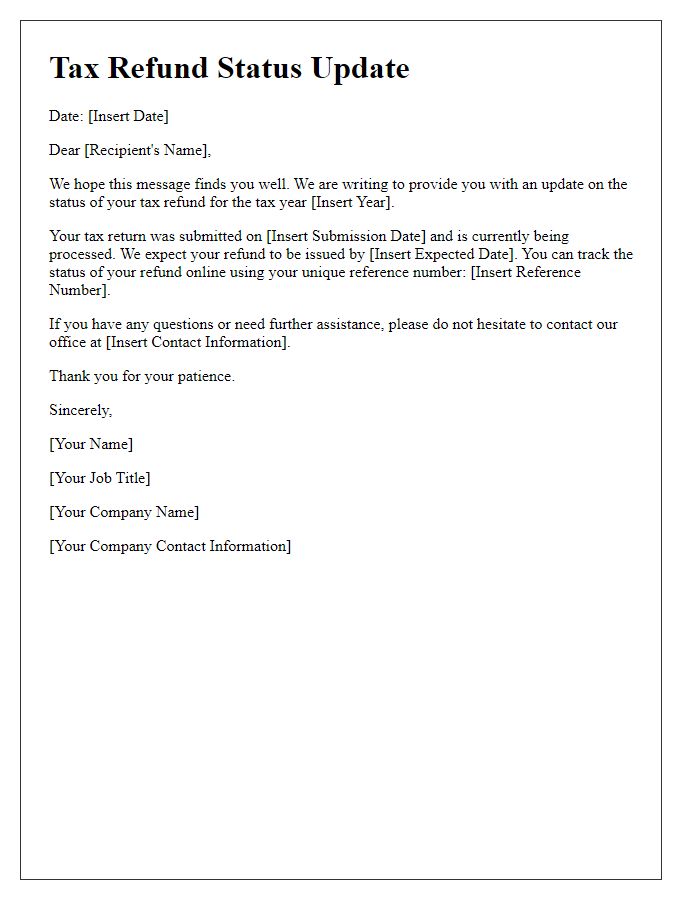

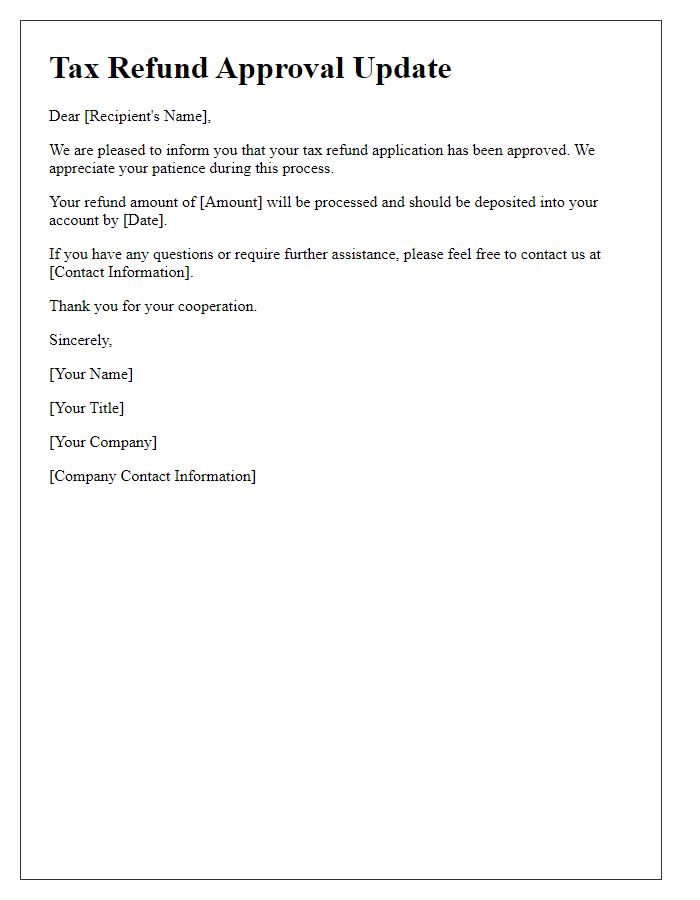

Processing timeline and method of refund

Tax refund approval notifications typically detail the processing timeline and the method of refund disbursement. Upon successful application review, taxpayers can expect to receive their refunds within seven to fourteen business days, primarily depending on the volume of requests during peak periods such as tax season (April in the United States). Refunds are generally issued via direct deposit, which is the most efficient and secure method, or through paper checks mailed to the taxpayer's registered address. Taxpayers can track their refund status through the official IRS website or corresponding tax authority portals, ensuring they are informed throughout the entire refund process.

Contact information for inquiries or assistance

The notification of tax refund approval can bring significant relief to taxpayers, often resulting from diligent financial management or an overpayment during the tax filing process, usually conducted with the Internal Revenue Service (IRS) in the United States. The average tax refund in recent years hovers around $2,800, a substantial amount that can aid in covering expenses or savings. For individuals seeking more information regarding the status of their refund, the IRS provides customer service numbers, such as 1-800-829-1040, available during business hours. Additionally, taxpayers can access online services through the IRS website to check refund statuses and obtain assistance related to discrepancies or delays, enhancing the overall transparency and efficiency of the tax refund process.

Legal disclaimers and obligations

Tax refund approvals can significantly impact individual finances and government operations. Refund amounts, such as those processed through the Internal Revenue Service (IRS) in the United States, may vary based on several factors, including income level, deductions, and filing status. Legal disclaimers are essential, providing taxpayers with necessary information regarding eligibility, processing times, and appeal rights for denied claims. Obligations may include timely filing of future returns, accurate reporting of income, and adherence to any changes in tax laws enacted by legislation like the Tax Cuts and Jobs Act of 2017. Awareness of tax refund regulations is crucial to avoid complications or potential penalties.

Comments