Are you considering buying a new home but unsure about your mortgage eligibility? Navigating the world of loans and interest rates can be confusing, but understanding your qualifications is the first step toward homeownership. In this article, we'll break down the essential criteria lenders typically look for when determining your mortgage eligibility. So, let's dive in and equip you with the knowledge you need to take your first steps toward securing that dream home!

Personal Information

Inquiries regarding mortgage eligibility require thorough evaluation of personal financial details. Key details include credit score (typically ranging from 300 to 850), debt-to-income ratio (preferably below 36%), and annual income (average household income varies by region, with $68,700 reported in the U.S. in 2021). Additionally, employment history (usually a minimum of two years in the same job) and assets (including savings and investments exceeding three months of mortgage payments) play crucial roles. Prospective buyers should also prepare to disclose personal identification, social security number, and bank statements for precise assessment by lenders. Overall, clear and accurate personal information is vital for determining mortgage eligibility and securing favorable loan terms.

Property Details

When considering mortgage eligibility, various property details play a crucial role. The address of the property (including street, city, and ZIP code) provides essential location information. Property type (single-family home, condominium, or multi-family dwelling) influences criteria for loan approval. The year built (dates like 2005 or 2010) may affect its market value and loan terms. Square footage (measured in square feet, e.g., 1,500 sq ft) indicates the interior size, impacting overall appraisals. Lot size (often described as acres or square feet) also contributes to value assessments. Condition rating (new, good, or needs repairs) provides insight into potential renovation costs. Important amenities (like a swimming pool or garage) can enhance desirability and market value. Including property tax information (local tax rates such as 1.25% in certain states) is essential for calculating costs. Homeowners association fees (if applicable) may influence overall budgeting and loan qualification assessments.

Financial Overview

A financial overview is essential for assessing mortgage eligibility, particularly when considering factors such as credit score, debt-to-income ratio, and saving history. The average credit score required for a conventional mortgage typically hovers around 620, while government-backed loans, like FHA (Federal Housing Administration) loans, might accept scores as low as 580, depending on the specifics. Debt-to-income ratios should ideally stay below 36%, with the total monthly debt not exceeding this threshold, allowing for easier approval processes. Employment stability is crucial; lenders often verify that applicants have consistent income over the past two years, particularly in industries with solid growth. Additionally, demonstrating savings through a down payment, which averages around 20% of the home's purchase price, can significantly enhance eligibility. A detailed financial overview aids lenders in making informed decisions about mortgage applications.

Loan Amount Request

Mortgage eligibility inquiries for specific loan amounts often revolve around a borrower's financial profile and property type. In this context, understanding factors like credit score (typically ranging from 300 to 850), debt-to-income ratio (should ideally be below 43%), and employment history (minimum of two years in the same industry) is crucial in determining qualification. Furthermore, the desired loan amount, such as a $300,000 mortgage for a residential property in California, will require an assessment of local market conditions and property appraisals to ensure adequate collateral. Lenders may also evaluate monthly payment capacity, focusing on ensuring that the mortgage payment does not exceed 28% of gross monthly income.

Contact Information

Mortgage eligibility inquiries involve assessing financial qualifications for potential home loans. Factors such as credit score (typically above 620), debt-to-income ratio (ideally below 43%), and employment history (generally two years) are crucial in determining eligibility. Interested borrowers should provide personal contact information, including full name, address, phone number, and email (to facilitate communication). Additionally, documentation may include proof of income (recent pay stubs or tax returns), asset statements (bank accounts or retirement funds), and any existing debts (credit card balances or personal loans). Understanding lender requirements can significantly impact mortgage approval decisions, influencing interest rates and loan terms.

Letter Template For Mortgage Eligibility Inquiry Samples

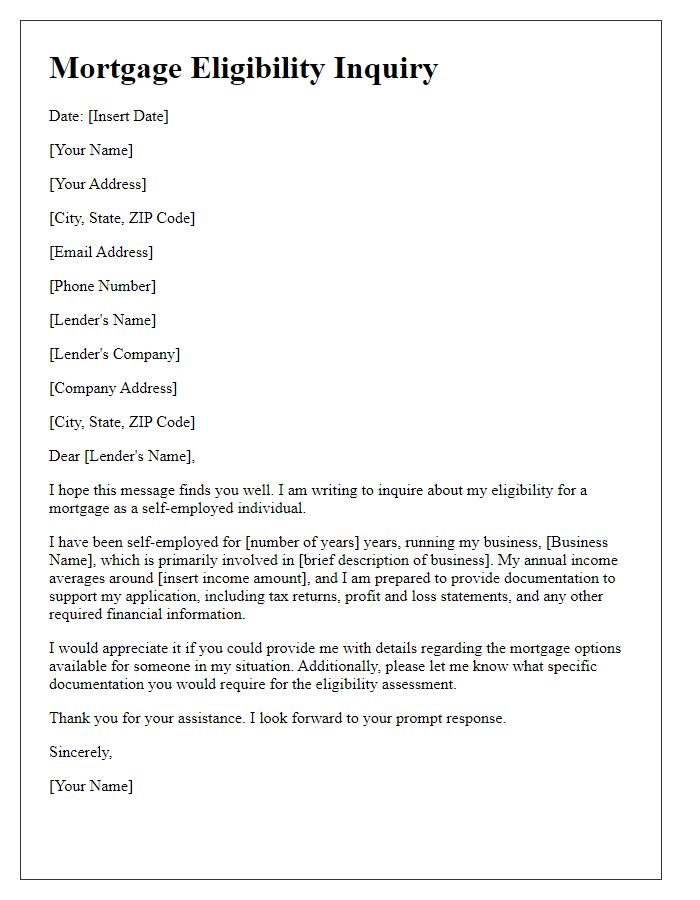

Letter template of mortgage eligibility inquiry for self-employed individuals

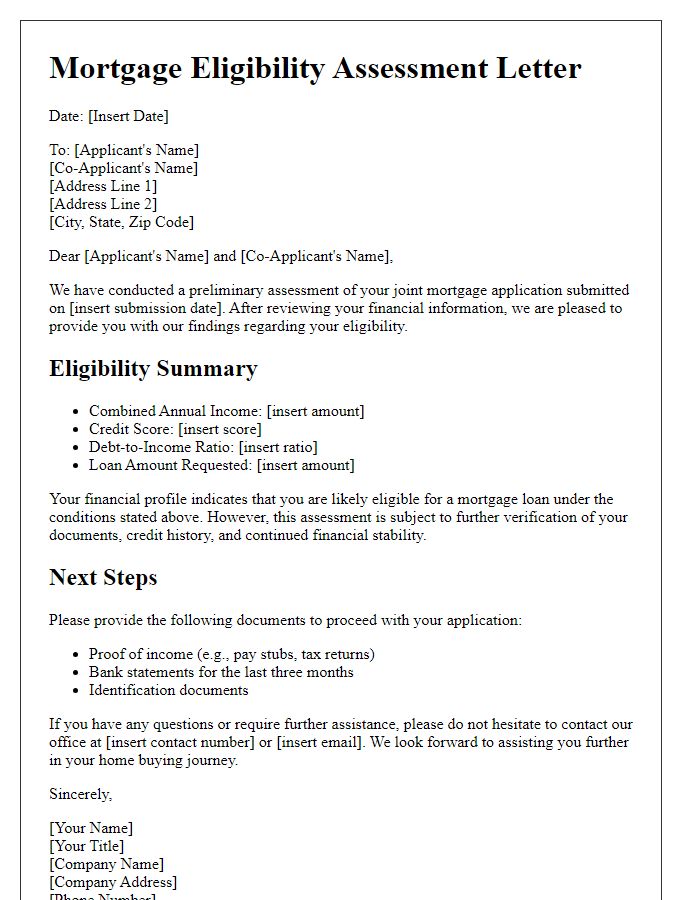

Letter template of mortgage eligibility assessment for joint applications

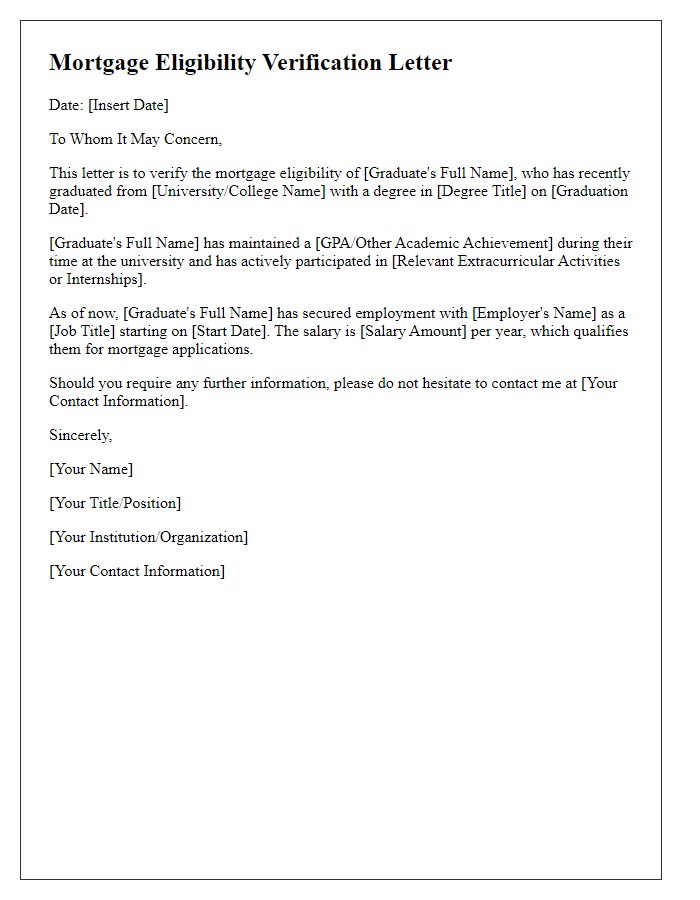

Letter template of mortgage eligibility verification for recent graduates

Letter template of mortgage eligibility question for low credit score applicants

Letter template of mortgage eligibility inquiry for investment property buyers

Letter template of mortgage eligibility request for veterans or active military personnel

Comments