If you've recently experienced a change in your mortgage situation, updating your account information is crucial to stay on track. Whether it's a change in your address, financial details, or contact information, keeping your lender informed can help avoid unnecessary complications. It's easier than you might think to get this done, and ensuring your information is accurate can save you from headaches down the road. Ready to learn how to update your mortgage account seamlessly? Let's dive in!

Borrower's full name and contact details

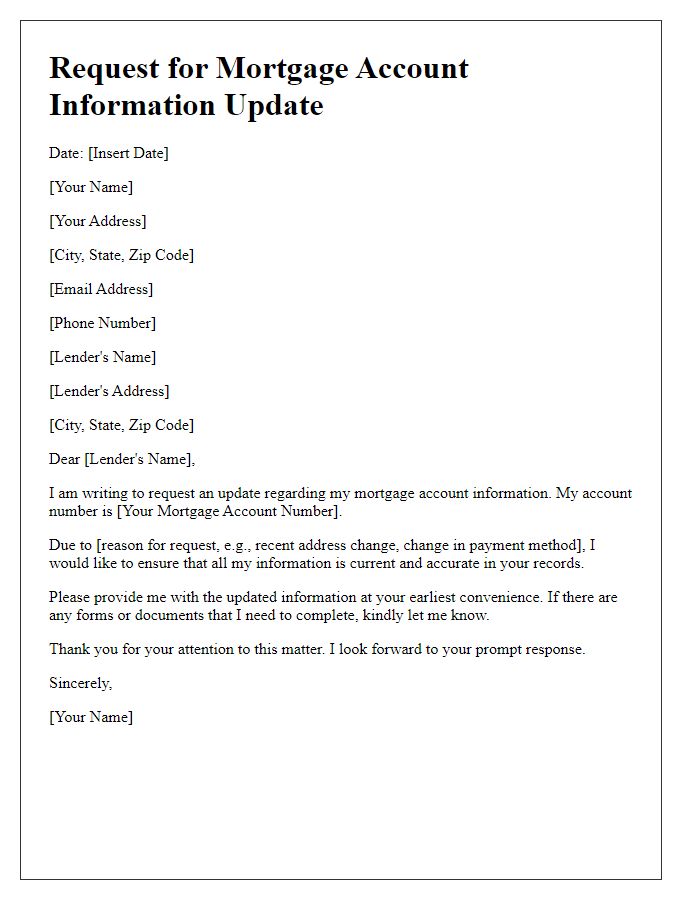

Updating mortgage account information involves providing accurate details such as the borrower's full name, a vital identification in the mortgage process. Including current contact details, such as phone number and email address, ensures effective communication with the mortgage lender, facilitating smooth updates. The mortgage account number, a unique identifier, is essential for linking the information to the correct account. Additionally, specifying the nature of the update, such as changes in employment or address, is crucial for accurate processing. Promptly providing this information can help avoid potential issues related to payments and account management.

Mortgage account number

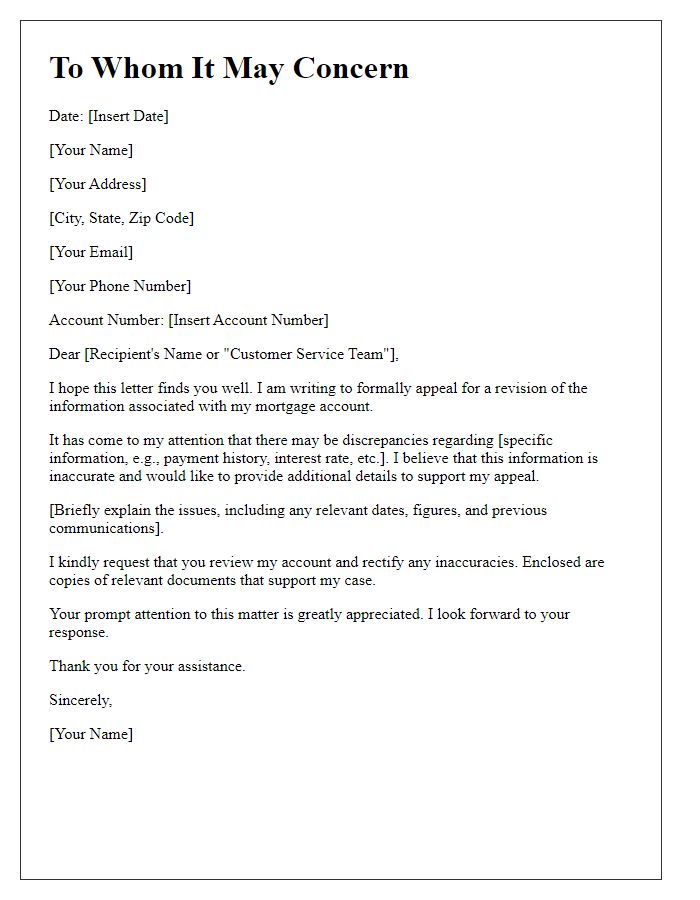

Updating mortgage account information is essential for homeowners to ensure accuracy. Homeowners often need to change personal details, such as address, contact number, or marital status. The mortgage account number serves as a unique identifier (typically a combination of numbers and letters, often 10-15 characters long) essential for processing updates within the lender's system. Failure to update this information promptly may lead to missed communications regarding important events like payment deadlines or changes in terms. Properly maintaining this information ensures continued compliance with mortgage agreements and avoids potential negative consequences such as late fees or credit score impacts.

Updated personal and financial information

Updating mortgage account information is crucial for maintaining accurate records with financial institutions. Homeowners often need to provide new personal details, such as current addresses or contact numbers, to lenders like Bank of America or Wells Fargo. Financial updates may include changes in income due to job transitions, reflecting accurate creditworthiness. It's essential to submit supporting documents, like pay stubs or tax returns, as validation. Ensuring timely updates can improve communication regarding mortgage statements and potential refinancing opportunities. Properly organizing this information prevents discrepancies in account management and aids in maintaining favorable terms.

Specific details of changes requested

Updating mortgage account information involves various essential details, such as the account holder's name, contact information, and property address. For instance, if the account holder's phone number changes from (555) 123-4567 to (555) 765-4321, it is crucial to inform the mortgage lender promptly to ensure seamless communication. Additionally, if the account holder moves and the property address changes from 123 Elm Street, Springfield to 789 Maple Avenue, Springfield, an update is essential to reflect accurate records. Furthermore, if there are changes in the employment status or income, such as transitioning from a full-time position at XYZ Corporation to self-employment, this information is vital for the lender's assessment of the mortgage account. Timely updates help avoid issues such as misplaced correspondence or delays in payments.

Signature and date

Updating mortgage account information requires careful attention to details such as account numbers, loan servicer names, and contact information. Ensure to include the mortgage account number, typically a unique 10 to 15 digit code assigned by the lender, alongside your full name and any applicable co-borrower names. Specify the changes being requested, such as a new mailing address or updated phone number. Utilizing proper formats, like including the date in MM/DD/YYYY format, enhances clarity. Additionally, include a handwritten signature at the bottom of your correspondence, confirming authenticity and intent to update the account records with your lender. Always retain a copy of your request for your personal records.

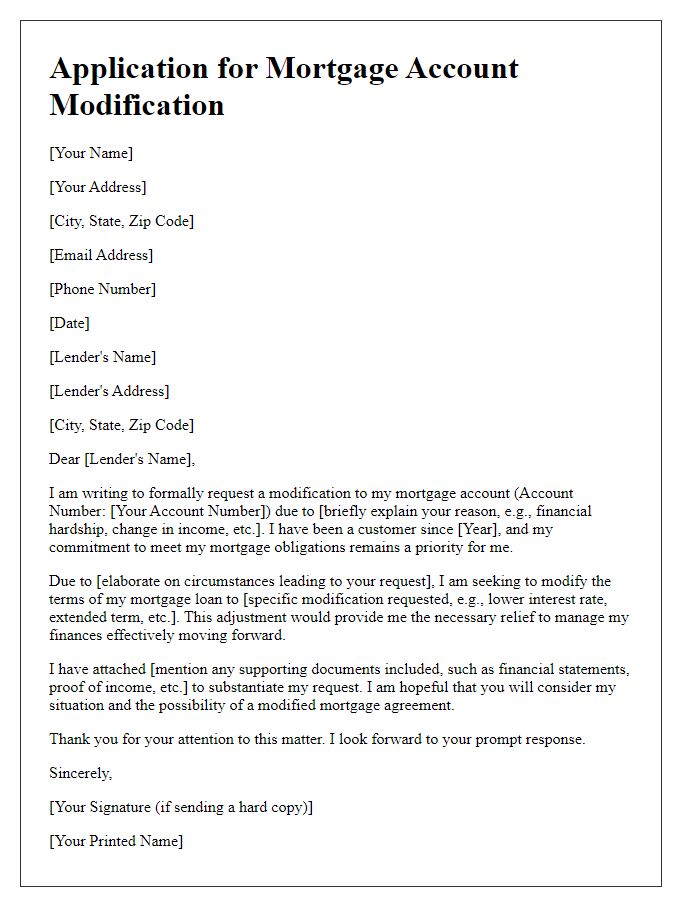

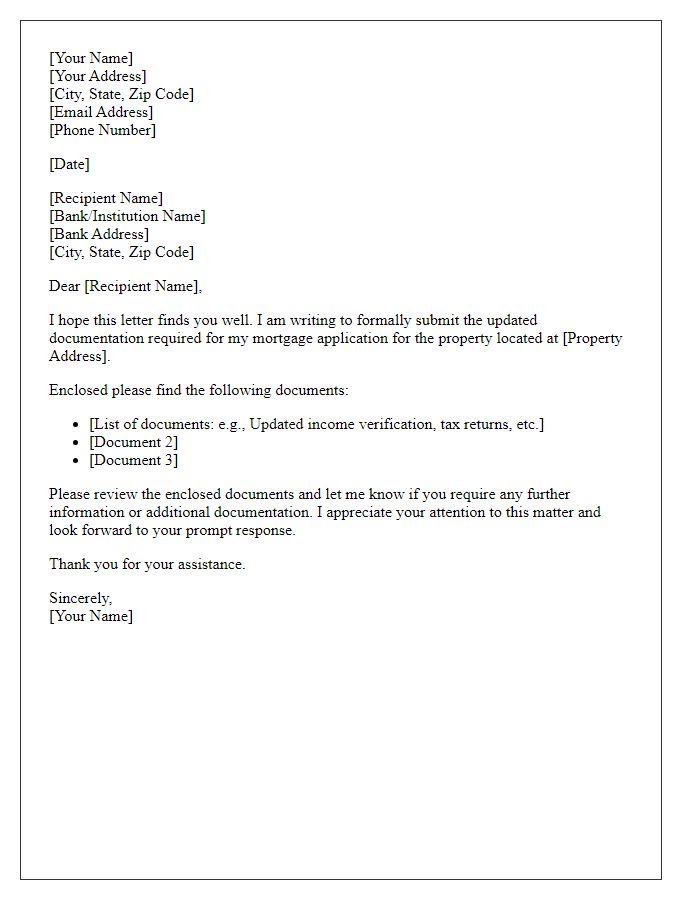

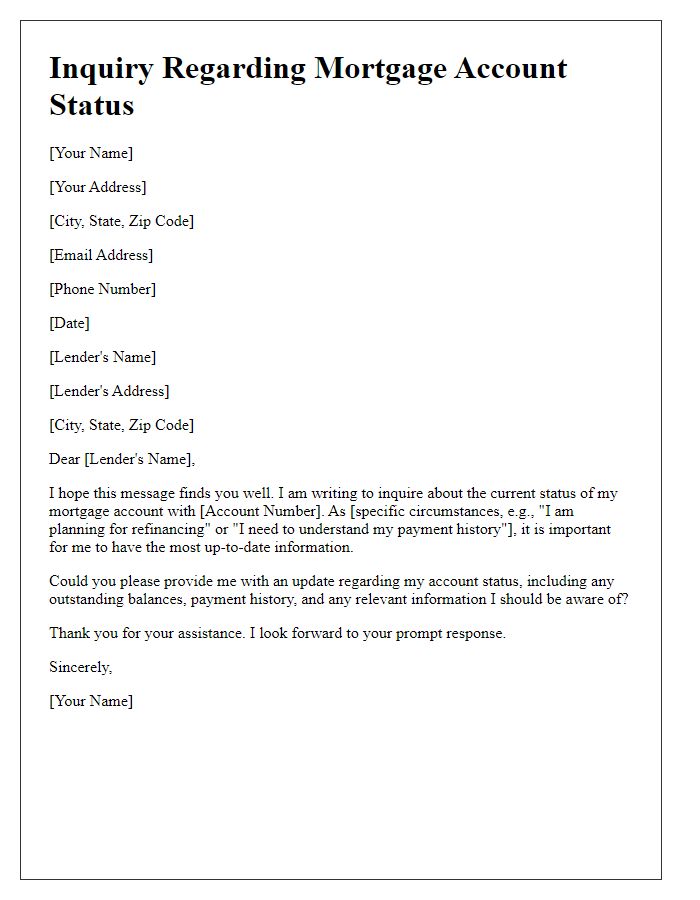

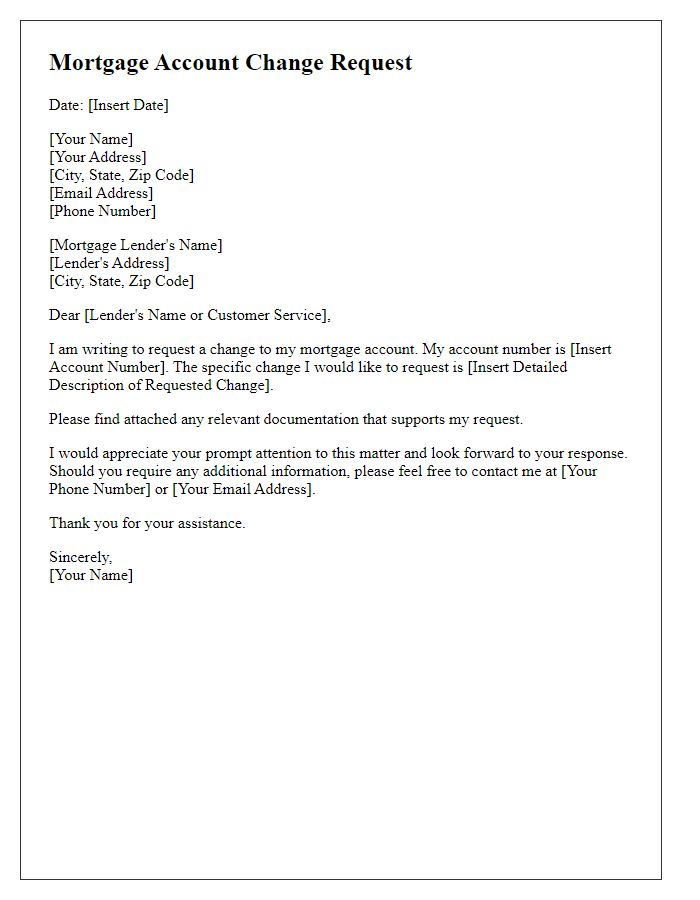

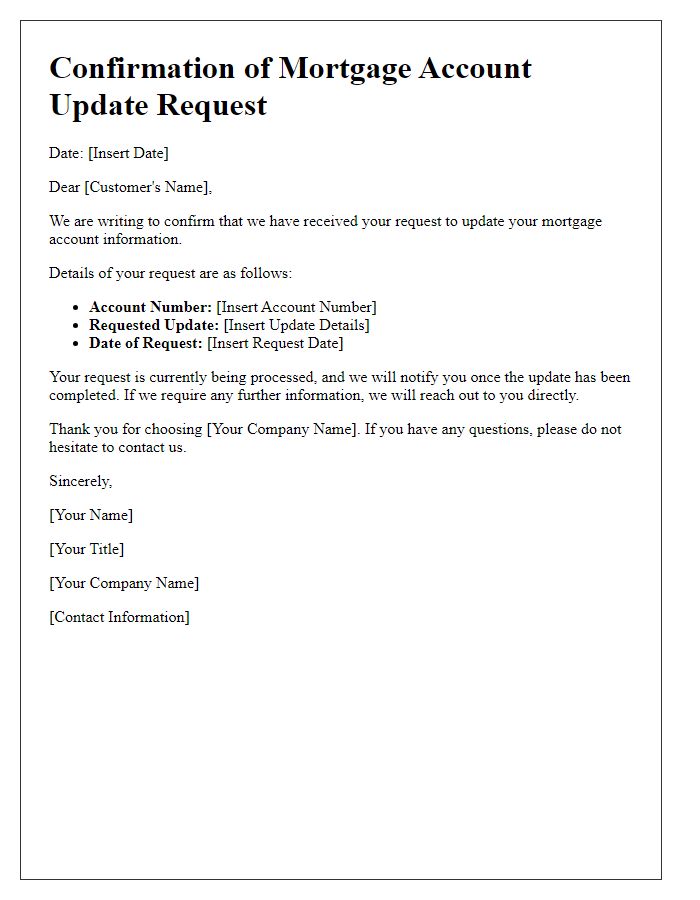

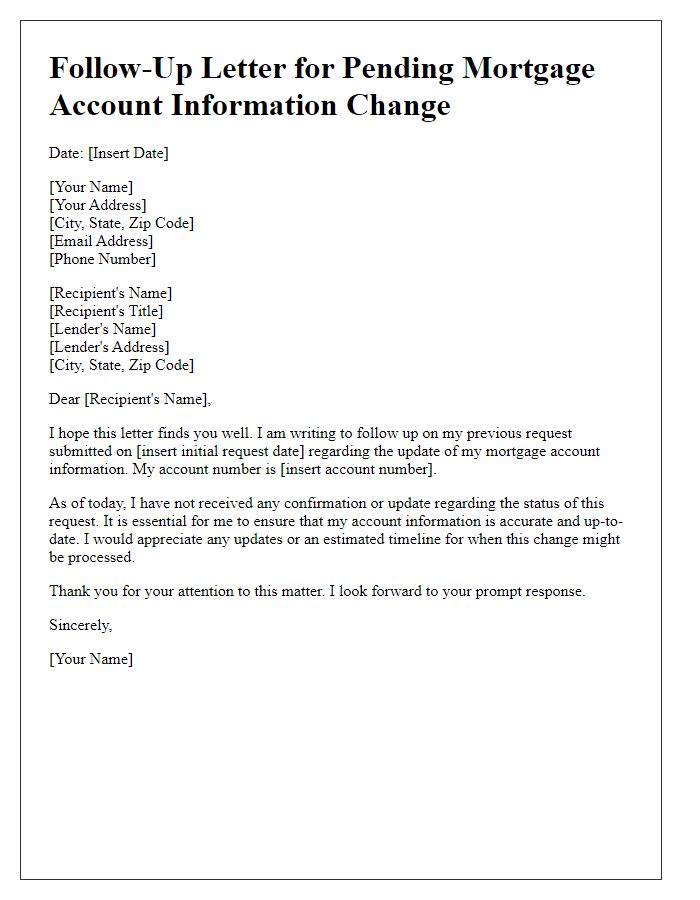

Letter Template For Updating Mortgage Account Information Samples

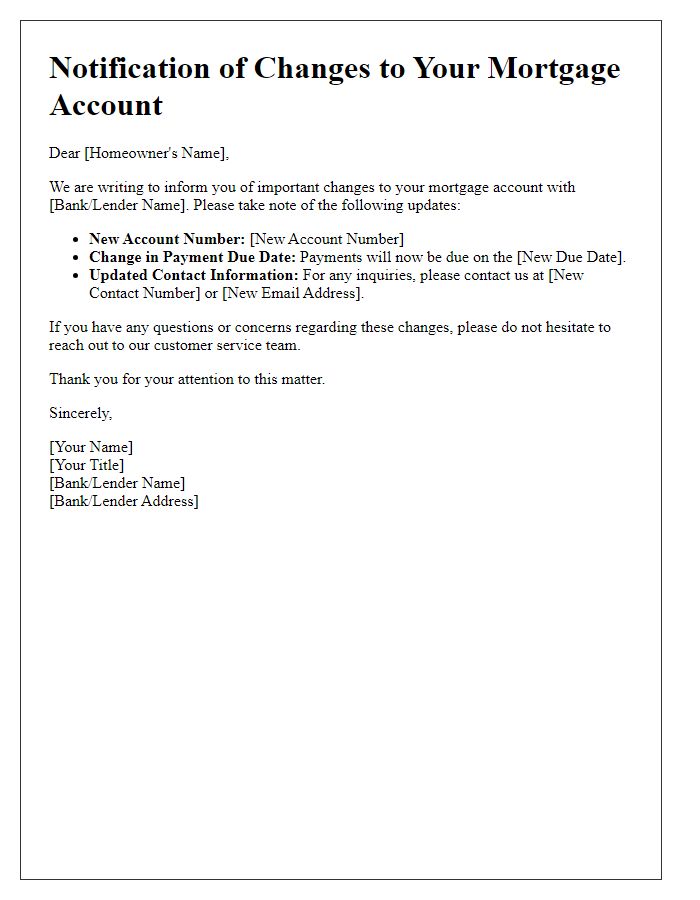

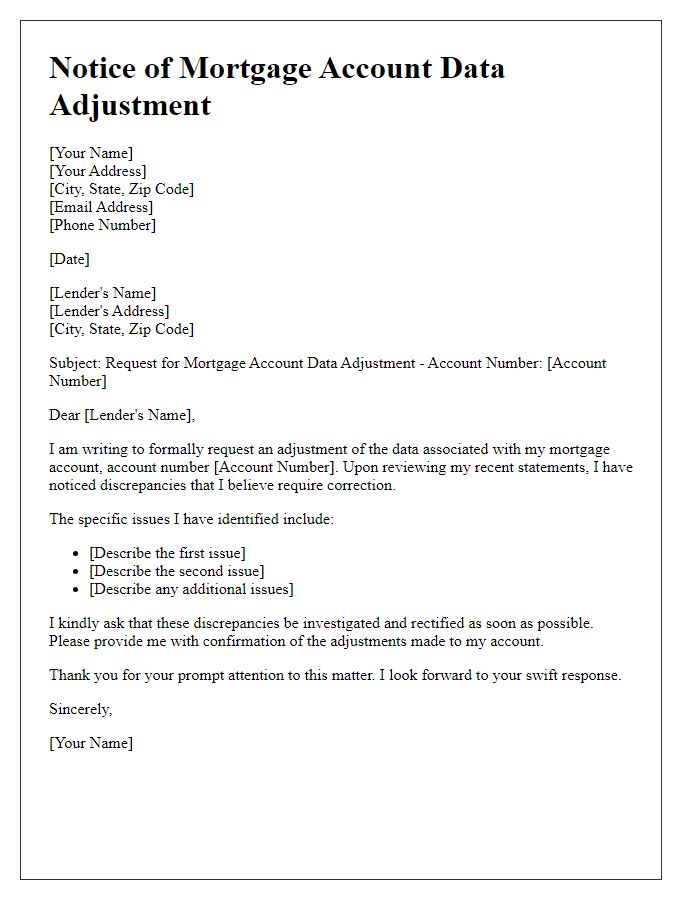

Letter template of notification for changes in mortgage account details.

Comments