Are you feeling a little unsure about the recent changes in interest rates? You're not alone; many borrowers and savers alike are trying to navigate this evolving financial landscape. Understanding how these shifts impact you can make all the difference in your financial planning. So, let's dive deeper into what this means for you and explore how these changes could affect your financial decisions moving forward!

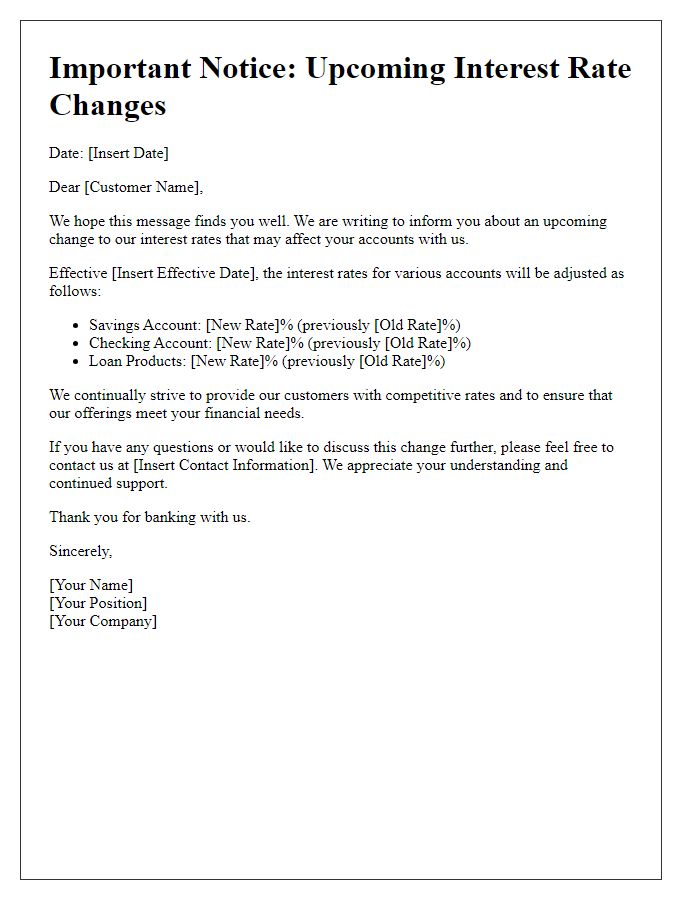

Clear Introduction

Interest rate changes can significantly influence financial decisions, particularly for borrowers and investors. On November 2, 2023, the Federal Reserve announced a 0.25% increase in the federal funds rate, elevating it to 5.50%. This decision may affect variable-rate loans, including mortgages and personal loans, as financial institutions typically adjust their interest rates following the Fed's announcements. Additionally, this change may impact savings account rates, potentially offering higher returns for savers. Understanding the implications of these adjustments is crucial for making informed financial choices in a fluctuating economic landscape.

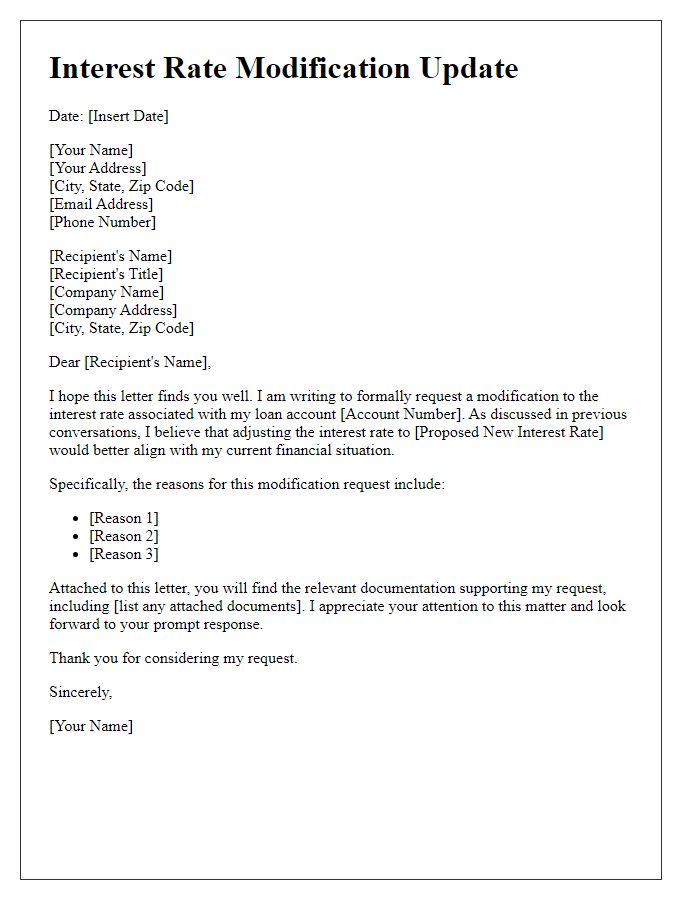

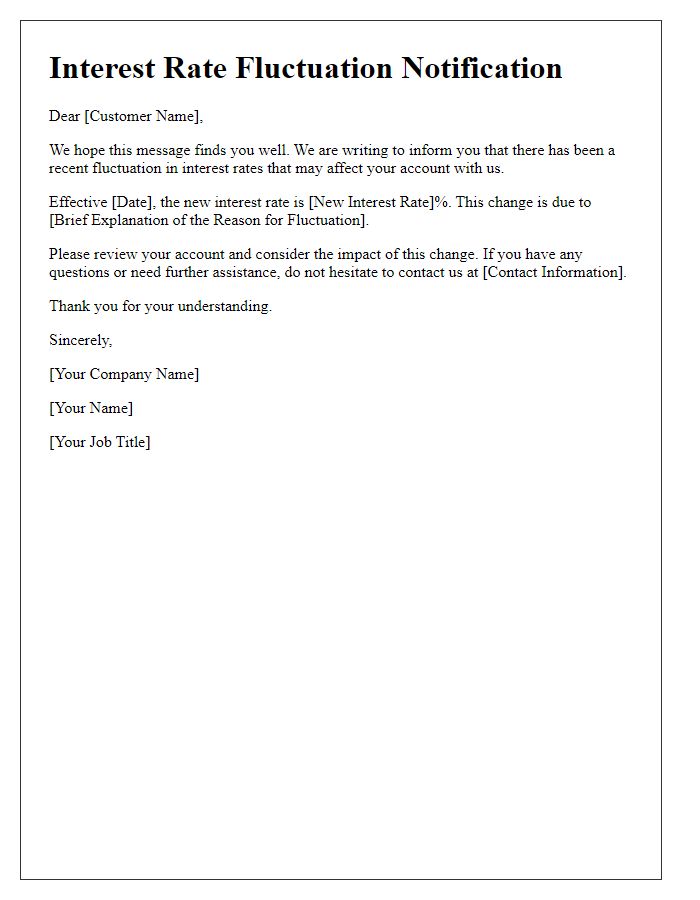

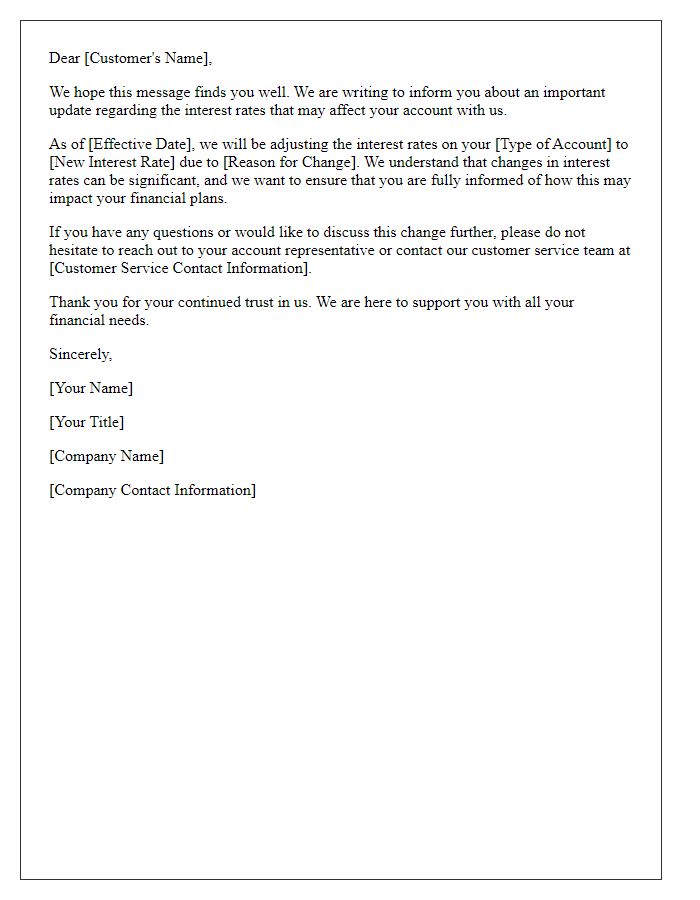

Concise Explanation

Interest rate changes can significantly impact various financial products, such as mortgages, loans, and savings accounts. Central banks, like the Federal Reserve in the United States, often adjust rates in response to economic indicators, aiming to manage inflation and promote economic growth. For example, an increase in the federal funds rate can lead to higher borrowing costs for consumers and influence interest rates on new loans and credit cards. Conversely, a decrease in rates can encourage spending and investment. These changes typically affect loan repayment amounts and overall savings growth, making it essential for individuals to stay informed about their bank's policies and market conditions.

Impact Details

Interest rate fluctuations significantly influence mortgage payments for homeowners. A rise in interest rates, such as a 0.5% increase announced by the Federal Reserve in September 2023, can lead to an increase in monthly payments, potentially affecting affordability for borrowers. For instance, a $300,000 loan with a 30-year fixed rate mortgage at 4% versus 4.5% can result in almost $100 more in monthly payments. Home equity loans also become costlier as interest rates climb, impacting consumers looking to fund renovations or consolidate debt. Additionally, high rates deter potential homebuyers, resulting in decreased housing market activity and slower price growth in areas like San Francisco or New York. Financial planning becomes crucial during periods of rising rates, as consumers may need to explore refinancing options or budget adjustments.

Effective Date

Interest rate adjustments significantly impact financial institutions and borrowers. An increase in the interest rate, typically set by central banks like the Federal Reserve in the United States, can elevate borrowing costs for loans and credit cards, affecting millions of consumers. For instance, an increase from 3% to 4% on a mortgage can result in hundreds of dollars in additional monthly payments. These changes often take effect on predetermined dates, allowing banks and lenders to communicate adjustments clearly to clients, ensuring transparency and opportunity for borrowers to explore refinancing options. In this context, understanding the implications of such rate changes is crucial for individuals managing personal finances and investments.

Contact Information

Interest rate changes in financial institutions significantly impact loan agreements and savings accounts. A notification letter typically includes the institution's name and contact information, such as the address, phone number, and website, allowing customers to reach out for clarification. Interest rates, often expressed as annual percentage rates (APRs), can fluctuate based on the Federal Reserve's monetary policy adjustments or changes in the market. Customers should be informed about the effective date of rate changes and how it affects their ongoing loans, credit cards, or savings accounts. Customers located in regions such as New York or California may experience different rates based on local market conditions.

Comments