Are you considering converting your existing mortgage into an installment loan? It's a smart move that can help you manage your finances more effectively and potentially lower your monthly payments. In this article, we'll guide you through the process, explaining each step in a simple, conversational way. So, if you're ready to take control of your financial future, keep reading to discover how an installment mortgage loan conversion can benefit you!

Borrower's Personal Information

Borrowers seeking an installment mortgage loan conversion may need to provide specific personal information for processing. Essentials include full name (as per government identification), current address including city, state, and zip code (for accurate correspondence), social security number (for credit assessment), and current employment details (including employer name and position). Financial information such as income amount (monthly or annually), existing debts (credit card balances, other loans, etc.), and assets (savings account balances, property values) are critical for evaluating eligibility. Additionally, providing loan account number (specific to the mortgage in question) and any previous correspondence with the lender may expedite the conversion process. Complete and accurate information ensures smooth transition during the refinancing or conversion phase.

Loan Account Details

An installment mortgage loan conversion involves the alteration of a mortgage type to enhance financial flexibility or reduce interest rates. Details such as loan account numbers, payment schedules, and outstanding balances must be clearly listed. For instance, the original account number (e.g., 12345678) represents the existing mortgage, while the proposed new terms may involve a different account pertaining to a fixed-rate or adjustable-rate mortgage option. Key dates, like loan origination (e.g., January 15, 2020) and the conversion proposal date (e.g., October 1, 2023), play crucial roles in the documentation process. Relevant interest rates, such as the previous rate (e.g., 4.5%) in contrast with the proposed new rate (e.g., 3.8%), should be specified to illustrate potential savings. Additional information required includes the borrower's personal details, property location (e.g., 123 Main Street, Springfield), and the desired loan term adjustments, ensuring all aspects of the conversion process are comprehensively documented for approval.

Conversion Request Statement

A mortgage loan conversion involves altering the terms of an existing installment mortgage, allowing homeowners to potentially secure better interest rates or adapt payment structures. The conversion process can take place in multiple scenarios, such as transitioning from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, offering greater financial stability, particularly in fluctuating markets. Homeowners should submit a formal Conversion Request Statement to their lending institution, detailing personal information like loan account number, property address in cities such as Los Angeles or Chicago, specific loan terms sought, and any accompanying documentation that may support their request. Additional details to consider include current interest rates, market trends, and personal financial objectives to ensure a well-rounded approach to the conversion process.

Reason for Conversion

Transitioning from a fixed-rate mortgage to an adjustable-rate mortgage can provide significant financial advantages for homeowners. This decision often stems from favorable market conditions, such as interest rates declining to historically low levels, which can reduce monthly payments. For instance, homeowners with loans in the 4% range may benefit from converting to a loan with an interest rate around 3%, leading to substantial savings over time. Additionally, conversion can facilitate access to home equity, providing funds for renovations or other investments. The process typically involves working with financial institutions, such as local banks or credit unions, which can offer tailored advice and services based on individual financial situations. Timing becomes crucial, as fluctuations in the market can impact whether conversion results in overall savings or costs.

Future Financial Plans and Consent

Future financial plans can significantly influence the conversion of an installment mortgage loan. Borrowers typically consider factors such as interest rates, loan duration, and potential prepayment penalties during this process. Consent for the loan conversion often requires thorough documentation outlining terms and conditions, including financial stability assessments, income verification, and credit score evaluations. The conversion may provide benefits such as lower monthly payments or reduced interest rates, which can enhance overall financial management. It is essential to evaluate current market conditions, including the Federal Reserve's interest rate decisions, to make informed choices about mortgage conversion strategies.

Letter Template For Installment Mortgage Loan Conversion Samples

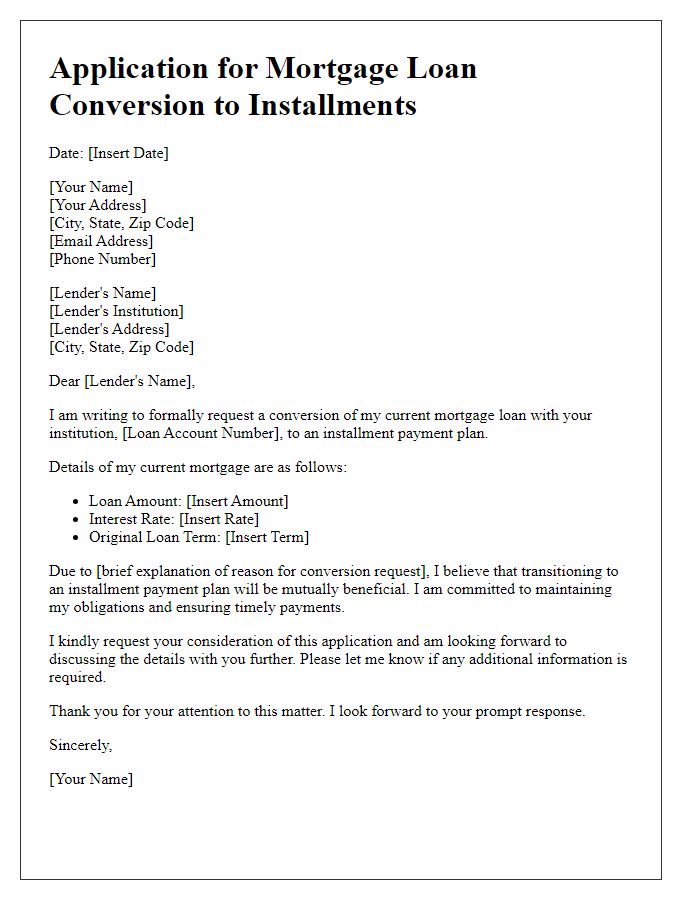

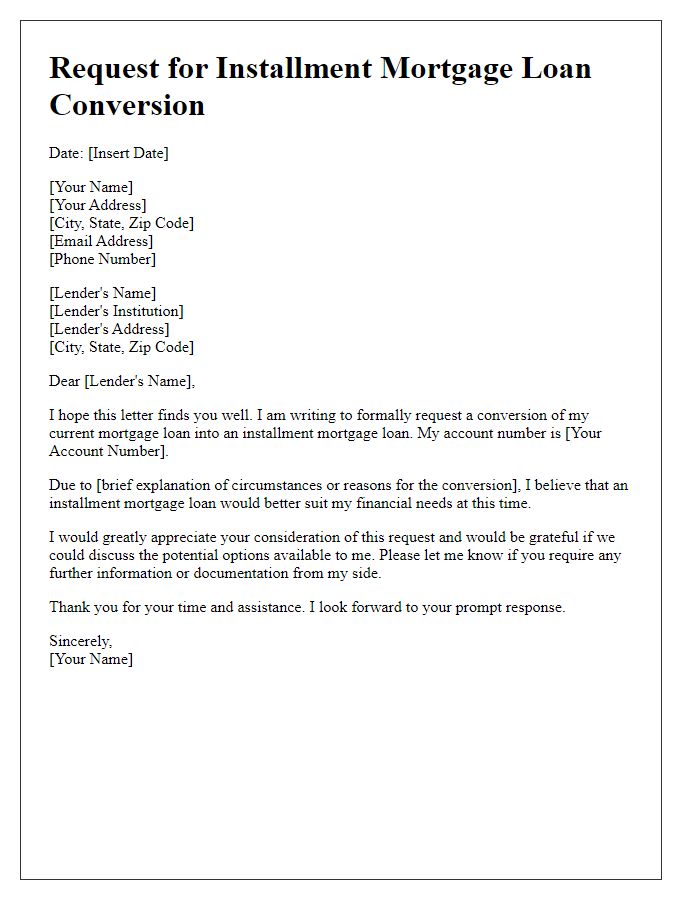

Letter template of application for mortgage loan conversion to installments

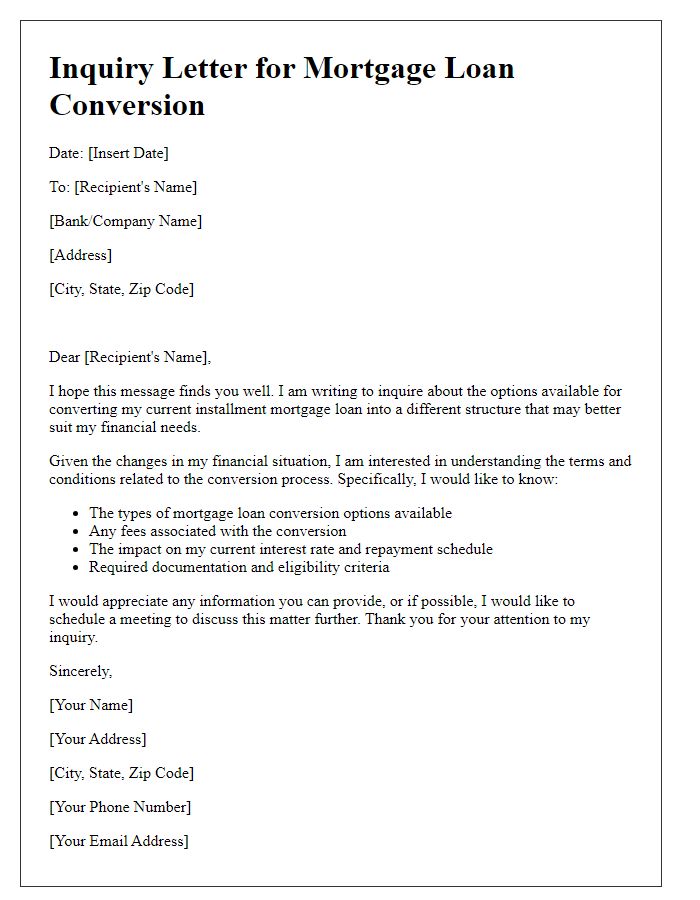

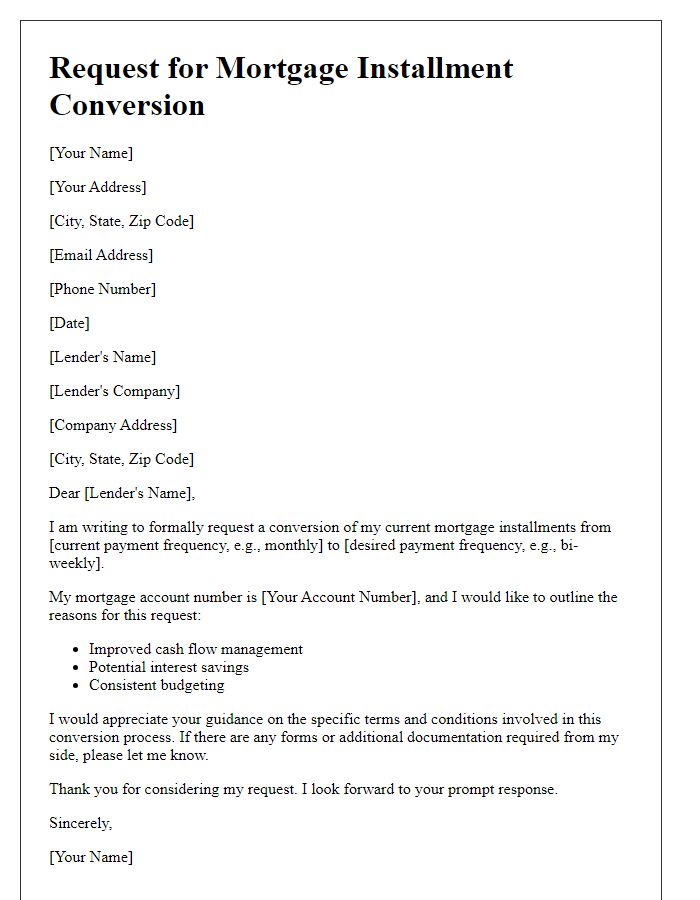

Letter template of inquiry regarding installment mortgage loan conversion options

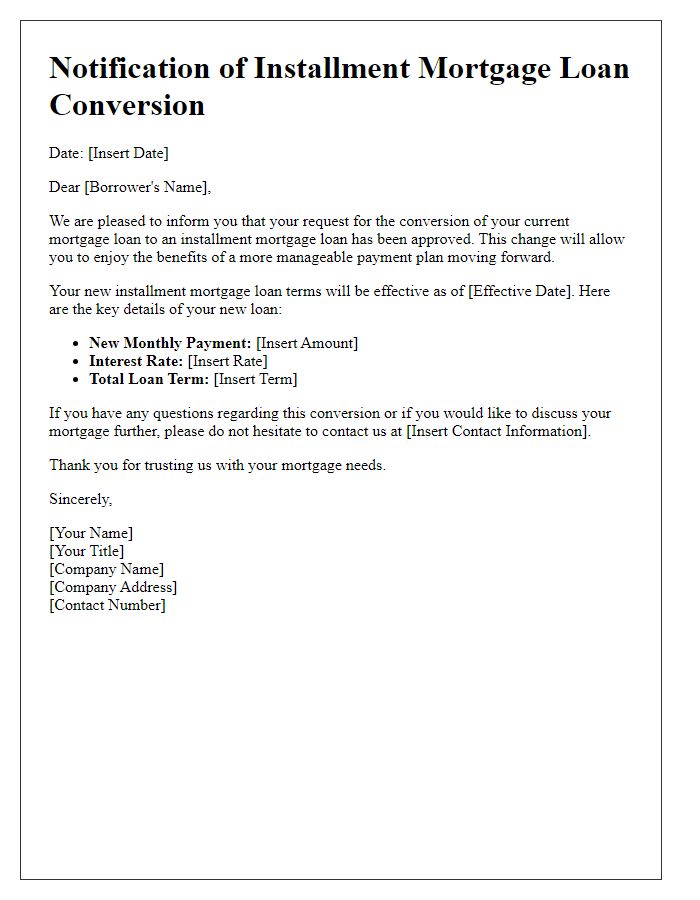

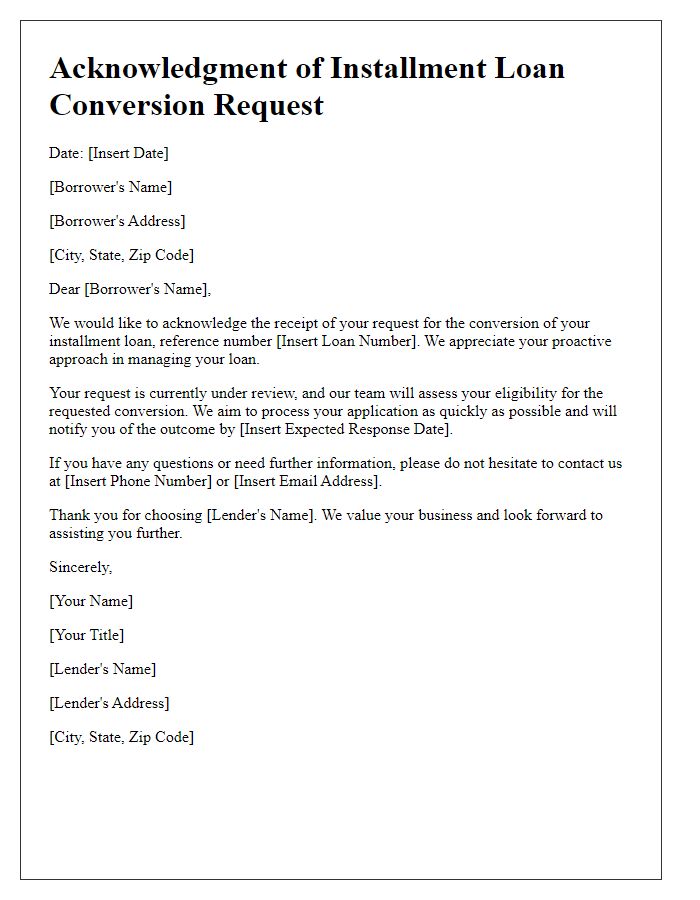

Letter template of notification for installment mortgage loan conversion

Letter template of approval request for mortgage loan installment conversion

Letter template of confirmation for installment loan conversion in mortgage

Letter template of support for installment mortgage loan conversion process

Letter template of disagreement on mortgage installment loan conversion terms

Comments