Are you feeling overwhelmed by tax debt and unsure of how to manage it? You're not alone, as many people find themselves in similar situations when tax season rolls around. Fortunately, an installment agreement can provide a viable solution, allowing you to pay off your tax obligations in manageable monthly payments. If you're curious about how to get started with a tax debt installment agreement, keep reading for valuable insights and tips!

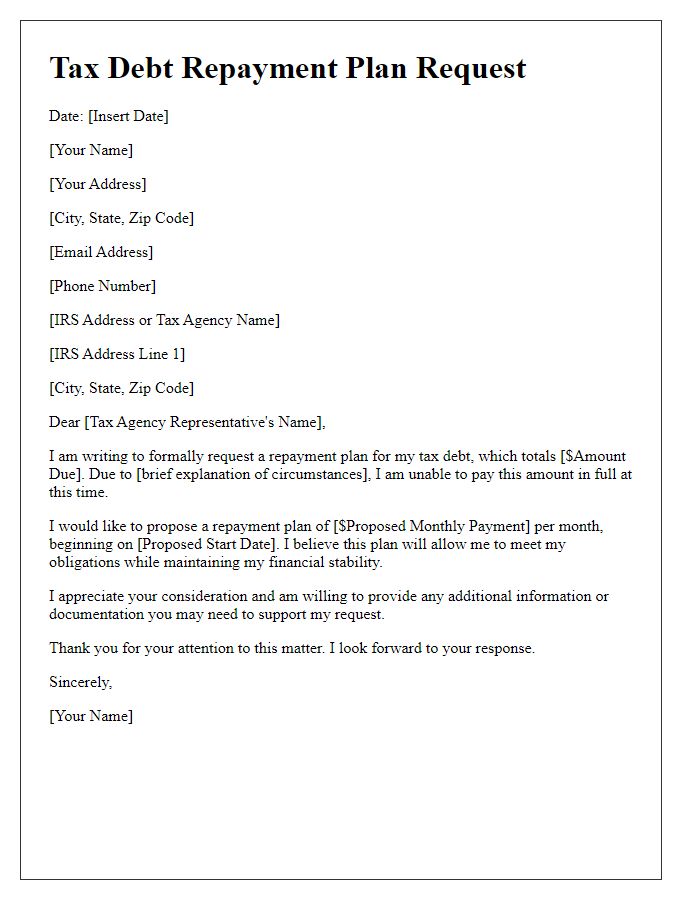

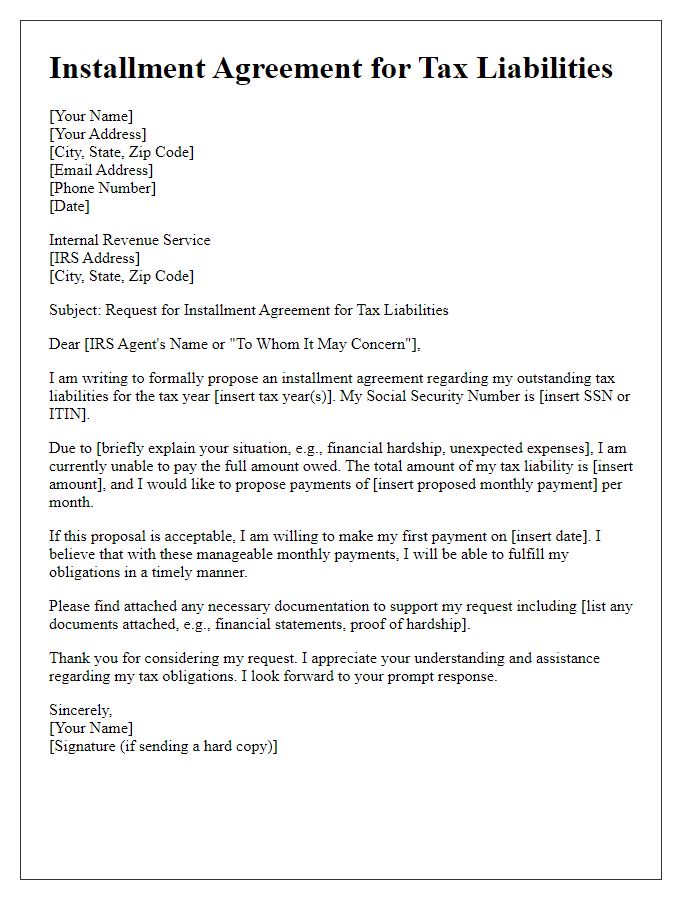

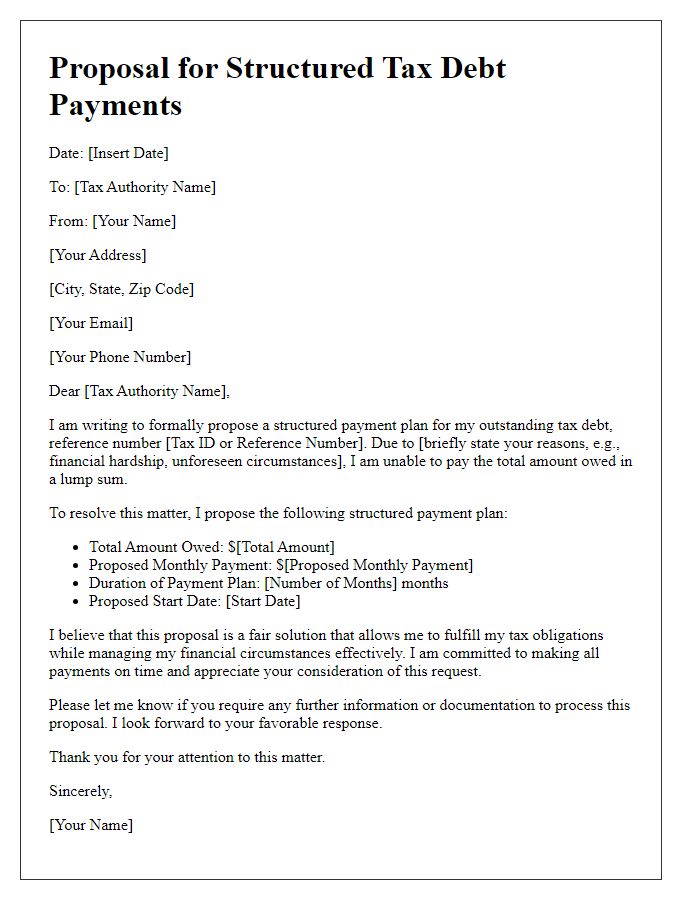

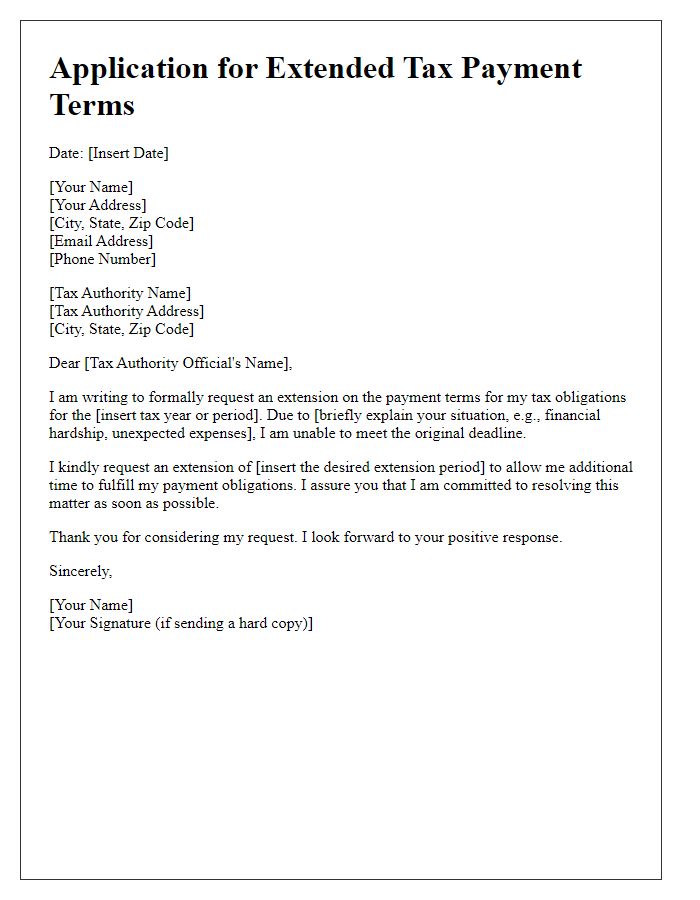

Header with taxpayer's information and date

A tax debt installment agreement letter should include crucial details such as the taxpayer's full name, address, social security number, and the date of the letter. For example, John Smith, residing at 123 Elm Street, Springfield, Illinois, with the social security number XXX-XX-6789, may address the letter to the Internal Revenue Service (IRS) at a specific processing center. The date could indicate when the letter is composed, such as April 30, 2023. This document serves as a formal request for an installment payment plan to manage tax obligations effectively. Including specific information about the total tax debt amount owed, monthly payment proposals, and reasons for the request can provide clarity and increase the likelihood of acceptance.

Subject line stating intent for installment agreement

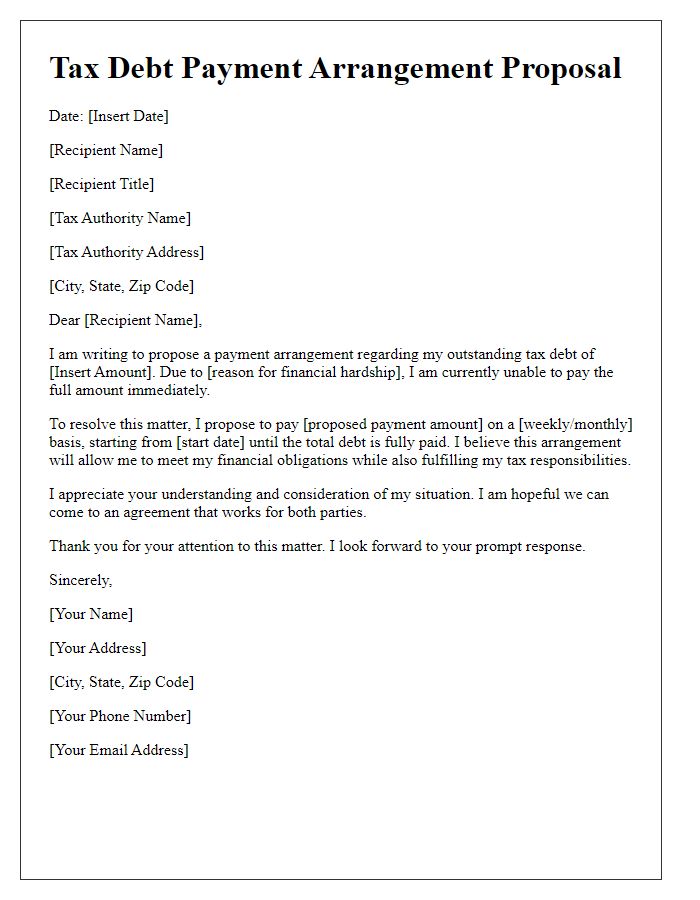

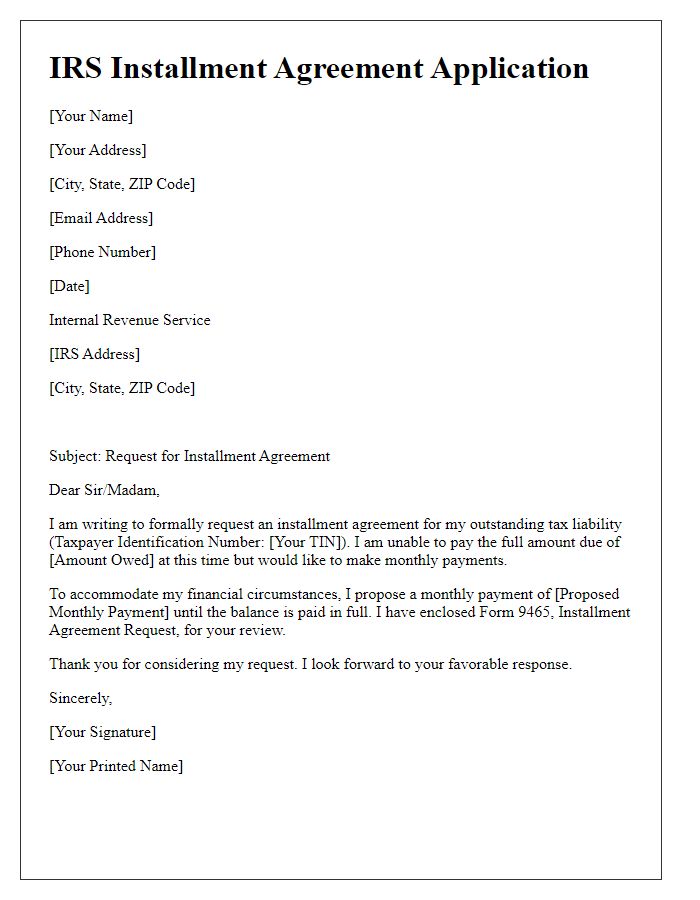

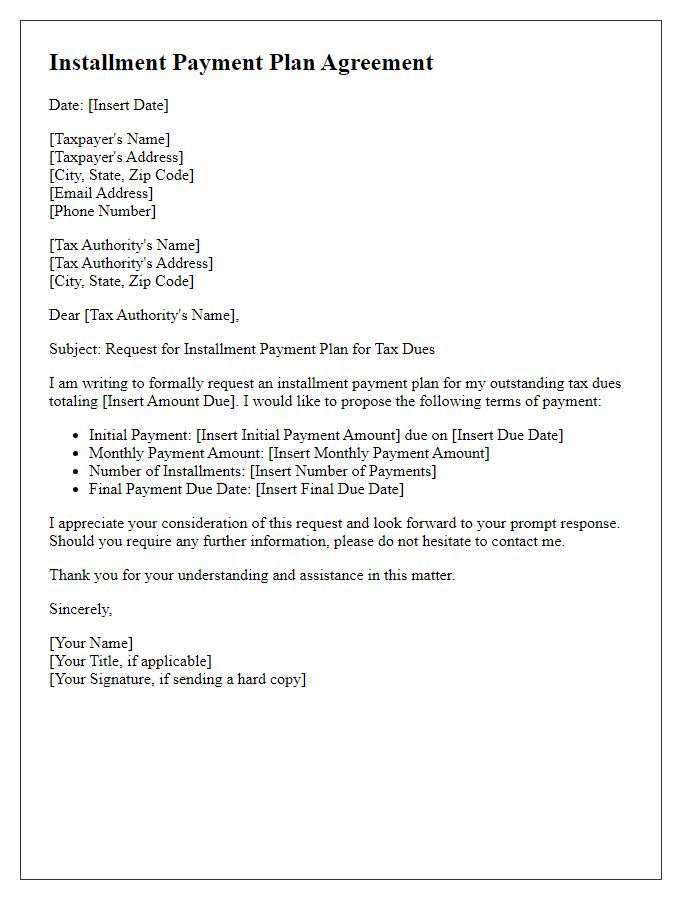

Tax debt installment agreements offer individuals a pathway to manage their outstanding tax liabilities with the Internal Revenue Service (IRS) or state tax authorities. These agreements allow taxpayers to pay off their debts over time through manageable monthly payments, easing the financial burden. Individuals should specify the exact amount owed, such as $5,000, and propose a reasonable payment plan based on their financial situation, for example, $500 monthly for ten months. Taxpayers must provide necessary documentation, such as income statements and expenses, to support their proposal and establish their inability to pay the full amount in a lump sum. The process typically requires form submissions, including the IRS Form 9465, which formalizes the request for an installment agreement. Clear communication is crucial, and individuals should mention their intent to comply with all future tax obligations to reinforce their commitment to financial responsibility.

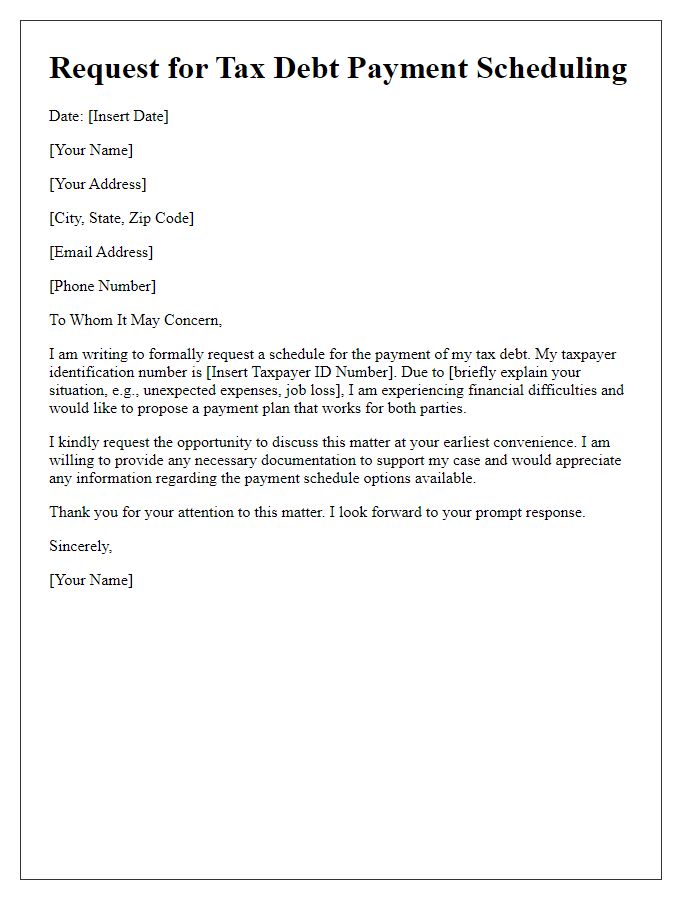

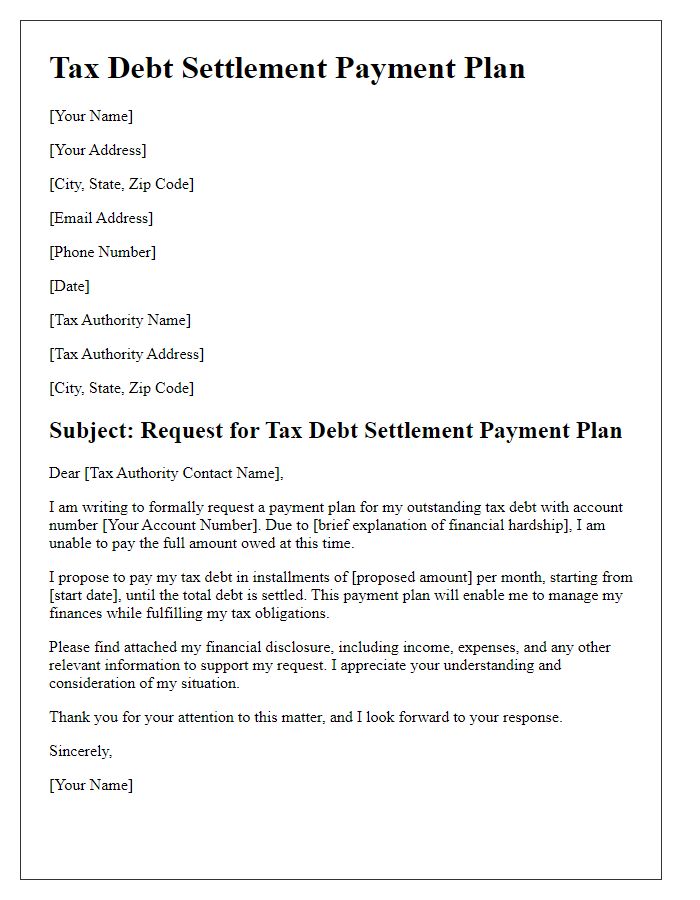

Explanation of financial hardship and inability to pay in full

Filing for a tax debt installment agreement requires a clear explanation of financial hardship and inability to pay in full. Taxpayers often face unforeseen circumstances such as job loss, medical emergencies, or significant expenses that hinder their ability to settle debts. For instance, a recent diagnosis of a chronic illness may incur medical bills exceeding thousands of dollars, diminishing disposable income. Rental expenses in high-cost areas like San Francisco can consume a large portion of monthly earnings, leaving little for debt repayment. Moreover, essential bills, including utilities and groceries, further restrict financial flexibility. Documenting all financial obligations clearly demonstrates the genuine struggles faced and justifies the request for manageable payment plans instead of immediate full payment.

Proposal of monthly payment amount and duration

A tax debt installment agreement is a formal arrangement between a taxpayer and a tax authority, such as the Internal Revenue Service (IRS) in the United States, allowing the taxpayer to pay off outstanding tax liabilities over a specified period. The proposed monthly payment amount typically takes into account the total tax owed, which can include penalties and interest accrued. For instance, if an individual owes $15,000, they might propose to pay $300 monthly over a duration of five years, resulting in a total payment of $18,000. The agreement must also detail the taxpayer's financial circumstances, such as income, living expenses, and assets, which justify the proposed payment plan. This arrangement helps prevent aggressive collection actions while allowing the taxpayer to regain financial stability. It is essential for taxpayers to adhere to the agreed payment schedule to avoid default, which may lead to additional penalties or legal actions.

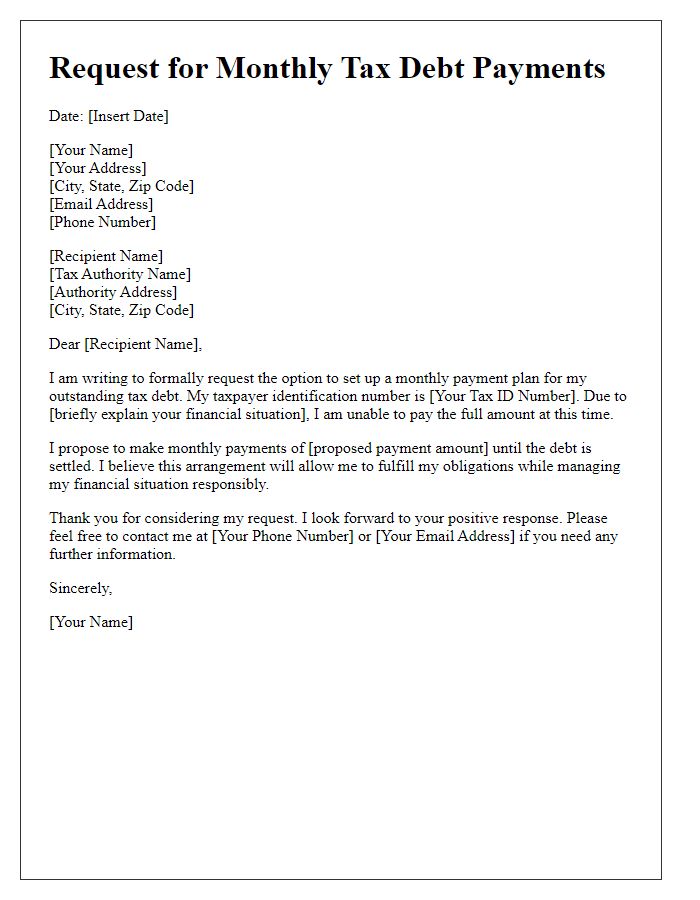

Contact information for further communication

Unresolved tax debts can lead to significant financial stress for individuals and businesses alike. The Internal Revenue Service (IRS), located in Washington D.C., enables taxpayers to establish an installment agreement (IA) to manage outstanding balances effectively. Key eligibility criteria include total tax liability under $50,000 for individuals and $100,000 for businesses, with a monthly payment plan that must be fully paid within 72 months. Taxpayers should prepare necessary financial documents, including income records, expenses, and any prior tax returns, as these will be crucial for negotiations. After submitting the IA request, the IRS may request further documentation or arrange communication via their dedicated phone lines for clarity and assistance. Therefore, maintaining open lines of communication throughout the process is essential to ensure prompt resolutions and avoid penalties.

Comments