Are you feeling overwhelmed by your current mortgage payments? You're not alone, as many homeowners find themselves in a tight spot navigating rising costs and unexpected life changes. Luckily, you have options, and one of the most effective is to request an expansion of your mortgage payment terms. If you're curious about how to approach this and the benefits it could bring, keep reading to discover more insights and helpful tips!

Loan account details

Mortgage payment term expansion provides borrowers the opportunity to extend the duration of their loan agreement, which can result in lower monthly payments. Loan account details include essential information such as the unique account number (often 10 to 12 digits), the lender's name (such as Bank of America or Wells Fargo), the outstanding balance amount (which may vary widely based on original loan amount and duration), interest rate percentage (fixed or variable, often between 3% to 5% in recent markets), and payment history (including any missed or late payments). Key events surrounding this process may involve discussing options with a mortgage advisor, submitting a formal request, and understanding possible fees or penalties that might arise with the term extension. Documentation may be required to verify income and expenses, ensuring the borrower's ability to manage the adjusted payment plan effectively.

Reason for extension request

Mortgage payment term expansion can provide significant relief for homeowners facing financial challenges. Increased economic pressures, such as rising interest rates (which averaged 7.08% in the United States as of late 2023) or unforeseen medical expenses, often compel individuals to seek an extension. This adjustment can lower monthly payments, making financial obligations more manageable. A longer repayment period may also improve cash flow, allowing homeowners to allocate funds toward essentials like groceries or education bills. By extending the mortgage term, homeowners can mitigate the risk of default and maintain their property, contributing to overall financial stability in fluctuating markets.

Current financial situation

During 2023, many individuals faced significant financial challenges, driven by factors such as inflation rates reaching 8.5% and supply chain disruptions affecting essential goods, leading to increased living costs. Families in regions like California witnessed average housing prices soaring to over $700,000, compounding financial strain. Employment stability remained fragile, with the unemployment rate peaking at 6.4% during the year, resulting in decreased disposable income for mortgage holders. As a result, homeowners are increasingly seeking options to restructure their mortgage agreements, hoping to extend payment terms to alleviate financial burdens while ensuring the sustainability of their housing situations.

Proposed new terms

Proposed mortgage payment term expansion involves extending the duration of loan repayment, allowing for lower monthly payments. For instance, a 30-year loan term may be adjusted to 40 years, potentially reducing monthly payments by 20 to 30 percent. Lowering the payment amount is significant for homeowners facing financial challenges, such as job loss or unexpected expenses. Adjusting the interest rate to a favorable percentage can also influence overall affordability, impacting the total cost of the mortgage over time. Homeowners should consider reaching out to their lenders to discuss options, including potential modifications to repayment plans that could alleviate financial stress.

Contact information for follow-up

Mortgage payment term expansion can provide relief for homeowners facing financial challenges. For instance, extending a mortgage term from 15 to 30 years can significantly lower monthly payments, making them more manageable. Homeowners in the United States, according to a 2022 report, are increasingly seeking this adjustment due to rising living costs and inflation over 7%. Contact information is crucial for follow-up discussions regarding eligibility assessments and loan restructuring agreements. Ensure to include numbers for mortgage advisors, lenders, and government support agencies, like the Department of Housing and Urban Development, to facilitate seamless communication and guidance through the process.

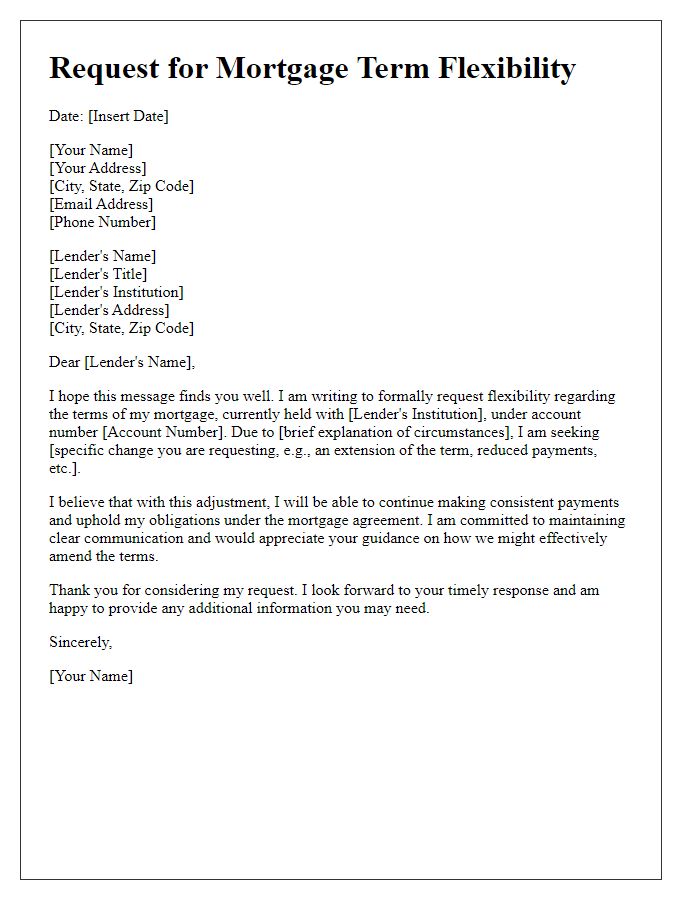

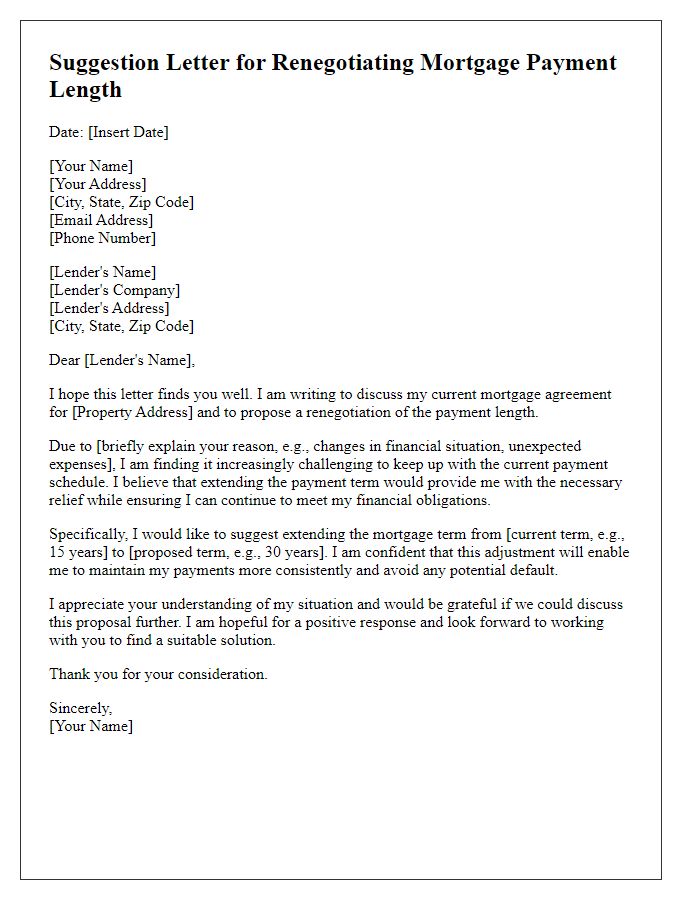

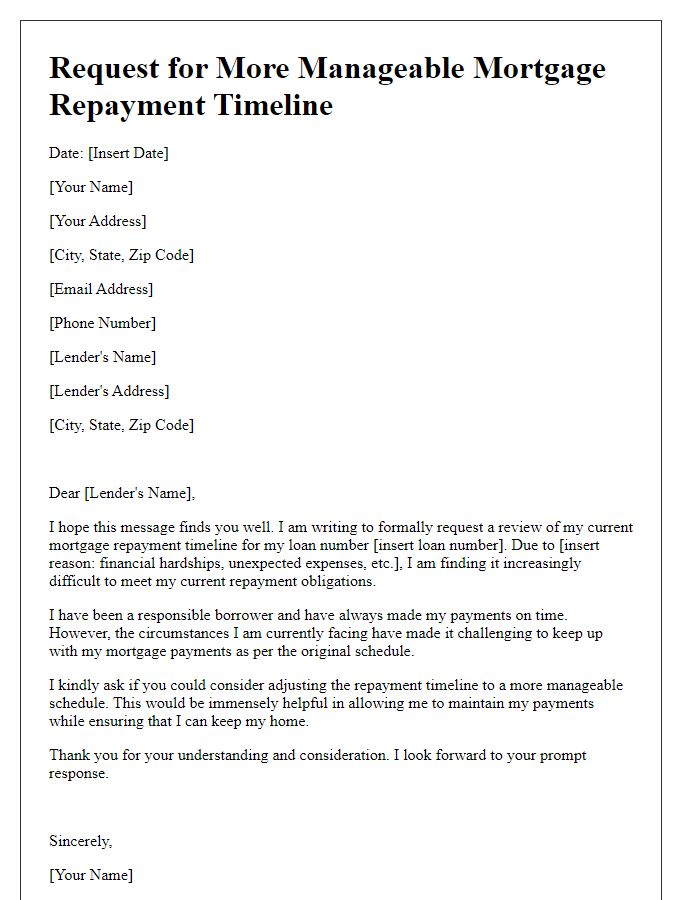

Letter Template For Mortgage Payment Term Expansion Samples

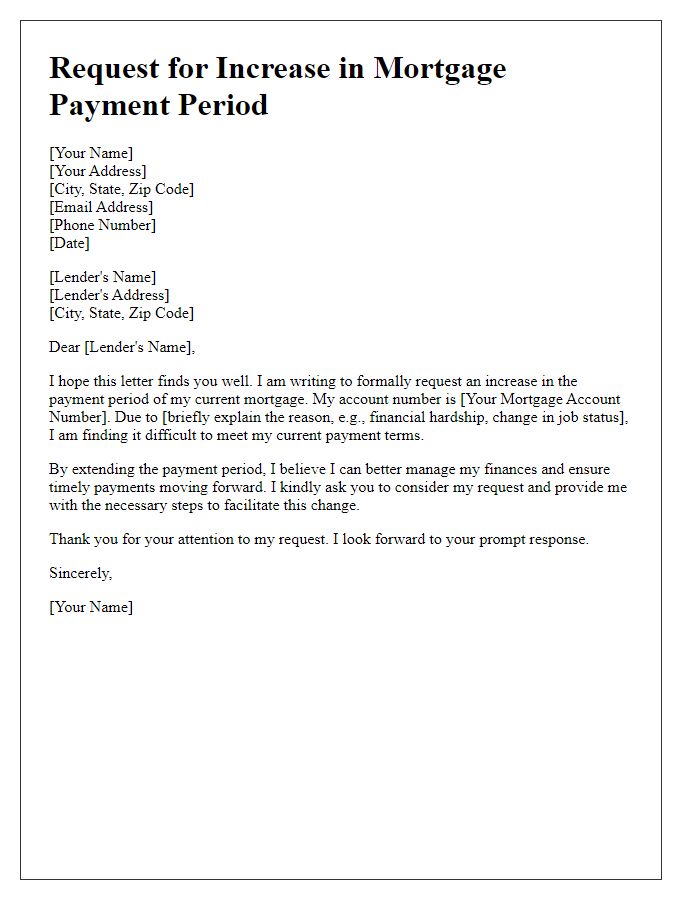

Letter template of solicitation for an increase in mortgage payment period

Comments