Hey there! If you've just taken the exciting step of locking in your mortgage rate, this letter template will help you confirm that crucial agreement. It's important to have everything documented clearly to avoid any misunderstandings down the road. So, let's dive into the details and ensure you have a solid foundation for your mortgage journey. Ready to learn more?

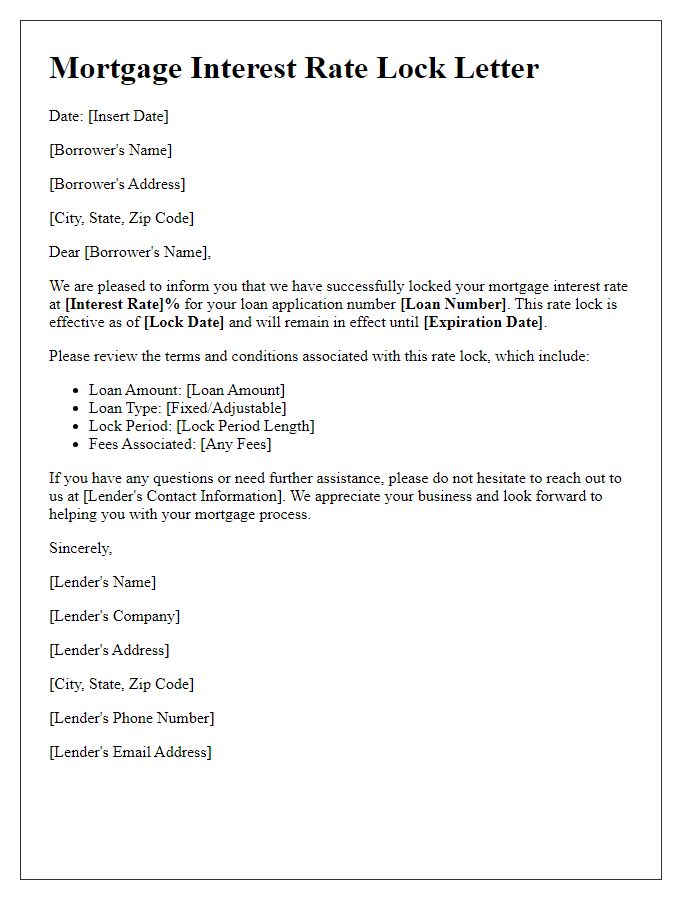

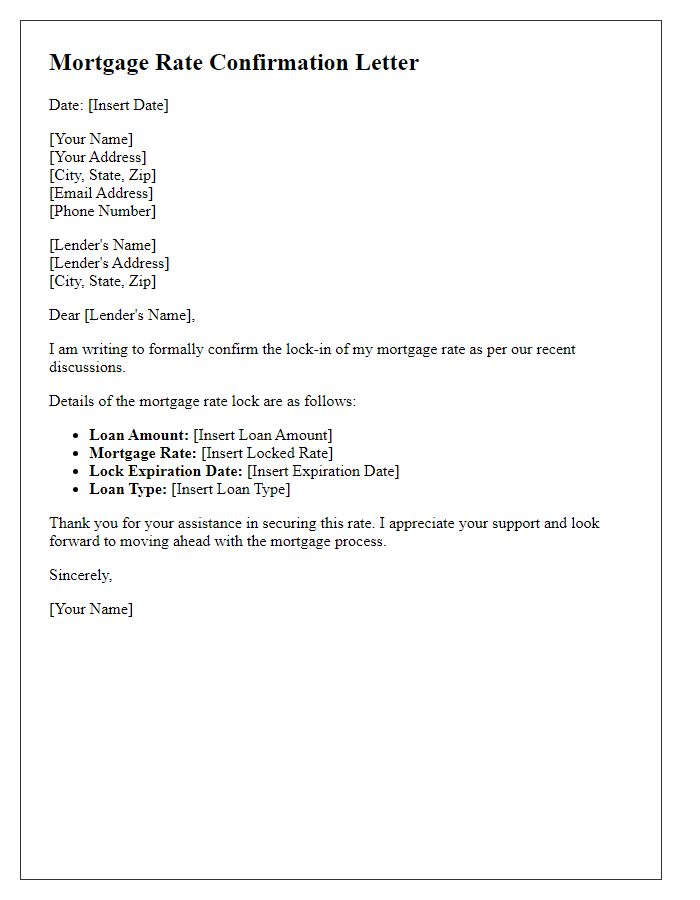

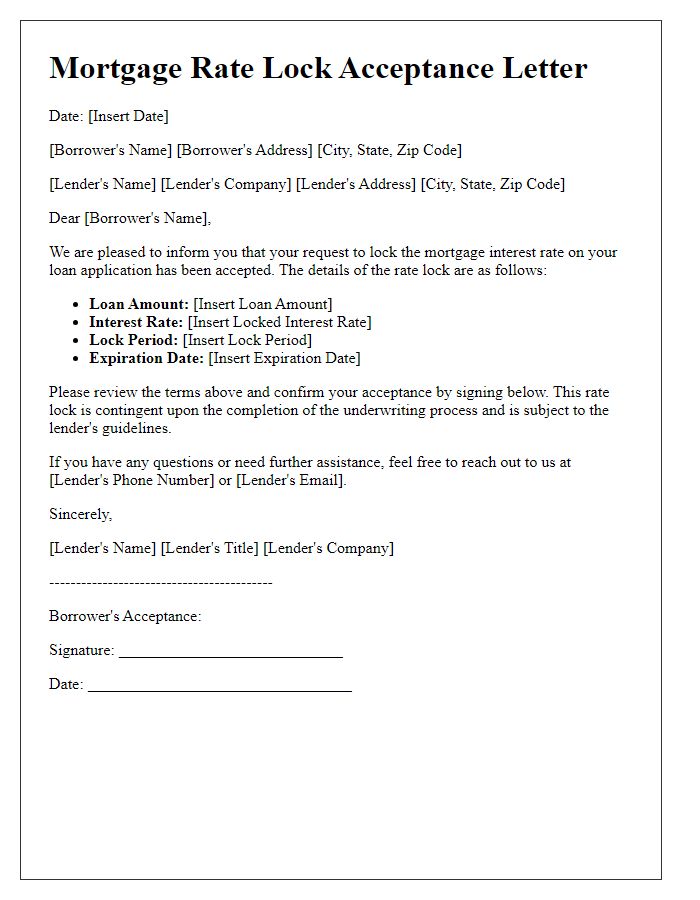

Borrower's full name and contact information

Mortgage rate locks are critical in obtaining favorable lending terms for real estate purchases. A typical borrower, such as John Smith, should ensure to provide essential contact information, including a phone number (e.g., 555-123-4567) and an email address (e.g., john.smith@example.com). This communication confirms the agreement between the borrower and lender regarding the interest rate, valid through a specified duration (usually 30 to 60 days). Most lenders stipulate conditions for locking in rates, linking them to market fluctuations and specific closing dates. In the current environment, where mortgage interest rates may vary, locking in a rate at 3.5% could potentially save thousands over the loan term. Each lender's process may differ, so prompt confirmation of details ensures a smoother transaction.

Lender's details and contact information

Mortgage rate locks are crucial in securing the loan terms, often influenced by variable economic factors. Lenders, such as Bank of America or Quicken Loans, typically provide specific details through an official confirmation document, highlighting the agreed-upon interest rate, duration of the lock (commonly 30, 45, or 60 days), and any associated fees. For instance, a 30-day lock could stabilize a 3.5% interest rate against potential market fluctuations, ensuring predictability in monthly payments. Contact information, featuring phone numbers and email addresses, enables borrowers to easily reach representatives for inquiries or assistance regarding their mortgage application.

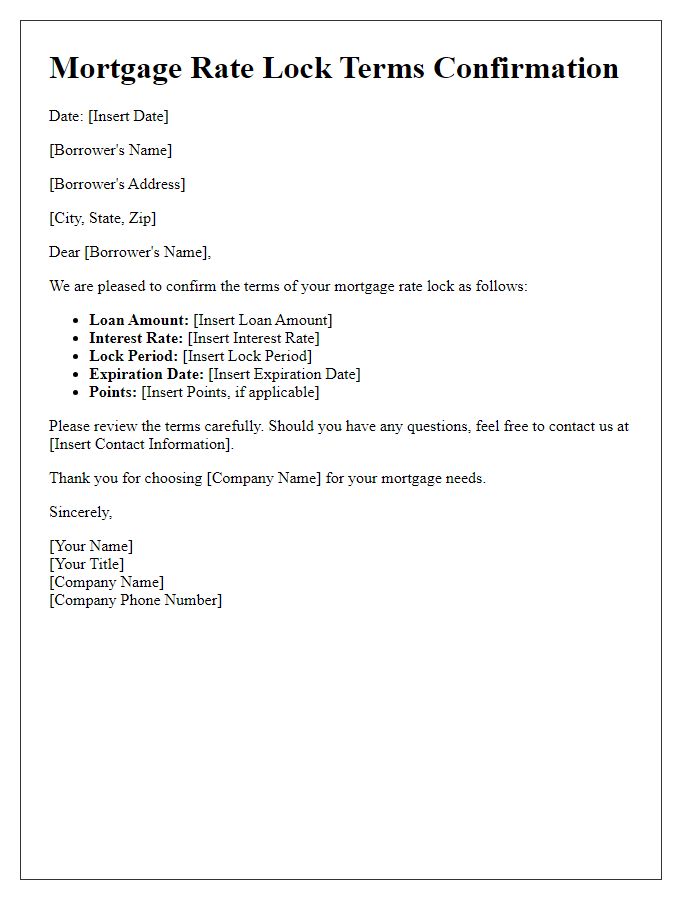

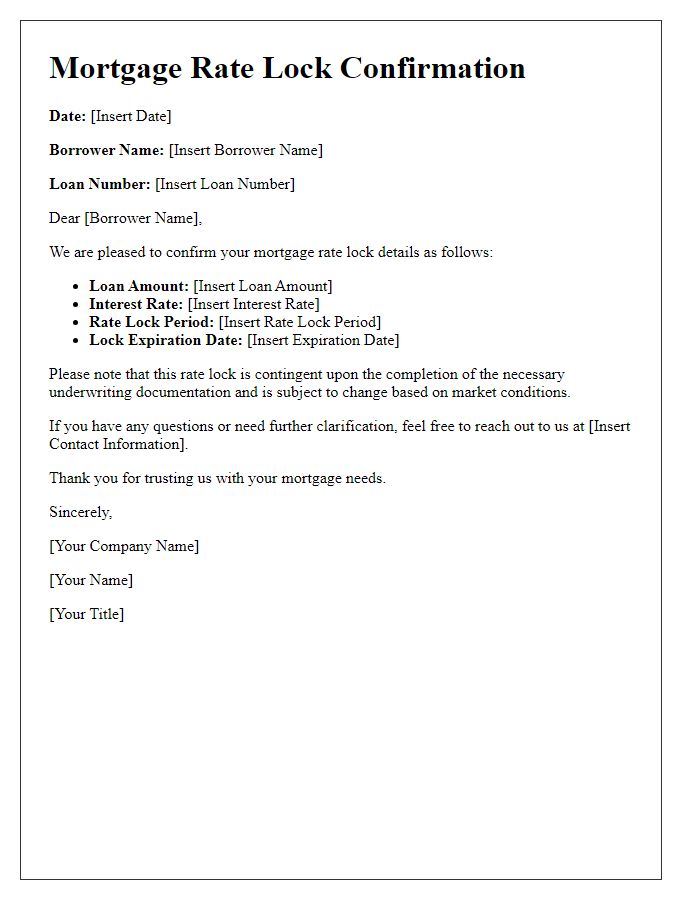

Loan terms and conditions

Locking in a mortgage rate is a crucial step in the home buying process. The mortgage rate lock confirmation details the agreed-upon interest rate (for example, 3.5% for a 30-year fixed-rate mortgage) and the lock period duration (typically ranging from 30 to 60 days). It outlines critical loan terms including the loan amount (for instance, $250,000 for purchasing a property in Los Angeles, California), loan type (such as conventional or FHA), and expected closing date (e.g., within 45 days). Furthermore, it addresses potential changes related to credit score adjustments, down payment percentages (e.g., a minimum of 20% to avoid private mortgage insurance), and any associated fees. Essential to this process is the lender's guarantee to honor the locked rate throughout the specified period, protecting borrowers from fluctuating market conditions.

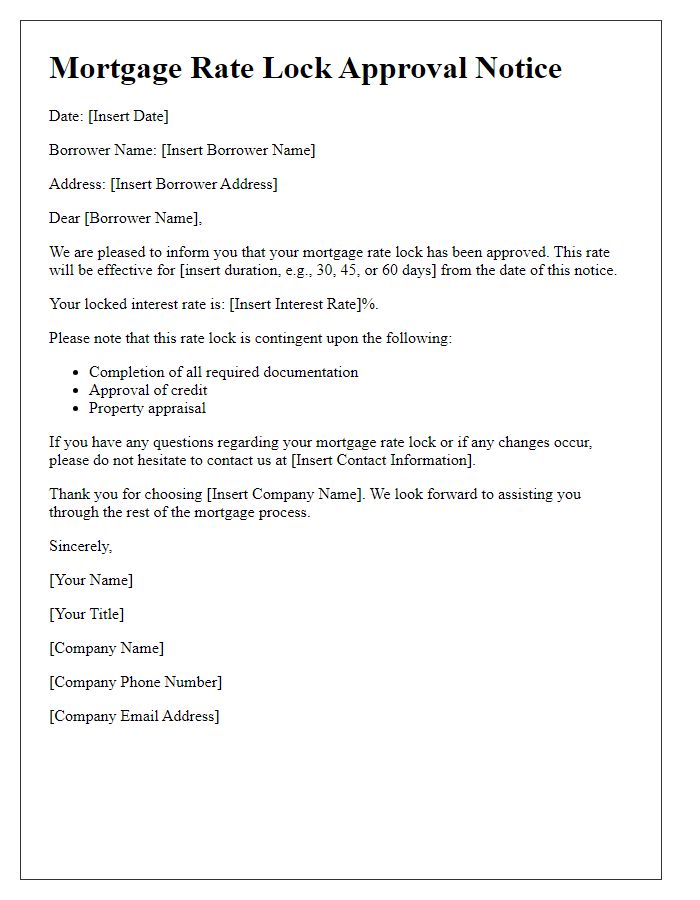

Locked-in interest rate and duration

Mortgage rate lock confirmation secures an interest rate for a specified duration, typically 30 to 60 days, protecting borrowers from potential increases. The locked-in interest rate, for example, may be set at 3.5%, beneficial during fluctuating market conditions. This confirmation is crucial for homeowners, as it allows for budgeting and planning, ensuring the loan aligns with financial forecasts. Rate locks often require written confirmation from lenders, detailing terms and expiration dates, thereby enabling borrowers to make informed decisions before closing. Understanding these elements is essential for a seamless mortgage process.

Date of confirmation and expiration

The mortgage rate lock confirmation process establishes a fixed interest rate for a loan over a specified period. The confirmation date marks the initiation of this agreement, while the expiration date indicates the deadline by which the borrower must close the loan to secure the locked rate. For example, a rate locked on October 15, 2023, may be secured until November 15, 2023, depending on the lender's policy. Factors such as market volatility and lender-specific terms can impact the rates and terms provided. Clear documentation of these dates is vital for both the lender and the borrower to ensure a smooth financing process.

Comments