Are you feeling overwhelmed by your debt-to-income ratio and unsure how to communicate your financial situation? Writing a clear and concise letter can help explain your circumstances to lenders or financial institutions. It's important to present your case in a friendly yet professional manner, providing relevant details about your income and expenses. Ready to learn how to craft the perfect debt-to-income explanation letter? Let's dive in!

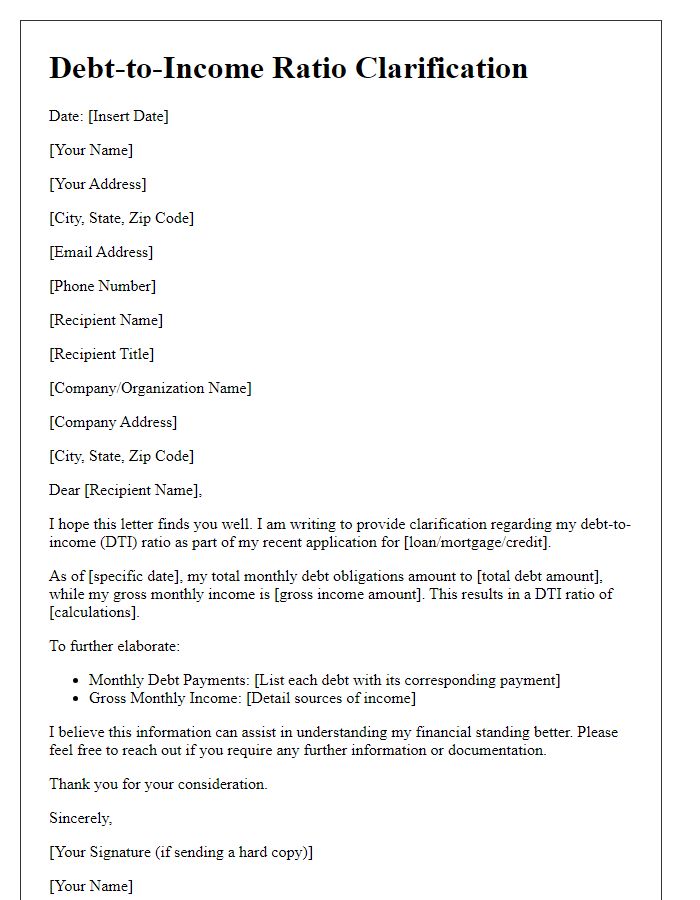

Clear identification of financial situation

A clear financial situation assessment reveals a debt-to-income (DTI) ratio of 45%, which exceeds the typically recommended threshold of 36%. Monthly expenses include $2,000 in housing costs for a one-bedroom apartment in downtown San Francisco, $500 in student loan payments, and $300 in credit card repayments. Gross monthly income stands at $4,400, reflecting employment as a marketing specialist. The financial landscape also contains significant obligations such as a $20,000 auto loan and medical bills totaling $5,000. These figures highlight the pressing need for financial restructuring or assistance to improve DTI and overall fiscal health.

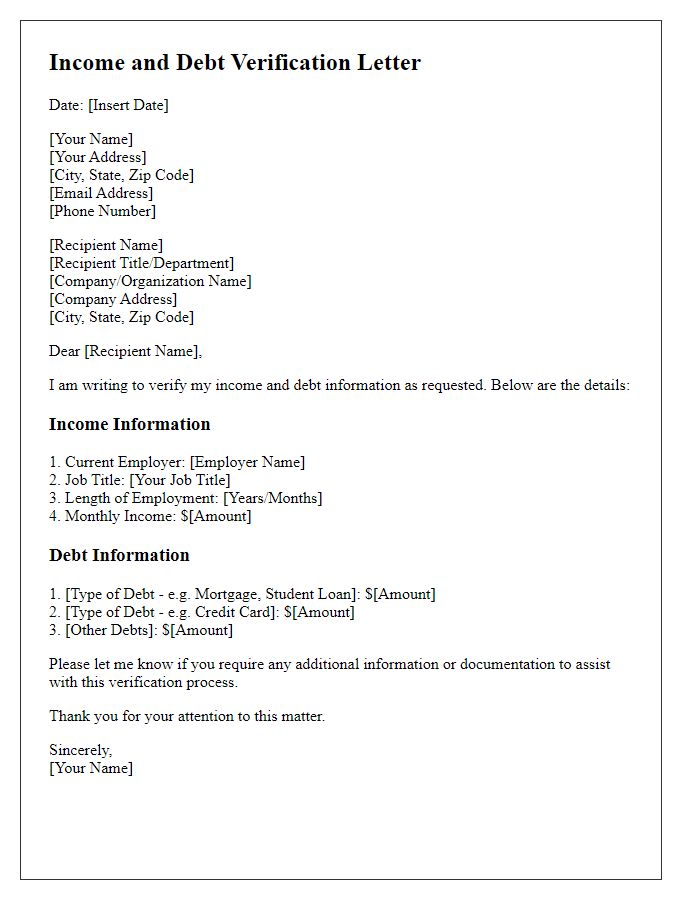

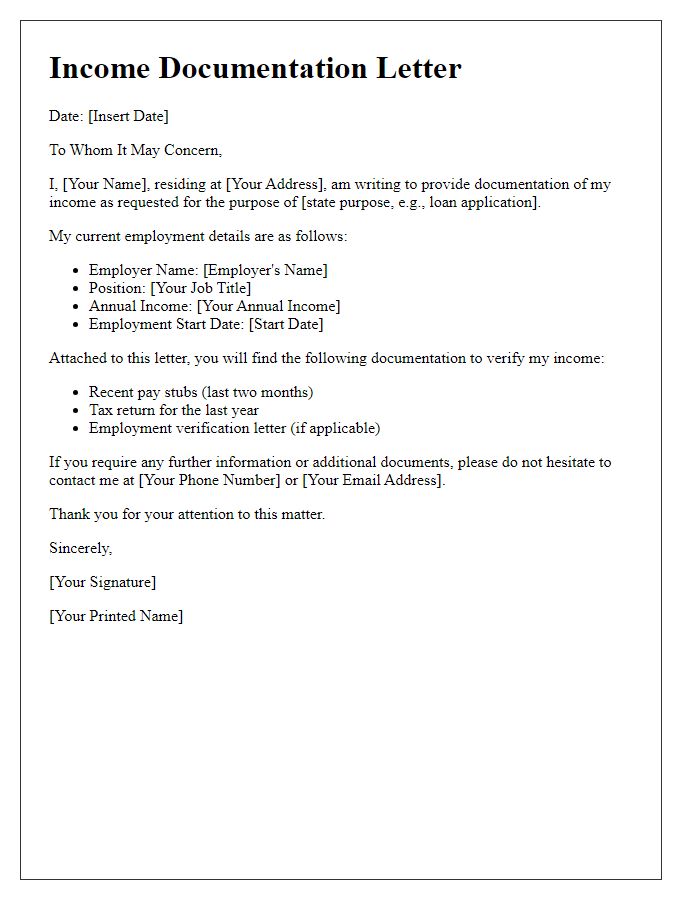

Detailed breakdown of income sources

In assessing an individual's financial stability, understanding the breakdown of various income sources is essential for determining the debt-to-income (DTI) ratio. Primary employment income, derived from a job at a corporate entity (for example, a full-time role at XYZ Corporation), forms the largest component, typically averaging $70,000 annually before taxes. Additional income streams may include rental income from investment properties, such as two condos in Miami, each generating $2,000 monthly, totaling $48,000 yearly. Freelance work in graphic design could contribute another $15,000 annually, based on projects sourced through platforms like Upwork. Passive income from dividend-yielding stocks might add an extra $5,000, while any relevant social security benefits would further supplement the financial profile, such as receiving $1,500 monthly, translating to $18,000 per year. Together, these income streams comprehensively illustrate the individual's financial picture, crucial for evaluating their capacity to manage existing and potential debt obligations.

Specific debt obligations and amounts

Managing debt-to-income ratio can significantly impact financial health and loan eligibility. This ratio, defined as the percentage of gross monthly income utilized to pay existing debt obligations, plays a crucial role in lending decisions. Common obligations include monthly mortgage payments of approximately $1,500, auto loans averaging $300, student loans totaling $400 monthly, and credit card payments that may vary but average $200. High levels of existing debt can strain this ratio, which lenders typically prefer to keep below 43%, posing challenges during mortgage applications. Accurate documentation of these specific obligations, along with total monthly income from reliable sources, is essential for clear financial representation during lender evaluations.

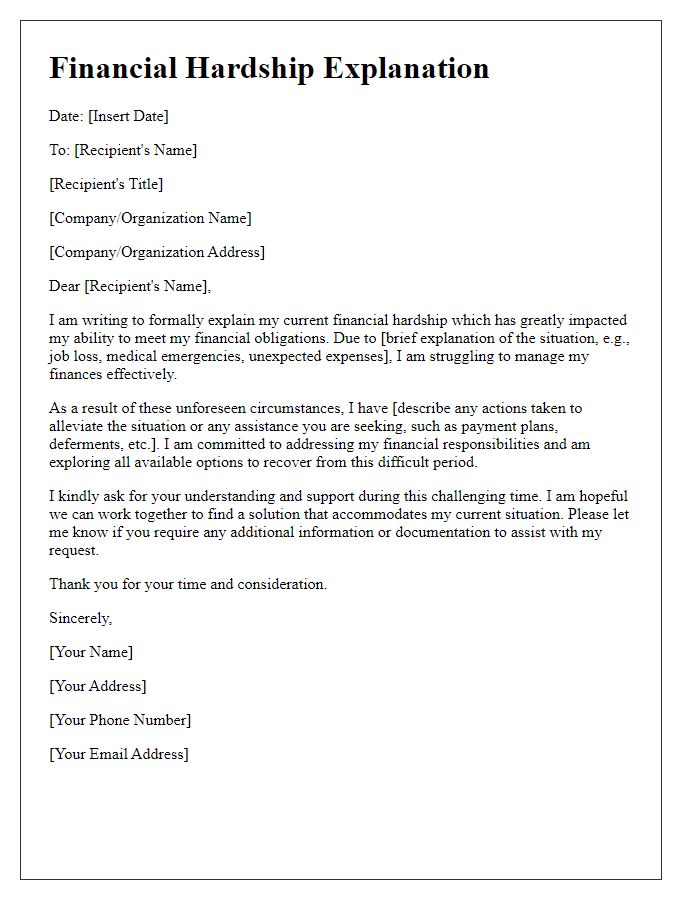

Explanation of any irregularities or inconsistencies

Debt-to-income ratio, a crucial metric in assessing financial stability, can reveal inconsistencies that impact loan eligibility. For instance, irregular income sources, such as freelance work or seasonal employment, may result in fluctuating earnings. Annual income (varying between $40,000 and $70,000) can create difficulties in demonstrating consistent cash flow. Sudden medical expenses, averaging $5,000, can lead to temporary debt increases that skew the ratio. Inconsistent reporting of part-time earnings, sometimes disclosed as $1,500 monthly, further complicates evaluations. These factors highlight the importance of thorough documentation to clarify any potential discrepancies for lenders, ensuring accurate financial assessments.

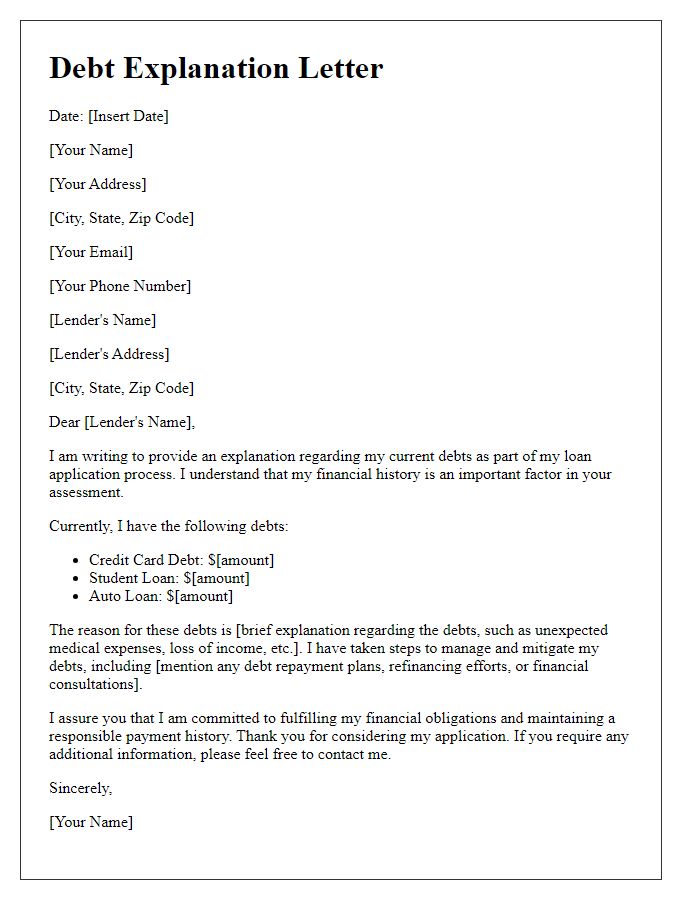

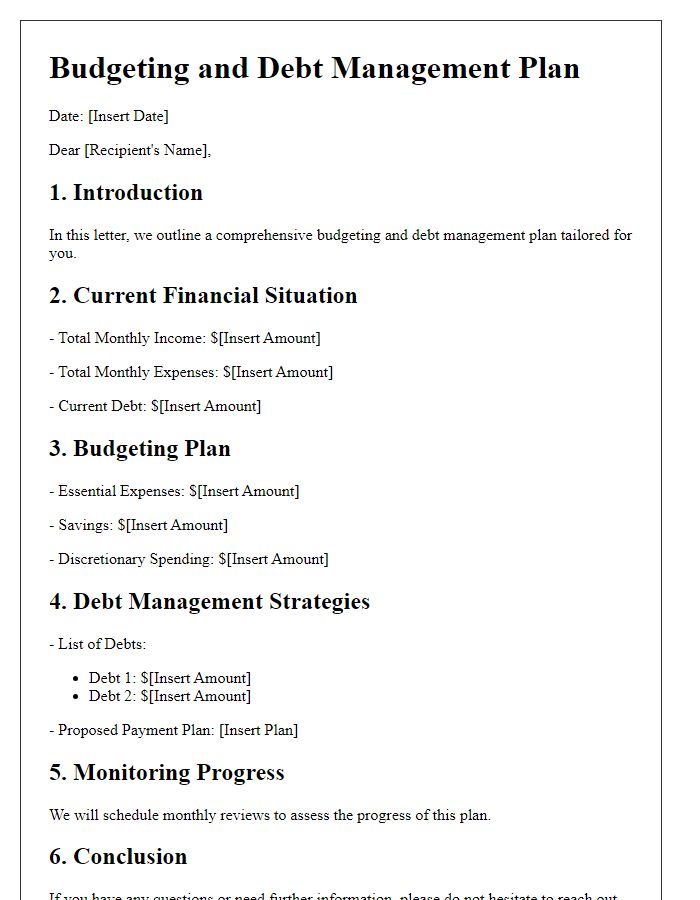

Future plans for managing debt and increasing income

Creating a strategic plan for managing debt effectively while increasing income involves careful consideration of financial habits, potential opportunities, and realistic goals. Budgeting allows for tracking monthly expenses, identifying unnecessary expenditures, and reallocating funds towards debt repayment. Exploring additional income streams such as freelance opportunities, part-time jobs, or passive income options can significantly supplement regular earnings. Continuous education and skill development in areas like digital marketing or programming can enhance employability and lead to higher-paying job opportunities. Setting specific deadlines to achieve milestones, such as reducing debt by a certain percentage each quarter, can help maintain motivation and focus. Moreover, regular assessments of financial progress and adjustments to the plan ensure adaptability to changing circumstances, ultimately fostering financial stability and growth.

Comments