When it comes to managing your mortgage, understanding the transfer process can be crucial, especially if you're looking to switch lenders or modify your loan terms. This simple yet important step often requires a formal letter of authorization, allowing your new lender to take over. In this article, we'll explore the ins and outs of writing a mortgage loan transfer authorization letter, ensuring you're equipped with the correct information and format. So, grab a cup of coffee and let's dive into the details to make this transition as smooth as possible!

Borrower's personal information

A mortgage loan transfer authorization involves critical documentation required for transferring loan responsibilities. Borrower's personal information should include full name, current address, Social Security number for identification, phone number for contact, and email address for communication purposes. The mortgage account number uniquely identifies the loan, ensuring accurate processing of the request. Additional details such as the current loan servicer's name, property address associated with the loan, and the date of the transfer request can expedite the authorization process. Secure handling of this personal information is essential to prevent identity theft and protect confidentiality during the transfer.

Property details

Transferring a mortgage loan can involve a variety of property details associated with the real estate, including the address, legal description, and identification number. The address of the property, such as 123 Main Street, Springfield, IL, provides a specific location identifiable within local property records. The legal description offers an official designation often found in public property documents, which can include lot number and block details. The property identification number (PIN), unique to each property within a jurisdiction, helps delineate ownership and tax assessments. Additionally, inclusions such as mortgage account number and seller or buyer information are critical for documenting the transition of the mortgage loan and ensuring all parties consent to the transfer effectively.

Loan account number

Mortgage loan transfer authorization allows the transfer of a mortgage loan from one lender to another. Key elements include the loan account number, typically a unique identifier such as a 10 to 12-digit sequence assigned by the lender. This process often involves financial institutions like banks or credit unions, which assess documentation to ensure compliance with regulations governing such transfers. Furthermore, the authorization must include borrower signatures and may require notarization to enhance legitimacy. Mortgage transfer involves legal agreements, potentially utilizing state-specific laws that impact the process within jurisdictions, affecting timelines and costs associated with the transfer.

Transfer request details

A mortgage loan transfer authorization enables an individual or entity to assign their mortgage obligations to another party, typically involving paperwork such as the mortgage deed, loan transfer form, and borrower consent. This process may include comprehensive details such as the loan amount (potentially thousands of dollars), the original lender's name (e.g., Wells Fargo, Bank of America), and the mortgage account number (a unique identifier for the loan). Additionally, specific instructions regarding the transfer date (for example, a proposed date in the upcoming month), along with the new borrower's contact information, should be included to ensure clarity and a smooth transition. Communication between the parties involved should also emphasize the importance of understanding local regulations and potential fees associated with the transfer process to avoid complications.

Signatures and consent acknowledgment

Mortgage loan transfer authorization involves the formal agreement allowing the transfer of responsibilities and obligations from the current borrower to another party. Essential details include the original loan amount of $250,000 secured on a property located at 123 Main Street, Springfield, signed on June 15, 2022. The current lender, ABC Bank, necessitates a signature from both the existing borrower and the new party, acknowledging the terms of the transfer and consent to assume the loan obligations. This process ensures legal acknowledgment and protects all involved parties' interests during the transition of mortgage responsibilities. Compliance with regulatory guidelines governing loan transfers is critical to avoid potential legal complications.

Letter Template For Mortgage Loan Transfer Authorization Samples

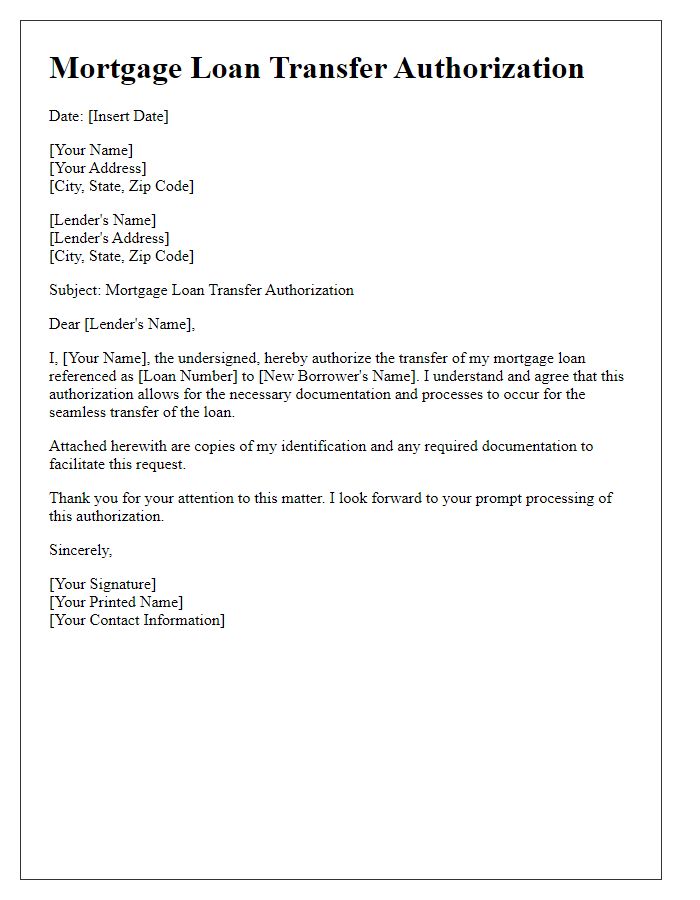

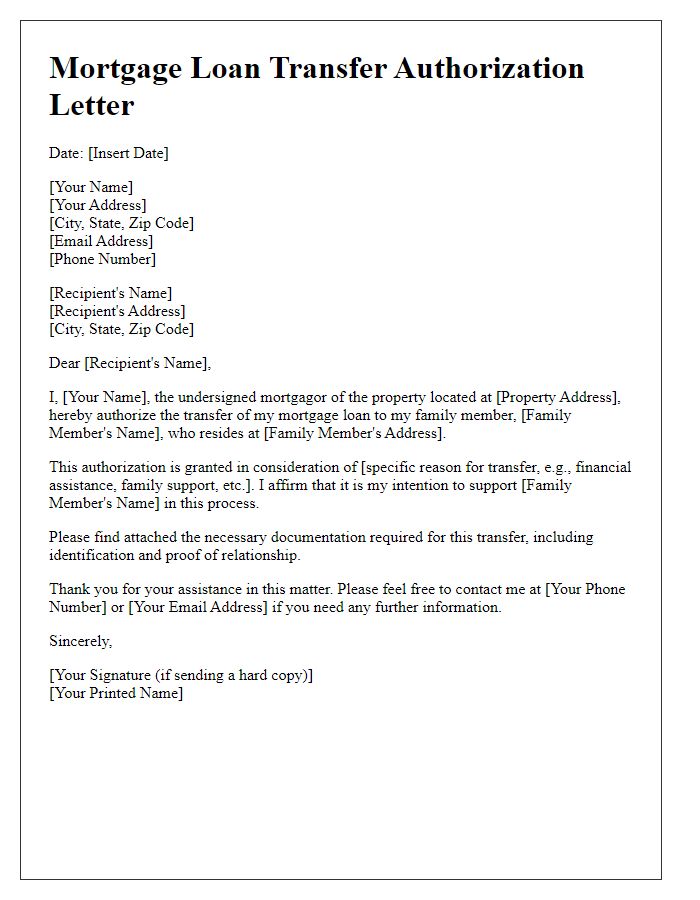

Letter template of mortgage loan transfer authorization for personal use.

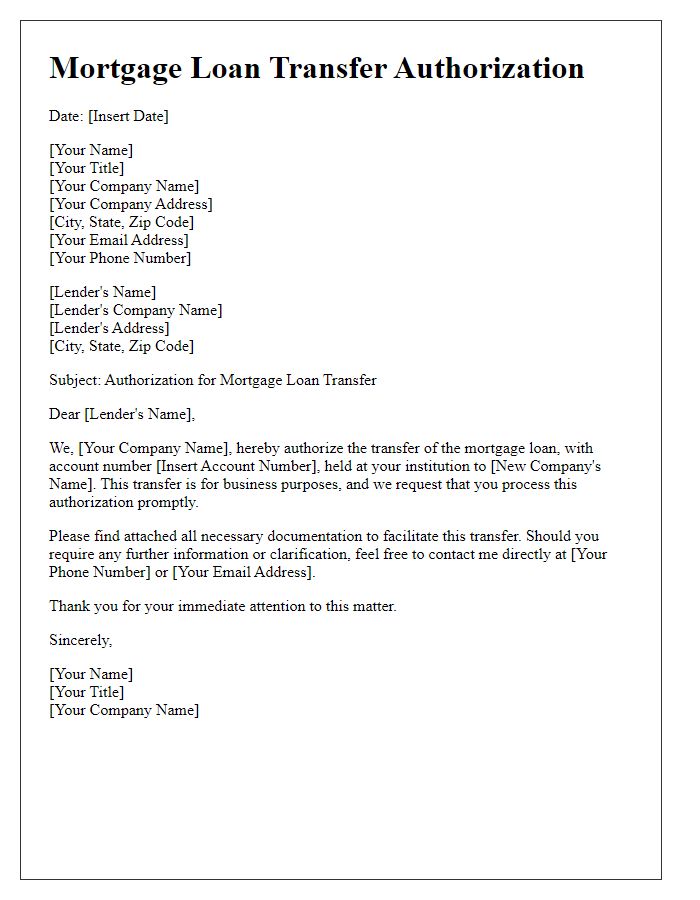

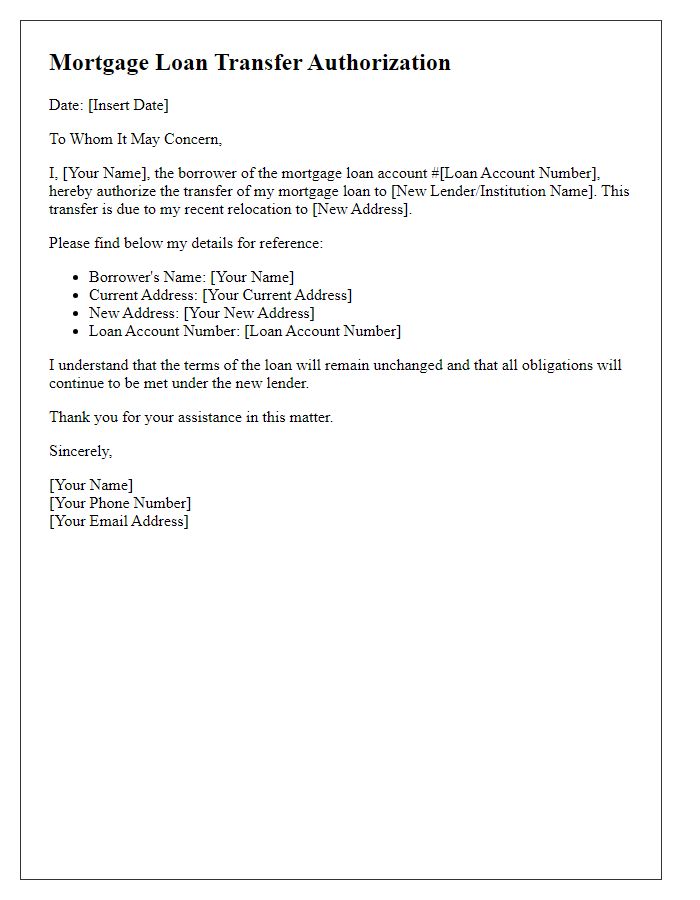

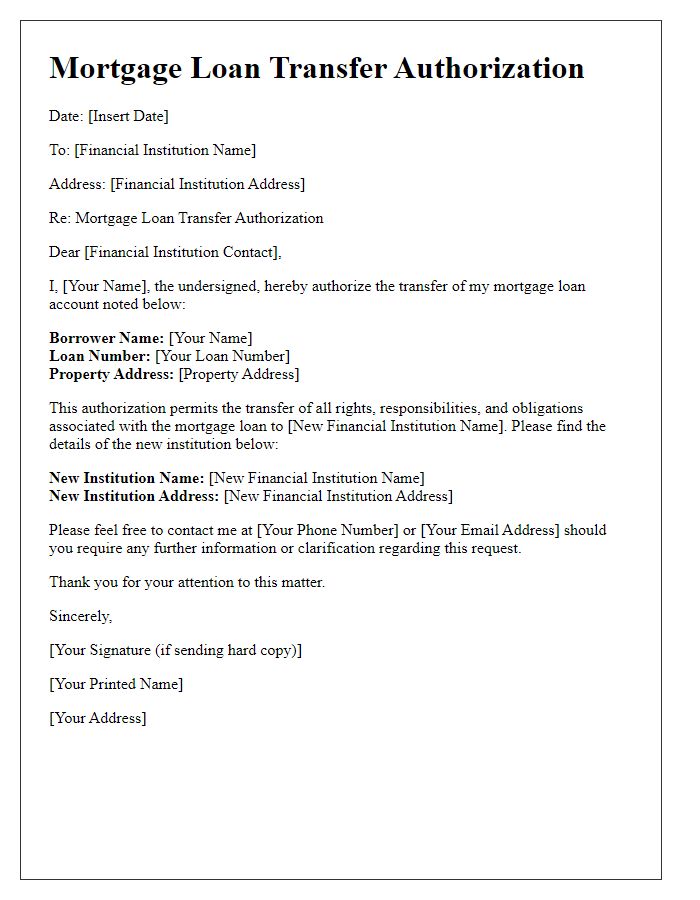

Letter template of mortgage loan transfer authorization for business purposes.

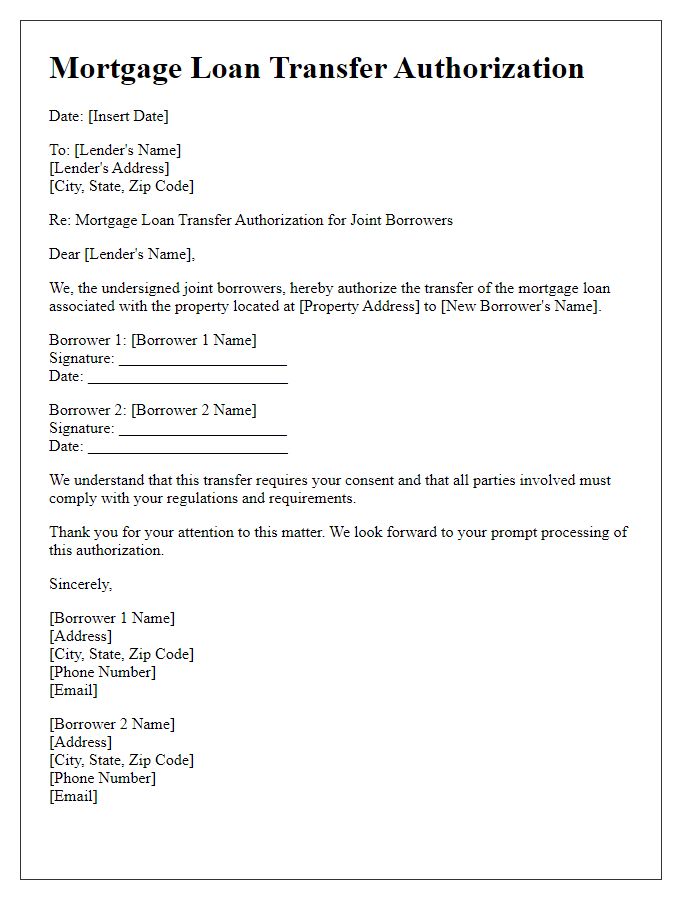

Letter template of mortgage loan transfer authorization for joint borrowers.

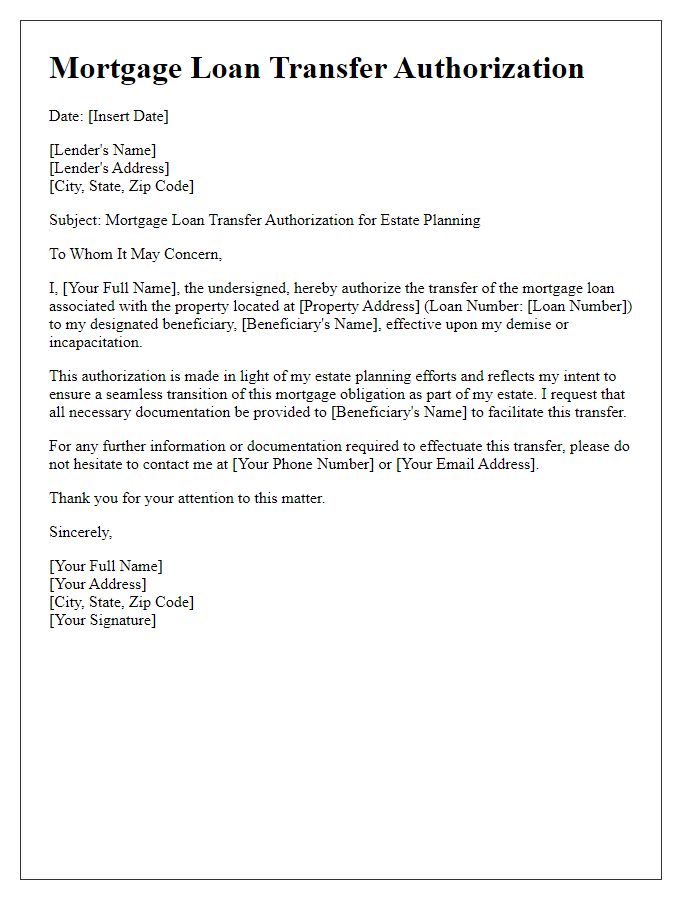

Letter template of mortgage loan transfer authorization for estate planning.

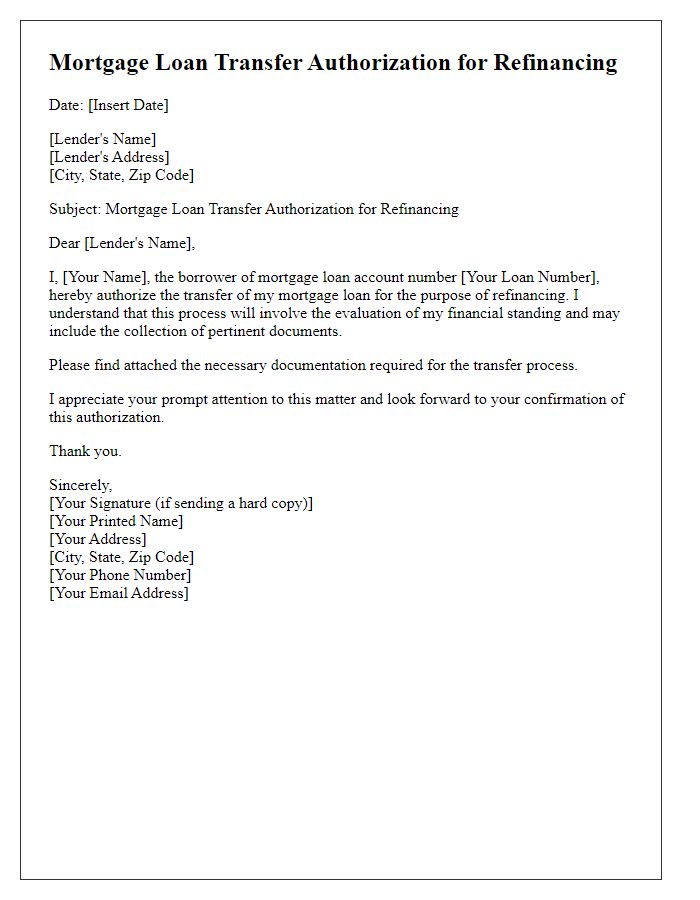

Letter template of mortgage loan transfer authorization for refinancing.

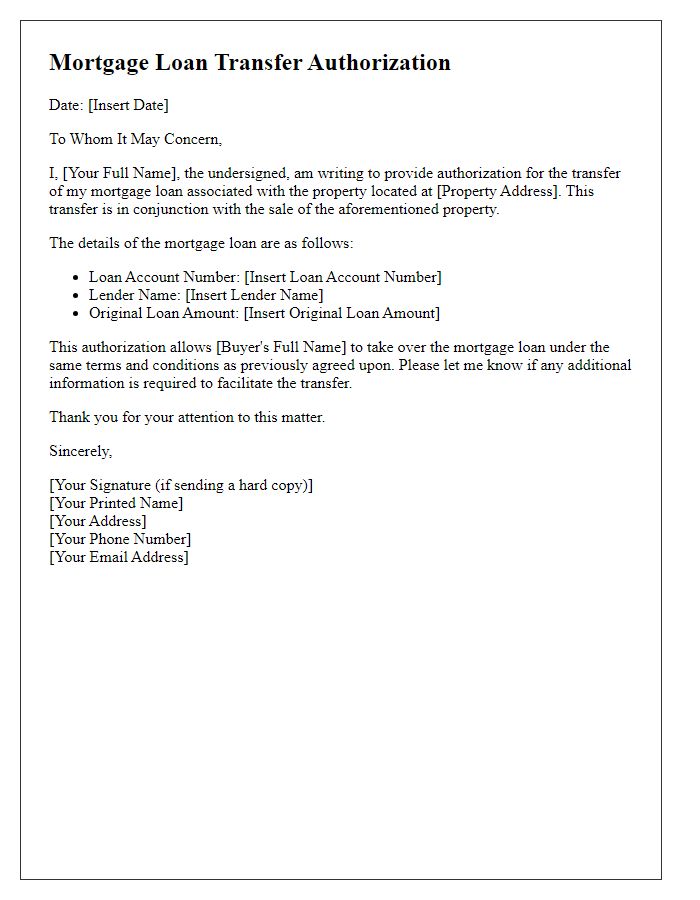

Letter template of mortgage loan transfer authorization for property sale.

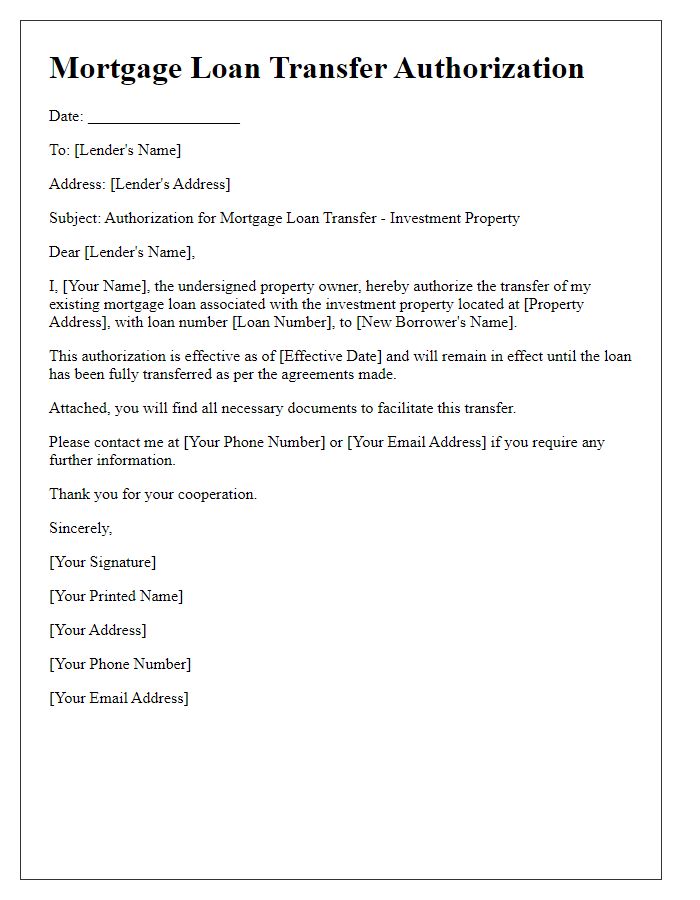

Letter template of mortgage loan transfer authorization for investment properties.

Letter template of mortgage loan transfer authorization for family members.

Comments