Are you ready to take the exciting step toward homeownership? Applying for a pre-approval mortgage can seem daunting, but it doesn't have to be! In this article, we'll break down the key components of a pre-approval letter template and provide tips to make your application process smoother. Let's dive in and empower you on your journey to buying your dream home!

Personal Information

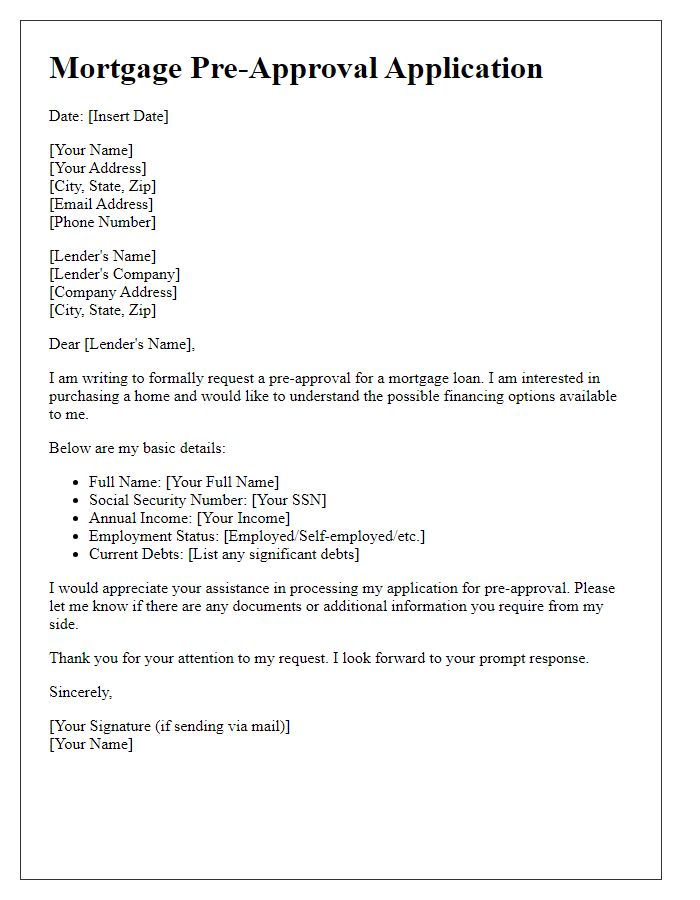

When applying for a pre-approval mortgage, essential personal information includes full name, address, social security number, and employment details. Full name identifies the applicant (first, middle, last) for financial institutions. Current address provides an accurate residential history, often requiring previous addresses for the last two years. The social security number verifies the applicant's identity and enables the lender to check credit history, which is crucial in determining eligibility. Employment details such as job title, employer name, income, and duration of employment help lenders assess financial stability and repayment ability. Additional information like bank statements, asset documentation, and monthly expenses may also be required to complete the financial profile. This comprehensive personal information allows lenders to accurately evaluate pre-approval for the mortgage.

Loan Amount Request

A pre-approval mortgage application enables prospective homebuyers to understand their borrowing capacity for a residential property purchase. The loan amount request typically consists of a detailed financial profile, including total income figures such as annual salary (for instance, $80,000), monthly debts (like $2,000), and credit score ranges (ideally above 700). Lenders evaluate key factors such as debt-to-income ratio (commonly under 43%) and employment status, utilizing this data to determine the appropriate loan amount. Additionally, documentation may include bank statements, tax returns from the past two years, and identification verification. Market conditions and interest rates also play a critical role in shaping the pre-approval outcome, influencing the amount offered and overall mortgage terms.

Employment and Income Details

Completing a mortgage application accurately requires detailed employment and income information to assess financial stability. The employment section should include the employer's name, job title, and duration of employment, ensuring clarity on job history. For income, specifics such as annual salary, bonuses, and other forms of compensation need to be listed comprehensively. Self-employed individuals should include net income from business activities, typically shown on relevant tax documents, including the IRS Form 1040 and associated schedules. Including additional financial documents, like W-2 forms or pay stubs, enhances the application by providing evidence of consistent earnings. Detail-orientedness during this process is crucial to avoid delays in pre-approval status.

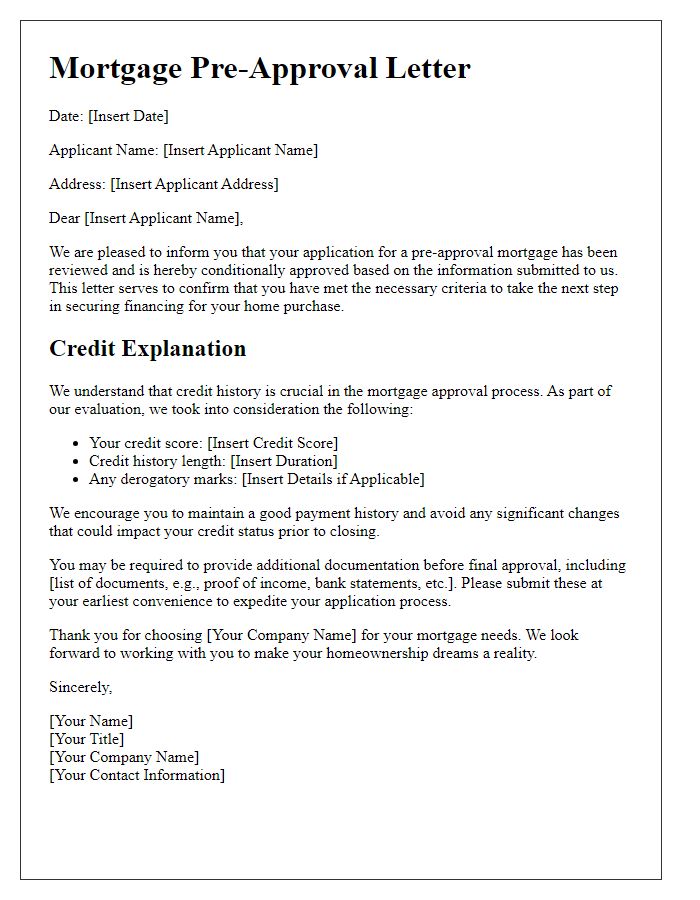

Credit Score Acknowledgment

A strong credit score, typically over 700, plays a crucial role in a successful mortgage application process. Lenders, such as banks and credit unions, evaluate credit histories for any missed payments, outstanding debts, or derogatory marks, which can significantly impact the loan terms offered. Acknowledging the importance of maintaining a healthy credit score encourages potential homeowners to regularly check their credit reports from agencies like Experian, Equifax, or TransUnion for accuracy. Understanding factors that influence credit scores, including credit utilization ratios and payment history, helps applicants take proactive steps before approaching lenders. In today's competitive housing market, a solid credit score can enhance opportunities for favorable interest rates and more appealing mortgage conditions.

Property Details and Purpose

The property details for the pre-approval mortgage application include key information such as the address of the property, which is located at 123 Maple Street, Springfield, Illinois. This single-family home, built in 1998, features a total living area of 1,500 square feet and comprises three bedrooms and two bathrooms. The property is situated in a family-oriented neighborhood, characterized by its proximity to local schools, parks, and shopping centers. The purpose of this mortgage application is to secure funding for the purchase of the property, which is currently listed at a price of $250,000. Prospective buyers aim to finance this investment with a 30-year fixed-rate mortgage, allowing for long-term stability and predictable monthly payments amidst fluctuating interest rates in the market.

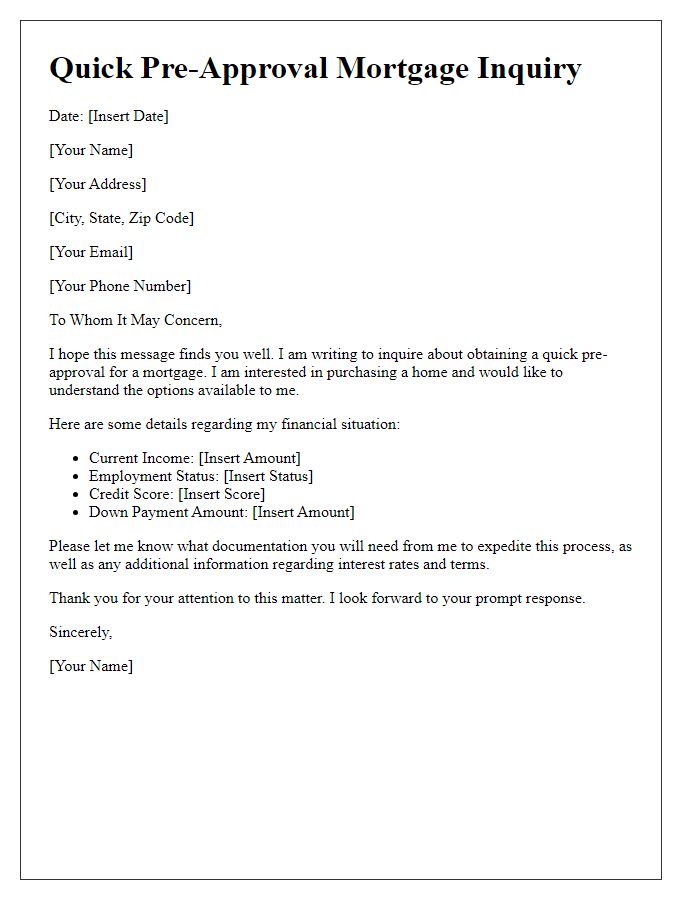

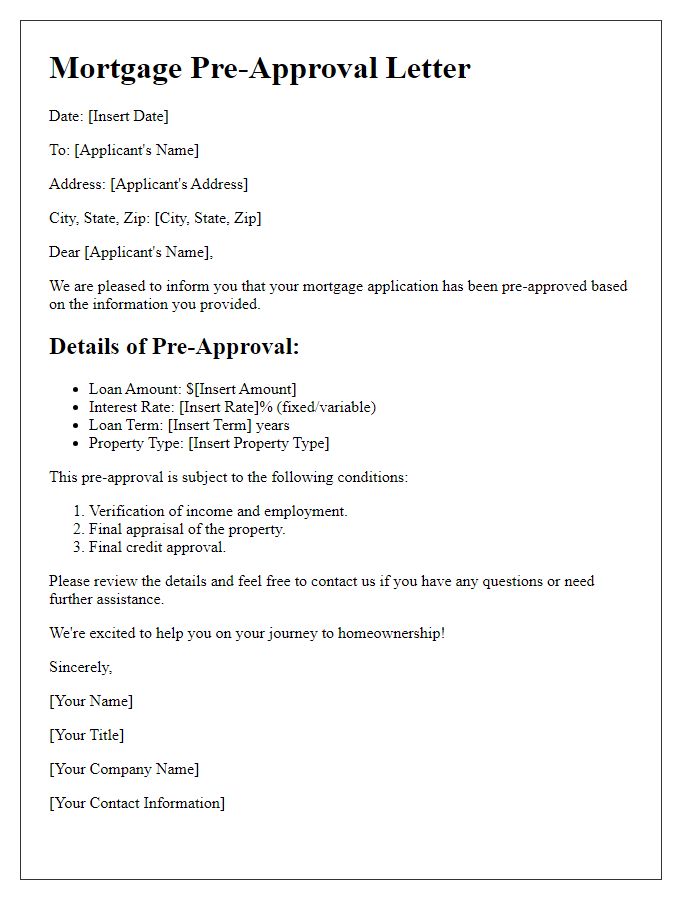

Letter Template For Pre-Approval Mortgage Application Samples

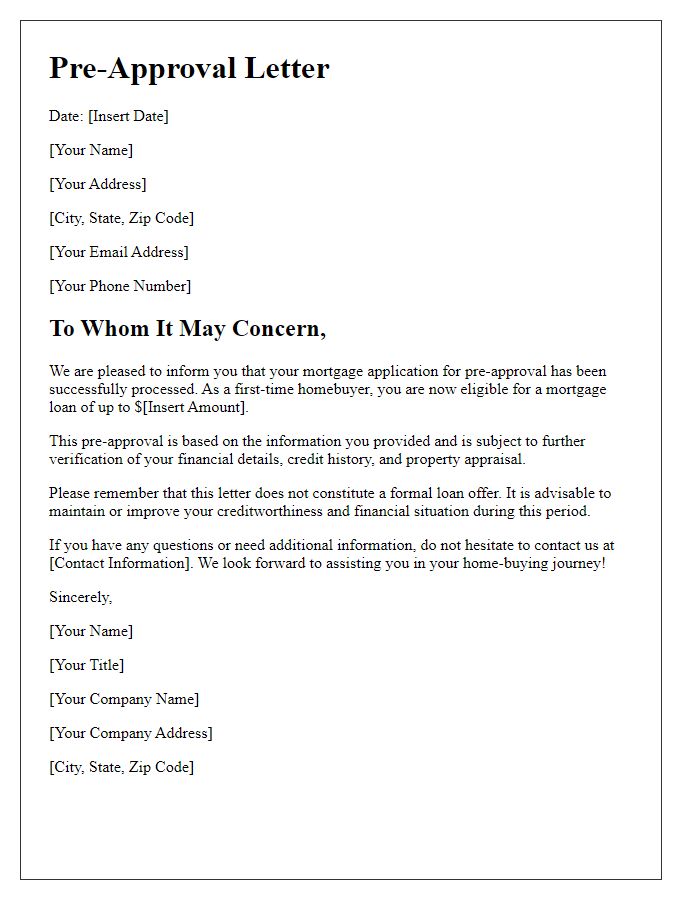

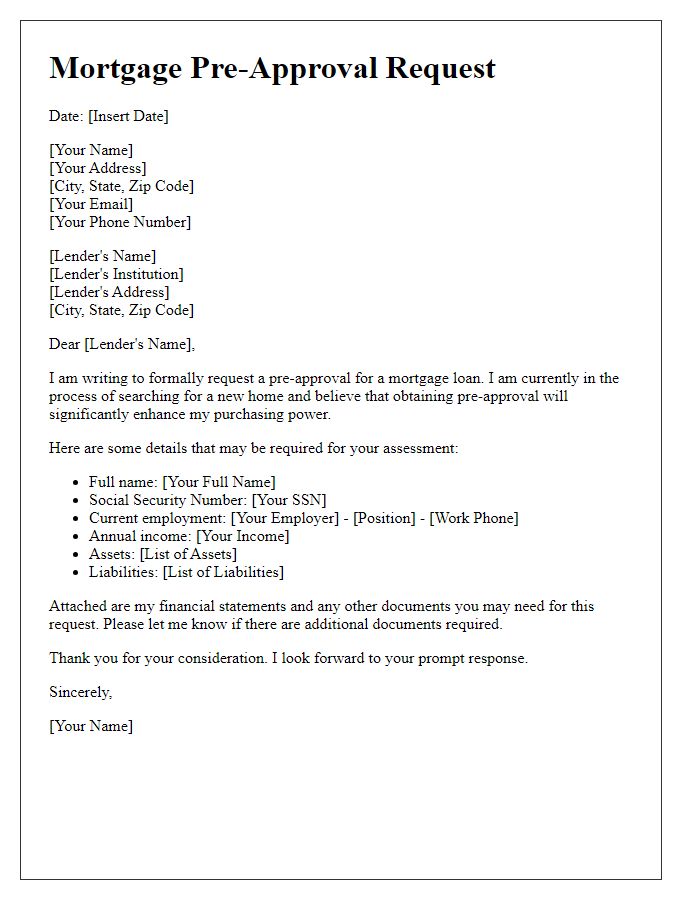

Letter template of pre-approval mortgage application for first-time buyers

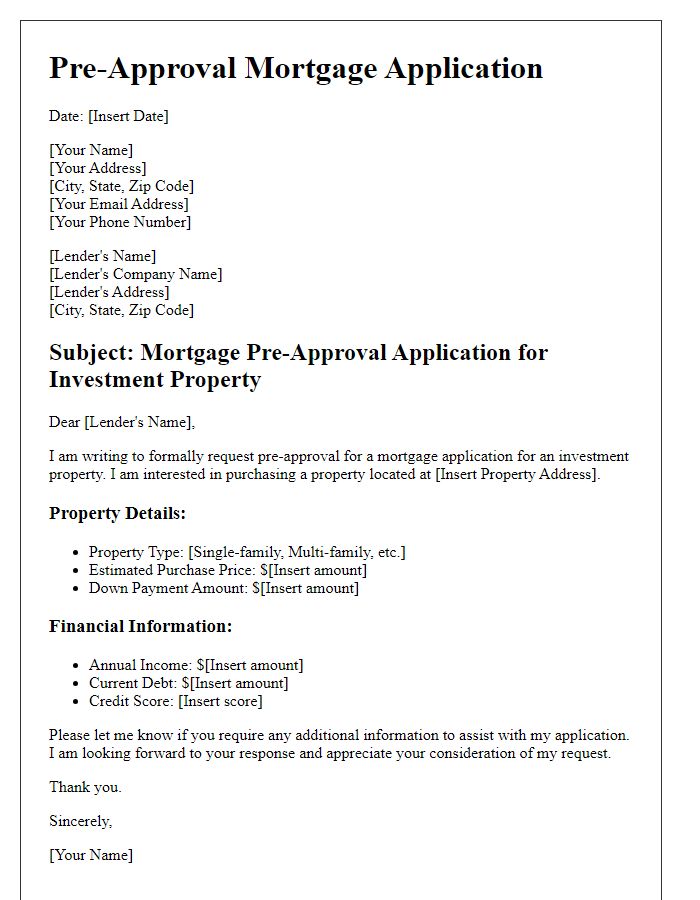

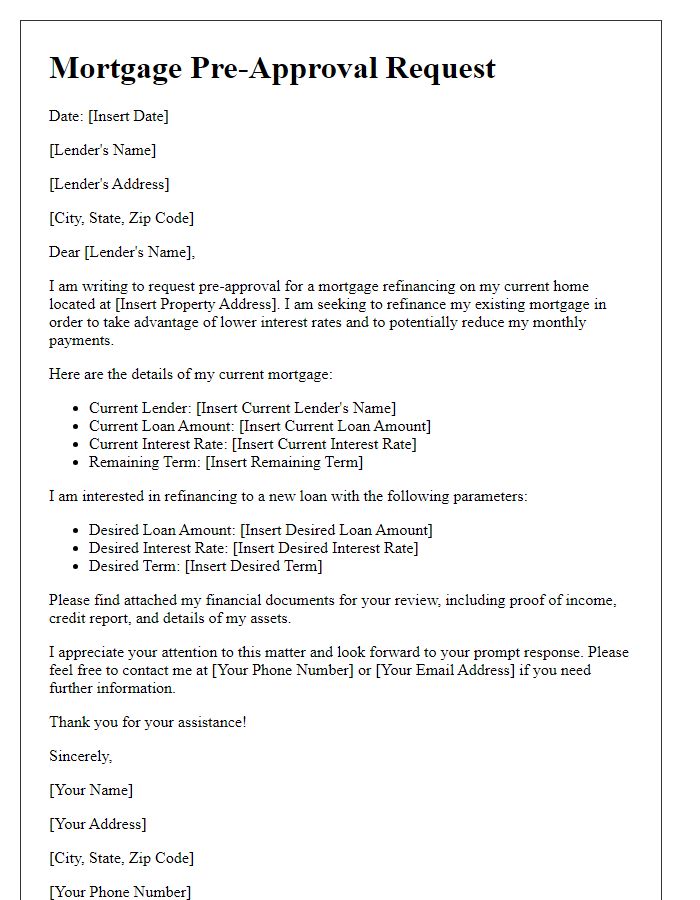

Letter template of pre-approval mortgage application for investment property

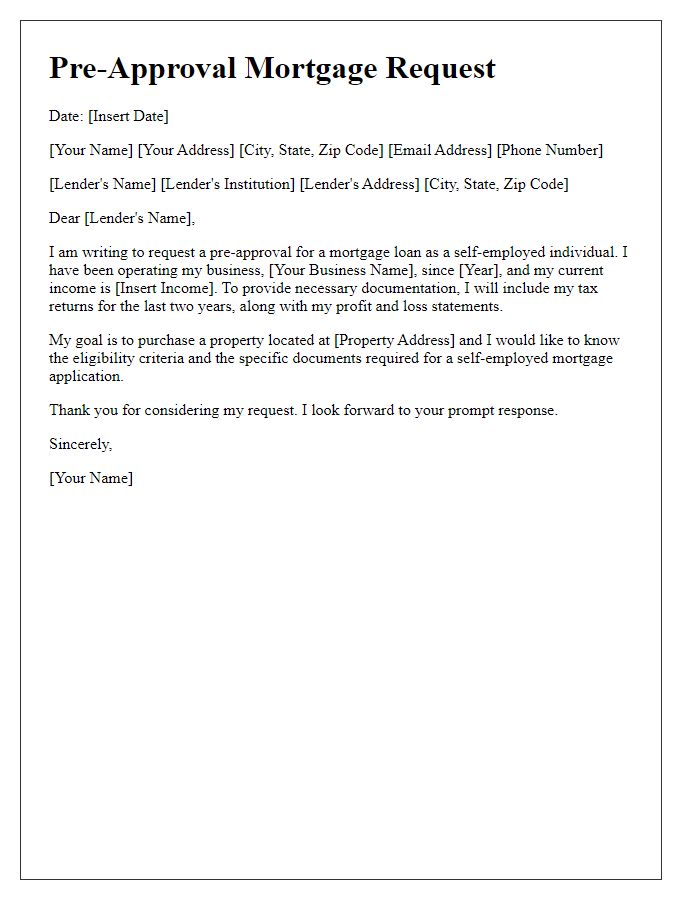

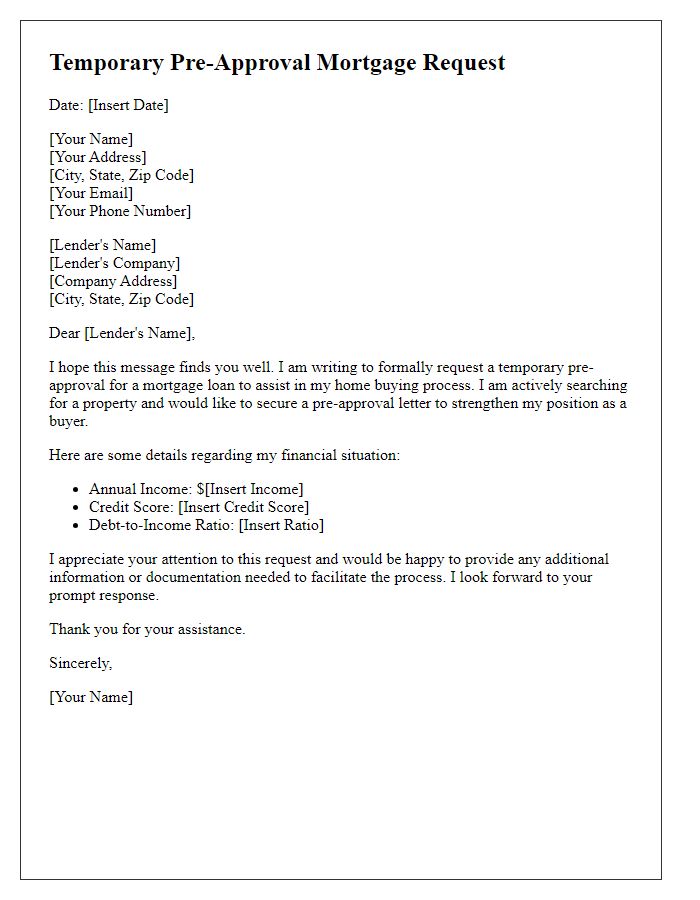

Letter template of pre-approval mortgage request for self-employed individuals

Comments