Are you considering a mortgage transfer without refinancing? This process can seem daunting, but it can also be an efficient way to manage your financial obligations. By transferring your mortgage, you could potentially lower your interest rate or change your loan terms without restarting the entire process. Curious about how to navigate this journey? Read on to discover the steps and benefits of mortgage transfer!

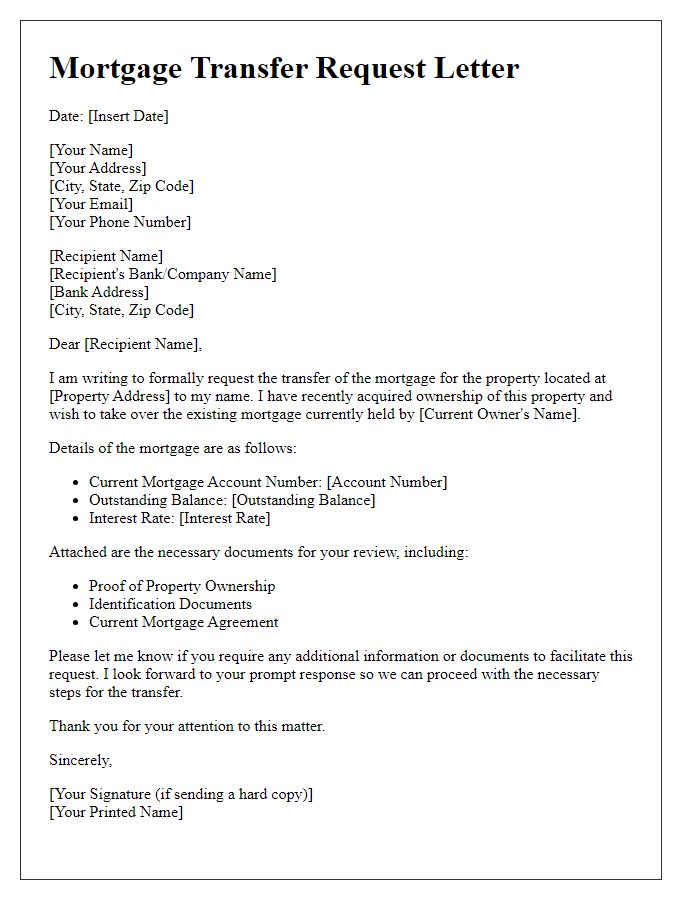

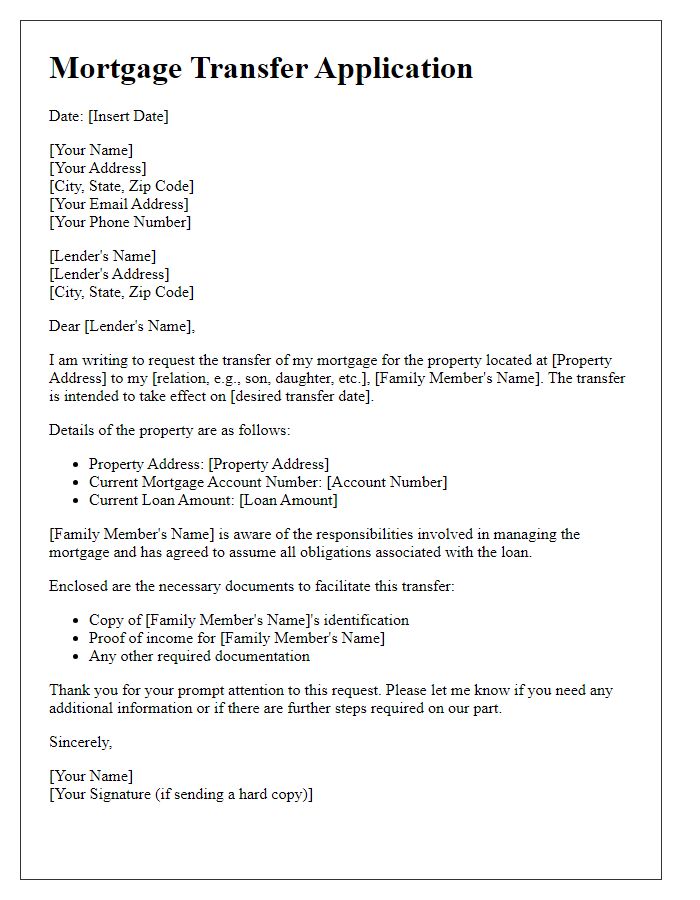

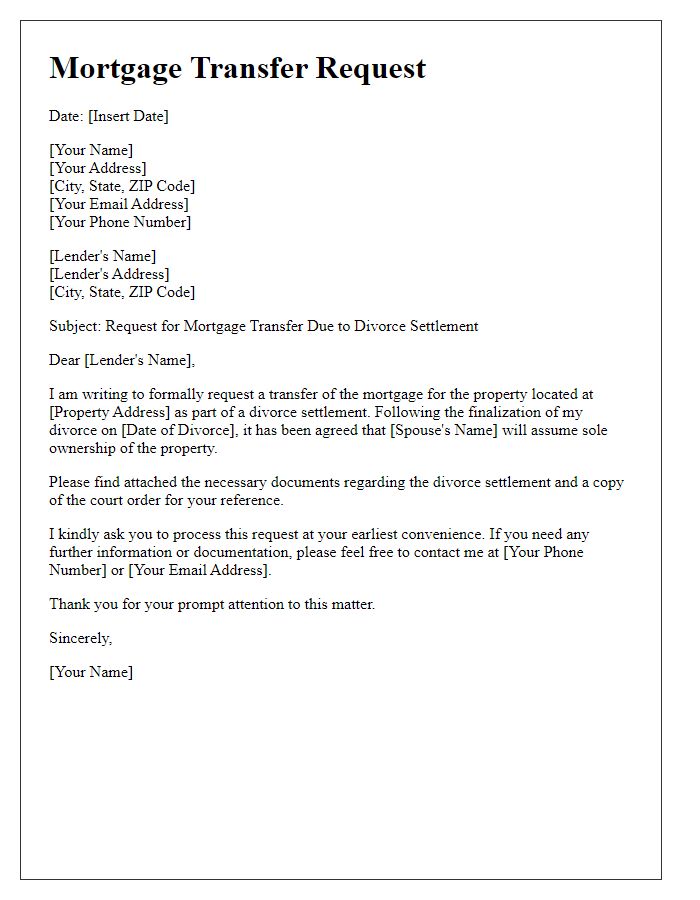

Borrower's information and existing mortgage details.

The mortgage transfer process involves the transfer of existing mortgage obligations without requiring a refinancing action. Borrower's information must include full name, social security number, and contact details for identification. Existing mortgage details should encompass mortgage lender's name, loan number, remaining balance (as of the transfer date), interest rate, loan type (fixed or adjustable), and original mortgage date (indicating the beginning of the loan term). Additionally, it is necessary to provide property information such as the address, legal description, and current market value for accurate assessment within the transfer documentation. This ensures compliance with local mortgage regulations and streamlines the transfer process between parties.

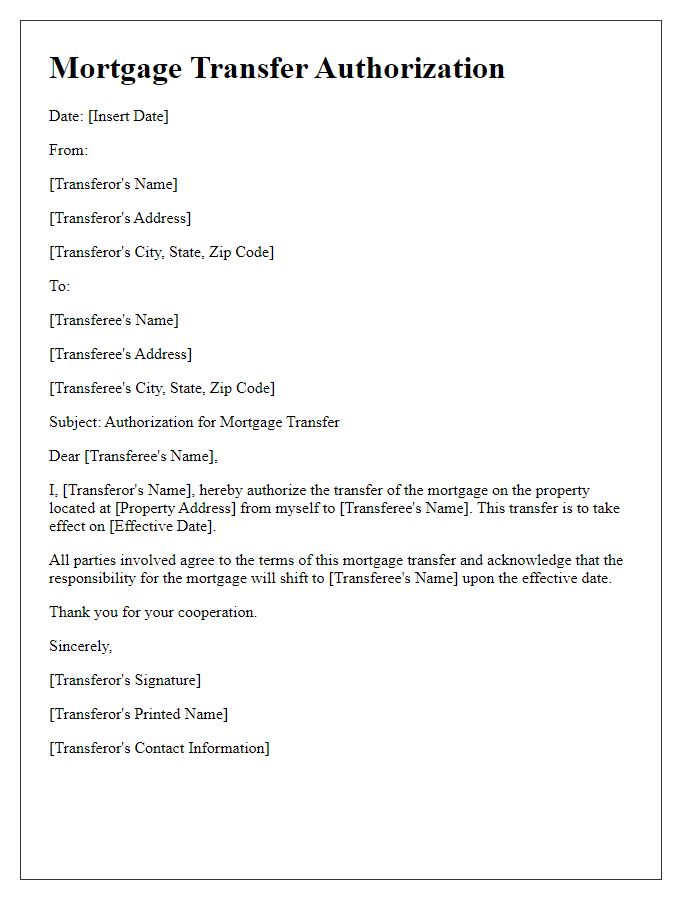

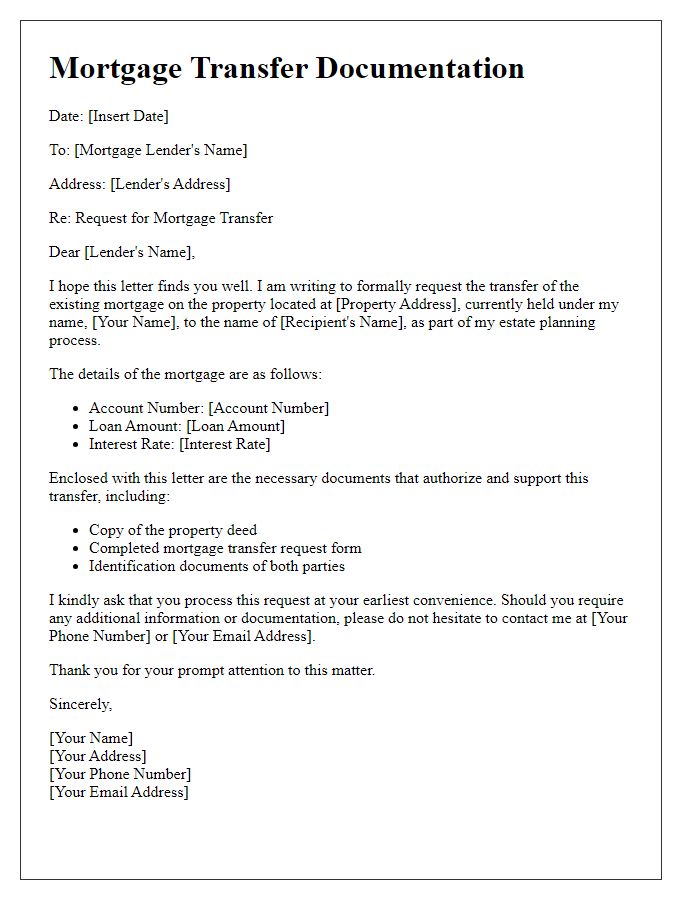

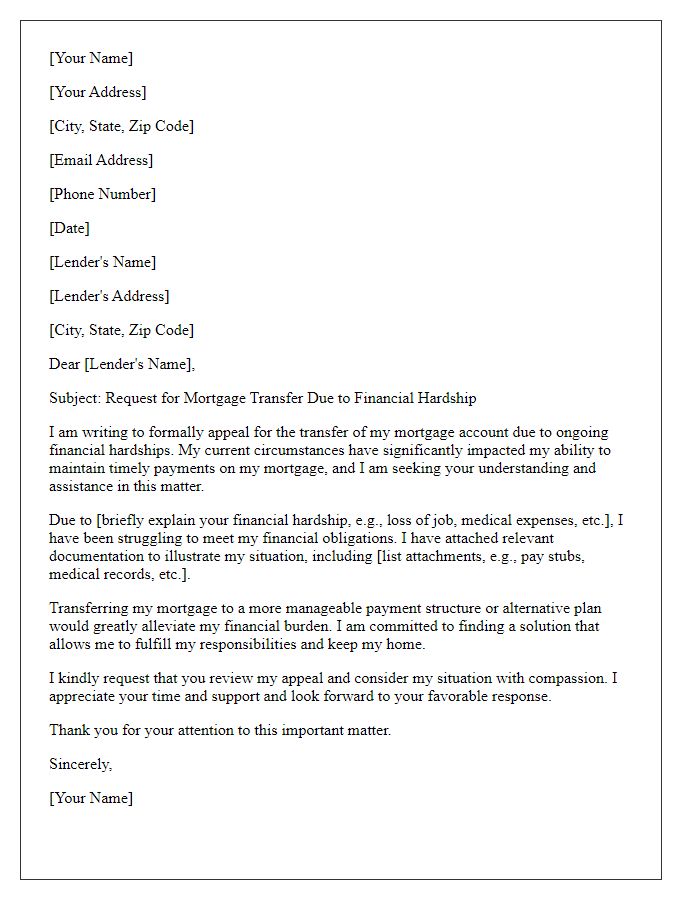

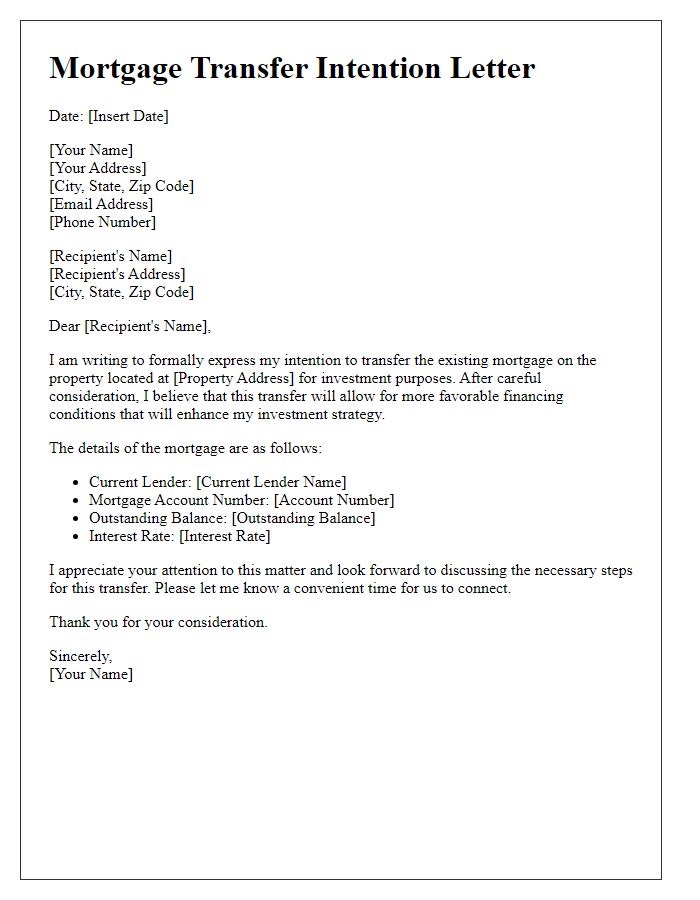

Reason for mortgage transfer and justification.

Transferring a mortgage can facilitate effective asset management during significant life events, such as divorce or inheritance. In cases of divorce, one party may seek to remove the other from the mortgage obligation, allowing for a fair financial separation while retaining the property. Inheritance situations often lead to the transfer of mortgage responsibility to heirs, who intend to continue residing in the property, avoiding potential foreclosure risks. This process maintains credit stability for the parties involved, preserves home equity, and ensures continuous adherence to loan agreements without the need for refinancing, which can incur additional fees and possibly higher interest rates based on current market conditions. Moreover, retaining the existing mortgage terms benefits the borrower by providing stability in monthly payments amidst fluctuating interest rates.

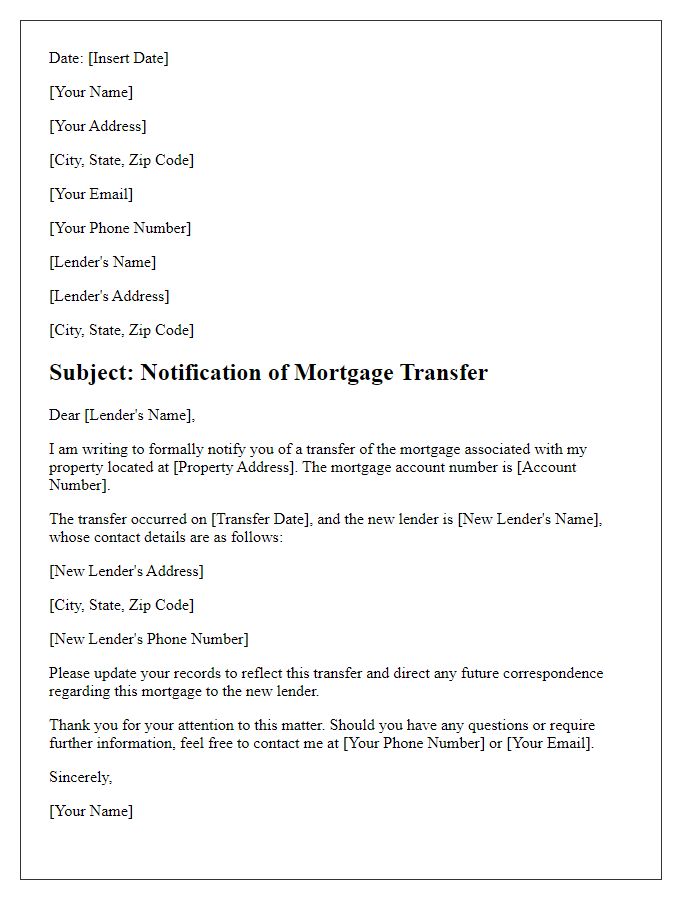

New lender or transferee information.

Mortgage transfers without refinancing can occur when a borrower wishes to transfer their existing mortgage obligation to a new lender or transferee. This type of transaction often involves directly communicating necessary information about the mortgage, including the outstanding principal balance, interest rate (typically fixed or variable), loan term, and payment schedule. Additionally, the existing mortgage agreement should detail any assumptions or conditions required for the transfer, which can vary depending on lender policies. The new lender or transferee must provide documentation, such as financial statements and proof of income, to undergo an evaluation process for the transfer approval. State-specific regulations may also influence the procedure and timelines involved in the transfer process.

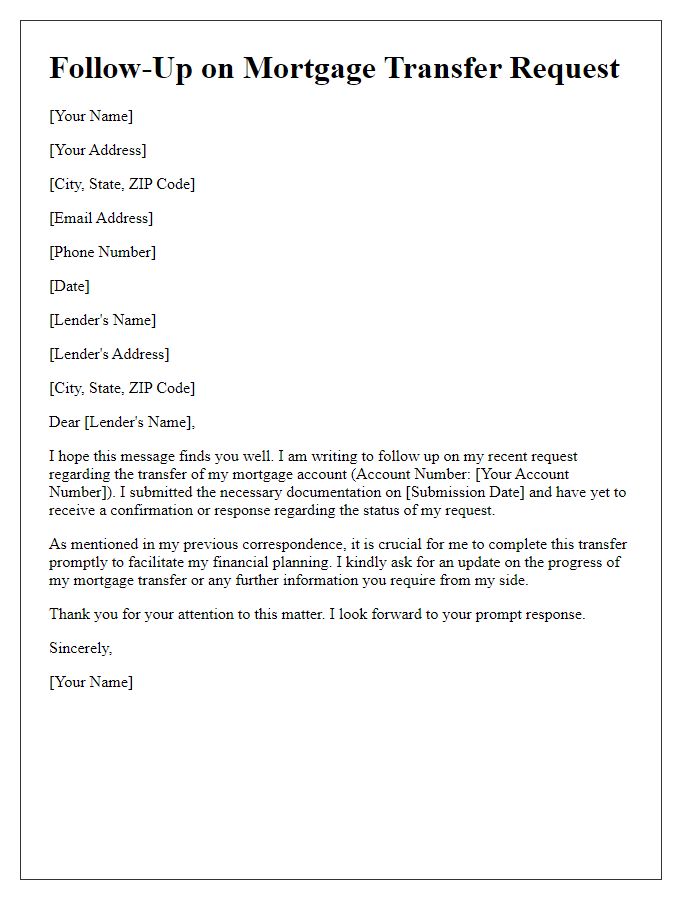

Legal and financial implications of the transfer.

A mortgage transfer without refinance involves legal and financial complexities that warrant careful consideration. Title transfer events occur when property ownership changes hands while the existing mortgage remains intact, typically during inheritance or property sale scenarios. Financial institutions often impose conditions under which a mortgage can be assumed, impacting the remaining borrower's liability. Additionally, state laws govern the assumption process, specifying required documentation like the assumption agreement. Credit assessments may also occur, determining the new owner's creditworthiness and ability to meet mortgage obligations. Potential risks include the original borrower remaining responsible for the mortgage balance if the new borrower defaults, potentially leading to foreclosure in severe cases. Understanding these implications is crucial for both parties involved in the transaction to ensure compliance and mitigate financial risks.

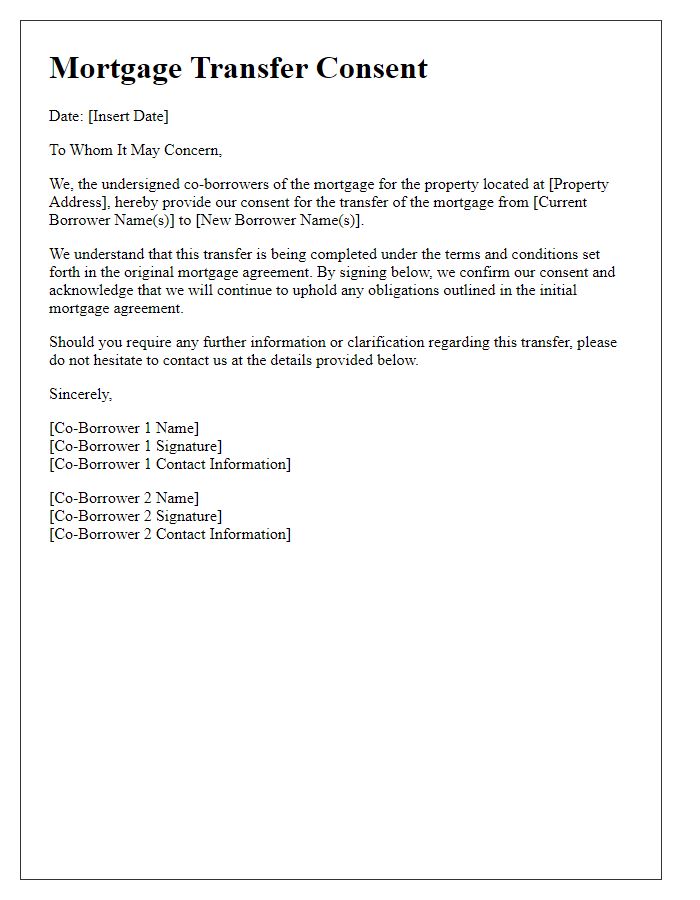

Contact information for further communication.

The mortgage transfer process without refinancing involves the careful handling of legal and financial documents to facilitate the transfer of ownership rights of a property. This typically occurs when a seller wishes to transfer their mortgage obligation to a buyer without altering the existing loan terms. Accurate documentation, such as the mortgage agreement, can include detailed terms of the loan, payment history, and any pertinent legal obligations tied to the original loan agreement. Parties involved may require a thorough understanding of local real estate laws, particularly within specific jurisdictions, as regulations can vary significantly. Documentation should also include contact information for relevant parties involved, ensuring effective communication throughout the process.

Comments