If you've recently received a mortgage loan denial, you may be feeling confused or overwhelmed. Understanding the reasons behind this decision can help you find a path forward and better prepare for future applications. In this article, we'll break down the common factors that lead to denial, including credit scores, income verification, and debt-to-income ratios. So, let's dive in and empower you with the information you need to navigate your mortgage journey!

Specific reason for denial

Mortgage loan applications can be denied for various reasons, significantly impacting potential homeowners. Common reasons for denial include insufficient credit scores, generally below 620, which indicates a higher risk to lenders. Debt-to-income ratios exceeding 43% often raise red flags as they suggest financial strain, making it harder to manage additional debt obligations. Additionally, lenders may cite lack of sufficient income documentation, such as recent pay stubs or tax returns, which fails to demonstrate stable earnings. The condition of the property being financed can also lead to denial; if it does not meet industry standards or if the appraisal value falls short of the loan amount, approval becomes uncertain. Lastly, unverifiable employment history or frequent job changes can create concerns about the applicant's stability and future financial prospects.

Borrower's credit score and financial history

Borrowers often face mortgage loan denials due to credit score issues and financial history complications. A credit score, typically calculated using the FICO model ranging from 300 to 850, serves as a crucial factor in assessing loan eligibility. For instance, a score below 620 may categorically disqualify a loan applicant from securing favorable mortgage terms. Moreover, lenders evaluate financial history, examining aspects like past delinquencies, outstanding debts, and overall payment patterns. A history of late payments or high debt-to-income ratios can raise red flags, prompting lenders to reconsider the loan application. This careful scrutiny by lending institutions, including banks such as Wells Fargo or Bank of America, underscores the importance of maintaining a robust financial profile to enhance eligibility for mortgage approval.

Property appraisal value and condition

The recent property appraisal determined the value of the home to be significantly lower than the expected market price, specifically at $250,000, while similar properties in the neighborhood are valued around $300,000. The appraisal revealed notable condition concerns including a leaky roof, outdated electrical wiring, and plumbing issues, which need immediate attention. Such deficiencies demonstrate a lack of adequate maintenance and lower the home's overall market appeal. Consequently, these factors contributed to the decision to deny the mortgage loan application, reflecting the risk associated with financing a property that does not meet essential structural standards and warranted value assessments.

Income and employment status

Mortgage loan denial often stems from income and employment status concerns. Lenders typically require consistent income history, usually verified through documents like pay stubs or tax returns from the previous two years. A stable employment record, such as continuous full-time work with the same employer, is crucial; frequent job changes (more than three in a year) may raise red flags regarding reliability. Additionally, fluctuating income, especially in self-employment or commission-based roles, could signal potential financial instability to lenders. Important guidelines from agencies like the Federal Housing Administration (FHA) emphasize these factors, leading to thorough evaluations of applicant earning capability against debt-to-income ratios, which ideally should remain below 43%.

Compliance with lender policies and regulations

Mortgage loan applications often face denial due to strict adherence to lender policies and regulatory requirements. Compliance with established guidelines, such as credit score thresholds (typically a minimum of 620 for conventional loans), debt-to-income ratios (usually not exceeding 43%), or specific income documentation (last two years of tax returns, W-2s), plays a crucial role in the decision process. Furthermore, factors like property appraisal values (determined through a professional assessment) must align with the loan amount requested, ensuring the property's market value justifies the investment. Lenders must also comply with federal regulations, including the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), which govern disclosure practices and protect consumers. Understanding these elements is vital for applicants seeking alignment in future submissions or re-evaluations.

Letter Template For Mortgage Loan Denial Explanation Samples

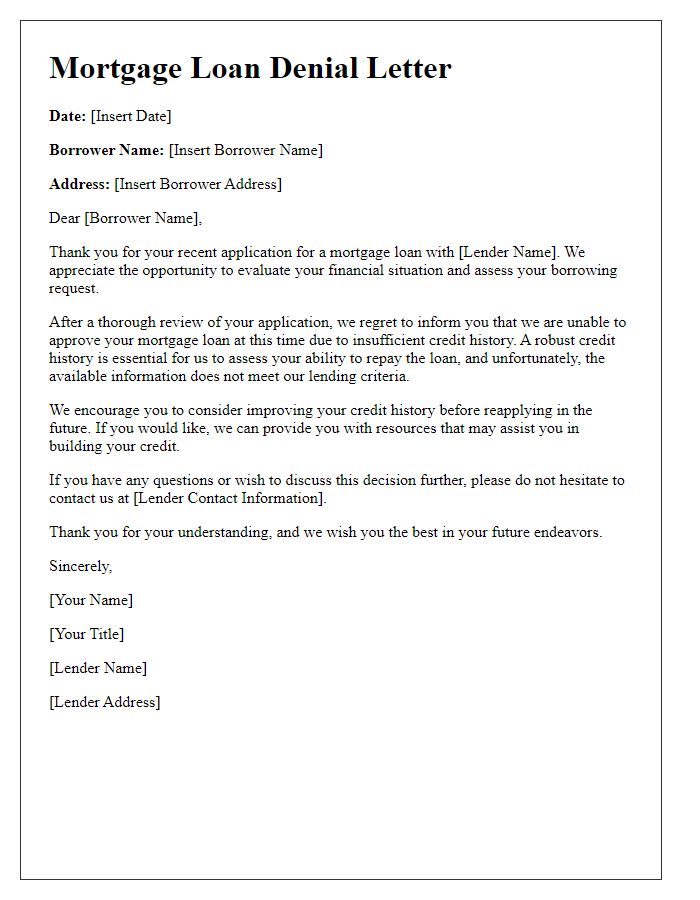

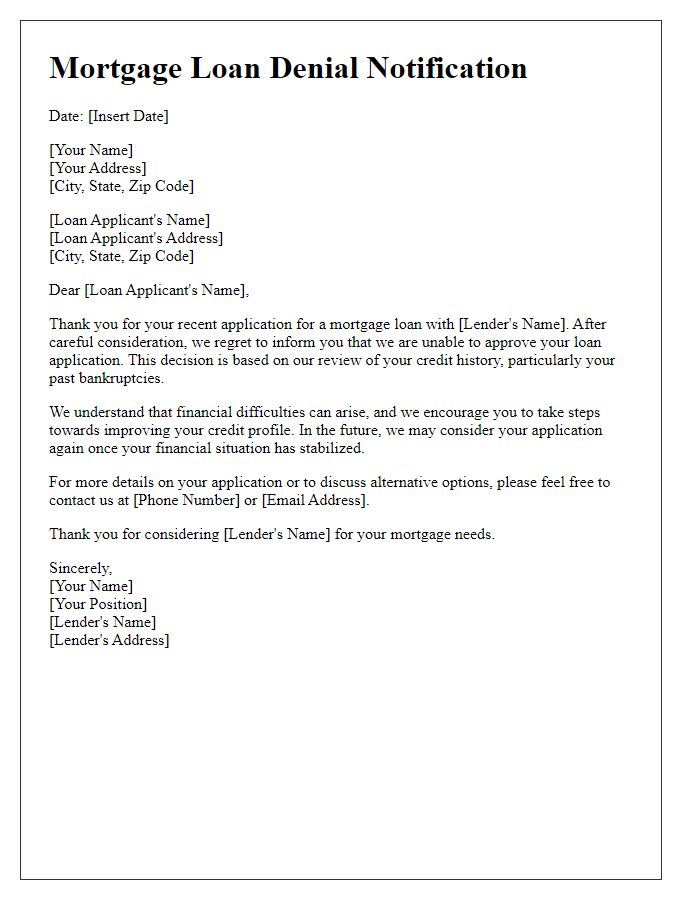

Letter template of mortgage loan denial due to insufficient credit history.

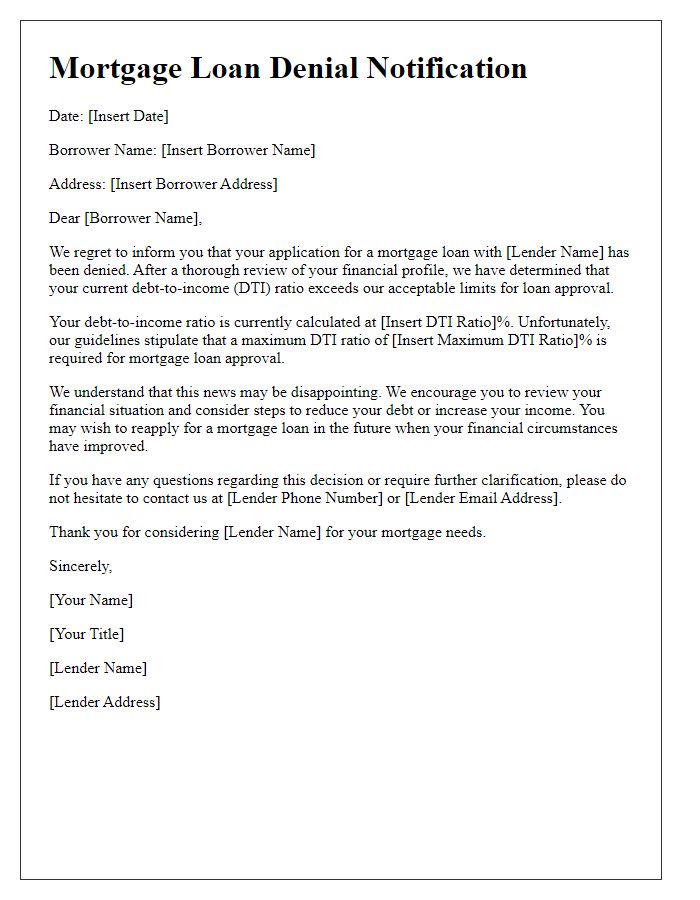

Letter template of mortgage loan denial because of high debt-to-income ratio.

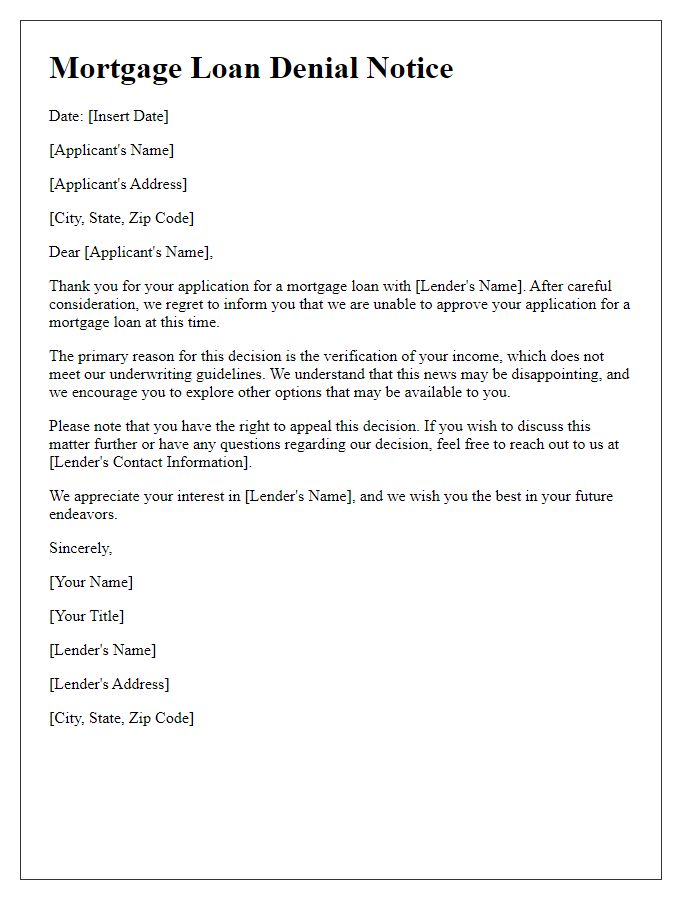

Letter template of mortgage loan denial based on low income verification.

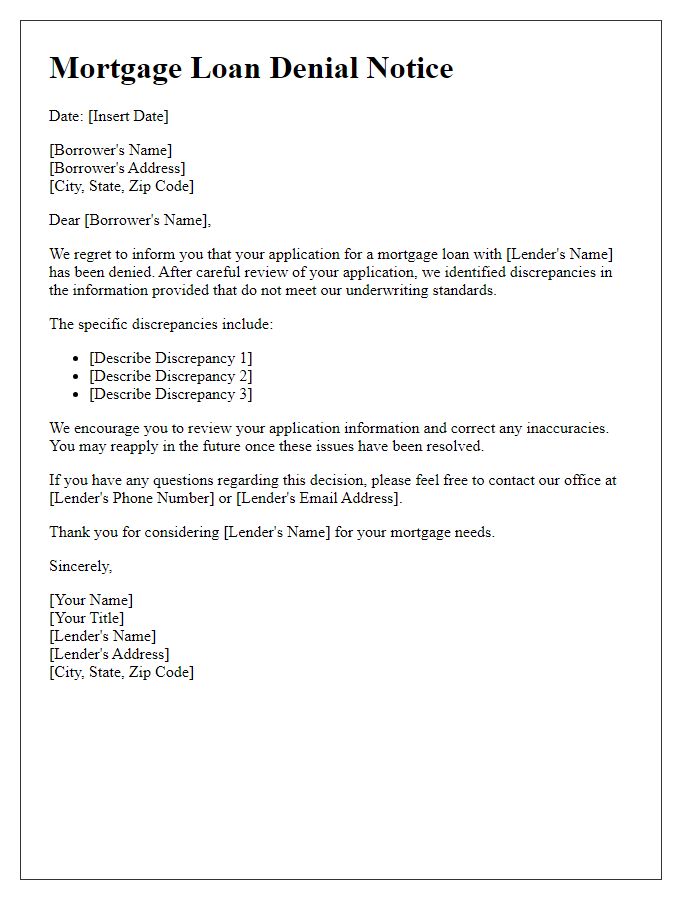

Letter template of mortgage loan denial related to property appraisal issues.

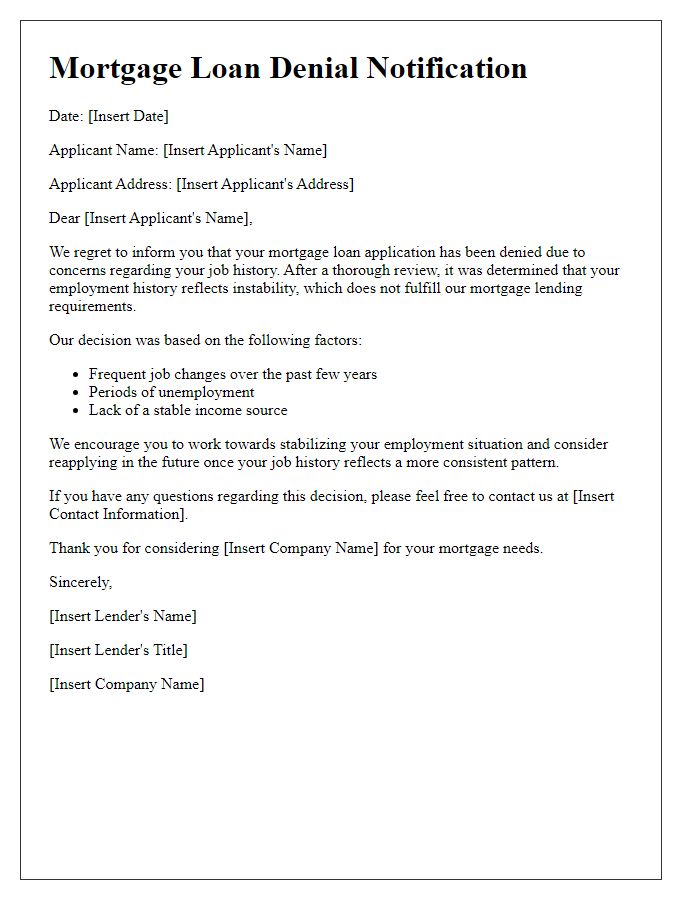

Letter template of mortgage loan denial for failure to meet employment requirements.

Letter template of mortgage loan denial from insufficient down payment funds.

Comments