Are you eager to expedite your mortgage processing and unlock the door to your dream home faster? The right letter can make a significant difference in how quickly your application moves through the system. In this article, we'll discuss the essential elements of a compelling letter template that effectively communicates your urgency and intentions to your lender. Ready to streamline your mortgage experience? Let's dive in!

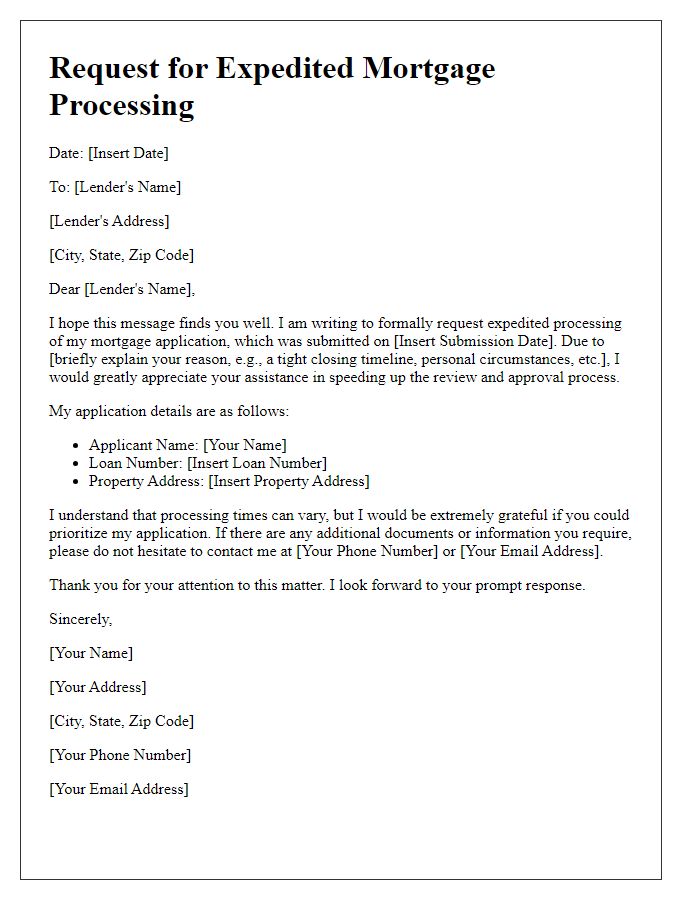

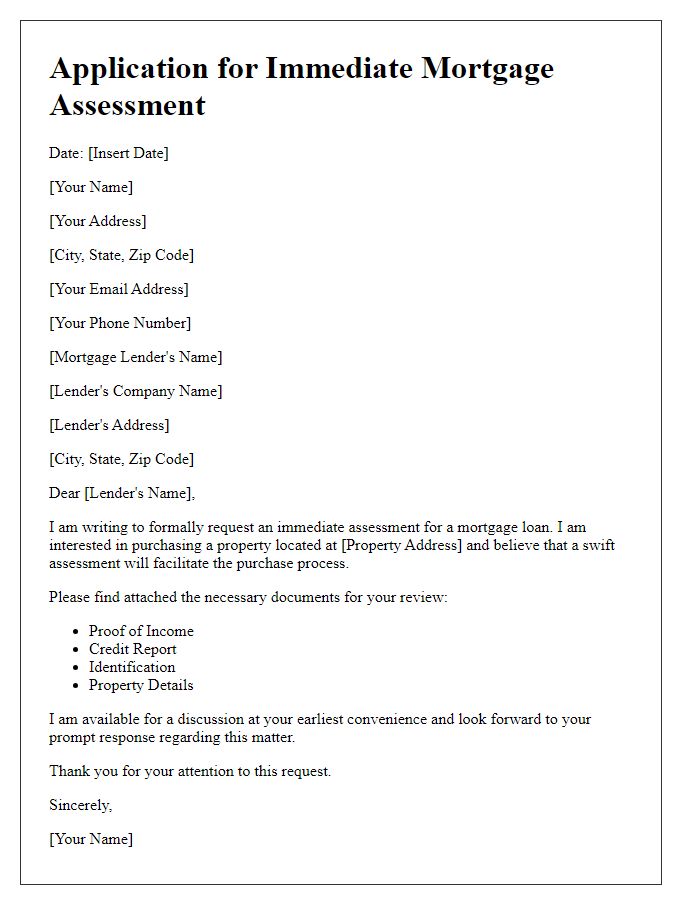

Applicant Information

Expedited mortgage processing requires precise applicant information to streamline approval. Essential details include the applicant's full name, financial status, and contact information. Previous addresses provide historical context for residency. Employment history, including job titles and income details, helps assess financial stability. Documentation such as social security numbers and tax returns (typically from the last two years) verify identity and earnings. Property details including the address, purchase price, and type of property (single-family home, condo, etc.) are crucial for appraisal purposes. A timely submission of all necessary documents can significantly accelerate the processing timeline and improve communication with mortgage underwriters.

Loan Details

Expedited mortgage processing can significantly impact the timeline of securing home loans, particularly in high-demand markets like San Francisco. Applications for amounts over $500,000 often require additional documentation, such as income verification for the last two years, tax returns, and credit reports from major bureaus like Experian and TransUnion. A well-structured application can expedite the underwriting process--typically taking 30 to 45 days--and facilitate quicker approval, essential for homebuyers competing in rapidly changing real estate conditions, where properties may receive multiple offers within days. Successful expedited processing also relies on prompt communication with loan originators to address any questions that arise during the review stage, ensuring a smooth transaction.

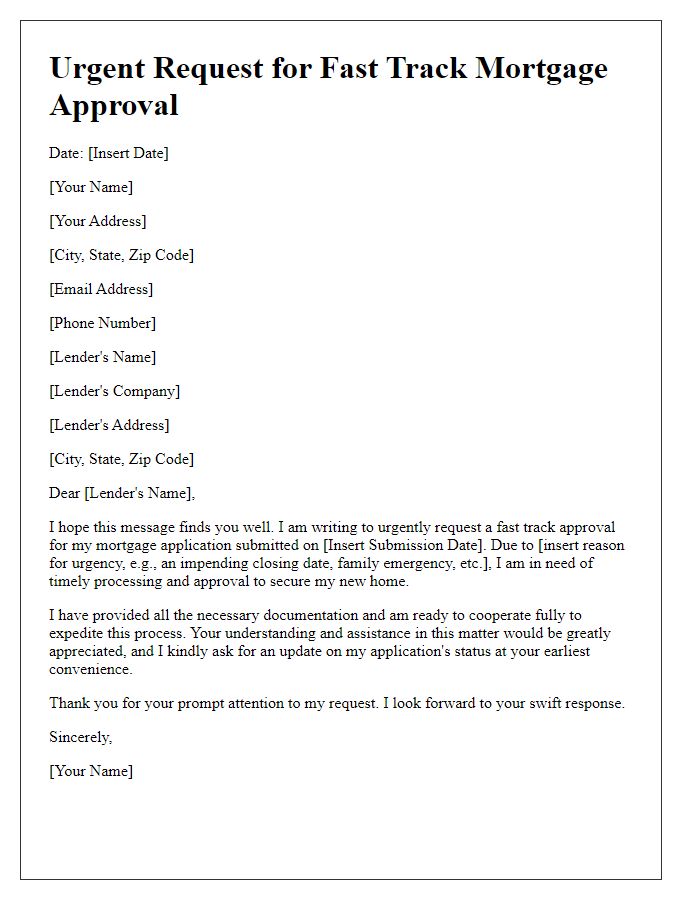

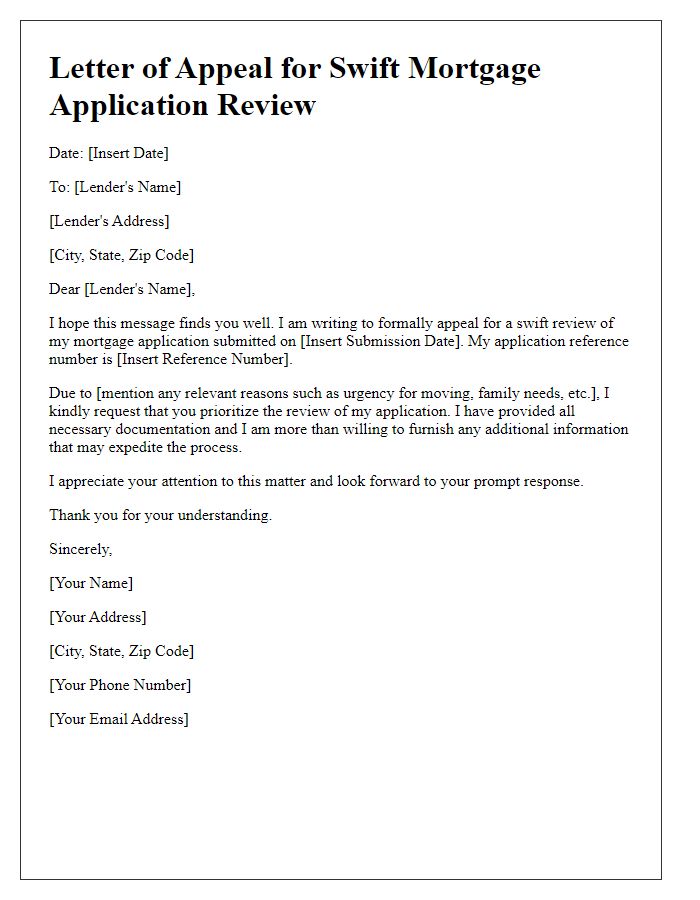

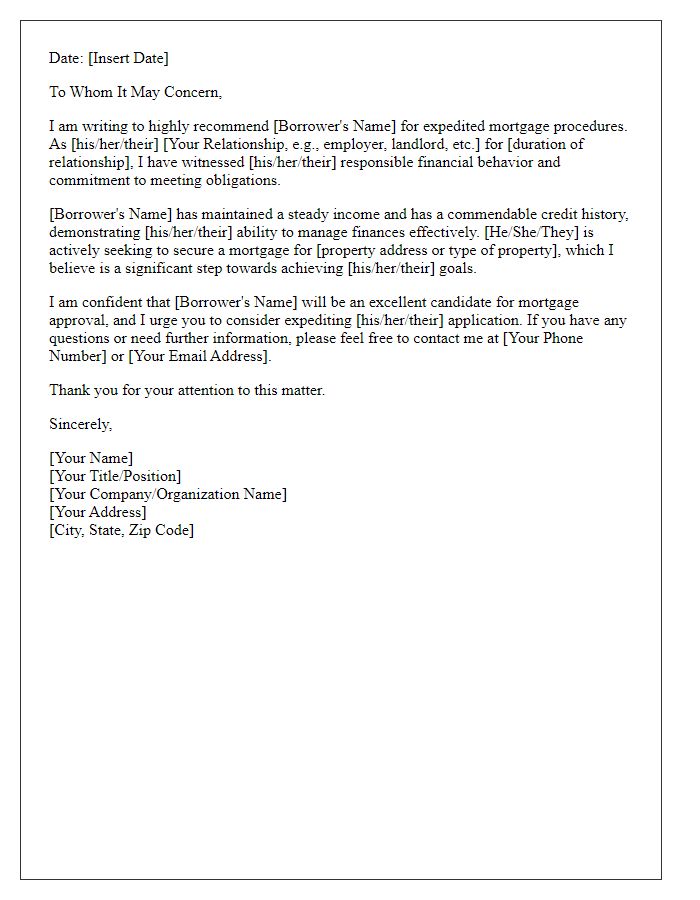

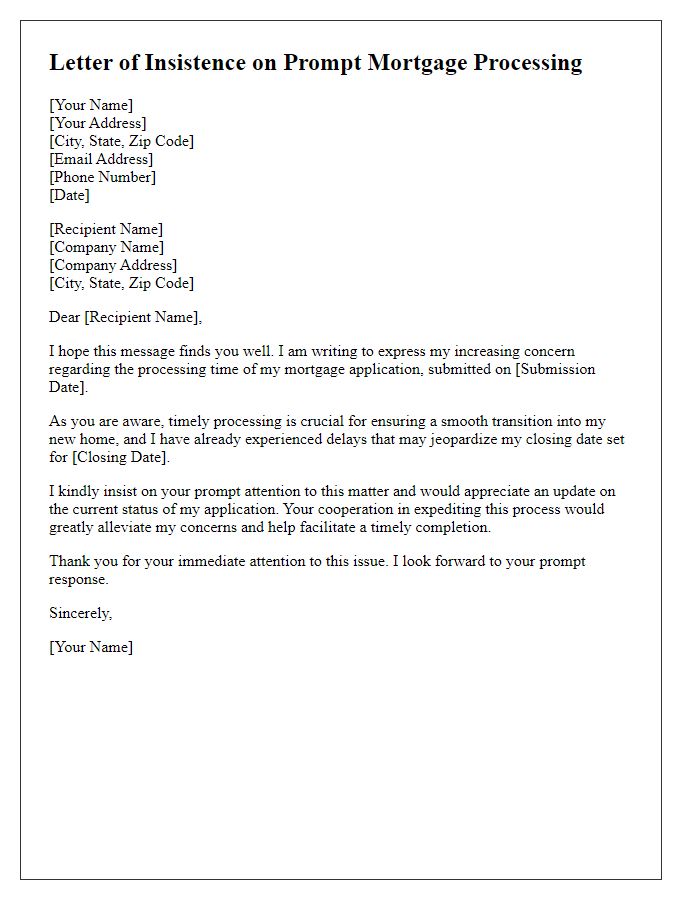

Request for Expedited Processing

The expedited mortgage processing request aims to accelerate the handling of mortgage applications, especially in critical situations like home purchases or refinancing. Applicants typically submit this request to lenders or mortgage brokers to emphasize urgency caused by events, such as purchasing a home in a competitive market or facing imminent expiration of a loan rate lock. Key details include the property address (e.g., 123 Main Street, Anytown), the applicant's credit score (above 700 for favorable rates), and a specific processing timeline (such as completion within two weeks). Supporting documents often include proof of income, employment verification, and the signed purchase agreement to streamline approvals and minimize delays in obtaining necessary financing.

Supporting Documentation

Expedited mortgage processing requires comprehensive and accurate supporting documentation to ensure a swift approval process. Essential documents include recent pay stubs, typically covering the last 30 days, as well as W-2 forms from the previous two years that verify annual income. Borrowers must provide bank statements from the past two months, detailing all transactions and current balances in checking and savings accounts. A detailed list of all outstanding debts, including credit card balances and loans, is vital for assessing creditworthiness. A copy of the applicant's driver's license or state-issued identification verifies identity, while tax returns for the last two years provide insights into financial stability. For those who are self-employed, profit and loss statements for the current year may be required alongside business tax returns. Furthermore, a purchase agreement or contract for the property is critical, outlining the terms of the transaction. Gathering these documents expedites the mortgage processing, reducing delays and facilitating quicker approval and funding.

Contact Information

Expedited mortgage processing requires clear communication and accurate details. Key contact information includes the borrower's full name, Social Security number, and date of birth. The lender's organization name, address (including city, state, zip code), phone number, and email address are essential. Additionally, necessary financial documents such as W-2 forms (last two years), recent bank statements (three months), and pay stubs (last month) must be gathered. Highlighting deadlines, such as 30-day closing periods or specific rate locks, can further emphasize urgency. Establishing a direct line for inquiries enhances accessibility, ensuring streamlined coordination between all parties involved in the mortgage process.

Comments